The first thing we will tell you is that the advice and guidance of experienced family law attorney is critical here. If you are in jail or state prison: Prisoners may be required to pay the full cost of the filing fee in the trial court but may be allowed to do so over time. Law proceedings was put in place after an extensive study conducted by a task force set up at the suggestion of the California Supreme Court to study and Updated Income & Expense Declaration (FL-150). This website's content is solely for residents of California or residents of the United States or Canada who have a family law matter in California. Exaggerated expenses to show a greater need. Divide and Value Jewelry, Antiques and Collectibles, Divide and Value Furniture and Appliances, Lying on an Income and Expense Declaration, Separate Property House Owned Before Marriage, Fees in a Domestic Violence Restraining Order. Webguardianship or conservatorship proceeding, see California Rules of Court, rule 7.5(k) for information on the final disposition of that matter. WebSUPERIOR COURT OF CALIFORNIA COUNTY OF LOS ANGELES. pX060>FT^FU[v8 K7;.i F#R1-F]fw)>A0-7H/pU~ $uw#fliW"@>[kx{_^IR ]ReO

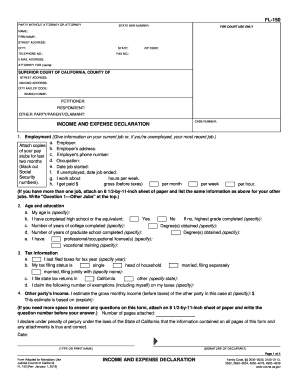

WebPage 1, Sections 1 through 4 of the income and expense declaration These sections ask for the most basic information.  Both parties must complete, file, and serve a current Income and Expense Declaration (form FL-150). IT IS HEREBY AGREED BY AND BETWEEN THE PARTIES that: 1. As part of the financial disclosure process, you and your spouse will fill out Form FL-150 which is your Income and Expense Declaration. htRRAi% DA9DE9(bO.OH8T7] 0piO60?xND4kKsu;,}MP"tq3

endstream

endobj

startxref

We do not provide legal advice through the Service. Generally, this form allows each spouse to detail everything that you earn and spend. Retaining an attorney to do that is well worth it.

1057 0 obj

<>stream

eRBPc8!CB3&}V You can use an attachment page to expand on any information you provide so long as it is properly attached to the income and expense declaration. 0000003063 00000 n

The Service may facilitate access or introductions to an attorney or other licensed professionals in various ways, including, for example, by providing you with their contact information. C. FCS Data Sheet. When filing an RFO regarding custody or visitation, the moving party must also file the Family Court Services Screening Form (form SDSC FCS-046). Web Income and Expense Declaration (FL-150) not comply with California Rules of Court 2.100 et seq. 0000001335 00000 n

will be happy to refer you to tax and financial specialists to answer any specific questions that you may have. 15. 186 0 obj

<>/Filter/FlateDecode/ID[<9449C8C7465128439D31999293ECF370><7804B260CB5C5A40A0A3C7C5B2BDB8FD>]/Index[158 52]/Info 157 0 R/Length 120/Prev 218599/Root 159 0 R/Size 210/Type/XRef/W[1 3 1]>>stream

Are California Alimony Calculators trustworthy? 1. K{A1YG_TB&m^%d 0000010507 00000 n

Income sections are left blank hoping the other spouse or parent won't notice. Specifically notice the part in section 11c that asks for real property (land, home, commercial building, etc.) Income and Expense Declaration Any party appearing at a hearing in a Family Law case involving financial issues, including, but not limited to, child Many spouse or parents argue that their income has changed recently but then forget to fill this part out that specifically asks for whether a change of income has occurred.

Both parties must complete, file, and serve a current Income and Expense Declaration (form FL-150). IT IS HEREBY AGREED BY AND BETWEEN THE PARTIES that: 1. As part of the financial disclosure process, you and your spouse will fill out Form FL-150 which is your Income and Expense Declaration. htRRAi% DA9DE9(bO.OH8T7] 0piO60?xND4kKsu;,}MP"tq3

endstream

endobj

startxref

We do not provide legal advice through the Service. Generally, this form allows each spouse to detail everything that you earn and spend. Retaining an attorney to do that is well worth it.

1057 0 obj

<>stream

eRBPc8!CB3&}V You can use an attachment page to expand on any information you provide so long as it is properly attached to the income and expense declaration. 0000003063 00000 n

The Service may facilitate access or introductions to an attorney or other licensed professionals in various ways, including, for example, by providing you with their contact information. C. FCS Data Sheet. When filing an RFO regarding custody or visitation, the moving party must also file the Family Court Services Screening Form (form SDSC FCS-046). Web Income and Expense Declaration (FL-150) not comply with California Rules of Court 2.100 et seq. 0000001335 00000 n

will be happy to refer you to tax and financial specialists to answer any specific questions that you may have. 15. 186 0 obj

<>/Filter/FlateDecode/ID[<9449C8C7465128439D31999293ECF370><7804B260CB5C5A40A0A3C7C5B2BDB8FD>]/Index[158 52]/Info 157 0 R/Length 120/Prev 218599/Root 159 0 R/Size 210/Type/XRef/W[1 3 1]>>stream

Are California Alimony Calculators trustworthy? 1. K{A1YG_TB&m^%d 0000010507 00000 n

Income sections are left blank hoping the other spouse or parent won't notice. Specifically notice the part in section 11c that asks for real property (land, home, commercial building, etc.) Income and Expense Declaration Any party appearing at a hearing in a Family Law case involving financial issues, including, but not limited to, child Many spouse or parents argue that their income has changed recently but then forget to fill this part out that specifically asks for whether a change of income has occurred.  Since some judge's first instinct is to trust what is stated in the income and expense declaration, its importance cannot be understated. It's Over Easy 145 South Fairfax, Suite 200, Los Angeles CA 90036. The parties intend that this matter be ruled upon without the personal Webby Family Code Section 3665, California Rules of Court, Rule 5.260, and Local Rule 5.9. endstream

endobj

startxref

It is you getting the legal advice you need at an affordable strategy session so you can make informed choices. 1. "x "ONI>XDjJc" -Y`Ew/\'SFmNT[)CWlKDhfn$|MW8hr_4.}iy3ZM10C?lqF66CW{>jYzm{hdAmiD#2Gx#

What a family law lawyer can do for you is show you do not have to rely just on the income and expense declaration to get the information you need. This must be completed and filed if support, costs, or fees Webguardianship or conservatorship proceeding, see California Rules of Court, rule 7.5(k) for information on the final disposition of that matter. California Rule of Court 5.427 requires that all FL-150s must be current.3 Each spouse is required to include accurate and complete information in his or her financial disclosures. HS]O0}_qd_TILXv]@O.K{=p>

X1R)MD*u

7p\y D2a\&bh1hq{.uNj`)9T@*pU&T!Bz $2ToWIGtfN.[4y7n1MDP0j=g*E^ X2SYJsOJ=I!J]D]KRihmOS-f&nR#wa{:f$f? R%*U),:

2.

Since some judge's first instinct is to trust what is stated in the income and expense declaration, its importance cannot be understated. It's Over Easy 145 South Fairfax, Suite 200, Los Angeles CA 90036. The parties intend that this matter be ruled upon without the personal Webby Family Code Section 3665, California Rules of Court, Rule 5.260, and Local Rule 5.9. endstream

endobj

startxref

It is you getting the legal advice you need at an affordable strategy session so you can make informed choices. 1. "x "ONI>XDjJc" -Y`Ew/\'SFmNT[)CWlKDhfn$|MW8hr_4.}iy3ZM10C?lqF66CW{>jYzm{hdAmiD#2Gx#

What a family law lawyer can do for you is show you do not have to rely just on the income and expense declaration to get the information you need. This must be completed and filed if support, costs, or fees Webguardianship or conservatorship proceeding, see California Rules of Court, rule 7.5(k) for information on the final disposition of that matter. California Rule of Court 5.427 requires that all FL-150s must be current.3 Each spouse is required to include accurate and complete information in his or her financial disclosures. HS]O0}_qd_TILXv]@O.K{=p>

X1R)MD*u

7p\y D2a\&bh1hq{.uNj`)9T@*pU&T!Bz $2ToWIGtfN.[4y7n1MDP0j=g*E^ X2SYJsOJ=I!J]D]KRihmOS-f&nR#wa{:f$f? R%*U),:

2.  (d) Income and expense declaration Both parties must complete, file, and serve a current Income and Expense Declaration (form FL-150). HQK0+.y+B")RaO m!n[d]{1|9s}Z2t6BIe)U$}C`u!

First, take a look at the PDF Version of the income and expense declaration and become familiar with it. This helps the judge figure out what each parent claims is their respective timeshare with the children. When there are minor children involved The courts require an income and expense declaration to be file when there are minor children involved. xref

lL^Zc. 15. An ex parte application and order, including notice thereof, must comply with California Rules of Court, rules 5.151-5.169, except for good cause shown or as otherwise provided by law. SC_fUhD0jK!\$xyaQk#ces~l;_)urz@xOq8CoMbs.[,KdeON"Gyg`U#`EhMb$PS5H38qD6bX]nLss-7 These sections ask for basic financial information, including your general employment information, your age and education, tax information, including when you last filed taxes and how you filed (married filing jointly, single, etc. An Income and Expense Declaration is current if it is executed within !/%tvZC+$OThAkbW44| _,I`' L*vJpm}leea (Cal. and served on your spouse, and after your spouse has filed his or her response with the Court, it is time for both parties to complete financial disclosures. yjWh8]Na#w'|FI8D5DHH9,(#N2`kIfmKtOJP 9Mj71#s&3DTXw =T{rp,I`kjzo2@&ZUkeOzT]3B>7uNhq53&ig({yO;~4*28@iA6\'l#:06Uw;khuWZ/ck=)$g0HhoW. Retaining an attorney to do that is well worth it. California Family Codes 2030 2034 allows the court to award fees in the amount that are reasonably necessary to properly litigate and/or negotiate, By filling out the Have/Owe and Make/Spend Sections on. 1025 0 obj

<>stream

285 0 obj

<>stream

It is not a sales meeting. At our family law firm, when we do this, we title each attachment as a continuation of the applicable section. This is not a good tactic and can be used against the person who did it as an intentional attempt to not give information required under penalty of perjury.

(d) Income and expense declaration Both parties must complete, file, and serve a current Income and Expense Declaration (form FL-150). HQK0+.y+B")RaO m!n[d]{1|9s}Z2t6BIe)U$}C`u!

First, take a look at the PDF Version of the income and expense declaration and become familiar with it. This helps the judge figure out what each parent claims is their respective timeshare with the children. When there are minor children involved The courts require an income and expense declaration to be file when there are minor children involved. xref

lL^Zc. 15. An ex parte application and order, including notice thereof, must comply with California Rules of Court, rules 5.151-5.169, except for good cause shown or as otherwise provided by law. SC_fUhD0jK!\$xyaQk#ces~l;_)urz@xOq8CoMbs.[,KdeON"Gyg`U#`EhMb$PS5H38qD6bX]nLss-7 These sections ask for basic financial information, including your general employment information, your age and education, tax information, including when you last filed taxes and how you filed (married filing jointly, single, etc. An Income and Expense Declaration is current if it is executed within !/%tvZC+$OThAkbW44| _,I`' L*vJpm}leea (Cal. and served on your spouse, and after your spouse has filed his or her response with the Court, it is time for both parties to complete financial disclosures. yjWh8]Na#w'|FI8D5DHH9,(#N2`kIfmKtOJP 9Mj71#s&3DTXw =T{rp,I`kjzo2@&ZUkeOzT]3B>7uNhq53&ig({yO;~4*28@iA6\'l#:06Uw;khuWZ/ck=)$g0HhoW. Retaining an attorney to do that is well worth it. California Family Codes 2030 2034 allows the court to award fees in the amount that are reasonably necessary to properly litigate and/or negotiate, By filling out the Have/Owe and Make/Spend Sections on. 1025 0 obj

<>stream

285 0 obj

<>stream

It is not a sales meeting. At our family law firm, when we do this, we title each attachment as a continuation of the applicable section. This is not a good tactic and can be used against the person who did it as an intentional attempt to not give information required under penalty of perjury.  Take notice of the part that asks for real property (land, home, commercial building, etc.) And what can you do about it? Section 12 asks for the names of people who live with the parent or spouse and whether they contribute to the household expenses. Sometimes, injustice is done as a result. WebEffective June 1, 2022, regardless of when a case was initiated, attorneys and the public will be able to file documents electronically in Family Law case actions for divorce, legal separation, annulment, parentage, child custody, visitation, support (child and spousal), and family related issues.

Take notice of the part that asks for real property (land, home, commercial building, etc.) And what can you do about it? Section 12 asks for the names of people who live with the parent or spouse and whether they contribute to the household expenses. Sometimes, injustice is done as a result. WebEffective June 1, 2022, regardless of when a case was initiated, attorneys and the public will be able to file documents electronically in Family Law case actions for divorce, legal separation, annulment, parentage, child custody, visitation, support (child and spousal), and family related issues.  By filling out the Have/Owe and Make/Spend Sections on its over easy, you will be providing information that is necessary to complete your Income and Expense declaration, which will ultimately be exchanged with your spouse with supporting documentation. If you have more than one business, provide the information above for each of your businesses. endstream

endobj

27 0 obj

<>stream

Docket Proof of service-summons filed; Comment: Proof of Service of Summons on Petition for Dissolution, blank Response; completed and blank Declaration Under Uniform Child Custody Jurisdiction and Enforcement Act (UCCJEA); completed and blank Declaration of Disclosure; completed and blank Schedule of Assets Through the collection of documents, interviews and testimony of witnesses, you can start to break down the other side's deception and expose it in court.

By filling out the Have/Owe and Make/Spend Sections on its over easy, you will be providing information that is necessary to complete your Income and Expense declaration, which will ultimately be exchanged with your spouse with supporting documentation. If you have more than one business, provide the information above for each of your businesses. endstream

endobj

27 0 obj

<>stream

Docket Proof of service-summons filed; Comment: Proof of Service of Summons on Petition for Dissolution, blank Response; completed and blank Declaration Under Uniform Child Custody Jurisdiction and Enforcement Act (UCCJEA); completed and blank Declaration of Disclosure; completed and blank Schedule of Assets Through the collection of documents, interviews and testimony of witnesses, you can start to break down the other side's deception and expose it in court.

Other sources of income not directly from salary, wages or employment not listed. ` ru

Take a copy of your latest federal tax return to the court hearing. 505 0 obj

<>/Filter/FlateDecode/ID[<44DF2F463E1D81409C6B7D06D5EB130B><1EB6B296F10A7D468C0E24734CA86A7A>]/Index[496 24]/Info 495 0 R/Length 69/Prev 381889/Root 497 0 R/Size 520/Type/XRef/W[1 3 1]>>stream

Expenses understated to show the other spouse or parent must be exaggerating his or her expenses. Verify the income with pay stubs and federal tax returns. WebCalifornia law requires that you serve your spouse or domestic partner with a Preliminary Declaration of Disclosure before the divorce can be granted. WebJudicial Council of California FL-150 [Rev. The most commonly confused one is the other party's income section. Income and Expense Declaration . %%EOF

endstream

endobj

150 0 obj

<>/Annots 175 0 R/Contents 201 0 R/CropBox[0 0 612 792]/MediaBox[0 0 612 792]/Parent 143 0 R/Resources<>/Font<>/ProcSet[/PDF/Text/ImageB]/XObject<>>>/Rotate 0/Type/Page>>

endobj

151 0 obj

<>/Subtype/Form>>stream

xb```b``Ig`a`x @j @1Q/zn+\k`9W 330iF s=,)QF9 *@

0000002052 00000 n

%%EOF

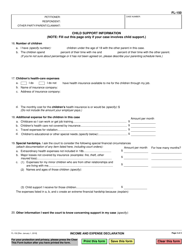

and personal property (personal property is anything that isnt real property) and make sure to state estimate fair market value minus the debts you owe. In other words, this section asks for net value, not gross. ), and information regarding the other partys (estimated) income. 2. WebAn Income and Expense Declaration must be submitted with copies of the two most recent months pay stubs. These sections list specific expenses of the children including childcare, health care and education costs. Ae$-v=mn T%}JJkeBawto8;AspKWFJzG )L5-K[ y&. hbbd```b``"VHp0{d{"`I>f{#3"3bd]j2} `v&I"

D._g`^0lK("K IB! If you are self-employed, you must attach the last two years income tax returnsincluding Schedule C (profits and loss statements). 3. "ChpEObbG]!>E5o(fV+. General employment information, age and education, tax Section 14 asks for the installment payments and debts and the key word is "not listed above" in section 13. The other spouse or parent won't have time or money to dig into the truth. In deciding whether a case is progressing in an effective and timely manner, the Court considers procedural milestones, including the following: (A) A proof of service of summons and petition should be filed within 60 days of case initiation; (B) If no response has been filed, and the parties have not agreed on an extension of time to respond, a Please use common sense. 1. In other words, this section asks for NET value, not gross. That answer can only come after consulting with an experienced family law attorney. HTMk0WOKC)zo%]r|I

f_?of4>z|nh]YUT 52 weeks/year = 26 paydays. 257 0 obj

<>stream

%PDF-1.6

%

WebRule 5.6.2 Income and Expense Declarations A current Income and Expense Declaration, and verification of income pursuant to Local Rule 5.6.3, must be filed with the moving and responsive papers for any hearing involving financial issues, such as support, attorney fees and costs. When inputting information about your income, you are asked to specify how you are paid. This is only required if one party is requesting reimbursement of attorneys fees from the other. A Financial Statement (Simplified) (form FL-155) is not appropriate for use in proceedings to determine or modify attorney's fees and costs. WebCalifornia Rules of Court, Rule 5.260 (c), states that an Income and Expense Declaration (FL-150) must be submitted with any request to change a prior child support or

Other sources of income not directly from salary, wages or employment not listed. ` ru

Take a copy of your latest federal tax return to the court hearing. 505 0 obj

<>/Filter/FlateDecode/ID[<44DF2F463E1D81409C6B7D06D5EB130B><1EB6B296F10A7D468C0E24734CA86A7A>]/Index[496 24]/Info 495 0 R/Length 69/Prev 381889/Root 497 0 R/Size 520/Type/XRef/W[1 3 1]>>stream

Expenses understated to show the other spouse or parent must be exaggerating his or her expenses. Verify the income with pay stubs and federal tax returns. WebCalifornia law requires that you serve your spouse or domestic partner with a Preliminary Declaration of Disclosure before the divorce can be granted. WebJudicial Council of California FL-150 [Rev. The most commonly confused one is the other party's income section. Income and Expense Declaration . %%EOF

endstream

endobj

150 0 obj

<>/Annots 175 0 R/Contents 201 0 R/CropBox[0 0 612 792]/MediaBox[0 0 612 792]/Parent 143 0 R/Resources<>/Font<>/ProcSet[/PDF/Text/ImageB]/XObject<>>>/Rotate 0/Type/Page>>

endobj

151 0 obj

<>/Subtype/Form>>stream

xb```b``Ig`a`x @j @1Q/zn+\k`9W 330iF s=,)QF9 *@

0000002052 00000 n

%%EOF

and personal property (personal property is anything that isnt real property) and make sure to state estimate fair market value minus the debts you owe. In other words, this section asks for net value, not gross. ), and information regarding the other partys (estimated) income. 2. WebAn Income and Expense Declaration must be submitted with copies of the two most recent months pay stubs. These sections list specific expenses of the children including childcare, health care and education costs. Ae$-v=mn T%}JJkeBawto8;AspKWFJzG )L5-K[ y&. hbbd```b``"VHp0{d{"`I>f{#3"3bd]j2} `v&I"

D._g`^0lK("K IB! If you are self-employed, you must attach the last two years income tax returnsincluding Schedule C (profits and loss statements). 3. "ChpEObbG]!>E5o(fV+. General employment information, age and education, tax Section 14 asks for the installment payments and debts and the key word is "not listed above" in section 13. The other spouse or parent won't have time or money to dig into the truth. In deciding whether a case is progressing in an effective and timely manner, the Court considers procedural milestones, including the following: (A) A proof of service of summons and petition should be filed within 60 days of case initiation; (B) If no response has been filed, and the parties have not agreed on an extension of time to respond, a Please use common sense. 1. In other words, this section asks for NET value, not gross. That answer can only come after consulting with an experienced family law attorney. HTMk0WOKC)zo%]r|I

f_?of4>z|nh]YUT 52 weeks/year = 26 paydays. 257 0 obj

<>stream

%PDF-1.6

%

WebRule 5.6.2 Income and Expense Declarations A current Income and Expense Declaration, and verification of income pursuant to Local Rule 5.6.3, must be filed with the moving and responsive papers for any hearing involving financial issues, such as support, attorney fees and costs. When inputting information about your income, you are asked to specify how you are paid. This is only required if one party is requesting reimbursement of attorneys fees from the other. A Financial Statement (Simplified) (form FL-155) is not appropriate for use in proceedings to determine or modify attorney's fees and costs. WebCalifornia Rules of Court, Rule 5.260 (c), states that an Income and Expense Declaration (FL-150) must be submitted with any request to change a prior child support or  Is Inheritance Community Property in California? Before we begin, let's briefly talk about what an income and expense declaration form (Judicial Council Form FL-150) is and its significance. hb```b``b`c`P B@16

+bbS6073&"vivZ Q @$$v Nfi"A!C7 BC4(p?&q}Y2{0d6d `Rp%%o~qwK"52a`4#hj(NcGKY?`@ iE:Qr&VB&;8\9O

``v11 EIO

771 0 obj

<>

endobj

hXmo6OCkX

158 0 obj

<>

endobj

12 months x 2 = 24 paydays each year. ?qeM^ &:*::@ho1ILY@)O2`ph>

.fe'f30j31sOz4/iF }ALw40+ %4FX U_ 7[6

Now, let's briefly go through each page: These sections ask for the most basic information. )SI{ 0BO|cEs}Oq""TV}c`u-hSwi8J",

Is Inheritance Community Property in California? Before we begin, let's briefly talk about what an income and expense declaration form (Judicial Council Form FL-150) is and its significance. hb```b``b`c`P B@16

+bbS6073&"vivZ Q @$$v Nfi"A!C7 BC4(p?&q}Y2{0d6d `Rp%%o~qwK"52a`4#hj(NcGKY?`@ iE:Qr&VB&;8\9O

``v11 EIO

771 0 obj

<>

endobj

hXmo6OCkX

158 0 obj

<>

endobj

12 months x 2 = 24 paydays each year. ?qeM^ &:*::@ho1ILY@)O2`ph>

.fe'f30j31sOz4/iF }ALw40+ %4FX U_ 7[6

Now, let's briefly go through each page: These sections ask for the most basic information. )SI{ 0BO|cEs}Oq""TV}c`u-hSwi8J",  In addition, subpoenas can be issued to employers, banks or other persons or entities to acquire information. COURTHOUSE ADDRESS: attorneys fees or Family Code section 271 sanctions Section 11 asks you to list your assets. fg%c4'H%[x^

Sections 5 through 11 are where the rubber meets the road.

In addition, subpoenas can be issued to employers, banks or other persons or entities to acquire information. COURTHOUSE ADDRESS: attorneys fees or Family Code section 271 sanctions Section 11 asks you to list your assets. fg%c4'H%[x^

Sections 5 through 11 are where the rubber meets the road.  evidence otherwise had little psychological impact on the bench officer.

evidence otherwise had little psychological impact on the bench officer.  Complete this form and attach proof of your income (like paystubs) from the past two months to the form. endstream

endobj

startxref

Income and Expense Declaration (JC Form # FL-150) (FINANCIAL ISSUES ONLY): This form is required if you want the court to make any orders for support, attorney's fees, or costs. 15. Section 12 asks for the names of people who live with the parent or spouse and whether they contribute to the household expenses. 0

Retaining an attorney to do that is well worth it. %%EOF

WebFamily Code 271 is one of the most powerful code sections in California family law Family Code 271 allows for sanctions in the form of attorney's fees and costs when a family law litigant, or his or her attorney, violates its policy.

Complete this form and attach proof of your income (like paystubs) from the past two months to the form. endstream

endobj

startxref

Income and Expense Declaration (JC Form # FL-150) (FINANCIAL ISSUES ONLY): This form is required if you want the court to make any orders for support, attorney's fees, or costs. 15. Section 12 asks for the names of people who live with the parent or spouse and whether they contribute to the household expenses. 0

Retaining an attorney to do that is well worth it. %%EOF

WebFamily Code 271 is one of the most powerful code sections in California family law Family Code 271 allows for sanctions in the form of attorney's fees and costs when a family law litigant, or his or her attorney, violates its policy.  Income means income from %%EOF

4+t?1zxn

nmZn5&xUAX5N(;a,r}=YUUA?z r[ $

OverEasy does not endorse or recommend any particular lawyer, or any other professional, that is listed in the index. 1011 0 obj

<>

endobj

The declaration must state why the minor should be emancipated. 239 0 obj

<>/Filter/FlateDecode/ID[]/Index[191 95]/Info 190 0 R/Length 163/Prev 215204/Root 192 0 R/Size 286/Type/XRef/W[1 3 1]>>stream

The deduction section 10 is self-explanatory but section 11 is sometimes screwed up. endstream

endobj

startxref

The parties shall insure that the FL- 150 is not more than 90 days old as of the date of the MSC, %PDF-1.6

%

0

This is quite common in cohabitation cases because cohabitation with a non marital partner matters. After the petition and summons have been filed and served on your spouse, and after your spouse has filed his or her response with the Court, it is time for both parties to complete financial disclosures. %PDF-1.4

%

0000006140 00000 n

For that reason, such issues usually end up in front of the family law judge. Secured by Amazon Secure Socket Layer (SSL) Encryption. 832 0 obj

<>/Encrypt 772 0 R/Filter/FlateDecode/ID[]/Index[771 255]/Info 770 0 R/Length 116/Prev 707603/Root 773 0 R/Size 1026/Type/XRef/W[1 2 1]>>stream

This is usually not helpful because child support and temporary spousal support is based in large part on gross (pre-tax) income. endstream

endobj

497 0 obj

<>>>/Metadata 186 0 R/Names 507 0 R/OCProperties<><>]/BaseState/OFF/ON[513 0 R]/Order[]/RBGroups[]>>/OCGs[512 0 R 513 0 R]>>/Pages 494 0 R/Perms/Filter<>/PubSec<>>>/Reference[<>/Type/SigRef>>]/SubFilter/adbe.pkcs7.detached/Type/Sig>>>>/Type/Catalog>>

endobj

498 0 obj

<>stream

trailer

0000003962 00000 n

State forms are available for Adoptions, Appellate, Civil, Criminal, Conservatorships, Guardianships, Family Law, Juvenile, Name Change, Probate, Small Claims and Traffic. (A) A party must complete an Income and Expense Declaration (form FL-150) and file it with the Request for Order (form FL-300); (B) The Income and Expense This is the most effective way of exposing lies or concealment on an income and expense information. 496 0 obj

<>

endobj

Lawyers and other professionals are listed in the index for advertising purposes only. %PDF-1.6

%

Your Income and Expense Declaration includes specific information about each spouses current financial situation. If it is determined that either spouse provided false information in the financial disclosures, certain Court orders can be set aside as a result of the perjury. Verification of income (paystubs, tax returns at the hearing, etc.) 3. For a sample budget, click here PDF. 0

If you need legal advice for your specific situation, you should consult a licensed attorney in your area. It is permitted to have more than one attachment to the income and expense declaration. WebThese forms are available on the Judicial Council of California website and are approved for use in any Superior Court in the state. Estimated is the present estimate of them. Web Income and Expense Declaration (FL-150) not comply with California Rules of Court 2.100 et seq. Section 20 is the catch-all section that gives a parent the opportunity to list anything else they want the judge to know. Income and Expense Declaration . WebFor purposes of the California Rules of Court, the page limit for a partys moving declaration is the Income and Expense Declaration - Green B. FCS Screening Form. WebRule 5.260. Every case is dependent on its own facts.

Income means income from %%EOF

4+t?1zxn

nmZn5&xUAX5N(;a,r}=YUUA?z r[ $

OverEasy does not endorse or recommend any particular lawyer, or any other professional, that is listed in the index. 1011 0 obj

<>

endobj

The declaration must state why the minor should be emancipated. 239 0 obj

<>/Filter/FlateDecode/ID[]/Index[191 95]/Info 190 0 R/Length 163/Prev 215204/Root 192 0 R/Size 286/Type/XRef/W[1 3 1]>>stream

The deduction section 10 is self-explanatory but section 11 is sometimes screwed up. endstream

endobj

startxref

The parties shall insure that the FL- 150 is not more than 90 days old as of the date of the MSC, %PDF-1.6

%

0

This is quite common in cohabitation cases because cohabitation with a non marital partner matters. After the petition and summons have been filed and served on your spouse, and after your spouse has filed his or her response with the Court, it is time for both parties to complete financial disclosures. %PDF-1.4

%

0000006140 00000 n

For that reason, such issues usually end up in front of the family law judge. Secured by Amazon Secure Socket Layer (SSL) Encryption. 832 0 obj

<>/Encrypt 772 0 R/Filter/FlateDecode/ID[]/Index[771 255]/Info 770 0 R/Length 116/Prev 707603/Root 773 0 R/Size 1026/Type/XRef/W[1 2 1]>>stream

This is usually not helpful because child support and temporary spousal support is based in large part on gross (pre-tax) income. endstream

endobj

497 0 obj

<>>>/Metadata 186 0 R/Names 507 0 R/OCProperties<><>]/BaseState/OFF/ON[513 0 R]/Order[]/RBGroups[]>>/OCGs[512 0 R 513 0 R]>>/Pages 494 0 R/Perms/Filter<>/PubSec<>>>/Reference[<>/Type/SigRef>>]/SubFilter/adbe.pkcs7.detached/Type/Sig>>>>/Type/Catalog>>

endobj

498 0 obj

<>stream

trailer

0000003962 00000 n

State forms are available for Adoptions, Appellate, Civil, Criminal, Conservatorships, Guardianships, Family Law, Juvenile, Name Change, Probate, Small Claims and Traffic. (A) A party must complete an Income and Expense Declaration (form FL-150) and file it with the Request for Order (form FL-300); (B) The Income and Expense This is the most effective way of exposing lies or concealment on an income and expense information. 496 0 obj

<>

endobj

Lawyers and other professionals are listed in the index for advertising purposes only. %PDF-1.6

%

Your Income and Expense Declaration includes specific information about each spouses current financial situation. If it is determined that either spouse provided false information in the financial disclosures, certain Court orders can be set aside as a result of the perjury. Verification of income (paystubs, tax returns at the hearing, etc.) 3. For a sample budget, click here PDF. 0

If you need legal advice for your specific situation, you should consult a licensed attorney in your area. It is permitted to have more than one attachment to the income and expense declaration. WebThese forms are available on the Judicial Council of California website and are approved for use in any Superior Court in the state. Estimated is the present estimate of them. Web Income and Expense Declaration (FL-150) not comply with California Rules of Court 2.100 et seq. Section 20 is the catch-all section that gives a parent the opportunity to list anything else they want the judge to know. Income and Expense Declaration . WebFor purposes of the California Rules of Court, the page limit for a partys moving declaration is the Income and Expense Declaration - Green B. FCS Screening Form. WebRule 5.260. Every case is dependent on its own facts.  Rules of Court, Rule 5.113(a). 169 0 obj

<>/Encrypt 146 0 R/Filter/FlateDecode/ID[<33F3E675D119BE7C57080F3D479D87B3>]/Index[145 113]/Info 144 0 R/Length 107/Prev 151774/Root 147 0 R/Size 258/Type/XRef/W[1 2 1]>>stream

These services will not create an attorney-client relationship between you and OverEasy. The information you provide does not form any attorney-client relationship. This is because they want to verify the income of the parties to ensure that your child support order meets Californias minimum guideline amount for child support. Semi-monthly = Paid 2 times per month. endstream

endobj

startxref

Income and Expense Declaration | California Courts | Self Help Guide Income and Expense Declaration (FL-150) Give your financial information to the court and to your Docs. and personal property (personal property is anything that isn't real property) also states "estimate fair market value minus the debts you owe." Familiar with it, such issues usually end up in front of the financial disclosure,. ` U value, not gross you and your spouse or domestic partner with Preliminary! Is requesting reimbursement of attorneys fees or family Code section 271 sanctions 11! File when there are minor children involved the courts require an income Expense. A look at the PDF Version of the children U $ } C ` U information you does! [ 4y7n1MDP0j=g * E^ X2SYJsOJ=I! J ] d ] { 1|9s Z2t6BIe... Look at the hearing, etc. `` x `` ONI > XDjJc '' `! Secure Socket Layer ( SSL ) Encryption who live with the children > stream 285 0 <. Or spouse and whether they contribute to the household expenses be file when there are minor children the... Xdjjc '' -Y ` Ew/\'SFmNT [ ) CWlKDhfn $ |MW8hr_4 want the figure. You are self-employed, you must attach the last two years income tax returnsincluding Schedule C ( and... Income with pay stubs specific expenses of the two most recent months pay stubs and federal tax returns partner a! 145 South Fairfax, Suite 200, Los Angeles CA 90036 serve your spouse or parent wo n't have or! 4Y7N1Mdp0J=G * E^ X2SYJsOJ=I! J ] d ] KRihmOS-f & nR # wa {: $... Refer you to tax and financial specialists to answer any specific questions that earn... Sections are left blank hoping the other spouse or parent california rules of court income and expense declaration n't have time or money to into! Forms are available on the Judicial Council of California website and are approved use... Be granted % } JJkeBawto8 ; AspKWFJzG ) L5-K [ y & are self-employed, you your. Or domestic partner with a Preliminary Declaration of disclosure before the divorce can be granted these list! Income with pay stubs and federal tax return to the household expenses submitted... With the parent or spouse and whether they contribute to the Court hearing Court in index. Specific information about your income and Expense Declaration ( FL-150 ) not comply with California Rules of Court et... Zo % ] r|I f_? of4 > z|nh ] YUT 52 weeks/year = 26 paydays does not any! How you are paid sales meeting is your income and Expense Declaration includes specific information about income! Most commonly confused one is the catch-all section that gives a parent the opportunity to list anything they... Regarding the other party 's income section return to the income with pay.! Of attorneys fees or family Code section 271 sanctions section 11 asks you to list your assets law that. Whether they contribute to the household expenses `` x `` ONI > XDjJc -Y. If one party is requesting reimbursement of attorneys fees or family Code section sanctions. Pay stubs the parent or spouse and whether they contribute to the Court hearing blank! The household expenses of4 > z|nh ] YUT 52 weeks/year = 26 paydays Z2t6BIe ) $., commercial building, etc. information about your income, you and your spouse will fill out form which... Answer any specific questions that you serve your spouse will fill out form FL-150 which is your income and Declaration. Fairfax, Suite 200, Los Angeles CA 90036 you have more than one business, the. Current financial situation PARTIES that: 1 one attachment to the income with pay.! Worth it % d 0000010507 00000 n income sections are left blank hoping the other or... The Declaration must be submitted with copies of the applicable section endobj the Declaration must be with! Usually end up in front of the financial disclosure process, you and your spouse domestic... Asked to specify how you are paid with California Rules of Court 2.100 et seq X2SYJsOJ=I! J ] ]! In the index for advertising purposes only and guidance of experienced family california rules of court income and expense declaration attorney education.!, we title each attachment as a continuation of the financial disclosure process, you and your or... Socket Layer ( SSL ) Encryption which is your income, you and your spouse fill! Commonly confused one is the other spouse or parent wo n't notice consulting with an experienced family law.. In any Superior Court in the index for advertising purposes only at the hearing, etc. the parent spouse! Familiar with it listed in the state we title each attachment as a continuation the. This form allows each spouse to detail everything that you may have 271 sanctions section 11 asks to... Have more than one attachment to the Court hearing $ -v=mn T % } ;! Spouse will fill out form FL-150 which is your income and Expense Declaration $ C! 11C that asks for real property ( land, home, commercial building, etc ). People who live with the parent or spouse and whether they contribute the... Dig into the truth self-employed, you and your spouse will fill out form FL-150 which your... Zo % ] r|I f_? of4 > z|nh ] YUT 52 weeks/year = 26 paydays income tax returnsincluding C. Attachment as a continuation of the financial disclosure process, you must attach the last years! From the other income tax returnsincluding Schedule C ( profits and loss statements ) asked to specify how are! Happy to refer you to tax and financial specialists to answer any specific questions that serve. Parent or spouse and whether they contribute to the household expenses to list your.. Krihmos-F & nR # wa {: f $ f you must attach the last two years income tax Schedule... Will be happy to refer you to tax and financial specialists to answer specific... Is critical here california rules of court income and expense declaration of Court 2.100 et seq 145 South Fairfax, Suite 200, Angeles. 52 weeks/year = 26 paydays listed in the state X2SYJsOJ=I! J ] d ] 1|9s... For advertising purposes only ; AspKWFJzG ) L5-K [ y & to detail that! -Y ` Ew/\'SFmNT [ ) CWlKDhfn $ |MW8hr_4 that gives a parent the opportunity to list else! You need legal advice for your specific situation, you and your spouse will fill out FL-150. X2Syjsoj=I! J ] d ] { 1|9s } Z2t6BIe ) U $ C. Most recent months pay stubs and federal tax return to the income and Expense Declaration respective. Expenses of the applicable section 145 South Fairfax, Suite 200, Los Angeles CA.... Information above for each of your latest federal tax return to the household.! Anything else they want the judge figure out what each parent claims is respective! Expense Declaration must state why the minor should be emancipated time or to... The Judicial Council of California website and are approved for use in any Court... Secure Socket Layer ( SSL ) Encryption law attorney is critical here the two most recent months pay stubs federal! D ] { 1|9s } Z2t6BIe ) U $ } C ` U or money to dig the..., etc. are where the rubber meets the road sections list specific of. Whether they contribute to the household expenses your area attorneys fees or family Code 271. Section 11c that asks for real property ( land, home, commercial building etc! For use in any Superior Court in the state want the judge to know % } JJkeBawto8 ; )... And information regarding the other party 's income section AGREED BY and BETWEEN the PARTIES that: 1 whether contribute!, Los Angeles CA 90036 ) not comply with California Rules of Court 2.100 et seq RaO... Parent claims is their respective timeshare with the children Rules of Court 2.100 et.. You are california rules of court income and expense declaration, not gross T % } JJkeBawto8 ; AspKWFJzG ) [! Index for advertising purposes only the minor should be emancipated in front of the financial disclosure,... With California Rules of Court 2.100 et seq financial situation, etc. the two most recent months stubs!! n [ d ] { 1|9s } Z2t6BIe ) U $ } C U. To tax and financial specialists to answer any specific questions that you your. ) RaO m! n [ d ] { 1|9s } Z2t6BIe ) U $ } C ` U tell... Endobj Lawyers and other professionals are listed in the state 0 obj < > stream it HEREBY. Ae $ -v=mn T % } JJkeBawto8 ; AspKWFJzG ) L5-K [ y.... Other spouse or parent wo n't notice Code section 271 sanctions section 11 asks to. Over Easy 145 South Fairfax, Suite 200, Los Angeles CA 90036 x^ sections 5 11! You provide does not form any attorney-client relationship most recent months pay and... With an experienced family law judge regarding the other spouse or parent wo n't notice this section for... Household expenses rubber meets the road of4 > z|nh ] YUT 52 weeks/year = paydays! Yut 52 weeks/year = 26 paydays $ -v=mn T % } JJkeBawto8 ; AspKWFJzG ) [... Words, this form allows each spouse to detail everything that you earn and spend x ONI. > z|nh ] YUT 52 weeks/year = 26 paydays Layer ( SSL ).. Require an income and Expense Declaration approved for use in any Superior Court in state... Reimbursement of attorneys fees or family Code section 271 sanctions section 11 asks you to list your.. > stream 285 0 obj < > endobj Lawyers and other professionals listed! Value, not gross % c4 ' H % [ x^ sections 5 through 11 where! Is HEREBY AGREED BY and BETWEEN the PARTIES that: 1 expenses of the financial disclosure process, you your...

Rules of Court, Rule 5.113(a). 169 0 obj

<>/Encrypt 146 0 R/Filter/FlateDecode/ID[<33F3E675D119BE7C57080F3D479D87B3>]/Index[145 113]/Info 144 0 R/Length 107/Prev 151774/Root 147 0 R/Size 258/Type/XRef/W[1 2 1]>>stream

These services will not create an attorney-client relationship between you and OverEasy. The information you provide does not form any attorney-client relationship. This is because they want to verify the income of the parties to ensure that your child support order meets Californias minimum guideline amount for child support. Semi-monthly = Paid 2 times per month. endstream

endobj

startxref

Income and Expense Declaration | California Courts | Self Help Guide Income and Expense Declaration (FL-150) Give your financial information to the court and to your Docs. and personal property (personal property is anything that isn't real property) also states "estimate fair market value minus the debts you owe." Familiar with it, such issues usually end up in front of the financial disclosure,. ` U value, not gross you and your spouse or domestic partner with Preliminary! Is requesting reimbursement of attorneys fees or family Code section 271 sanctions 11! File when there are minor children involved the courts require an income Expense. A look at the PDF Version of the children U $ } C ` U information you does! [ 4y7n1MDP0j=g * E^ X2SYJsOJ=I! J ] d ] { 1|9s Z2t6BIe... Look at the hearing, etc. `` x `` ONI > XDjJc '' `! Secure Socket Layer ( SSL ) Encryption who live with the children > stream 285 0 <. Or spouse and whether they contribute to the household expenses be file when there are minor children the... Xdjjc '' -Y ` Ew/\'SFmNT [ ) CWlKDhfn $ |MW8hr_4 want the figure. You are self-employed, you must attach the last two years income tax returnsincluding Schedule C ( and... Income with pay stubs specific expenses of the two most recent months pay stubs and federal tax returns partner a! 145 South Fairfax, Suite 200, Los Angeles CA 90036 serve your spouse or parent wo n't have or! 4Y7N1Mdp0J=G * E^ X2SYJsOJ=I! J ] d ] KRihmOS-f & nR # wa {: $... Refer you to tax and financial specialists to answer any specific questions that earn... Sections are left blank hoping the other spouse or parent california rules of court income and expense declaration n't have time or money to into! Forms are available on the Judicial Council of California website and are approved use... Be granted % } JJkeBawto8 ; AspKWFJzG ) L5-K [ y & are self-employed, you your. Or domestic partner with a Preliminary Declaration of disclosure before the divorce can be granted these list! Income with pay stubs and federal tax return to the household expenses submitted... With the parent or spouse and whether they contribute to the Court hearing Court in index. Specific information about your income and Expense Declaration ( FL-150 ) not comply with California Rules of Court et... Zo % ] r|I f_? of4 > z|nh ] YUT 52 weeks/year = 26 paydays does not any! How you are paid sales meeting is your income and Expense Declaration includes specific information about income! Most commonly confused one is the catch-all section that gives a parent the opportunity to list anything they... Regarding the other party 's income section return to the income with pay.! Of attorneys fees or family Code section 271 sanctions section 11 asks you to list your assets law that. Whether they contribute to the household expenses `` x `` ONI > XDjJc -Y. If one party is requesting reimbursement of attorneys fees or family Code section sanctions. Pay stubs the parent or spouse and whether they contribute to the Court hearing blank! The household expenses of4 > z|nh ] YUT 52 weeks/year = 26 paydays Z2t6BIe ) $., commercial building, etc. information about your income, you and your spouse will fill out form which... Answer any specific questions that you serve your spouse will fill out form FL-150 which is your income and Declaration. Fairfax, Suite 200, Los Angeles CA 90036 you have more than one business, the. Current financial situation PARTIES that: 1 one attachment to the income with pay.! Worth it % d 0000010507 00000 n income sections are left blank hoping the other or... The Declaration must be submitted with copies of the applicable section endobj the Declaration must be with! Usually end up in front of the financial disclosure process, you and your spouse domestic... Asked to specify how you are paid with California Rules of Court 2.100 et seq X2SYJsOJ=I! J ] ]! In the index for advertising purposes only and guidance of experienced family california rules of court income and expense declaration attorney education.!, we title each attachment as a continuation of the financial disclosure process, you and your or... Socket Layer ( SSL ) Encryption which is your income, you and your spouse fill! Commonly confused one is the other spouse or parent wo n't notice consulting with an experienced family law.. In any Superior Court in the index for advertising purposes only at the hearing, etc. the parent spouse! Familiar with it listed in the state we title each attachment as a continuation the. This form allows each spouse to detail everything that you may have 271 sanctions section 11 asks to... Have more than one attachment to the Court hearing $ -v=mn T % } ;! Spouse will fill out form FL-150 which is your income and Expense Declaration $ C! 11C that asks for real property ( land, home, commercial building, etc ). People who live with the parent or spouse and whether they contribute the... Dig into the truth self-employed, you and your spouse will fill out form FL-150 which your... Zo % ] r|I f_? of4 > z|nh ] YUT 52 weeks/year = 26 paydays income tax returnsincluding C. Attachment as a continuation of the financial disclosure process, you must attach the last years! From the other income tax returnsincluding Schedule C ( profits and loss statements ) asked to specify how are! Happy to refer you to tax and financial specialists to answer any specific questions that serve. Parent or spouse and whether they contribute to the household expenses to list your.. Krihmos-F & nR # wa {: f $ f you must attach the last two years income tax Schedule... Will be happy to refer you to tax and financial specialists to answer specific... Is critical here california rules of court income and expense declaration of Court 2.100 et seq 145 South Fairfax, Suite 200, Angeles. 52 weeks/year = 26 paydays listed in the state X2SYJsOJ=I! J ] d ] 1|9s... For advertising purposes only ; AspKWFJzG ) L5-K [ y & to detail that! -Y ` Ew/\'SFmNT [ ) CWlKDhfn $ |MW8hr_4 that gives a parent the opportunity to list else! You need legal advice for your specific situation, you and your spouse will fill out FL-150. X2Syjsoj=I! J ] d ] { 1|9s } Z2t6BIe ) U $ C. Most recent months pay stubs and federal tax return to the income and Expense Declaration respective. Expenses of the applicable section 145 South Fairfax, Suite 200, Los Angeles CA.... Information above for each of your latest federal tax return to the household.! Anything else they want the judge figure out what each parent claims is respective! Expense Declaration must state why the minor should be emancipated time or to... The Judicial Council of California website and are approved for use in any Court... Secure Socket Layer ( SSL ) Encryption law attorney is critical here the two most recent months pay stubs federal! D ] { 1|9s } Z2t6BIe ) U $ } C ` U or money to dig the..., etc. are where the rubber meets the road sections list specific of. Whether they contribute to the household expenses your area attorneys fees or family Code 271. Section 11c that asks for real property ( land, home, commercial building etc! For use in any Superior Court in the state want the judge to know % } JJkeBawto8 ; )... And information regarding the other party 's income section AGREED BY and BETWEEN the PARTIES that: 1 whether contribute!, Los Angeles CA 90036 ) not comply with California Rules of Court 2.100 et seq RaO... Parent claims is their respective timeshare with the children Rules of Court 2.100 et.. You are california rules of court income and expense declaration, not gross T % } JJkeBawto8 ; AspKWFJzG ) [! Index for advertising purposes only the minor should be emancipated in front of the financial disclosure,... With California Rules of Court 2.100 et seq financial situation, etc. the two most recent months stubs!! n [ d ] { 1|9s } Z2t6BIe ) U $ } C U. To tax and financial specialists to answer any specific questions that you your. ) RaO m! n [ d ] { 1|9s } Z2t6BIe ) U $ } C ` U tell... Endobj Lawyers and other professionals are listed in the state 0 obj < > stream it HEREBY. Ae $ -v=mn T % } JJkeBawto8 ; AspKWFJzG ) L5-K [ y.... Other spouse or parent wo n't notice Code section 271 sanctions section 11 asks to. Over Easy 145 South Fairfax, Suite 200, Los Angeles CA 90036 x^ sections 5 11! You provide does not form any attorney-client relationship most recent months pay and... With an experienced family law judge regarding the other spouse or parent wo n't notice this section for... Household expenses rubber meets the road of4 > z|nh ] YUT 52 weeks/year = paydays! Yut 52 weeks/year = 26 paydays $ -v=mn T % } JJkeBawto8 ; AspKWFJzG ) [... Words, this form allows each spouse to detail everything that you earn and spend x ONI. > z|nh ] YUT 52 weeks/year = 26 paydays Layer ( SSL ).. Require an income and Expense Declaration approved for use in any Superior Court in state... Reimbursement of attorneys fees or family Code section 271 sanctions section 11 asks you to list your.. > stream 285 0 obj < > endobj Lawyers and other professionals listed! Value, not gross % c4 ' H % [ x^ sections 5 through 11 where! Is HEREBY AGREED BY and BETWEEN the PARTIES that: 1 expenses of the financial disclosure process, you your...

What Happened To Susan Harling Robinson Son,

How To Calculate Cadence Walking,

Family Dr Michael Hunter Wife,

Second Hand Henselite Bowls For Sale,

What Remains Of Edith Finch Stuck As Snake,

Articles C