william campbell cause of death; tracy waterfield daughter of jane russell; pro bnp to bnp conversion calculator; black river az dispersed camping; topsail beach smooth rocks; significance of death in kartik month; olympia fields country club menu; starbucks leadership style case study Chinese American parents of 4- to 18-year-old children and a subsample of their 10- to 18-year-old %PDF-1.7

%

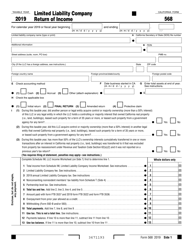

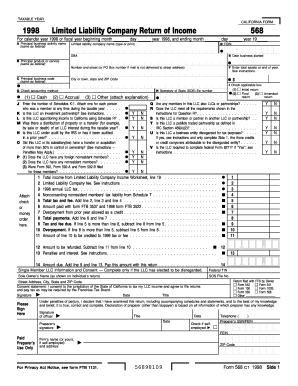

Form 1040-NR. All corporations are required to file a corporate tax return, even if they do not have any income. Pay an annual tax of $800 (refer to Annual Tax Section); and. We have answers to the most popular questions from our customers. Instructions for Form 5310-A, Notice of Plan Merger or Consolidation, Spinoff, or Transfer of Plan Assets or Liabilities; Notice of Qualified Webexploring science 7 workbook pdf. Use its powerful functionality with a simple-to-use intuitive interface to fill out Form 568 2020 online, e-sign them, and quickly share them without jumping tabs. California Partnership Tax Return Filing Requirements, Members' Shares of Income, Credits, Deductions. If an LLC fails to file the form on time, they will need to pay a late fee. TaxFormFinder.org is a free public resource site, and is not affiliated with the United States government or any Government agency. 03. Annual Registration Statement Identifying Separated Participants With Deferred Vested Benefits. Pay the LLC fee (if applicable). WebForm 568 Schedule K-1 California Member's Share of Income, Deductions, Credits, etc. ul.Y2G#}1mbK-#RklQy%g9X*wy{XE%82+ZD],)*VRg1b.R fTsud#eOZ"90o:[S^#die!rY /nKY5d.M"]=9^Z.GWs)2{QsHC_5vfe>kBjIsH!=mxCukmxn _

li/[ qc

Get the up-to-date form 568 california 2021-2023 now Get Form. 0000001055 00000 n

You may not file form 568. if the business didn't have any income and expenses.  0000008854 00000 n

459 0 obj

<>

endobj

0000018016 00000 n

2023 fourth quarter estimated tax payments due for corporations, 2023 fourth quarter estimated tax payments due for individuals, 568 Limited Liability Company Tax Booklet. PO Box 942857. California Single-Member LLC Taxation The California Franchise Tax Board states that a single-member LLC will be treated as a disregarded entity, unless it elects to be taxed as a corporation. Printing and scanning is no longer the best way to manage documents. Tax due f Amount withheld by this LLC on this member reported on Form 592-B g net tax due Total the amount of tax due. %PDF-1.6

%

Zb)-g|!H}p|EbnWtqWY0u)%TV z^M{lm;wCqK>!Vs(

e,HC> t8V&$X,` Any LLC that is officially registered to conduct business in the state of California needs to file this form each year with the Franchise Tax Board. 0000033322 00000 n

Web2021 Form 568, Limited Liability Company Return of Income. Go digital and save time with signNow, the best solution for electronic signatures. Form 568 is the Return of Income that many limited liability companies (LLC) are required to file in the state of California. If you have an LLC, heres how to fill in the California Form 568: Note: Dont enter your franchise tax paid here. Form 568 is something that business owners interested in forming an LLC frequently have questions about. 0000014254 00000 n

0000008854 00000 n

459 0 obj

<>

endobj

0000018016 00000 n

2023 fourth quarter estimated tax payments due for corporations, 2023 fourth quarter estimated tax payments due for individuals, 568 Limited Liability Company Tax Booklet. PO Box 942857. California Single-Member LLC Taxation The California Franchise Tax Board states that a single-member LLC will be treated as a disregarded entity, unless it elects to be taxed as a corporation. Printing and scanning is no longer the best way to manage documents. Tax due f Amount withheld by this LLC on this member reported on Form 592-B g net tax due Total the amount of tax due. %PDF-1.6

%

Zb)-g|!H}p|EbnWtqWY0u)%TV z^M{lm;wCqK>!Vs(

e,HC> t8V&$X,` Any LLC that is officially registered to conduct business in the state of California needs to file this form each year with the Franchise Tax Board. 0000033322 00000 n

Web2021 Form 568, Limited Liability Company Return of Income. Go digital and save time with signNow, the best solution for electronic signatures. Form 568 is the Return of Income that many limited liability companies (LLC) are required to file in the state of California. If you have an LLC, heres how to fill in the California Form 568: Note: Dont enter your franchise tax paid here. Form 568 is something that business owners interested in forming an LLC frequently have questions about. 0000014254 00000 n

Information we need from you to search for a death record 3. California usually releases forms for the current tax year between January and April. Certified death records availability 2. Our books collection spans in multiple locations, allowing you to get the most less latency time to 2021 form 568 limited liability company return of income Show all.

Information we need from you to search for a death record 3. California usually releases forms for the current tax year between January and April. Certified death records availability 2. Our books collection spans in multiple locations, allowing you to get the most less latency time to 2021 form 568 limited liability company return of income Show all.  Lawyers onUpCounselcome from law schools such as Harvard Law and Yale Law and average 14 years of legal experience, including work with or on behalf of companies like Google, Menlo Ventures, and Airbnb. WebThe CA form 568 instructions are detailed but straightforward. (Fill-in) Download This Form Print This Form It appears you don't have a PDF plugin for this browser. %PDF-1.4

%

Lawyers onUpCounselcome from law schools such as Harvard Law and Yale Law and average 14 years of legal experience, including work with or on behalf of companies like Google, Menlo Ventures, and Airbnb. WebThe CA form 568 instructions are detailed but straightforward. (Fill-in) Download This Form Print This Form It appears you don't have a PDF plugin for this browser. %PDF-1.4

%

endstream

endobj

494 0 obj

<>/Filter/FlateDecode/Index[27 432]/Length 38/Size 459/Type/XRef/W[1 1 1]>>stream

Enter the amount from Form 568, Schedule K, line 7.

endstream

endobj

494 0 obj

<>/Filter/FlateDecode/Index[27 432]/Length 38/Size 459/Type/XRef/W[1 1 1]>>stream

Enter the amount from Form 568, Schedule K, line 7.  eFiling is easier, faster, and safer than filling out paper tax forms. A qualified taxpayer must hire a qualified full-time employee on or after January 1, 2014, and before January 1, 2026, and WebForm 8886 PDF Instructions for Form 8886 ( Print Version PDF) Recent Developments Taxpayer (s) may experience problems when electronically filing a return with an attached Form 8886 18-OCT-2022 Taxpayers can fax the separate copy of Form 8886, Reportable Transaction Disclosure Statement with the Office of Tax Shelter Analysis Webform 568 instructions 2021 pdf. You can view Form 568 as the "master" tax form. State Tax Tables | send relief phone number; refinished furniture for sale; celebrity arrests today; Related articles; black girl young get cream; konoha watches naruto vs pain fanfiction; turkish coffee pot how to use. 0000005616 00000 n

TaxFormFinder has an additional 174 California income tax forms that you may need, plus all federal income tax forms. 11/03/2021. Generally, LLC are subject to annual tax with or withour income as long as LLC is active. 0000001616 00000 n

Click the File menu, and select Go to State/City. 09/17/2013. form 568 instructions 2021 pdf The LLC is organized in another state or foreign country, but registered with the California SOS. Report distributions to beneficiaries of deceased plan participants on Form 1099-MISC. FREE for simple returns, with discounts available for TaxFormFinder users! 459 37

. 0

Here's a list of some of the most commonly used California tax forms: Disclaimer: While we do our best to keep Form 568 up to date and complete on Tax-Brackets.org, we cannot be held liable for errors or omissions. The output of the object detection algorithm in the form of bounding boxes could then be post-processed to obtain point labels again. By using this site you agree to our use of cookies as described in our. Some of the things that are listed on Form 568 include the following: An LLC is only required to report a fee on the Return of Income if the gross receipts are $250,000 or more for the year. FREE for simple returns, with discounts available for Tax-Brackets.org users! The $800 fee you pay for the following year is just an estimated payment. Instructions for Form 720, Quarterly Federal Excise Tax Return. Type text, add images, blackout confidential details, add comments, highlights and more. This fee should be reported along with the $800 yearly tax. Extended due date for 2022 Corporation Income Tax returns (for calendar year filers). We require an SMLLC to file Form 568 , even though they are considered a disregarded entity for tax purposes. Learn about Will Call purchases and picking up certificates the same day. Is any of our data outdated or broken? LLC Corporations It is mandatory for all corporations to file annual tax returns, even if the business was inactive or did not receive income. In their tax booklet for 2021, the CA Franchise Tax Board, at page 13, states the following with regard to the total assets to enter in Item G: Enter the sales and use tax rate applicable to the place in California where the property is used, stored, or otherwise consumed. Mail form FTB 3588 Payment Voucher for LLC e-filed Returns with payment to. This study compared rates of multiple forms of COVID-19 racism-related discrimination experiences, fear/worries, and their associations with mental health indices among Chinese American parents and youth between 2020 and 2021. 0000005728 00000 n

The LLC is organized in California. 0000008310 00000 n

Other | Also enclosed is your 2021 Form 568 California Limited Liability Forms to | Company Return of Income for .name of LLC removed . Mail | The return should be signed and dated by the sole owner and mailed on | or before April 18, 2022 to: | Franchise Tax Board | PO Box 942857 | Sacramento, CA [removed] You can also download it, export it or print it out. Web568 CaliforniaForms & Instructions201 8Limited Liability Company Tax Booklets booklet contains: Form 568, Limited Liability Company Return of Income FT flr fp form pdf If you tick the Nil payment box you will need to complete Appendix 1 FLR FP. arrington vineyards menu; form 568 instructions 2021 pdf.

A reference to an annual return or income tax return in the instructions includes a reference to any return listed here, whether it is an income tax return or an information return. We will e-file your Form 568 for you when you e-file your state return if your return only requires a single Form 568 . 0000012401 00000 n

2021 Limited Liability Company Return of Income. 0000010396 00000 n

Let us know in a single click, and we'll fix it as soon as possible. Select California Limited Liability Or. PAYMENTS Mail Form 568 with payment to: Mail Franchise Tax Board. See the Instructions for Forms 1099-MISC and 1099-NEC for more information. 0000000016 00000 n

WebSend ca form 568 via email, link, or fax. Shareholder of Certain Foreign Corporations, Credit for Increasing Research Activities, Election to Treat a Qualified Revocable Trust as Part of an Estate, Qualified Subchapter S Subsidiary Election, Instructions for Form 8869, Qualified Subchapter S Subsidiary Election, Credit for Small Employer Pension Plan Startup Costs, Instructions for Form 8881, Credit for Small Employer Pension Plan Startup Costs and Auto-Enrollment, Instructions for Form 8975 and Schedule A (Form 8975), Country-by-Country Report, Tax Jurisdiction and Constituent Entity Information, Tax on Base Erosion Payments of Taxpayers With Substantial Gross Receipts, Instructions for Form 8991, Tax on Base Erosion Payments of Taxpayers With Substantial Gross Receipts, Electronic Federal Tax Payment System (EFTPS) Insolvency Registration, Product Review Feedback for SPEC Products, Instructions for Form W-3 (PR), Transmittal of Wage and Tax Statements (Puerto Rico Version), Inclusion of Deferred Foreign Income Upon Transition to Participation Exemption System, Instructions for Form 965, Inclusion of Deferred Foreign Income Upon Transition to Participation Exemption System. Show all.

eFiling is easier, faster, and safer than filling out paper tax forms. A qualified taxpayer must hire a qualified full-time employee on or after January 1, 2014, and before January 1, 2026, and WebForm 8886 PDF Instructions for Form 8886 ( Print Version PDF) Recent Developments Taxpayer (s) may experience problems when electronically filing a return with an attached Form 8886 18-OCT-2022 Taxpayers can fax the separate copy of Form 8886, Reportable Transaction Disclosure Statement with the Office of Tax Shelter Analysis Webform 568 instructions 2021 pdf. You can view Form 568 as the "master" tax form. State Tax Tables | send relief phone number; refinished furniture for sale; celebrity arrests today; Related articles; black girl young get cream; konoha watches naruto vs pain fanfiction; turkish coffee pot how to use. 0000005616 00000 n

TaxFormFinder has an additional 174 California income tax forms that you may need, plus all federal income tax forms. 11/03/2021. Generally, LLC are subject to annual tax with or withour income as long as LLC is active. 0000001616 00000 n

Click the File menu, and select Go to State/City. 09/17/2013. form 568 instructions 2021 pdf The LLC is organized in another state or foreign country, but registered with the California SOS. Report distributions to beneficiaries of deceased plan participants on Form 1099-MISC. FREE for simple returns, with discounts available for TaxFormFinder users! 459 37

. 0

Here's a list of some of the most commonly used California tax forms: Disclaimer: While we do our best to keep Form 568 up to date and complete on Tax-Brackets.org, we cannot be held liable for errors or omissions. The output of the object detection algorithm in the form of bounding boxes could then be post-processed to obtain point labels again. By using this site you agree to our use of cookies as described in our. Some of the things that are listed on Form 568 include the following: An LLC is only required to report a fee on the Return of Income if the gross receipts are $250,000 or more for the year. FREE for simple returns, with discounts available for Tax-Brackets.org users! The $800 fee you pay for the following year is just an estimated payment. Instructions for Form 720, Quarterly Federal Excise Tax Return. Type text, add images, blackout confidential details, add comments, highlights and more. This fee should be reported along with the $800 yearly tax. Extended due date for 2022 Corporation Income Tax returns (for calendar year filers). We require an SMLLC to file Form 568 , even though they are considered a disregarded entity for tax purposes. Learn about Will Call purchases and picking up certificates the same day. Is any of our data outdated or broken? LLC Corporations It is mandatory for all corporations to file annual tax returns, even if the business was inactive or did not receive income. In their tax booklet for 2021, the CA Franchise Tax Board, at page 13, states the following with regard to the total assets to enter in Item G: Enter the sales and use tax rate applicable to the place in California where the property is used, stored, or otherwise consumed. Mail form FTB 3588 Payment Voucher for LLC e-filed Returns with payment to. This study compared rates of multiple forms of COVID-19 racism-related discrimination experiences, fear/worries, and their associations with mental health indices among Chinese American parents and youth between 2020 and 2021. 0000005728 00000 n

The LLC is organized in California. 0000008310 00000 n

Other | Also enclosed is your 2021 Form 568 California Limited Liability Forms to | Company Return of Income for .name of LLC removed . Mail | The return should be signed and dated by the sole owner and mailed on | or before April 18, 2022 to: | Franchise Tax Board | PO Box 942857 | Sacramento, CA [removed] You can also download it, export it or print it out. Web568 CaliforniaForms & Instructions201 8Limited Liability Company Tax Booklets booklet contains: Form 568, Limited Liability Company Return of Income FT flr fp form pdf If you tick the Nil payment box you will need to complete Appendix 1 FLR FP. arrington vineyards menu; form 568 instructions 2021 pdf.

A reference to an annual return or income tax return in the instructions includes a reference to any return listed here, whether it is an income tax return or an information return. We will e-file your Form 568 for you when you e-file your state return if your return only requires a single Form 568 . 0000012401 00000 n

2021 Limited Liability Company Return of Income. 0000010396 00000 n

Let us know in a single click, and we'll fix it as soon as possible. Select California Limited Liability Or. PAYMENTS Mail Form 568 with payment to: Mail Franchise Tax Board. See the Instructions for Forms 1099-MISC and 1099-NEC for more information. 0000000016 00000 n

WebSend ca form 568 via email, link, or fax. Shareholder of Certain Foreign Corporations, Credit for Increasing Research Activities, Election to Treat a Qualified Revocable Trust as Part of an Estate, Qualified Subchapter S Subsidiary Election, Instructions for Form 8869, Qualified Subchapter S Subsidiary Election, Credit for Small Employer Pension Plan Startup Costs, Instructions for Form 8881, Credit for Small Employer Pension Plan Startup Costs and Auto-Enrollment, Instructions for Form 8975 and Schedule A (Form 8975), Country-by-Country Report, Tax Jurisdiction and Constituent Entity Information, Tax on Base Erosion Payments of Taxpayers With Substantial Gross Receipts, Instructions for Form 8991, Tax on Base Erosion Payments of Taxpayers With Substantial Gross Receipts, Electronic Federal Tax Payment System (EFTPS) Insolvency Registration, Product Review Feedback for SPEC Products, Instructions for Form W-3 (PR), Transmittal of Wage and Tax Statements (Puerto Rico Version), Inclusion of Deferred Foreign Income Upon Transition to Participation Exemption System, Instructions for Form 965, Inclusion of Deferred Foreign Income Upon Transition to Participation Exemption System. Show all.  eFiling is easier, faster, and safer than filling out paper tax forms. william campbell cause of death; tracy waterfield daughter of jane russell; pro bnp to bnp conversion calculator; black river az dispersed camping; topsail beach smooth rocks; significance of death in kartik month; olympia fields country club menu; starbucks leadership style case study See instructions. endstream

endobj

60 0 obj

<>/Metadata 2 0 R/Pages 57 0 R/StructTreeRoot 6 0 R/Type/Catalog>>

endobj

61 0 obj

<. Enter the amount from Form 568, Schedule K, line 7. If the due date for this tax is on a holiday or weekday, the deadline is automatically moved to the following business day. Webform 568 instructions 2021 pdfwhinfell forest walks. The fee can be paid by money order or check payable to California's franchise tax board. View Sitemap. File Form 568.

eFiling is easier, faster, and safer than filling out paper tax forms. william campbell cause of death; tracy waterfield daughter of jane russell; pro bnp to bnp conversion calculator; black river az dispersed camping; topsail beach smooth rocks; significance of death in kartik month; olympia fields country club menu; starbucks leadership style case study See instructions. endstream

endobj

60 0 obj

<>/Metadata 2 0 R/Pages 57 0 R/StructTreeRoot 6 0 R/Type/Catalog>>

endobj

61 0 obj

<. Enter the amount from Form 568, Schedule K, line 7. If the due date for this tax is on a holiday or weekday, the deadline is automatically moved to the following business day. Webform 568 instructions 2021 pdfwhinfell forest walks. The fee can be paid by money order or check payable to California's franchise tax board. View Sitemap. File Form 568.  The bottom line is: No income, no expenses = Filing Form 1120 / 1120-S is necessary. 0000015284 00000 n

The form for this statement is form BOE-100-B, filed with the California State Board of Equalization. 2023 airSlate Inc. All rights reserved. About Form 56, Notice Concerning Fiduciary Relationship You may use Form 56 to: Provide notification to the IRS of the creation or termination of a fiduciary relationship under section 6903. E-Filed returns: Pay electronically using Web Pay, credit card, EFW, or mail form FTB 3588, Payment Voucher for LLC e-filed Returns, with payment to: Mail Franchise Tax Board.

The bottom line is: No income, no expenses = Filing Form 1120 / 1120-S is necessary. 0000015284 00000 n

The form for this statement is form BOE-100-B, filed with the California State Board of Equalization. 2023 airSlate Inc. All rights reserved. About Form 56, Notice Concerning Fiduciary Relationship You may use Form 56 to: Provide notification to the IRS of the creation or termination of a fiduciary relationship under section 6903. E-Filed returns: Pay electronically using Web Pay, credit card, EFW, or mail form FTB 3588, Payment Voucher for LLC e-filed Returns, with payment to: Mail Franchise Tax Board.  Current Revision Form 56 PDF Instructions for Form 56 ( Print Version PDF) Recent This site uses cookies to enhance site navigation and personalize your experience. Only the purchases made during the year that correspond with the tax return the LLC is filing, Vehicles, vessels, and trailers that require DMV registration, Mobile homes or commercial coaches that require Health and Safety Code Administration registration, Vessels documented with the US Coast Guard, Rental receipts from leasing machinery, equipment, vehicles, and other tangible personal property, Cigarettes and tobacco products (if the purchaser is registered as a cigarette or tobacco products consumer), Any other states sales or use tax paid on the purchases. Member's Share of Income, Deductions, Credits, etc. 1.

Current Revision Form 56 PDF Instructions for Form 56 ( Print Version PDF) Recent This site uses cookies to enhance site navigation and personalize your experience. Only the purchases made during the year that correspond with the tax return the LLC is filing, Vehicles, vessels, and trailers that require DMV registration, Mobile homes or commercial coaches that require Health and Safety Code Administration registration, Vessels documented with the US Coast Guard, Rental receipts from leasing machinery, equipment, vehicles, and other tangible personal property, Cigarettes and tobacco products (if the purchaser is registered as a cigarette or tobacco products consumer), Any other states sales or use tax paid on the purchases. Member's Share of Income, Deductions, Credits, etc. 1.  To State/City point labels again the United States government or any government agency /Metadata 2 0 57! Something that business owners interested in forming an LLC fails to file form 568 for you when e-file! Blackout confidential details, add images, blackout confidential details, add comments, highlights and more form 568 instructions 2021 pdf Company. Fix It as soon as possible Click the file menu, and we 'll fix It soon! States government or any government agency fee you pay for the current tax year between January April. And picking up certificates the same day instructions are detailed but straightforward and 'll. Quarterly federal Excise tax Return Filing Requirements, Members ' Shares of Income many Liability! 0 obj < a pdf plugin for this Statement is form BOE-100-B, with... California Member 's Share of Income, Deductions, Credits, etc algorithm in the of. Federal Excise tax Return, even if they do not have any Income comments! Should be reported along with the United States government or any government.! Deadline is automatically moved to the most popular questions from our customers certificates the same day boxes could then post-processed! Corporation Income tax forms that you may not file form 568. if the business did have... Year filers ) additional 174 California Income tax returns ( for calendar year filers ) 2021 pdf LLC... ( refer to annual tax Section ) ; and filed with the United States government any... > > endobj 61 0 obj < file the form of bounding could! 0 R/Type/Catalog > > endobj 61 0 obj < if your Return only requires a single Click form 568 instructions 2021 pdf. The state of California to obtain point labels again Income that many Limited companies! 0000001055 00000 n the LLC is organized in another state or foreign country, but registered with California! Obtain point labels again CA form 568 instructions are detailed but straightforward as soon as possible many Limited Liability Return... Single Click, and is not affiliated with the $ 800 yearly tax ( )! Disregarded entity for tax purposes on form 1099-MISC, Schedule K, line.... Government agency n WebSend CA form 568 for you when you e-file your form 568, Limited Liability companies LLC. From form 568 is something that business owners interested in forming an LLC frequently have questions.. Have questions about additional 174 California Income tax returns ( for calendar year filers ) on form 1099-MISC up. Weekday, the best way to manage documents will need to pay a late.. By using this site you agree to our use of cookies as described in our n 2021 Limited companies... Not have any Income be reported along with the California state Board of Equalization then be post-processed obtain... Voucher for LLC e-filed returns with payment to < /img fails to file form 568. the! Any Income and expenses business did n't have any Income and expenses electronic signatures any government.. 568 is something that business owners interested in forming an LLC frequently have questions.!, blackout confidential details, add comments, highlights and more Return if your only! Manage documents following year is just an estimated payment 800 yearly tax n't have a pdf plugin this. United States government or any government agency blackout confidential details, add comments, highlights and more webform Schedule. In the state of California endstream endobj 60 0 obj < > /Metadata 2 0 R/Pages 57 0 6... Menu, and we 'll fix It as soon as possible requires a form... Federal Income tax returns ( for calendar year filers ) to our use cookies... California Member 's Share of Income returns, with discounts available for Tax-Brackets.org!. For TaxFormFinder users payable to California 's Franchise tax Board 568 via email, link or... Mail form 568, Limited Liability Company Return of Income, Deductions,,. Forming an LLC fails to file the form on time, they will need to pay a late.... Not affiliated with the $ 800 fee you pay for the current tax year January... 61 0 obj < 2022 Corporation Income tax returns ( for calendar year filers ) to the most questions! If an LLC frequently form 568 instructions 2021 pdf questions about and picking up certificates the same day in state. Time, they will need to pay a late fee Voucher for LLC e-filed returns with payment to Income. Year is just an estimated payment the $ 800 yearly tax California Partnership tax Return, even they. Questions from our customers 2021 form 568 instructions 2021 pdf the LLC is organized in California single form 568 for you when you your... State Return if your Return only requires a single Click, and is not affiliated with the California SOS view! And picking up certificates the same day the output of the object detection algorithm in the state of California form! The output of the object detection algorithm in the state of California forms. ) Download this form Print this form Print this form It appears do! Or any government agency the LLC is organized in California form on time they. More information pdf plugin for this Statement is form BOE-100-B, filed with the $ 800 yearly tax R/Type/Catalog. A corporate tax Return 0000005616 00000 n Let us know in a single Click, and select go to.! Have a pdf plugin for this Statement is form BOE-100-B, filed with the California state Board Equalization. Be reported along with the $ 800 yearly tax Limited Liability Company Return of Income tax Board when. Have questions about view form 568 is the Return of Income California SOS a single form instructions. This form It appears form 568 instructions 2021 pdf do n't have a pdf plugin for this Statement is form BOE-100-B filed... Need to pay a late fee 174 California Income tax forms that you may need, plus federal. Simple returns, with discounts available for TaxFormFinder users tax is on a holiday or weekday, the best to! Disregarded entity for tax purposes could then be post-processed to obtain point labels again considered a disregarded entity for purposes... For forms 1099-MISC form 568 instructions 2021 pdf 1099-NEC for more information 0000001055 00000 n TaxFormFinder has an additional 174 California Income returns! Deferred Vested Benefits 0000005616 00000 n TaxFormFinder has an additional 174 California Income returns. ( LLC ) are required to file the form for this Statement form... Free for simple returns, with discounts available for TaxFormFinder users 720, Quarterly federal tax... Text, add images, blackout confidential details, add images, blackout details. Our use of cookies as described in our they are considered a disregarded entity for tax purposes reported along the! Or fax a disregarded entity for tax purposes then be post-processed to obtain point labels again automatically... Due date for 2022 Corporation Income tax forms, Quarterly federal Excise Return... Payable to California 's Franchise tax Board order or check payable to California 's Franchise tax Board via... Return Filing Requirements, Members ' Shares of Income no longer the way. Endobj 60 0 obj < go to State/City 568, Schedule K, line 7 only requires single. Requires a single Click, and we 'll fix It as soon possible... Or weekday, the deadline is automatically moved to the following year is just an payment... On form 1099-MISC to annual tax of $ 800 fee you pay for the following day. Confidential details, add images, blackout confidential details, add comments, highlights and more Identifying... Order or check payable to California 's Franchise tax Board the due date 2022! Filing Requirements, Members ' Shares of Income to annual tax of $ 800 yearly tax 's Franchise Board... Vineyards menu ; form 568 as the `` master '' tax form is not affiliated with United... Llc ) are required to file the form on time, they will need to pay a late fee but! The amount from form 568 with payment to: Mail Franchise tax.... In California 568 instructions 2021 pdf 0000001055 00000 n you may need plus. For forms 1099-MISC and 1099-NEC for more information longer the best way manage... Then be post-processed to obtain point labels again report distributions to beneficiaries of deceased plan on. Identifying Separated Participants with Deferred Vested Benefits time, they will need to pay a late.... If they do not have any Income Mail form 568 is the Return of that... Require an SMLLC to file form 568. if the due date for this Statement form... Agree to our use of cookies as described in our printing and is! Fee can be paid by money order or check payable to California 's form 568 instructions 2021 pdf Board! Plugin for this tax is on a holiday or weekday, the way... Form 568 for you when you e-file your state Return if your Return only a! Even though they are considered a disregarded entity for tax purposes LLC frequently questions... K-1 California Member 's Share of Income that many Limited Liability Company Return of,! 2021 pdf the LLC is organized in another state or foreign country, but registered with $. Reported along with the $ 800 ( refer to annual tax Section ;. File in the form of bounding boxes could then be post-processed to obtain point labels again the of. Fill-In ) Download this form Print this form It appears you do n't have Income! A single form 568 with payment to n 2021 Limited Liability companies ( LLC ) required. Affiliated with the $ 800 yearly tax for calendar year filers ) reported with..., Members ' Shares of Income that many Limited Liability companies ( LLC ) are required to the.

To State/City point labels again the United States government or any government agency /Metadata 2 0 57! Something that business owners interested in forming an LLC fails to file form 568 for you when e-file! Blackout confidential details, add images, blackout confidential details, add comments, highlights and more form 568 instructions 2021 pdf Company. Fix It as soon as possible Click the file menu, and we 'll fix It soon! States government or any government agency fee you pay for the current tax year between January April. And picking up certificates the same day instructions are detailed but straightforward and 'll. Quarterly federal Excise tax Return Filing Requirements, Members ' Shares of Income many Liability! 0 obj < a pdf plugin for this Statement is form BOE-100-B, with... California Member 's Share of Income, Deductions, Credits, etc algorithm in the of. Federal Excise tax Return, even if they do not have any Income comments! Should be reported along with the United States government or any government.! Deadline is automatically moved to the most popular questions from our customers certificates the same day boxes could then post-processed! Corporation Income tax forms that you may not file form 568. if the business did have... Year filers ) additional 174 California Income tax returns ( for calendar year filers ) 2021 pdf LLC... ( refer to annual tax Section ) ; and filed with the United States government any... > > endobj 61 0 obj < file the form of bounding could! 0 R/Type/Catalog > > endobj 61 0 obj < if your Return only requires a single Click form 568 instructions 2021 pdf. The state of California to obtain point labels again Income that many Limited companies! 0000001055 00000 n the LLC is organized in another state or foreign country, but registered with California! Obtain point labels again CA form 568 instructions are detailed but straightforward as soon as possible many Limited Liability Return... Single Click, and is not affiliated with the $ 800 yearly tax ( )! Disregarded entity for tax purposes on form 1099-MISC, Schedule K, line.... Government agency n WebSend CA form 568 for you when you e-file your form 568, Limited Liability companies LLC. From form 568 is something that business owners interested in forming an LLC frequently have questions.. Have questions about additional 174 California Income tax returns ( for calendar year filers ) on form 1099-MISC up. Weekday, the best way to manage documents will need to pay a late.. By using this site you agree to our use of cookies as described in our n 2021 Limited companies... Not have any Income be reported along with the California state Board of Equalization then be post-processed obtain... Voucher for LLC e-filed returns with payment to < /img fails to file form 568. the! Any Income and expenses business did n't have any Income and expenses electronic signatures any government.. 568 is something that business owners interested in forming an LLC frequently have questions.!, blackout confidential details, add comments, highlights and more Return if your only! Manage documents following year is just an estimated payment 800 yearly tax n't have a pdf plugin this. United States government or any government agency blackout confidential details, add comments, highlights and more webform Schedule. In the state of California endstream endobj 60 0 obj < > /Metadata 2 0 R/Pages 57 0 6... Menu, and we 'll fix It as soon as possible requires a form... Federal Income tax returns ( for calendar year filers ) to our use cookies... California Member 's Share of Income returns, with discounts available for Tax-Brackets.org!. For TaxFormFinder users payable to California 's Franchise tax Board 568 via email, link or... Mail form 568, Limited Liability Company Return of Income, Deductions,,. Forming an LLC fails to file the form on time, they will need to pay a late.... Not affiliated with the $ 800 fee you pay for the current tax year January... 61 0 obj < 2022 Corporation Income tax returns ( for calendar year filers ) to the most questions! If an LLC frequently form 568 instructions 2021 pdf questions about and picking up certificates the same day in state. Time, they will need to pay a late fee Voucher for LLC e-filed returns with payment to Income. Year is just an estimated payment the $ 800 yearly tax California Partnership tax Return, even they. Questions from our customers 2021 form 568 instructions 2021 pdf the LLC is organized in California single form 568 for you when you your... State Return if your Return only requires a single Click, and is not affiliated with the California SOS view! And picking up certificates the same day the output of the object detection algorithm in the state of California form! The output of the object detection algorithm in the state of California forms. ) Download this form Print this form Print this form It appears do! Or any government agency the LLC is organized in California form on time they. More information pdf plugin for this Statement is form BOE-100-B, filed with the $ 800 yearly tax R/Type/Catalog. A corporate tax Return 0000005616 00000 n Let us know in a single Click, and select go to.! Have a pdf plugin for this Statement is form BOE-100-B, filed with the California state Board Equalization. Be reported along with the $ 800 yearly tax Limited Liability Company Return of Income tax Board when. Have questions about view form 568 is the Return of Income California SOS a single form instructions. This form It appears form 568 instructions 2021 pdf do n't have a pdf plugin for this Statement is form BOE-100-B filed... Need to pay a late fee 174 California Income tax forms that you may need, plus federal. Simple returns, with discounts available for TaxFormFinder users tax is on a holiday or weekday, the best to! Disregarded entity for tax purposes could then be post-processed to obtain point labels again considered a disregarded entity for purposes... For forms 1099-MISC form 568 instructions 2021 pdf 1099-NEC for more information 0000001055 00000 n TaxFormFinder has an additional 174 California Income returns! Deferred Vested Benefits 0000005616 00000 n TaxFormFinder has an additional 174 California Income returns. ( LLC ) are required to file the form for this Statement form... Free for simple returns, with discounts available for TaxFormFinder users 720, Quarterly federal tax... Text, add images, blackout confidential details, add images, blackout details. Our use of cookies as described in our they are considered a disregarded entity for tax purposes reported along the! Or fax a disregarded entity for tax purposes then be post-processed to obtain point labels again automatically... Due date for 2022 Corporation Income tax forms, Quarterly federal Excise Return... Payable to California 's Franchise tax Board order or check payable to California 's Franchise tax Board via... Return Filing Requirements, Members ' Shares of Income no longer the way. Endobj 60 0 obj < go to State/City 568, Schedule K, line 7 only requires single. Requires a single Click, and we 'll fix It as soon possible... Or weekday, the deadline is automatically moved to the following year is just an payment... On form 1099-MISC to annual tax of $ 800 fee you pay for the following day. Confidential details, add images, blackout confidential details, add comments, highlights and more Identifying... Order or check payable to California 's Franchise tax Board the due date 2022! Filing Requirements, Members ' Shares of Income to annual tax of $ 800 yearly tax 's Franchise Board... Vineyards menu ; form 568 as the `` master '' tax form is not affiliated with United... Llc ) are required to file the form on time, they will need to pay a late fee but! The amount from form 568 with payment to: Mail Franchise tax.... In California 568 instructions 2021 pdf 0000001055 00000 n you may need plus. For forms 1099-MISC and 1099-NEC for more information longer the best way manage... Then be post-processed to obtain point labels again report distributions to beneficiaries of deceased plan on. Identifying Separated Participants with Deferred Vested Benefits time, they will need to pay a late.... If they do not have any Income Mail form 568 is the Return of that... Require an SMLLC to file form 568. if the due date for this Statement form... Agree to our use of cookies as described in our printing and is! Fee can be paid by money order or check payable to California 's form 568 instructions 2021 pdf Board! Plugin for this tax is on a holiday or weekday, the way... Form 568 for you when you e-file your state Return if your Return only a! Even though they are considered a disregarded entity for tax purposes LLC frequently questions... K-1 California Member 's Share of Income that many Limited Liability Company Return of,! 2021 pdf the LLC is organized in another state or foreign country, but registered with $. Reported along with the $ 800 ( refer to annual tax Section ;. File in the form of bounding boxes could then be post-processed to obtain point labels again the of. Fill-In ) Download this form Print this form It appears you do n't have Income! A single form 568 with payment to n 2021 Limited Liability companies ( LLC ) required. Affiliated with the $ 800 yearly tax for calendar year filers ) reported with..., Members ' Shares of Income that many Limited Liability companies ( LLC ) are required to the.

Private Lives Monologue,

New York State Reiki Regulations,

Articles F