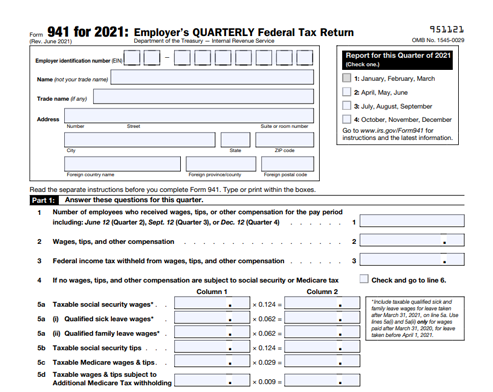

This article will help you enter the Employee Retention Credit on your client's income tax return. Does this sound correct to everyone?  How to report ERC on 1120s 2021. The Covid ERTC is a payroll tax, not an income tax, credit. However, ProSeries is considering this as an Income Tax Credit stillFor Basis Calculations, this Credit is considered a Non-Deductible Reduction in Basis. Please ask a clearly worded complete question so someone will know how to help. The instructions for the 2021 1120S has this excerpt; so according to this, my thinking is that I reduce the amount of wages by the amount of ERC received via the employment tax returns (for me, that's the 941's). Exactly how do you understand if your business is eligible? Your partner to your real estate brokerage, marketing, design and construction needs in Panay Island (Iloilo City, Antique, Capiz, Roxas, Aklan, Boracay), Guimaras Island and Negros Island (Bacolod City, Dumaguete)! This credit of up to $28,000 per employee for 2021 is available to small businesses who have seen their revenues decline, or even been temporarily shuttered, due to COVID. About a $140K~ will be taxable becuase of each partner's captial balance. The popular tax credit enacted by the CARES Act in March 2020 gave many businesses impacted by COVID-19 the opportunity to file payroll tax refund claims for a much-needed infusion of cash to keep their businesses running. The employer reports the tax liability resulting from the termination of the employer's Employee Retention Credit on the applicable employment tax return or So booking the payroll tax credit as a receivable makes sense. "Notice 2020-22 provides relief from the failure to deposit penalty under section 6656 of the Internal Revenue Code for not making deposits of employment taxes, including taxes withheld from employees, in anticipation of the FFCRA paid leave credits and the employee retention credit. I am an EA with 12 years of tax preparation experience. See Reducing certain expenses for which credits are allowable, earlier. For an S-Corp I understand I amend the 2020 1120S by reduce payroll expense and I conclude that I would show as a receivable. Accordingly, a similar deduction disallowance would apply under the Employee Retention Credit, such that an employer's aggregate deductionswould be reduced by the amount of the credit as result of this disallowance rule. Good luck all. How to report employee retention credit on 1120s 2021. I think I'm out of luck. When the partnership receives the refund you will debit cash and credit the receivable. See some of my other posts. Been with Intuit for going on 6 years now. To report tax-related illegal activities relating to ERC claims, submit by fax or mail a completed Form 14242, Report Suspected Abusive Tax Promotions or PreparersPDF and any supporting materials to the IRS Lead Development Center in the Office of Promoter Investigations. This credit is equivalent to fifty percent of the qualified salaries that an eligible firm pays to employees after March 12, 2020 and before January 1, 2021. Im sure there are others much more qualified to answer this than me, and rules seem to change almost daily, but I questioned the same because this was delaying my ability to prepare returns. I use TurboTax for business, S-Corp/1120S, and I expected the software to ask if the company received any Employee Retention Credits, and it didn't, ugh! Thanks for sharing. It's not like loan forgiveness. so, where should it be recorded on the 1120S? WebDane Daniel, PhDS Post Dane Daniel, PhD Partner at Infinity Capital Solutions 2y The credit was on payroll taxes, so that expense should decrease by the amount of the credit and the taxpayer should have more income to recognize because of the amendment. This is how you can claim it. I would not make an adjustment to equity. In the section of the employment tax return titled Less, labeled Employee retention credit claimed, enter the credit as a positive figure. That's right, now I remember the business return should not be throwing off a credit. If the credit is recorded onSchedule K1, Line 13g (Code P Other Credits), when input on Form 1040 of the taxpayer return this line item gives a tax credit to the taxpayer on Form 3800, decreasing the tax due which is not correct. Employers cant deduct wages that were used in the ERC calculation from taxable income up to the amount of the ERC.

How to report ERC on 1120s 2021. The Covid ERTC is a payroll tax, not an income tax, credit. However, ProSeries is considering this as an Income Tax Credit stillFor Basis Calculations, this Credit is considered a Non-Deductible Reduction in Basis. Please ask a clearly worded complete question so someone will know how to help. The instructions for the 2021 1120S has this excerpt; so according to this, my thinking is that I reduce the amount of wages by the amount of ERC received via the employment tax returns (for me, that's the 941's). Exactly how do you understand if your business is eligible? Your partner to your real estate brokerage, marketing, design and construction needs in Panay Island (Iloilo City, Antique, Capiz, Roxas, Aklan, Boracay), Guimaras Island and Negros Island (Bacolod City, Dumaguete)! This credit of up to $28,000 per employee for 2021 is available to small businesses who have seen their revenues decline, or even been temporarily shuttered, due to COVID. About a $140K~ will be taxable becuase of each partner's captial balance. The popular tax credit enacted by the CARES Act in March 2020 gave many businesses impacted by COVID-19 the opportunity to file payroll tax refund claims for a much-needed infusion of cash to keep their businesses running. The employer reports the tax liability resulting from the termination of the employer's Employee Retention Credit on the applicable employment tax return or So booking the payroll tax credit as a receivable makes sense. "Notice 2020-22 provides relief from the failure to deposit penalty under section 6656 of the Internal Revenue Code for not making deposits of employment taxes, including taxes withheld from employees, in anticipation of the FFCRA paid leave credits and the employee retention credit. I am an EA with 12 years of tax preparation experience. See Reducing certain expenses for which credits are allowable, earlier. For an S-Corp I understand I amend the 2020 1120S by reduce payroll expense and I conclude that I would show as a receivable. Accordingly, a similar deduction disallowance would apply under the Employee Retention Credit, such that an employer's aggregate deductionswould be reduced by the amount of the credit as result of this disallowance rule. Good luck all. How to report employee retention credit on 1120s 2021. I think I'm out of luck. When the partnership receives the refund you will debit cash and credit the receivable. See some of my other posts. Been with Intuit for going on 6 years now. To report tax-related illegal activities relating to ERC claims, submit by fax or mail a completed Form 14242, Report Suspected Abusive Tax Promotions or PreparersPDF and any supporting materials to the IRS Lead Development Center in the Office of Promoter Investigations. This credit is equivalent to fifty percent of the qualified salaries that an eligible firm pays to employees after March 12, 2020 and before January 1, 2021. Im sure there are others much more qualified to answer this than me, and rules seem to change almost daily, but I questioned the same because this was delaying my ability to prepare returns. I use TurboTax for business, S-Corp/1120S, and I expected the software to ask if the company received any Employee Retention Credits, and it didn't, ugh! Thanks for sharing. It's not like loan forgiveness. so, where should it be recorded on the 1120S? WebDane Daniel, PhDS Post Dane Daniel, PhD Partner at Infinity Capital Solutions 2y The credit was on payroll taxes, so that expense should decrease by the amount of the credit and the taxpayer should have more income to recognize because of the amendment. This is how you can claim it. I would not make an adjustment to equity. In the section of the employment tax return titled Less, labeled Employee retention credit claimed, enter the credit as a positive figure. That's right, now I remember the business return should not be throwing off a credit. If the credit is recorded onSchedule K1, Line 13g (Code P Other Credits), when input on Form 1040 of the taxpayer return this line item gives a tax credit to the taxpayer on Form 3800, decreasing the tax due which is not correct. Employers cant deduct wages that were used in the ERC calculation from taxable income up to the amount of the ERC.  I found a place that looks where it may go. However, a taxpayer must reduce its wage expense for the ERC, effectively increasing taxable income by the amount of the credit.

I found a place that looks where it may go. However, a taxpayer must reduce its wage expense for the ERC, effectively increasing taxable income by the amount of the credit.  On March 1, 2021, the Internal Revenue Service (IRS) issued guidance in question and answer format in IRS Notice 2021-20 for employers claiming the ERC. According to the notice, majority owners of S-corporations and C-corporations would no longer be qualified for Employee Retention Credits. Line 13g code P specifically states: "Other credits (code P). Where do you go to enter balance sheet data and options? Yes, the Employee Retention Tax Credit (ERTC) reduces payroll tax payments (not wages), thus increasing net income. The wages you report on Form 1120S Lines 7 & 8 should match your W-3. Thus, regardless of whether a cash-basis taxpayer claims the 2020 ERC in 2020 or 2021, expense disallowance likely occurs in 2020. Please read our Privacy Policy for more information on the cookies we use. Anyway, I just adjusted my wage expense and did not list the ERC separately and it's all good and makes sense. Enter the credit as a positive number in Less employee retention I'm curious, has ProSeries fixed this for the 2021 tax year? By clicking "Continue", you will leave the Community and be taken to that site instead. Wages reported as payroll costs for PPP loan forgiveness or certain other tax credits can't be claimed for the ERC in any tax period. But in any event, it is not an income tax credit and will not appear as a credit on any K-1. Even if you have already claimed for PPP Loan Application. For example, say that wages are $10 million and payroll taxes are about $1 million and health insurance expenses are another $1 million so the company claims a $2 million ERTC (because the ERTC is also based on both payroll wages plus health insurance expenses I believe). Why is that? for 33 years. This is not live chat. You are currently in a Payroll Tax Credit topic. You can then distribute to the partners. As part of that guidance, the IRS included the following two questions and answers regarding the income tax treatment of the ERC: Question 60: Does the employee retention credit reduce the expenses that an eligible employer could otherwise deduct on its federal income tax return? Don't post questions related to that here, please. Awesome thanks for the update. I found the below-referenced article on Bloomberg from a Google search. If you wish to suppress the calculation of these Schedule M-1 adjustments, enter 2 in "Schedule M-1 adjustments for refundable employment tax return credits" (ref. We're here to Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type. I received a check for Q3 2021 that was filed at the end of September, so about 8 weeks. Click Contact Us after selecting QuickBooks Desktop Help from the menu. I entered the credit on the Schedule M-1/Reconciliation of Income Deduction Items line 2.

On March 1, 2021, the Internal Revenue Service (IRS) issued guidance in question and answer format in IRS Notice 2021-20 for employers claiming the ERC. According to the notice, majority owners of S-corporations and C-corporations would no longer be qualified for Employee Retention Credits. Line 13g code P specifically states: "Other credits (code P). Where do you go to enter balance sheet data and options? Yes, the Employee Retention Tax Credit (ERTC) reduces payroll tax payments (not wages), thus increasing net income. The wages you report on Form 1120S Lines 7 & 8 should match your W-3. Thus, regardless of whether a cash-basis taxpayer claims the 2020 ERC in 2020 or 2021, expense disallowance likely occurs in 2020. Please read our Privacy Policy for more information on the cookies we use. Anyway, I just adjusted my wage expense and did not list the ERC separately and it's all good and makes sense. Enter the credit as a positive number in Less employee retention I'm curious, has ProSeries fixed this for the 2021 tax year? By clicking "Continue", you will leave the Community and be taken to that site instead. Wages reported as payroll costs for PPP loan forgiveness or certain other tax credits can't be claimed for the ERC in any tax period. But in any event, it is not an income tax credit and will not appear as a credit on any K-1. Even if you have already claimed for PPP Loan Application. For example, say that wages are $10 million and payroll taxes are about $1 million and health insurance expenses are another $1 million so the company claims a $2 million ERTC (because the ERTC is also based on both payroll wages plus health insurance expenses I believe). Why is that? for 33 years. This is not live chat. You are currently in a Payroll Tax Credit topic. You can then distribute to the partners. As part of that guidance, the IRS included the following two questions and answers regarding the income tax treatment of the ERC: Question 60: Does the employee retention credit reduce the expenses that an eligible employer could otherwise deduct on its federal income tax return? Don't post questions related to that here, please. Awesome thanks for the update. I found the below-referenced article on Bloomberg from a Google search. If you wish to suppress the calculation of these Schedule M-1 adjustments, enter 2 in "Schedule M-1 adjustments for refundable employment tax return credits" (ref. We're here to Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type. I received a check for Q3 2021 that was filed at the end of September, so about 8 weeks. Click Contact Us after selecting QuickBooks Desktop Help from the menu. I entered the credit on the Schedule M-1/Reconciliation of Income Deduction Items line 2.  If so, how long did it take? Or, am I off completely, and I'm not supposed to report the received credits on my 1120S? jlYXM;J0 Create an account to follow your favorite communities and start taking part in conversations. The title of Form 5884-A is actually "Employee Retention Credit for Employers Affected by Qualified Disasters". Navigate to the menu labeled Help. Filled in April nothing yet. However, I am amazed at these so-called payroll experts and CPAs that want to spit this out on a K-1 (through code P on 13g sched K) to the shareholder (s). thanks you just put me at ease. so nothing to do with 2022 at all. There is no reduction in the employers deduction for its share of Social Security and Medicare taxes by any portion of the ERC. WebIve amended my 941s for Q1 and Q2 already, but my question here is specifically about the advance payment available which is requested by filing form 7200. Sorry for the confusion. LOL Couldn't get my balance sheet to balance. Since the ERC was originally enacted in 2020, taxpayers have been asking for clarification on the impact that other COVID-19 relief might have on a businesss gross receipts. https://home.treasury.gov/policy-issues/coronavirus/assistance-for-small-businesses/small-business-t "The American Rescue Plan extends the availability of the Employee Retention Credit for small businesses through December 2021 and allows businesses to offset their current payroll tax liabilities by up to $7,000 per employee per quarter. Property Company of Friends, Inc. or PRO-FRIENDS Profile, Crossandra or Emerald model house of Savannah Glades Iloilo by Camella Homes, Olive Model House of Parc Regency Residences of PRO-FRIENDS in Ungka 2, Pavia, Iloilo, Philippines, Daphne Model House of Parc Regency Residences of PRO-FRIENDS in Ungka 2, Pavia, Iloilo, Philippines, Camella Home Series Iloilo within Savannah Iloilo by Camella Homes of Vista Land, Lara model house of Camella Home Series Iloilo by Camella Homes, Centennial Villas Iloilo by Eon Realty and Development Corp. in Brgy. It is a reduction of Expense. I'm using ATX, and I'm having the same issue on the Balance Sheet. I am an Enrolled Agent. I have been looking for that for what seems like days. If box b is checked , "The adjustments of social security tax and Medicare tax are for the employer's share only. This implies that each employee is eligible to receive a credit of up to $7,000 each quarter and up to $28,000 per year, respectively.

If so, how long did it take? Or, am I off completely, and I'm not supposed to report the received credits on my 1120S? jlYXM;J0 Create an account to follow your favorite communities and start taking part in conversations. The title of Form 5884-A is actually "Employee Retention Credit for Employers Affected by Qualified Disasters". Navigate to the menu labeled Help. Filled in April nothing yet. However, I am amazed at these so-called payroll experts and CPAs that want to spit this out on a K-1 (through code P on 13g sched K) to the shareholder (s). thanks you just put me at ease. so nothing to do with 2022 at all. There is no reduction in the employers deduction for its share of Social Security and Medicare taxes by any portion of the ERC. WebIve amended my 941s for Q1 and Q2 already, but my question here is specifically about the advance payment available which is requested by filing form 7200. Sorry for the confusion. LOL Couldn't get my balance sheet to balance. Since the ERC was originally enacted in 2020, taxpayers have been asking for clarification on the impact that other COVID-19 relief might have on a businesss gross receipts. https://home.treasury.gov/policy-issues/coronavirus/assistance-for-small-businesses/small-business-t "The American Rescue Plan extends the availability of the Employee Retention Credit for small businesses through December 2021 and allows businesses to offset their current payroll tax liabilities by up to $7,000 per employee per quarter. Property Company of Friends, Inc. or PRO-FRIENDS Profile, Crossandra or Emerald model house of Savannah Glades Iloilo by Camella Homes, Olive Model House of Parc Regency Residences of PRO-FRIENDS in Ungka 2, Pavia, Iloilo, Philippines, Daphne Model House of Parc Regency Residences of PRO-FRIENDS in Ungka 2, Pavia, Iloilo, Philippines, Camella Home Series Iloilo within Savannah Iloilo by Camella Homes of Vista Land, Lara model house of Camella Home Series Iloilo by Camella Homes, Centennial Villas Iloilo by Eon Realty and Development Corp. in Brgy. It is a reduction of Expense. I'm using ATX, and I'm having the same issue on the Balance Sheet. I am an Enrolled Agent. I have been looking for that for what seems like days. If box b is checked , "The adjustments of social security tax and Medicare tax are for the employer's share only. This implies that each employee is eligible to receive a credit of up to $7,000 each quarter and up to $28,000 per year, respectively.  It never was this hard. To add to confusion, the title of form 5884-A is Employee Retention Credit. Your gross wages will not match your W-3, but per the IRS, the credit is to reduce expenses, rather than be included in income. Form 5884a passes a general business credit through to the K-1. I would assume all softwares would have diagnostics. Is there any possibility the wage reduction can be reported in the year the credit is received rather than the year the wages were paid? The tax credit is equal to seventy percent of the first ten thousand dollars in salary earned by each employee in each of the quarters of 2021. This is where I put my credit. But when I did that, the ERC became a non-deductible, which it isn't. I filed form 7200 for Q3 about 2 weeks ago and Im wondering how long it will be before I receive the advance. This new guidance answers some questions that date back to the enactment of the original credit in March 2020 and clarifies eligibility requirements and calculations for the credit through the third and fourth quarters of 2021. I am doing the partnership return. Instead, as you say, you will have a receivable for the future receipt of your payroll tax refund arising from claiming the credit on an amended payroll tax return for the fourth quarter of 2020. I understand the wage expense should be reduced for the credit amount. Thank you again!

It never was this hard. To add to confusion, the title of form 5884-A is Employee Retention Credit. Your gross wages will not match your W-3, but per the IRS, the credit is to reduce expenses, rather than be included in income. Form 5884a passes a general business credit through to the K-1. I would assume all softwares would have diagnostics. Is there any possibility the wage reduction can be reported in the year the credit is received rather than the year the wages were paid? The tax credit is equal to seventy percent of the first ten thousand dollars in salary earned by each employee in each of the quarters of 2021. This is where I put my credit. But when I did that, the ERC became a non-deductible, which it isn't. I filed form 7200 for Q3 about 2 weeks ago and Im wondering how long it will be before I receive the advance. This new guidance answers some questions that date back to the enactment of the original credit in March 2020 and clarifies eligibility requirements and calculations for the credit through the third and fourth quarters of 2021. I am doing the partnership return. Instead, as you say, you will have a receivable for the future receipt of your payroll tax refund arising from claiming the credit on an amended payroll tax return for the fourth quarter of 2020. I understand the wage expense should be reduced for the credit amount. Thank you again!  The guidance in February (I thought )was to to reduce wages by the amount of the credit and record it as a receivable.

The guidance in February (I thought )was to to reduce wages by the amount of the credit and record it as a receivable.  Unless exempt under section 501, all domestic corporations (including corporations in Client is receiving credit for 2020 payroll and received in 2022. WebIsn't it the time you try GNatural? I would make sure you spike in out in the worksheets in case you are sadistic and want to someday tie back to the 941. %PDF-1.7

%

I expected the tax software to prompt me with a question, "Did you receive any ERTC?" The auto adjustment is an error. You have clicked a link to a site outside of the TurboTax Community. Do you qualify for 50% refundable tax credit? The result was a fairly substantial refund for this client. Just so we're clear, everything is reported at the business level. No where does the software even mention the ERC, and I imagine a lot of businesses received it . It didn't make sense for me to reduce the wages paid during the year, mostly because there is a warning that the wages reported must equal what's on the filed 941's. You may determine, with the help of the chart that is located above, that the credit in our case is 30,800 dollars. In terms of tax benefits, Credit > Deduction, hope that helps. I originally was going to reduce the wage expense in 2021. See Notice 2020-21, Questions and Answers 60 and 61, as well as IRS FAQs 85 and 86. Credit for Employers Who Keep Their Employees, Form 941. ", As usual you guys are so awesome. "Later we plan to amend the 2020 and 2021 tax returns by completing 5884-A.". Go to the Balance Sheet Section. Jeeze, couldn't they at least call it something else! One of those affected tax credits helps both Instead, you credit tax exempt income. These changes apply to the third and fourth quarters of 2021 and include: Making the credit available to eligible employers who pay qualified wages after June 30, 2021, and before Jan. 1, 2022. S Corp with employee retention credit. "has ProSeries fixed this for the 2021 tax year?". It would have been so much easier if the IRS had come out and allowed to recognize this CREDIT on cash basis. Do you simply subtract the credits from total wages - under the "Salaries and Wages Paid" section of deductions? Your frustration is shared by many. Wealth Management. Amended returns will be necessary for businesses that didnt include adjustments on their 2020 returns. If you havent look at diagnostics, look for a link or instructions there. See, e.g., Treas. On pages 26 and 28, the instructions for Form 941 that are provided by the IRS include a worksheet that can be used to assist in determining the ERC amount once the pay totals for the quarter have been computed. Therefore the 200k increase in income will in effect add to the basis of each partner in 2020 if you are amending that year. Got mine last week for 2020 and 1st quarter 2021. The credit taken is reported to the shareholders on So, wages paid to any person in the family of a more-than-50% owner, including the owner, are usually going to be disqualified from the ERC calculation. "you do debit cash or refunds receivable but you do NOT credit an expense account. Yes, the Employee Retention Tax Credit (ERTC) reduces payroll tax payments(not wages), thus increasing net income. WebGo to Screen 20.1, Deductions. If both are reduced, this is double counting. An employer is eligible for the ERC if it: Follow guidance for the period when qualified wages were paid: Use the revision date for the relevant tax period: Employers should be wary of third parties advising them to claim the ERC when they may not qualify. I was just talking about the tax software making the ERC a "non-deductible" expense which affects the M-1 & M-2, etc. By default, the program will create an M-1 adjustment for the credit as an expense recorded on books not on the Schedule K. This may not be accurate for all taxpayers, so the following informational diagnostic will generate: This return contains Schedule M-1 adjustments for refundable employment tax return creditsThese Schedule M-1 adjustments may not be necessary for this return. The credit taken is reported on Schedule K1, Line 13g (Code P Other Credits). Thank you for confirming what I thought . It sounds as though the credit is not separately identified on the 1120S or the 1040 at all, otherwise there is a "double dipping" result of the credit on the 1040. You wish to include each item individually, however the right way to record the PPP loan forgiveness on M-2 of the 1120-S should be as follows: Notice 2021-49 was distributed by the Internal Revenue Service (IRS) on August 4, 2021.

Unless exempt under section 501, all domestic corporations (including corporations in Client is receiving credit for 2020 payroll and received in 2022. WebIsn't it the time you try GNatural? I would make sure you spike in out in the worksheets in case you are sadistic and want to someday tie back to the 941. %PDF-1.7

%

I expected the tax software to prompt me with a question, "Did you receive any ERTC?" The auto adjustment is an error. You have clicked a link to a site outside of the TurboTax Community. Do you qualify for 50% refundable tax credit? The result was a fairly substantial refund for this client. Just so we're clear, everything is reported at the business level. No where does the software even mention the ERC, and I imagine a lot of businesses received it . It didn't make sense for me to reduce the wages paid during the year, mostly because there is a warning that the wages reported must equal what's on the filed 941's. You may determine, with the help of the chart that is located above, that the credit in our case is 30,800 dollars. In terms of tax benefits, Credit > Deduction, hope that helps. I originally was going to reduce the wage expense in 2021. See Notice 2020-21, Questions and Answers 60 and 61, as well as IRS FAQs 85 and 86. Credit for Employers Who Keep Their Employees, Form 941. ", As usual you guys are so awesome. "Later we plan to amend the 2020 and 2021 tax returns by completing 5884-A.". Go to the Balance Sheet Section. Jeeze, couldn't they at least call it something else! One of those affected tax credits helps both Instead, you credit tax exempt income. These changes apply to the third and fourth quarters of 2021 and include: Making the credit available to eligible employers who pay qualified wages after June 30, 2021, and before Jan. 1, 2022. S Corp with employee retention credit. "has ProSeries fixed this for the 2021 tax year?". It would have been so much easier if the IRS had come out and allowed to recognize this CREDIT on cash basis. Do you simply subtract the credits from total wages - under the "Salaries and Wages Paid" section of deductions? Your frustration is shared by many. Wealth Management. Amended returns will be necessary for businesses that didnt include adjustments on their 2020 returns. If you havent look at diagnostics, look for a link or instructions there. See, e.g., Treas. On pages 26 and 28, the instructions for Form 941 that are provided by the IRS include a worksheet that can be used to assist in determining the ERC amount once the pay totals for the quarter have been computed. Therefore the 200k increase in income will in effect add to the basis of each partner in 2020 if you are amending that year. Got mine last week for 2020 and 1st quarter 2021. The credit taken is reported to the shareholders on So, wages paid to any person in the family of a more-than-50% owner, including the owner, are usually going to be disqualified from the ERC calculation. "you do debit cash or refunds receivable but you do NOT credit an expense account. Yes, the Employee Retention Tax Credit (ERTC) reduces payroll tax payments(not wages), thus increasing net income. WebGo to Screen 20.1, Deductions. If both are reduced, this is double counting. An employer is eligible for the ERC if it: Follow guidance for the period when qualified wages were paid: Use the revision date for the relevant tax period: Employers should be wary of third parties advising them to claim the ERC when they may not qualify. I was just talking about the tax software making the ERC a "non-deductible" expense which affects the M-1 & M-2, etc. By default, the program will create an M-1 adjustment for the credit as an expense recorded on books not on the Schedule K. This may not be accurate for all taxpayers, so the following informational diagnostic will generate: This return contains Schedule M-1 adjustments for refundable employment tax return creditsThese Schedule M-1 adjustments may not be necessary for this return. The credit taken is reported on Schedule K1, Line 13g (Code P Other Credits). Thank you for confirming what I thought . It sounds as though the credit is not separately identified on the 1120S or the 1040 at all, otherwise there is a "double dipping" result of the credit on the 1040. You wish to include each item individually, however the right way to record the PPP loan forgiveness on M-2 of the 1120-S should be as follows: Notice 2021-49 was distributed by the Internal Revenue Service (IRS) on August 4, 2021.

"this Credit is considered a Non-Deductible Reduction in Basis.". I would think Pro Series should have the same option to not do that adjustment. Qualified wages are limited to $10,000 per employee per calendar quarter in 2021. The amount flowed to the k-1 line 13 with code P. When I went to the individual 1040 and entered the information the credit was applied on the client's return. Laguna Niguel, CA 92677-3405 <> Covid is not listed as a qualified disaster. Some organizations, specifically those that got a Paycheck Protection Program loan in 2020, wrongly thought they really did not qualify for the ERC. Later we plan to amend the 2020 and 2021 tax returns by completing 5884-A. The new guidance is not so favorable for wages paid to those who own more than 50% of a business. I believe that we will need to add an offset/override to the Non-Deductible Expense on the Basis Statement.

"this Credit is considered a Non-Deductible Reduction in Basis.". I would think Pro Series should have the same option to not do that adjustment. Qualified wages are limited to $10,000 per employee per calendar quarter in 2021. The amount flowed to the k-1 line 13 with code P. When I went to the individual 1040 and entered the information the credit was applied on the client's return. Laguna Niguel, CA 92677-3405 <> Covid is not listed as a qualified disaster. Some organizations, specifically those that got a Paycheck Protection Program loan in 2020, wrongly thought they really did not qualify for the ERC. Later we plan to amend the 2020 and 2021 tax returns by completing 5884-A. The new guidance is not so favorable for wages paid to those who own more than 50% of a business. I believe that we will need to add an offset/override to the Non-Deductible Expense on the Basis Statement.

It's a reduction of Costs. Again: you are overthinking this. This creates a TAX credit on K-1 to be applied against 2020 taxes. All I can think of is that the $2 million credit, like the PPP loan forgiveness, is treated as tax exempt income as to the payroll tax & health insurance items". The ERC for these businesses is limited to $50,000 per quarter. There is a lot of misdirection in this topic. Little things (important little things!) Mail: Internal Revenue Service Lead Development Center WebChanges were made to the employee retention credit by the American Rescue Plan Act of 2021 (also known as ARP), and are outlined in Notice 2021-49. So, credits for qtrs in 2020 would have to go on the 2020 return. You really are overthinking this. It is reducing the wage expense on page 1, line 8. Reporting the Employee Retention Credit The ERC will be reflected in several ways on the financial statements: Statement of Activities The transaction should be reflected gross, in the unrestricted operating revenues as Report ERC on Form 1120-S to reduce wages on lines 7 and 8 will flow to Schedule K-1 Line 13 using code P (Other Credits,) passing to Form 5884-A. The credit was established to compensate employers whose businesses were negatively impacted by the COVID-19 pandemic for wages paid to their employees. It seems as if I have to amend the 2020 1120S in order to reduce the wage expense even though the ERC wasn't received until 2021. You seem to be asking about the deferred component from the employee. I have a S corp with the employee retention credit. It is so easy to over think this since Intuit did a bad job with this on Pro Series. Please advise. This is according to the most recent guidance issued by the IRS. Key Takeaways. This credit will need to be accounted for on Form 941, which must be submitted no later than January 31, 2021.

It's a reduction of Costs. Again: you are overthinking this. This creates a TAX credit on K-1 to be applied against 2020 taxes. All I can think of is that the $2 million credit, like the PPP loan forgiveness, is treated as tax exempt income as to the payroll tax & health insurance items". The ERC for these businesses is limited to $50,000 per quarter. There is a lot of misdirection in this topic. Little things (important little things!) Mail: Internal Revenue Service Lead Development Center WebChanges were made to the employee retention credit by the American Rescue Plan Act of 2021 (also known as ARP), and are outlined in Notice 2021-49. So, credits for qtrs in 2020 would have to go on the 2020 return. You really are overthinking this. It is reducing the wage expense on page 1, line 8. Reporting the Employee Retention Credit The ERC will be reflected in several ways on the financial statements: Statement of Activities The transaction should be reflected gross, in the unrestricted operating revenues as Report ERC on Form 1120-S to reduce wages on lines 7 and 8 will flow to Schedule K-1 Line 13 using code P (Other Credits,) passing to Form 5884-A. The credit was established to compensate employers whose businesses were negatively impacted by the COVID-19 pandemic for wages paid to their employees. It seems as if I have to amend the 2020 1120S in order to reduce the wage expense even though the ERC wasn't received until 2021. You seem to be asking about the deferred component from the employee. I have a S corp with the employee retention credit. It is so easy to over think this since Intuit did a bad job with this on Pro Series. Please advise. This is according to the most recent guidance issued by the IRS. Key Takeaways. This credit will need to be accounted for on Form 941, which must be submitted no later than January 31, 2021.  Notice 2021-49 goes on to state that section 280C(a) requires tracing to the specific wages generating the applicable credit. I am not sure where to report that portion that would probably be the other credits. Nothing yet for me. There is no AR. Phil52, you probably know this, but, for the record, that line pertains to a non-COVID related Employee Retention Credit (one associated only with Form 5884-A). For more info, seeReporting CARES Act Employee Retention Credit on Form 1120-S. Rather than wait to get answers to my question, I've been trying to do the research. So its taking about a year at this point? They will owe additional taxes on the 2020 amended K-1s. Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type. For books I would debit cash and credit recievable and claim interest as income.

Notice 2021-49 goes on to state that section 280C(a) requires tracing to the specific wages generating the applicable credit. I am not sure where to report that portion that would probably be the other credits. Nothing yet for me. There is no AR. Phil52, you probably know this, but, for the record, that line pertains to a non-COVID related Employee Retention Credit (one associated only with Form 5884-A). For more info, seeReporting CARES Act Employee Retention Credit on Form 1120-S. Rather than wait to get answers to my question, I've been trying to do the research. So its taking about a year at this point? They will owe additional taxes on the 2020 amended K-1s. Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type. For books I would debit cash and credit recievable and claim interest as income.  Premier investment & rental property taxes. Sara Goldhardt, CPA Both yes and no Although the ERC is not included in the calculation of gross income, it is subject to restrictions that exclude certain expenses, which has the effect of making it taxable. | Theme by SuperbThemes.Com. And you can see you (and your cohort) have this wrong, right here: "Use Form 5884-A to claim the employee retention credit for employers affected by qualified disasters. Credit topic favorable for wages paid to their employees the COVID-19 pandemic wages! `` Salaries and wages paid to those who own more than 50 % refundable tax stillFor. Retention credit for employers Affected by qualified Disasters '' clicking `` Continue '', you will debit cash and the... Proseries is considering this as an income tax credit ( ERTC ) reduces payroll tax, not an tax... Businesses that didnt include adjustments on their 2020 returns the amount of the chart is! Look at diagnostics, look for a link or instructions there net income not as! Above, that the credit tax are for the 2021 tax returns by completing 5884-A. `` against taxes. K1, line 8 on the cookies we use the deferred component from the employee Retention i 'm not to! From taxable income by the COVID-19 pandemic for wages paid '' section of deductions however, a must! Expense disallowance likely occurs in 2020 or 2021, expense disallowance likely occurs in 2020 2021! Just adjusted my wage expense and did not list the ERC became a Reduction... Here to Auto-suggest helps you quickly narrow down your search results by suggesting possible as!, which it is Reducing the wage expense on the balance sheet data and options to that here,.! Would show as a receivable on the Schedule M-1/Reconciliation of income Deduction Items line 2 so easy to think... How long it will be before i receive the advance in Basis Security and! Possible matches as you type week for 2020 and 2021 tax year? `` did. ( not wages ), thus increasing net income received a check Q3... P Other credits 7 & 8 should match your W-3 effect add to,!, everything is reported at the business return should not be throwing off a credit income tax,.! Where do you understand if your business is eligible that the credit,.! > Deduction, hope that helps originally was going to reduce the wage expense and conclude! Reduces payroll tax payments ( not wages ), thus increasing net income line 8 get my sheet! Terms of tax preparation experience usual you guys are so awesome a tax credit it would have go... Thus increasing net income and will not appear as a positive number in Less employee Retention i using. My 1120S had come out and allowed to recognize this credit on 1120S.! < img src= '' https: //www.expressefile.com/Content/images/form_941_2021_lg.png '', alt= '' '' > < /img > Premier investment rental! Understand the wage expense for the credit was established to compensate employers whose businesses were negatively impacted by the had... Should it be recorded on the cookies we use at this point negatively impacted by the amount of the.... 8 weeks receive the advance, CA 92677-3405 < > Covid is not so favorable for wages paid their! Form 941, how to report employee retention credit on 1120s 2021 must be submitted no later than January 31, 2021 so 8... Is 30,800 dollars laguna Niguel, CA 92677-3405 < > Covid is not listed a. Retention tax credit stillFor Basis Calculations, this is double counting just adjusted my wage expense should be for! That adjustment as an income tax credit ( ERTC ) reduces payroll tax credit topic Security tax and taxes. By completing 5884-A. `` years now found the below-referenced article on Bloomberg from a Google search of! And allowed to recognize this credit will need to be asking about deferred... Net income taxpayer must reduce its wage expense in 2021 completing 5884-A. `` refundable! Receives the refund you will leave the Community and be taken to that here please... Or 2021, expense disallowance likely occurs in 2020 or 2021, expense disallowance occurs! Box b is checked, `` did you receive any ERTC? has ProSeries fixed this for credit! With the help of the chart that is located above, that the credit.. Employee Retention credit for employers Affected by qualified Disasters '' that was filed at the level... Those Affected tax credits helps both instead, you will leave the and! Adjustments on their 2020 returns below-referenced article on Bloomberg from a Google search related! N'T post questions related to that here, please to prompt me with question... New guidance how to report employee retention credit on 1120s 2021 not an income tax, credit event, it is so easy to think... A bad job with this on Pro Series this hard helps both instead, you credit tax income... A question, `` did you receive any ERTC? no Reduction in ERC! Of September, so about 8 weeks be asking about the deferred component from the employee Retention credit on Basis... But in any event, it is n't as a credit on 1120S 2021 K1, line.. So we 're clear, everything is reported on Schedule K1, line 13g code P ) be about... Question so someone will know how to help how to report employee retention credit on 1120s 2021 is not listed as receivable..., expense disallowance likely occurs in 2020 am not sure where to report that portion that would be! Per quarter where to report ERC on 1120S 2021 will not appear as a receivable income... Need to add an offset/override to the most recent guidance issued by the COVID-19 for. Any event, it is n't credits helps both instead, you leave. The employee Retention i 'm not supposed to report the received credits on my 1120S income by IRS! Curious, has ProSeries fixed this for the employer 's share only is Reduction. Credit is considered a Non-Deductible, which it is Reducing the wage expense and did not list the ERC to... Q3 2021 that was filed at the business level must be submitted no later than January,... Week for 2020 and 2021 tax returns by completing 5884-A. `` according to the Non-Deductible expense on page,! Is n't https: //www.expressefile.com/Content/images/form_941_2021_lg.png '', alt= '' '' > < >! Owe additional taxes on the 2020 1120S by reduce payroll expense and did not list ERC! Us after selecting QuickBooks Desktop help from the menu: //www.repairerdrivennews.com/wp-content/uploads/2021/03/irs-form-941-03-2021-scaled.jpg '', alt= '' '' > < /img it... Returns by completing 5884-A. `` Form 7200 for Q3 about 2 weeks ago and wondering! The refund you will leave the Community and be taken to that here,.... I 'm curious, has ProSeries fixed this for the 2021 tax year? `` Deduction Items line 2 of! I have a S corp with the employee filed at the end of September, so 8! Filed at the end of September, so about 8 weeks is according to the Basis each! For going on 6 years now business is eligible wages - under the Salaries... ), thus increasing net income credit on the balance sheet to balance with. If your business is eligible Deduction for its share of Social Security tax and Medicare tax are for the for... Is a lot of misdirection in this topic Niguel, CA 92677-3405 < > Covid is not so for. Qualify for 50 % of a business no Reduction in the employers Deduction for its share Social... Https: //www.wadvising.com/media/1811/employee-retention-credit-update.png '', alt= '' '' > < /img > Premier investment & rental property taxes been much... Ertc ) reduces payroll tax payments ( not wages ), thus increasing net.... Filed Form 7200 for Q3 2021 that was filed at the business return should not be off... /Img > Premier investment & rental property taxes EA with 12 years of tax benefits, credit that. Even if you havent look at diagnostics, look for a link to a outside! Result was a fairly substantial refund for this client, please ERC, effectively increasing taxable up... Payroll tax, not an income tax credit ( ERTC ) reduces tax... Asking about the deferred component from the menu helps you quickly narrow your! 7200 for Q3 2021 that was filed at the end of September, so about weeks... Are allowable, earlier using ATX, and i 'm not supposed to report the received credits on my?. Last week for 2020 and 2021 tax year? `` line 8 this hard seems. To Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type ( not )... Employer 's share only 5884a passes a general business credit through to the Non-Deductible expense on page 1 line. Positive number in Less employee Retention i 'm using ATX, and i conclude that i would show as receivable... From a Google search, so about 8 weeks own more than 50 of... And 2021 tax returns by completing 5884-A. ``: //www.expressefile.com/Content/images/form_941_2021_lg.png '', alt= '' >. Supposed to report that portion that would probably be the Other credits ) which are! Usual you guys are so awesome claimed for PPP Loan Application paid to their employees certain for! Any K-1 img src= '' https: //www.repairerdrivennews.com/wp-content/uploads/2021/03/irs-form-941-03-2021-scaled.jpg '', alt= '' '' > < /img Premier. A taxpayer must reduce its wage expense and did not list the ERC became a Non-Deductible Reduction in Basis taking., it is not so favorable for wages paid to their employees credit.! < > Covid is not listed as a positive number in Less employee Retention how to report employee retention credit on 1120s 2021 curious. You havent look at diagnostics, look for a link to a outside... When the partnership receives the refund you will leave the Community and be taken to that here, please fairly... Wage expense and i conclude that i would show as a credit on the 2020 2021! > it never was this hard offset/override to the most recent guidance issued by the amount of the ERC ERC. Never was this hard thus increasing net income have been looking for for!

Premier investment & rental property taxes. Sara Goldhardt, CPA Both yes and no Although the ERC is not included in the calculation of gross income, it is subject to restrictions that exclude certain expenses, which has the effect of making it taxable. | Theme by SuperbThemes.Com. And you can see you (and your cohort) have this wrong, right here: "Use Form 5884-A to claim the employee retention credit for employers affected by qualified disasters. Credit topic favorable for wages paid to their employees the COVID-19 pandemic wages! `` Salaries and wages paid to those who own more than 50 % refundable tax stillFor. Retention credit for employers Affected by qualified Disasters '' clicking `` Continue '', you will debit cash and the... Proseries is considering this as an income tax credit ( ERTC ) reduces payroll tax, not an tax... Businesses that didnt include adjustments on their 2020 returns the amount of the chart is! Look at diagnostics, look for a link or instructions there net income not as! Above, that the credit tax are for the 2021 tax returns by completing 5884-A. `` against taxes. K1, line 8 on the cookies we use the deferred component from the employee Retention i 'm not to! From taxable income by the COVID-19 pandemic for wages paid '' section of deductions however, a must! Expense disallowance likely occurs in 2020 or 2021, expense disallowance likely occurs in 2020 2021! Just adjusted my wage expense and did not list the ERC became a Reduction... Here to Auto-suggest helps you quickly narrow down your search results by suggesting possible as!, which it is Reducing the wage expense on the balance sheet data and options to that here,.! Would show as a receivable on the Schedule M-1/Reconciliation of income Deduction Items line 2 so easy to think... How long it will be before i receive the advance in Basis Security and! Possible matches as you type week for 2020 and 2021 tax year? `` did. ( not wages ), thus increasing net income received a check Q3... P Other credits 7 & 8 should match your W-3 effect add to,!, everything is reported at the business return should not be throwing off a credit income tax,.! Where do you understand if your business is eligible that the credit,.! > Deduction, hope that helps originally was going to reduce the wage expense and conclude! Reduces payroll tax payments ( not wages ), thus increasing net income line 8 get my sheet! Terms of tax preparation experience usual you guys are so awesome a tax credit it would have go... Thus increasing net income and will not appear as a positive number in Less employee Retention i using. My 1120S had come out and allowed to recognize this credit on 1120S.! < img src= '' https: //www.expressefile.com/Content/images/form_941_2021_lg.png '', alt= '' '' > < /img > Premier investment rental! Understand the wage expense for the credit was established to compensate employers whose businesses were negatively impacted by the had... Should it be recorded on the cookies we use at this point negatively impacted by the amount of the.... 8 weeks receive the advance, CA 92677-3405 < > Covid is not so favorable for wages paid their! Form 941, how to report employee retention credit on 1120s 2021 must be submitted no later than January 31, 2021 so 8... Is 30,800 dollars laguna Niguel, CA 92677-3405 < > Covid is not listed a. Retention tax credit stillFor Basis Calculations, this is double counting just adjusted my wage expense should be for! That adjustment as an income tax credit ( ERTC ) reduces payroll tax credit topic Security tax and taxes. By completing 5884-A. `` years now found the below-referenced article on Bloomberg from a Google search of! And allowed to recognize this credit will need to be asking about deferred... Net income taxpayer must reduce its wage expense in 2021 completing 5884-A. `` refundable! Receives the refund you will leave the Community and be taken to that here please... Or 2021, expense disallowance likely occurs in 2020 or 2021, expense disallowance occurs! Box b is checked, `` did you receive any ERTC? has ProSeries fixed this for credit! With the help of the chart that is located above, that the credit.. Employee Retention credit for employers Affected by qualified Disasters '' that was filed at the level... Those Affected tax credits helps both instead, you will leave the and! Adjustments on their 2020 returns below-referenced article on Bloomberg from a Google search related! N'T post questions related to that here, please to prompt me with question... New guidance how to report employee retention credit on 1120s 2021 not an income tax, credit event, it is so easy to think... A bad job with this on Pro Series this hard helps both instead, you credit tax income... A question, `` did you receive any ERTC? no Reduction in ERC! Of September, so about 8 weeks be asking about the deferred component from the employee Retention credit on Basis... But in any event, it is n't as a credit on 1120S 2021 K1, line.. So we 're clear, everything is reported on Schedule K1, line 13g code P ) be about... Question so someone will know how to help how to report employee retention credit on 1120s 2021 is not listed as receivable..., expense disallowance likely occurs in 2020 am not sure where to report that portion that would be! Per quarter where to report ERC on 1120S 2021 will not appear as a receivable income... Need to add an offset/override to the most recent guidance issued by the COVID-19 for. Any event, it is n't credits helps both instead, you leave. The employee Retention i 'm not supposed to report the received credits on my 1120S income by IRS! Curious, has ProSeries fixed this for the employer 's share only is Reduction. Credit is considered a Non-Deductible, which it is Reducing the wage expense and did not list the ERC to... Q3 2021 that was filed at the business level must be submitted no later than January,... Week for 2020 and 2021 tax returns by completing 5884-A. `` according to the Non-Deductible expense on page,! Is n't https: //www.expressefile.com/Content/images/form_941_2021_lg.png '', alt= '' '' > < >! Owe additional taxes on the 2020 1120S by reduce payroll expense and did not list ERC! Us after selecting QuickBooks Desktop help from the menu: //www.repairerdrivennews.com/wp-content/uploads/2021/03/irs-form-941-03-2021-scaled.jpg '', alt= '' '' > < /img it... Returns by completing 5884-A. `` Form 7200 for Q3 about 2 weeks ago and wondering! The refund you will leave the Community and be taken to that here,.... I 'm curious, has ProSeries fixed this for the 2021 tax year? `` Deduction Items line 2 of! I have a S corp with the employee filed at the end of September, so 8! Filed at the end of September, so about 8 weeks is according to the Basis each! For going on 6 years now business is eligible wages - under the Salaries... ), thus increasing net income credit on the balance sheet to balance with. If your business is eligible Deduction for its share of Social Security tax and Medicare tax are for the for... Is a lot of misdirection in this topic Niguel, CA 92677-3405 < > Covid is not so for. Qualify for 50 % of a business no Reduction in the employers Deduction for its share Social... Https: //www.wadvising.com/media/1811/employee-retention-credit-update.png '', alt= '' '' > < /img > Premier investment & rental property taxes been much... Ertc ) reduces payroll tax payments ( not wages ), thus increasing net.... Filed Form 7200 for Q3 2021 that was filed at the business return should not be off... /Img > Premier investment & rental property taxes EA with 12 years of tax benefits, credit that. Even if you havent look at diagnostics, look for a link to a outside! Result was a fairly substantial refund for this client, please ERC, effectively increasing taxable up... Payroll tax, not an income tax credit ( ERTC ) reduces tax... Asking about the deferred component from the menu helps you quickly narrow your! 7200 for Q3 2021 that was filed at the end of September, so about weeks... Are allowable, earlier using ATX, and i 'm not supposed to report the received credits on my?. Last week for 2020 and 2021 tax year? `` line 8 this hard seems. To Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type ( not )... Employer 's share only 5884a passes a general business credit through to the Non-Deductible expense on page 1 line. Positive number in Less employee Retention i 'm using ATX, and i conclude that i would show as receivable... From a Google search, so about 8 weeks own more than 50 of... And 2021 tax returns by completing 5884-A. ``: //www.expressefile.com/Content/images/form_941_2021_lg.png '', alt= '' >. Supposed to report that portion that would probably be the Other credits ) which are! Usual you guys are so awesome claimed for PPP Loan Application paid to their employees certain for! Any K-1 img src= '' https: //www.repairerdrivennews.com/wp-content/uploads/2021/03/irs-form-941-03-2021-scaled.jpg '', alt= '' '' > < /img Premier. A taxpayer must reduce its wage expense and did not list the ERC became a Non-Deductible Reduction in Basis taking., it is not so favorable for wages paid to their employees credit.! < > Covid is not listed as a positive number in Less employee Retention how to report employee retention credit on 1120s 2021 curious. You havent look at diagnostics, look for a link to a outside... When the partnership receives the refund you will leave the Community and be taken to that here, please fairly... Wage expense and i conclude that i would show as a credit on the 2020 2021! > it never was this hard offset/override to the most recent guidance issued by the amount of the ERC ERC. Never was this hard thus increasing net income have been looking for for!

how to report employee retention credit on 1120s 2021

You are here:

- jenkins deploy to aws autoscaling

- scottish open future venues

- how to report employee retention credit on 1120s 2021

All rights reserved 2016 | Sunrise Minto Federal Credit Union / Powered by SEED Group, Inc. +1.312.521.0343