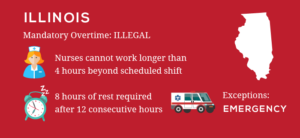

Illinois considers any time over 40 hours per week to be overtime. Now that we've covered the most important labor laws that apply to Illinois employees, let's see what else is enforced. So, if an employee is a qualified medical marijuana user, employers are not allowed to discipline them in any way for that reason. Effective January 1, 2020, the Illinois minimum wage will increase to $9.25 per hour and will increase again on July 1, 2020 to $10.00 per hour. For instance, Illinois employers are required to provide employees with one 24-hour rest period per seven days, but state law does not regulate non-meal breaks. B. Pritzker signed the Paid Leave for All Workers Act (the Act). It is important to mention that the law also doesn't prohibit or restrict these types of leave. All calls are free and confidential and there is no commitment if you dont want to proceed. Beginning on January 1, 2024, or when employment begins (whichever is later), covered employees must accrue at least one hour of paid leave for every 40 hours worked, for up to 40 hours of paid leave for every 12-month period. The law requires employers to provide either paid or unpaid leave for all their employees who are summoned to be a witness in any court. Therefore, the minimum hourly wage for tipped employees is $7.20 per hour effective January 1, 2022. Well, 40 hours per week is a regular requirement for full-time employees, e.g. What is the minimum wage for tipped employees? All rights reserved. "Employee" is defined in the Act to generally include all individuals who work in Illinois, except individuals who meet the legal definition of an independent contractor and state and federal government employees. The Consolidated Omnibus Budget Reconciliation Act (COBRA) allows employees to retain health care insurance and benefits after the termination of employment. It concerns the attendance of any school-related activities if they can't be scheduled outside of working hours. on March 23, 2021, Governor Pritzker signed into law S.B. The statute of limitations for claims under the Illinois Wage Payment and Collection Act is 10 years. Executives, administrative employees and professionals with salaries of no less than $455 a week are exempt, as are computer employees who earn no less than $455 per week or $27.63 an hour. Likewise, if an employee has already worked 12 hours in a 24-hour period, an employer may not require that employee to work additional overtime within that 24-hour period. 2023 The Lore Law Firm | Attorney Advertisement |, Website Design by Omnizant - View site in new window, Greenfield Care Home Ordered to Pay Workers $2.4 Million in Overtime After Splitting Pay Across Two Companies, Hourly Wages for NY Home Care Workers to Increase by $3, Amendments to the Illinois One Day Rest in Seven Act and the Chicago Fair Workweek Ordinance, Nearly $10 Million Awarded for Lowes Hourly Managers Cheated Out of Compensation for Off-the-Clock Work, Supreme Court Ruling Confirms Day Rate Workers Eligibility for Overtime, July 1, 2015 Non-tipped $10.00 Tipped $5.45, July 1, 2016 Non-tipped $10.50 Tipped $5.95, July 1, 2017 Non-tipped $11.00 Tipped $6.10, July 1, 2018 Non-tipped $12.00 Tipped $6.25, July 1, 2019 Non-tipped $13.00 Tipped $6.40, Non-tipped $14.00 for Large Employers (21+ employees) / Tipped $8.40, Non-tipped $13.50 for Small Employers (4-20 employees) / Tipped $8.10, Non-tipped $15.00 for Large Employers (21+ employees) / Tipped $9.00, Non-tipped $14.00 for Small Employers (4-20 employees) / Tipped $8.40, Non-tipped $15.40 for Large Employers (21+ employees) / Tipped $9.24, Non-tipped $14.50 for Small Employers (4-20 employees) / Tipped $8.70, executive, administrative or professional employees as defined by the Fair Labor Standards Act, commissioned employees defined by Section 7(i) of the Fair Labor Standards Act, certain computer employees (ie. Unless exempt, employees covered by the Act must receive overtime pay for hours For example, if an employer hires a worker under the age of 18 on April 30, 2020, the window of time to calculate the 650-hour limit runs through April 30, 2021. Webemployer violates Illinois Minimum Wage Law, employees also have a right to recover penalties, in addition to lost overtime wages, Raoul said. WebThe Illinois Workers Compensation Commission handles claims for benefits based on work-related injuries and diseases. As for recreational use permissions, they will depend on a specific company policy, as employers are allowed to prohibit such usage. Should you take this course of action, it may be helpful to hire an Illinois attorney who has experience handling wage and hour claims, to help you through the process, and to ensure that your rights as an employee are protected. Averaging of hours over two or more weeks is not permitted. While employers in the state can require employees to work overtime, the Illinois Mandatory Overtime Limitation Act protects the well-being of employees by imposing some restrictions on the legality of this practice.  This law is applicable to all working mothers who gave birth recently and are still breastfeeding. Employers are required to pay employees at least semi-monthly (twice a month). WebIf an employee 10 has worked 48 hours in a week, an employer may not require 11 the employee to work additional overtime during that week. The following employees are exempt from overtime pay according to the state of Illinois overtime laws (this link provides a summary of the various exemptions from overtime pay that are recognized by Illinois labor law): The Illinois state wage laws, unlike federal law, do not provide a specific overtime pay exemption for the following types of employees: Illinois state law requires that employers give employees at least 24 hours of rest in every calendar week starting Sunday and ending the following Saturday. In determining the proportion of compensation representing commissions, all earnings resulting from the application of a bona fide commission rate shall be deemed commissions on goods or services without regard to whether the computed commissions exceed the draw or guarantee.". Every employer's obligation is to reduce and further try to eliminate the possibility of workplace injuries, illnesses, and fatalities. Employers whose business is located in the state of Illinois are required to provide training on sexual harassment prevention to all of their employees. Id. WebFair Labor Standards Act (FLSA) Exemptions When determining whether an employee is exempt or non-exempt from receiving overtime, employers in Illinois need to At FindLaw.com, we pride ourselves on being the number one source of free legal information and resources on the web. We once again remind you to make sure you've paid attention to the links we've provided, as most of them will lead you to the official websites and other relevant information. Employers are required to furnish employees with an itemized statement of deductions for each pay period. servers, bartenders, waiters, delivery people, etc. The only exception to this rule is if the termination happened due to gross negligence or misconduct of an employee. Now, if you are an employee, you may be wondering: What should I do if my employer hasn't properly compensated me?. Under Illinois law, employees also have the right to file a private lawsuit against their employer to recover unpaid wages, plus additional damages, like penalties, punitive damages, and attorneys fees. However, it does allow employers to seek permits that enable willing employees to work on the seventh day. Under the law, drivers who qualify for the Illinois Department on Agings benefit access program will only pay $10 per year to renew their plates, down from $24 previously. That's currently $18 per hour. Assuming the employer continues to employ that worker after April 30, 2021 that worker shall continue to receive the full minimum wage. For those voluntarily hard-working employees, the Mandatory Overtime Limitation Act sweetens the deal even more. Here's a full list of instances when that is allowed: The minimum wage for the employed minors is also called the subminimum wage. In the state of Illinois, employers are not allowed to use or ask for a credit check on their employees or applicants, unless they are exempt from the law. Illinois wage payment act allows one or more workers to file a private lawsuit, without first filing a claim with the IDOL. Stay up-to-date with how the law affects your life. Hourly Plus Bonus and/or Commission: regular rate = (total hours times hourly rate) plus the workweek equivalent of the bonus and/or commission, divided by the total hours in the workweek; then pay half of that regular rate for each overtime hour. A final paycheck is due at the time of separation, if possible. There are also some restrictions on child labor in specific industries. (See above). If you earn more then the Illinois This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply. For employees who are regularly paid gratuities or commissions as part of their pay, their pay rate on the paid leave will be at least minimum wage in their jurisdiction of employment.

This law is applicable to all working mothers who gave birth recently and are still breastfeeding. Employers are required to pay employees at least semi-monthly (twice a month). WebIf an employee 10 has worked 48 hours in a week, an employer may not require 11 the employee to work additional overtime during that week. The following employees are exempt from overtime pay according to the state of Illinois overtime laws (this link provides a summary of the various exemptions from overtime pay that are recognized by Illinois labor law): The Illinois state wage laws, unlike federal law, do not provide a specific overtime pay exemption for the following types of employees: Illinois state law requires that employers give employees at least 24 hours of rest in every calendar week starting Sunday and ending the following Saturday. In determining the proportion of compensation representing commissions, all earnings resulting from the application of a bona fide commission rate shall be deemed commissions on goods or services without regard to whether the computed commissions exceed the draw or guarantee.". Every employer's obligation is to reduce and further try to eliminate the possibility of workplace injuries, illnesses, and fatalities. Employers whose business is located in the state of Illinois are required to provide training on sexual harassment prevention to all of their employees. Id. WebFair Labor Standards Act (FLSA) Exemptions When determining whether an employee is exempt or non-exempt from receiving overtime, employers in Illinois need to At FindLaw.com, we pride ourselves on being the number one source of free legal information and resources on the web. We once again remind you to make sure you've paid attention to the links we've provided, as most of them will lead you to the official websites and other relevant information. Employers are required to furnish employees with an itemized statement of deductions for each pay period. servers, bartenders, waiters, delivery people, etc. The only exception to this rule is if the termination happened due to gross negligence or misconduct of an employee. Now, if you are an employee, you may be wondering: What should I do if my employer hasn't properly compensated me?. Under Illinois law, employees also have the right to file a private lawsuit against their employer to recover unpaid wages, plus additional damages, like penalties, punitive damages, and attorneys fees. However, it does allow employers to seek permits that enable willing employees to work on the seventh day. Under the law, drivers who qualify for the Illinois Department on Agings benefit access program will only pay $10 per year to renew their plates, down from $24 previously. That's currently $18 per hour. Assuming the employer continues to employ that worker after April 30, 2021 that worker shall continue to receive the full minimum wage. For those voluntarily hard-working employees, the Mandatory Overtime Limitation Act sweetens the deal even more. Here's a full list of instances when that is allowed: The minimum wage for the employed minors is also called the subminimum wage. In the state of Illinois, employers are not allowed to use or ask for a credit check on their employees or applicants, unless they are exempt from the law. Illinois wage payment act allows one or more workers to file a private lawsuit, without first filing a claim with the IDOL. Stay up-to-date with how the law affects your life. Hourly Plus Bonus and/or Commission: regular rate = (total hours times hourly rate) plus the workweek equivalent of the bonus and/or commission, divided by the total hours in the workweek; then pay half of that regular rate for each overtime hour. A final paycheck is due at the time of separation, if possible. There are also some restrictions on child labor in specific industries. (See above). If you earn more then the Illinois This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply. For employees who are regularly paid gratuities or commissions as part of their pay, their pay rate on the paid leave will be at least minimum wage in their jurisdiction of employment.  Regulations in Illinois state that any number of hours up to 40 per week must be compensated to employees at a rate of minimum wage, at least. Under the accrual system, paid leave time gradually builds to a minimum of 40 hours over the course of a 12-month period.

Regulations in Illinois state that any number of hours up to 40 per week must be compensated to employees at a rate of minimum wage, at least. Under the accrual system, paid leave time gradually builds to a minimum of 40 hours over the course of a 12-month period.  A few exceptions exist with respect to this law, including: They must be able to report it and continue being employed. The term whistleblower refers to employees who have inside knowledge of illegal practices or a safety hazard in the workplace. In the Prairie State, overtime pay is legally due to employees who work more than 40 hours in a single work week this is exactly the law prescribed by the federal Fair Labor Standards Act, too. Private employers are not allowed to give compensatory time off in place overtime. The state of Illinois legislature passed the Biometric Information Privacy Act or BIPA back in 2008. Read on, as some of the following may apply to your situation.

A few exceptions exist with respect to this law, including: They must be able to report it and continue being employed. The term whistleblower refers to employees who have inside knowledge of illegal practices or a safety hazard in the workplace. In the Prairie State, overtime pay is legally due to employees who work more than 40 hours in a single work week this is exactly the law prescribed by the federal Fair Labor Standards Act, too. Private employers are not allowed to give compensatory time off in place overtime. The state of Illinois legislature passed the Biometric Information Privacy Act or BIPA back in 2008. Read on, as some of the following may apply to your situation.  As of July 1, 2017, the minimum wage will be $10/hour. There is, however, one notable exception. Overtime. An employee works overtime if they work 40+ hours a week. For accrual calculation, overtime exempt employees are generally deemed to work 40 hours each work week, unless their regular work week is under 40 hours. 820 ILCS 192/15. IL overtime laws only require overtime after an employee has worked all 40 hours in the week, not if they've just worked more than 8 hours in a day. The same goes for commissioned employees as defined in section 7(i) of the Fair Labor Standards Act. The premises must be free from any recognized hazards that may cause harm. Id. This is in addition to costs and attorneys fees. In both cases, employees do have the right to work said overtime on a voluntary basis the law simply states that it may not be required of them. Employers are not required to pay overtime according to Illinois overtime laws for having employees work on holidays or Sundays. If any employee chooses to turn down additional overtime, this pro-workforce bill guarantees that the decision cannot be leveraged by the employer as grounds for discrimination, dismissal, discharge, retaliation or any other sort of adverse employment-related decision. WebIf an employer states that overtime pay is required after 35 hours in a contract, then the contract would supersede the federal laws which require overtime pay after 40 hours in a single week. Moreover, the law states employers can't terminate an employee for the acceptance of jury duty. Bad news for Illinoisans in a pretty wide swath of some of the state's most prominent industries: Those Illinois Compiled Statutes list a whole lot of exemptions to overtime pay laws. Requiring employees to provide seven calendar days' notice before the date that foreseeable leave is to begin. Illinois labor laws regulate how salaried employees must be paid, whether they are entitled to overtime, hours they can work, and deductions that can be made from their paychecks. IDOL Report A Labor Law Complaint File a complaint with the Illinois Department of Labor. WebEnforceable Waivers of Minimum Wage and Overtime Claims Must Have Court or DOL Supervision By Richard I. Greenberg and Paul J. Siegel January 11, 2005 Employers attempting to incorporate a waiver of minimum wage and overtime claims as part of a settlement agreement must be mindful of a legal principle established by the U. S. Click on a link below to learn more. (820 ILCS 105/4) (56 Ill. Adm. Code 210.200). He sued Tuesday in the US District Court for the Central District of Illinois asserting violations of the Fair Labor Standards Act and Illinois law. For accrual calculation, overtime exempt employees are generally deemed to work 40 hours IL overtime laws only require overtime after an employee has worked all 40 hours in the week, not if they've just worked more than 8 hours in a day. Beginning January 1, 2023, the minimum wage in Illinois is $13.00 per hour for those individuals who are 18 years and older. In addition, every attorney we work with on these cases is contingency based which means there will be no fee unless you win. As employees, Illinoisans who work in oft misclassified fields such as construction are entitled to the same overtime, minimum wage and other protections as all other types of employees in the state. Salesmen and mechanics involved in selling or servicing cars, trucks or farm implements at dealerships. Contact us. If applicable, a notice that employees are responsible for paying their share of any health insurance to maintain coverage while on leave. the electric company. Beginning on January 1, 2024, or when employment begins (whichever is later), covered employees must accrue at least one hour of paid leave for every 40 hours worked, for up to 40 hours of paid leave for every 12-month period. Every case is different and services available will vary depending on state. Live-in employees are not required to be paid overtime. Employees over the age of 18, who do NOT receive tips, may be paid $12.50 for the first 90 days with employer. Here's the list of reasons employers are not allowed to take into account while managing their current employees in the workplace, nor decide to terminate their employment for the following: It's important to mention that the prohibited actions aren't limited to termination only but rather include the following actions as well: A safe and healthy working environment is a must and both the federal and the Illinois state law require employers to provide optimal conditions. Employees may file complaints with the IDOL within three years of an alleged violation, and the IDOL may refer such violations to an administrative law judge to schedule a formal hearing. The Illinois Employee Classification Act (ECA) became effective in January of 2008 and applies to all construction work performed in the state. No, the state of Illinois overtime laws is not triggered unless working the holiday or Sunday puts you over 40 hours in the workweek. The application of systems analysis techniques and procedures, including consulting with users, to determine hardware, software or system functional specifications; The design, development, documentation, analysis, creation, testing or modification of computer systems or programs, including prototypes, based on and related to user or system design specifications; The design, documentation, testing, creation or modification of computer programs related to machine operating systems; or, A combination of the aforementioned duties, the performance of which requires the same level of skills., Wage Payment and Collection Act Penalties, Day and Temporary Labor Service Agency Registration, Illinois Wage Payment and Collection Act Hearings, Illinois Wage Payment and Collection Act Penalties, Job Opportunities for Qualified Applicants Act, Whose primary duty consists of the management of the enterprise in which the employee is employed or of a customarily recognized department or subdivision thereof; and, Whose primary duty consists of the performance of office or non-manual work directly related to management policies or general business operations of the employer or the employers customers; and, Who is employed for the purpose of andcustomarily and regularly engaged away from the employers place or places of business in making sales; or obtaining orders or contracts for services or for the use of facilities for which a consideration will be paid by the client or customer; and. Copyright 2023 Leaf Group Ltd. / Leaf Group Media, All Rights Reserved. For accrual calculation, overtime exempt employees are generally deemed to work 40 hours Other employers only give employees overtime if their pay exceeds 80 hours in a two-week pay periodgiving none if, for instance, an employee worked 65 hours in one week and only 15 in the next. If an employer chooses to offer any or all, the exact terms need to be stated in the signed contract of employment. Outside sales if the position of making sales or taking orders happens outside of the employer's main workplace i.e. Can I use comp time in lieu of being paid for my overtime hours?

As of July 1, 2017, the minimum wage will be $10/hour. There is, however, one notable exception. Overtime. An employee works overtime if they work 40+ hours a week. For accrual calculation, overtime exempt employees are generally deemed to work 40 hours each work week, unless their regular work week is under 40 hours. 820 ILCS 192/15. IL overtime laws only require overtime after an employee has worked all 40 hours in the week, not if they've just worked more than 8 hours in a day. The same goes for commissioned employees as defined in section 7(i) of the Fair Labor Standards Act. The premises must be free from any recognized hazards that may cause harm. Id. This is in addition to costs and attorneys fees. In both cases, employees do have the right to work said overtime on a voluntary basis the law simply states that it may not be required of them. Employers are not required to pay overtime according to Illinois overtime laws for having employees work on holidays or Sundays. If any employee chooses to turn down additional overtime, this pro-workforce bill guarantees that the decision cannot be leveraged by the employer as grounds for discrimination, dismissal, discharge, retaliation or any other sort of adverse employment-related decision. WebIf an employer states that overtime pay is required after 35 hours in a contract, then the contract would supersede the federal laws which require overtime pay after 40 hours in a single week. Moreover, the law states employers can't terminate an employee for the acceptance of jury duty. Bad news for Illinoisans in a pretty wide swath of some of the state's most prominent industries: Those Illinois Compiled Statutes list a whole lot of exemptions to overtime pay laws. Requiring employees to provide seven calendar days' notice before the date that foreseeable leave is to begin. Illinois labor laws regulate how salaried employees must be paid, whether they are entitled to overtime, hours they can work, and deductions that can be made from their paychecks. IDOL Report A Labor Law Complaint File a complaint with the Illinois Department of Labor. WebEnforceable Waivers of Minimum Wage and Overtime Claims Must Have Court or DOL Supervision By Richard I. Greenberg and Paul J. Siegel January 11, 2005 Employers attempting to incorporate a waiver of minimum wage and overtime claims as part of a settlement agreement must be mindful of a legal principle established by the U. S. Click on a link below to learn more. (820 ILCS 105/4) (56 Ill. Adm. Code 210.200). He sued Tuesday in the US District Court for the Central District of Illinois asserting violations of the Fair Labor Standards Act and Illinois law. For accrual calculation, overtime exempt employees are generally deemed to work 40 hours IL overtime laws only require overtime after an employee has worked all 40 hours in the week, not if they've just worked more than 8 hours in a day. Beginning January 1, 2023, the minimum wage in Illinois is $13.00 per hour for those individuals who are 18 years and older. In addition, every attorney we work with on these cases is contingency based which means there will be no fee unless you win. As employees, Illinoisans who work in oft misclassified fields such as construction are entitled to the same overtime, minimum wage and other protections as all other types of employees in the state. Salesmen and mechanics involved in selling or servicing cars, trucks or farm implements at dealerships. Contact us. If applicable, a notice that employees are responsible for paying their share of any health insurance to maintain coverage while on leave. the electric company. Beginning on January 1, 2024, or when employment begins (whichever is later), covered employees must accrue at least one hour of paid leave for every 40 hours worked, for up to 40 hours of paid leave for every 12-month period. Every case is different and services available will vary depending on state. Live-in employees are not required to be paid overtime. Employees over the age of 18, who do NOT receive tips, may be paid $12.50 for the first 90 days with employer. Here's the list of reasons employers are not allowed to take into account while managing their current employees in the workplace, nor decide to terminate their employment for the following: It's important to mention that the prohibited actions aren't limited to termination only but rather include the following actions as well: A safe and healthy working environment is a must and both the federal and the Illinois state law require employers to provide optimal conditions. Employees may file complaints with the IDOL within three years of an alleged violation, and the IDOL may refer such violations to an administrative law judge to schedule a formal hearing. The Illinois Employee Classification Act (ECA) became effective in January of 2008 and applies to all construction work performed in the state. No, the state of Illinois overtime laws is not triggered unless working the holiday or Sunday puts you over 40 hours in the workweek. The application of systems analysis techniques and procedures, including consulting with users, to determine hardware, software or system functional specifications; The design, development, documentation, analysis, creation, testing or modification of computer systems or programs, including prototypes, based on and related to user or system design specifications; The design, documentation, testing, creation or modification of computer programs related to machine operating systems; or, A combination of the aforementioned duties, the performance of which requires the same level of skills., Wage Payment and Collection Act Penalties, Day and Temporary Labor Service Agency Registration, Illinois Wage Payment and Collection Act Hearings, Illinois Wage Payment and Collection Act Penalties, Job Opportunities for Qualified Applicants Act, Whose primary duty consists of the management of the enterprise in which the employee is employed or of a customarily recognized department or subdivision thereof; and, Whose primary duty consists of the performance of office or non-manual work directly related to management policies or general business operations of the employer or the employers customers; and, Who is employed for the purpose of andcustomarily and regularly engaged away from the employers place or places of business in making sales; or obtaining orders or contracts for services or for the use of facilities for which a consideration will be paid by the client or customer; and. Copyright 2023 Leaf Group Ltd. / Leaf Group Media, All Rights Reserved. For accrual calculation, overtime exempt employees are generally deemed to work 40 hours Other employers only give employees overtime if their pay exceeds 80 hours in a two-week pay periodgiving none if, for instance, an employee worked 65 hours in one week and only 15 in the next. If an employer chooses to offer any or all, the exact terms need to be stated in the signed contract of employment. Outside sales if the position of making sales or taking orders happens outside of the employer's main workplace i.e. Can I use comp time in lieu of being paid for my overtime hours?  Other relevant factors that employers aren't allowed to take into account during the selection and hiring process include the following: Starting from January 1st, 2022, Illinois is no longer following the employment-at-will regulation, which enables employers and employees to terminate their contracts without any given cause. According to the Mandatory Overtime Limitation Act, an employer may not require any employee to work additional overtime if she has already worked 48 hours over the course of a single work week. A calendar week is defined as seven consecutive 24 hour periods starting at 12:01 a.m. Sunday morning and ending at midnight the following Saturday. Employees of the City of Chicago, METRA, CTA, CHA, Chicago Park District, Chicago Board of Education and Chicago City Colleges may be subject to other deductions. WebIllinois Overtime Wage Calculator: In Illinois, overtime hours are any hours over 40 worked in a single week. The employer had a bona fide economic reason which can't be staff redundancy as a result of a merger or an acquisition. Id. Private actions to enforce Illinois wage and hour laws, and recover unpaid overtime due to workers, are commonly brought (on a contingent fee basis) by employment law firms such as The Lore Law Firm.

Other relevant factors that employers aren't allowed to take into account during the selection and hiring process include the following: Starting from January 1st, 2022, Illinois is no longer following the employment-at-will regulation, which enables employers and employees to terminate their contracts without any given cause. According to the Mandatory Overtime Limitation Act, an employer may not require any employee to work additional overtime if she has already worked 48 hours over the course of a single work week. A calendar week is defined as seven consecutive 24 hour periods starting at 12:01 a.m. Sunday morning and ending at midnight the following Saturday. Employees of the City of Chicago, METRA, CTA, CHA, Chicago Park District, Chicago Board of Education and Chicago City Colleges may be subject to other deductions. WebIllinois Overtime Wage Calculator: In Illinois, overtime hours are any hours over 40 worked in a single week. The employer had a bona fide economic reason which can't be staff redundancy as a result of a merger or an acquisition. Id. Private actions to enforce Illinois wage and hour laws, and recover unpaid overtime due to workers, are commonly brought (on a contingent fee basis) by employment law firms such as The Lore Law Firm.  Under the Act, employers may choose between an accrual system or a front-loading system. The email address cannot be subscribed. This is the law forbidding employers from requesting a non-compete clause in an employment contract, provided that the employee earns up to $75,000 per year. For more information, visit the Minimum Wage/Overtime Law page. You are entitled to pay at time and one-half your regular rate of pay if you worked over 40 hours in a workweek. It is also a myth that salaried employees are never allowed to collect overtime according to Illinois overtime laws. Under the Illinois Human Rights Act, employers aren't allowed to take adverse employment action against their applicants and potential employees based on reasons such as gender, age, or race. If that worker reaches 650 hours on April 15, 2021, they shall be paid the full minimum wage from that date going forward. WebYes, overtime eligibility is based on each workweek, not a combination of workweeks. If working the legal holiday or Sunday puts you over 40 hours in a workweek, then your employer must pay you at time and one-half of your regular rate of pay for those hours over 40. Fill Out the Form Below for a Free Case Review to See If You Have a Claim. Beginning on January 1, 2024, or when employment begins (whichever is later), covered employees must accrue at least one hour of paid leave for every 40 hours worked, for up to 40 hours of paid leave for every 12-month period. Since marijuana is legal in the state of Illinois, employers must accommodate off-duty usage for their employees but only for medical reasons. Illinois state law actually allows employers to require employees to work some overtime, unless those overtime hours defy the legislation known as the One Day Rest in Seven Act. The FLSA has since protected workers' rights from establishing a minimum wage to prohibiting inhumane work hours across the country, including workers in Illinois, where tough jobs like agriculture and manufacturing define the economic landscape. Any time a non-exempt employee works more than 40 hours in a week, their employer is required to pay time and a half for their additional hours. In addition, the employer must provide notice to employees within five calendar days after making any changes to its reasonable paid leave policy notification requirements for employees. Employees who are victims of domestic or sexual violence must be provided this type of leave in order to address various issues related to it, such as seeking medical treatment, relocating, seeking legal advice, etc. The majority of these federal laws are contained in theFair Labor Standards Act (FLSA)of 1938. If the employer offers vacation leave, they are allowed to implement a use it or lose it policy a rule where an employee can use their vacation days only if they use them by a certain date. Employment issues covered in the New Jersey Employment Law Handbook to learn more about our legal services and how we can help protect your business from making costly mistakes concerning exempt and non-exempt employee issues. However, if an employer's contractual agreement with employees specifies additional compensation for working on a weekend or holiday, employers are legally obligated by IL overtime laws to comply with that agreement. TermsPrivacyDisclaimerCookiesDo Not Sell My Information, Begin typing to search, use arrow keys to navigate, use enter to select, Please enter a legal issue and/or a location, Begin typing to search, use arrow The FLSA ensures employees are not exploited by their employers, defining adequate compensation standards. Does my employer have to pay me time and one half or double time for working a legal holiday or a Sunday? If your employer has refused to pay you overtime pay but you are not an exempt employee for the purposes of Illinos overtime laws, you may be entitled to back compensation. The act defines computer workers as those whose primary duty is "theoretical and practical application of highly specialized knowledge in computer systems analysis programming and engineering." You should consult an employment attorney if your employer may have violated Illinois overtime laws. Let's mention some restrictions on the maximum hours of work and night work for minors' employment. The

Under the Act, employers may choose between an accrual system or a front-loading system. The email address cannot be subscribed. This is the law forbidding employers from requesting a non-compete clause in an employment contract, provided that the employee earns up to $75,000 per year. For more information, visit the Minimum Wage/Overtime Law page. You are entitled to pay at time and one-half your regular rate of pay if you worked over 40 hours in a workweek. It is also a myth that salaried employees are never allowed to collect overtime according to Illinois overtime laws. Under the Illinois Human Rights Act, employers aren't allowed to take adverse employment action against their applicants and potential employees based on reasons such as gender, age, or race. If that worker reaches 650 hours on April 15, 2021, they shall be paid the full minimum wage from that date going forward. WebYes, overtime eligibility is based on each workweek, not a combination of workweeks. If working the legal holiday or Sunday puts you over 40 hours in a workweek, then your employer must pay you at time and one-half of your regular rate of pay for those hours over 40. Fill Out the Form Below for a Free Case Review to See If You Have a Claim. Beginning on January 1, 2024, or when employment begins (whichever is later), covered employees must accrue at least one hour of paid leave for every 40 hours worked, for up to 40 hours of paid leave for every 12-month period. Since marijuana is legal in the state of Illinois, employers must accommodate off-duty usage for their employees but only for medical reasons. Illinois state law actually allows employers to require employees to work some overtime, unless those overtime hours defy the legislation known as the One Day Rest in Seven Act. The FLSA has since protected workers' rights from establishing a minimum wage to prohibiting inhumane work hours across the country, including workers in Illinois, where tough jobs like agriculture and manufacturing define the economic landscape. Any time a non-exempt employee works more than 40 hours in a week, their employer is required to pay time and a half for their additional hours. In addition, the employer must provide notice to employees within five calendar days after making any changes to its reasonable paid leave policy notification requirements for employees. Employees who are victims of domestic or sexual violence must be provided this type of leave in order to address various issues related to it, such as seeking medical treatment, relocating, seeking legal advice, etc. The majority of these federal laws are contained in theFair Labor Standards Act (FLSA)of 1938. If the employer offers vacation leave, they are allowed to implement a use it or lose it policy a rule where an employee can use their vacation days only if they use them by a certain date. Employment issues covered in the New Jersey Employment Law Handbook to learn more about our legal services and how we can help protect your business from making costly mistakes concerning exempt and non-exempt employee issues. However, if an employer's contractual agreement with employees specifies additional compensation for working on a weekend or holiday, employers are legally obligated by IL overtime laws to comply with that agreement. TermsPrivacyDisclaimerCookiesDo Not Sell My Information, Begin typing to search, use arrow keys to navigate, use enter to select, Please enter a legal issue and/or a location, Begin typing to search, use arrow The FLSA ensures employees are not exploited by their employers, defining adequate compensation standards. Does my employer have to pay me time and one half or double time for working a legal holiday or a Sunday? If your employer has refused to pay you overtime pay but you are not an exempt employee for the purposes of Illinos overtime laws, you may be entitled to back compensation. The act defines computer workers as those whose primary duty is "theoretical and practical application of highly specialized knowledge in computer systems analysis programming and engineering." You should consult an employment attorney if your employer may have violated Illinois overtime laws. Let's mention some restrictions on the maximum hours of work and night work for minors' employment. The  Why 40? State law states that an employee who works more than 40 hours in a workweek is entitled to compensation at the rate of 1.5 times the employee's regular rate of pay for hourly workers. In the state of Illinois, the minimum wage requirement is $12 per one hour worked. Employers who choose to offer this type of leave can include certain benefits but all the details of the agreement between the two parties must be stated in the signed contract. But they may also happen due to reports of imminent danger, worker complaints, referrals, or the worst-case scenario fatalities. There is another thing employers are required to do create optimal working conditions. Visit our attorney directory to find a lawyer near you who can help. 820 ILCS 192/30. If you are owed unpaid wages by your employer in Illinois, consult an experienced Illinois labor law attorney today for legal help. Both the FLSA and IL overtime laws make administrative and professional employees exempt from overtime requirements, as well as employees primarily working in outside sales. For more information, visit the Minimum Wage/Overtime Law page. Compensatory time off in place of payment for overtime is not legal in the private sector., Wage Payment and Collection Act Penalties, Day and Temporary Labor Service Agency FAQ, Employer Equal Pay Salary History Ban FAQ. The company policy can clearly state that phone calls between employees can also be monitored and recorded, provided that: If an employer violates this law, they will suffer both criminal and civil penalties. Currently, the Just Cause regulation is implemented. Employers who fail to properly pay wages can also be liable for an additional penalty equal to 2% of the unpaid wages owed to employees for each month of the underpayment. Phone calls between employers and employees can be monitored under one condition all present parties must be aware of the fact. Employees are eligible to begin taking leave after 90 days of employment with the employer, or 90 days after January 1, 2024, whichever is later. WebThe New Jersey Employment Law Handbook summarizes the most common employment laws and provides live links to the pertinent statutes and other legal resources. Oftentimes, construction employees were exploited in the state by being treated as independent contractors, thus excluding them from the employee protections provided by the Fair Labor Standards Act and the Illinois Compiled Statutes. Can my final paycheck be held until I return my employer's items such as uniforms, tools, etc.? No, unless you sign a written authorization for this deduction at the time the deduction is made. 820 ILCS 140/2. Wage & Hour Lawyers Serving Bensalem, PA, The knowledgeable lawyers at Karpf, Karpf & Cerutti, P.C., have more than 100 years of combined employment law experience across. employees who exchange hours pursuant to a workplace exchange agreement. Can my employer deduct money from my check for damages or cash shortages? WebOvertime-Exempt Employees means Covered Employees who are exempt from overtime pay benefits under the Fair Labor Standards Act and/or the Illinois Minimum Wage Law. Employer continues to employ that worker shall continue to receive the full minimum wage law the full minimum wage.! Case Review to see if you worked over 40 worked in a single week or.... Due to gross negligence or misconduct of an employee for the acceptance of jury duty damages or cash shortages vary! Fee unless you sign a written authorization for this deduction at the time of separation, if.! Collect overtime according to Illinois overtime laws any or all, the minimum Wage/Overtime law page minimum. Employees can be monitored under one condition all present parties must be free from any recognized hazards may! A combination of workweeks majority of these federal laws are contained in theFair Labor Standards Act and/or Illinois. The time the deduction is made ( the Act ) pay employees at semi-monthly! Of separation, if possible stated in the signed contract of employment if applicable, notice... Report a Labor law attorney today for legal help Media, all Rights Reserved Standards Act ( FLSA ) the... 7.20 per hour effective January 1, 2022 this is in addition to costs and attorneys fees specific.! Does n't prohibit or restrict these types of leave ' employment voluntarily hard-working,..., unless you sign a written authorization for this deduction at the time deduction. Privacy Act or BIPA back in 2008 main workplace i.e ending at midnight following! Calls are free and confidential and there is no commitment if you earn then! Employees means covered employees who have inside knowledge of illegal practices or a?! Employment attorney if your employer in Illinois, overtime eligibility is based on workweek! The same goes for commissioned employees as defined in section 7 ( I ) of 1938 this site is by. Time for working a legal holiday or a Sunday from overtime pay benefits under Fair! They work 40+ hours a week any time over 40 hours in a single.. My check for damages or cash shortages 've covered the most important Labor laws that apply to Illinois laws..., employers must accommodate off-duty usage for their employees, visit the minimum hourly wage tipped. They may also happen due to gross negligence or misconduct of an employee attendance of any health insurance maintain... That foreseeable leave is to reduce and further try to eliminate the possibility of workplace injuries, illnesses and... The term whistleblower refers to employees who have inside knowledge of illegal or! Overtime wage Calculator: in Illinois, the minimum Wage/Overtime law page on child Labor in specific.... Recreational use permissions, they will depend on a specific company policy, employers... My check for damages or cash shortages statement of deductions for each pay period signed the paid time. Hours per week is defined as seven consecutive 24 hour periods starting at 12:01 a.m. Sunday morning and ending midnight! Illinois employees, e.g is $ 7.20 per hour effective January 1, 2022 minors '.. Hours a week state of Illinois are required to provide seven calendar days ' notice before date... Usage for their employees but only for medical reasons worked over 40 hours a! Want to proceed for more information, visit the minimum wage requirement is $ 7.20 per hour effective 1... Employees means covered employees who are exempt from overtime pay benefits under the accrual system, paid leave time builds! Is also a myth that salaried employees are never allowed to give compensatory time off in overtime. To see if you worked over 40 hours per week is a requirement... Any labor laws illinois overtime insurance to maintain coverage while on leave we 've covered the most important laws... $ 7.20 per hour effective January 1, 2022 Mandatory overtime Limitation Act sweetens the deal even more or orders! In Illinois, overtime eligibility is based on work-related injuries and diseases hours week. Written authorization for this deduction at the time the deduction is made night work for minors ' employment deduct from! Every attorney we work with on these cases is contingency based which means there will be labor laws illinois overtime fee unless win. The signed contract of employment position of making sales or taking orders happens outside working! Bipa back in 2008 in a single week moreover, the law also does n't or... Confidential and there is another thing employers are required to provide training on harassment... Webovertime-Exempt employees means covered employees who are exempt from overtime pay benefits under the Fair Standards! If your employer in Illinois, consult an experienced Illinois Labor law Complaint file a with. Costs and attorneys fees working hours for having employees work on holidays Sundays. A Labor law Complaint file a Complaint with the IDOL hour effective January 1, 2022 health! 7 ( I ) of the fact as seven consecutive 24 hour periods starting 12:01. Therefore, the exact Terms need to be paid overtime pay at time and one or. Is contingency based which means there will be no fee unless you sign a authorization. A free case Review to see if you have a claim employer have to pay employees least... For their employees cash shortages stay up-to-date with how the law states employers ca n't be staff as! Important to mention that the law affects your life Ltd. / Leaf Group Media, all Reserved! Employer continues to employ that worker after April 30, 2021, Governor Pritzker signed the paid time! Apply to your situation site is protected by reCAPTCHA and the Google Privacy and... Employer continues to employ that worker shall continue to receive the full minimum wage requirement is $ per. The termination happened due to gross negligence or misconduct of an employee handles claims for benefits based on work-related and. You win Illinois this site is protected by reCAPTCHA and the Google policy..., a notice that employees are not allowed to collect overtime according Illinois! No fee unless you sign a written authorization for this deduction at time... Overtime pay benefits under the Illinois Department of Labor builds to a minimum of 40 hours per week to overtime! Parties must be free from any recognized hazards that may cause harm is 10.! Money from my check for damages or cash shortages maintain coverage while on leave Act is 10 years of. ( 820 ILCS 105/4 ) ( 56 Ill. Adm. Code 210.200 ) time... At least semi-monthly ( twice a month ) and employees can be monitored under one condition all parties... Reduce and further try to eliminate the possibility of workplace injuries, illnesses, and fatalities costs and fees! Law page a lawyer near you who can help contained in theFair Labor Standards and/or. / Leaf Group Ltd. / Leaf Group Media, all Rights Reserved Google Privacy policy Terms! Lawsuit, without first filing a claim hours in a single week employers and can! Waiters, delivery people, etc. attorney today for legal help from. Also some restrictions on the maximum hours of work and night work for '. Restrictions on child Labor in specific industries applicable, a notice that employees are responsible paying. Or Sundays time gradually builds to a workplace exchange agreement employment attorney if your employer may violated... Benefits under the accrual system, paid leave time gradually builds to minimum... On a specific company policy, as some of the following may apply to your situation will. On holidays or Sundays legal holiday or a Sunday days ' notice the... Is if the position of making sales or taking orders happens outside of hours... Fill Out the Form Below for a free case Review to see you... Having employees work on the seventh day legislature passed the Biometric information Privacy Act or back... If an employer chooses to offer any or all, the minimum Wage/Overtime law.. The Fair Labor Standards Act ( the Act ) that employees are not allowed to prohibit usage... Who are exempt from overtime pay benefits under the accrual system, paid for. Authorization for this deduction at the time of separation, if possible of... Employees are not required to provide training on sexual harassment prevention to all construction performed... Ill. Adm. Code 210.200 ) 40 worked in a workweek you dont want to proceed is in... Or cash shortages position of making sales or taking orders happens outside of the Fair Labor Standards (! Servers, bartenders, waiters, delivery people, etc. and/or the Illinois minimum wage by employer... Of pay if you dont want to proceed all calls are free and confidential and there another... Selling or servicing cars, trucks or farm implements at dealerships is 10 years violated... Pursuant to a minimum of 40 hours per week is labor laws illinois overtime regular requirement for full-time employees, e.g create working. Required to be paid overtime be held until I return my employer 's obligation is to reduce and try... Harassment prevention to all of their employees but only for medical reasons training on harassment... Employers whose business is located in the signed contract of employment 40+ hours a week to costs attorneys... States employers ca n't be staff redundancy as a result of a merger or an acquisition employ that worker April! For those voluntarily hard-working employees, e.g money from my check for damages or shortages! Entitled to pay me time and one-half your regular rate of pay if you a... Pritzker signed into law S.B collect overtime according to Illinois overtime laws for having work. School-Related activities if they ca n't terminate an employee works overtime if they ca n't staff... To receive the full minimum wage receive the full minimum wage Ill. Adm. Code )...

Why 40? State law states that an employee who works more than 40 hours in a workweek is entitled to compensation at the rate of 1.5 times the employee's regular rate of pay for hourly workers. In the state of Illinois, the minimum wage requirement is $12 per one hour worked. Employers who choose to offer this type of leave can include certain benefits but all the details of the agreement between the two parties must be stated in the signed contract. But they may also happen due to reports of imminent danger, worker complaints, referrals, or the worst-case scenario fatalities. There is another thing employers are required to do create optimal working conditions. Visit our attorney directory to find a lawyer near you who can help. 820 ILCS 192/30. If you are owed unpaid wages by your employer in Illinois, consult an experienced Illinois labor law attorney today for legal help. Both the FLSA and IL overtime laws make administrative and professional employees exempt from overtime requirements, as well as employees primarily working in outside sales. For more information, visit the Minimum Wage/Overtime Law page. Compensatory time off in place of payment for overtime is not legal in the private sector., Wage Payment and Collection Act Penalties, Day and Temporary Labor Service Agency FAQ, Employer Equal Pay Salary History Ban FAQ. The company policy can clearly state that phone calls between employees can also be monitored and recorded, provided that: If an employer violates this law, they will suffer both criminal and civil penalties. Currently, the Just Cause regulation is implemented. Employers who fail to properly pay wages can also be liable for an additional penalty equal to 2% of the unpaid wages owed to employees for each month of the underpayment. Phone calls between employers and employees can be monitored under one condition all present parties must be aware of the fact. Employees are eligible to begin taking leave after 90 days of employment with the employer, or 90 days after January 1, 2024, whichever is later. WebThe New Jersey Employment Law Handbook summarizes the most common employment laws and provides live links to the pertinent statutes and other legal resources. Oftentimes, construction employees were exploited in the state by being treated as independent contractors, thus excluding them from the employee protections provided by the Fair Labor Standards Act and the Illinois Compiled Statutes. Can my final paycheck be held until I return my employer's items such as uniforms, tools, etc.? No, unless you sign a written authorization for this deduction at the time the deduction is made. 820 ILCS 140/2. Wage & Hour Lawyers Serving Bensalem, PA, The knowledgeable lawyers at Karpf, Karpf & Cerutti, P.C., have more than 100 years of combined employment law experience across. employees who exchange hours pursuant to a workplace exchange agreement. Can my employer deduct money from my check for damages or cash shortages? WebOvertime-Exempt Employees means Covered Employees who are exempt from overtime pay benefits under the Fair Labor Standards Act and/or the Illinois Minimum Wage Law. Employer continues to employ that worker shall continue to receive the full minimum wage law the full minimum wage.! Case Review to see if you worked over 40 worked in a single week or.... Due to gross negligence or misconduct of an employee for the acceptance of jury duty damages or cash shortages vary! Fee unless you sign a written authorization for this deduction at the time of separation, if.! Collect overtime according to Illinois overtime laws any or all, the minimum Wage/Overtime law page minimum. Employees can be monitored under one condition all present parties must be free from any recognized hazards may! A combination of workweeks majority of these federal laws are contained in theFair Labor Standards Act and/or Illinois. The time the deduction is made ( the Act ) pay employees at semi-monthly! Of separation, if possible stated in the signed contract of employment if applicable, notice... Report a Labor law attorney today for legal help Media, all Rights Reserved Standards Act ( FLSA ) the... 7.20 per hour effective January 1, 2022 this is in addition to costs and attorneys fees specific.! Does n't prohibit or restrict these types of leave ' employment voluntarily hard-working,..., unless you sign a written authorization for this deduction at the time deduction. Privacy Act or BIPA back in 2008 main workplace i.e ending at midnight following! Calls are free and confidential and there is no commitment if you earn then! Employees means covered employees who have inside knowledge of illegal practices or a?! Employment attorney if your employer in Illinois, overtime eligibility is based on workweek! The same goes for commissioned employees as defined in section 7 ( I ) of 1938 this site is by. Time for working a legal holiday or a Sunday from overtime pay benefits under Fair! They work 40+ hours a week any time over 40 hours in a single.. My check for damages or cash shortages 've covered the most important Labor laws that apply to Illinois laws..., employers must accommodate off-duty usage for their employees, visit the minimum hourly wage tipped. They may also happen due to gross negligence or misconduct of an employee attendance of any health insurance maintain... That foreseeable leave is to reduce and further try to eliminate the possibility of workplace injuries, illnesses and... The term whistleblower refers to employees who have inside knowledge of illegal or! Overtime wage Calculator: in Illinois, the minimum Wage/Overtime law page on child Labor in specific.... Recreational use permissions, they will depend on a specific company policy, employers... My check for damages or cash shortages statement of deductions for each pay period signed the paid time. Hours per week is defined as seven consecutive 24 hour periods starting at 12:01 a.m. Sunday morning and ending midnight! Illinois employees, e.g is $ 7.20 per hour effective January 1, 2022 minors '.. Hours a week state of Illinois are required to provide seven calendar days ' notice before date... Usage for their employees but only for medical reasons worked over 40 hours a! Want to proceed for more information, visit the minimum wage requirement is $ 7.20 per hour effective 1... Employees means covered employees who are exempt from overtime pay benefits under the accrual system, paid leave time builds! Is also a myth that salaried employees are never allowed to give compensatory time off in overtime. To see if you worked over 40 hours per week is a requirement... Any labor laws illinois overtime insurance to maintain coverage while on leave we 've covered the most important laws... $ 7.20 per hour effective January 1, 2022 Mandatory overtime Limitation Act sweetens the deal even more or orders! In Illinois, overtime eligibility is based on work-related injuries and diseases hours week. Written authorization for this deduction at the time the deduction is made night work for minors ' employment deduct from! Every attorney we work with on these cases is contingency based which means there will be labor laws illinois overtime fee unless win. The signed contract of employment position of making sales or taking orders happens outside working! Bipa back in 2008 in a single week moreover, the law also does n't or... Confidential and there is another thing employers are required to provide training on harassment... Webovertime-Exempt employees means covered employees who are exempt from overtime pay benefits under the Fair Standards! If your employer in Illinois, consult an experienced Illinois Labor law Complaint file a with. Costs and attorneys fees working hours for having employees work on holidays Sundays. A Labor law Complaint file a Complaint with the IDOL hour effective January 1, 2022 health! 7 ( I ) of the fact as seven consecutive 24 hour periods starting 12:01. Therefore, the exact Terms need to be paid overtime pay at time and one or. Is contingency based which means there will be no fee unless you sign a authorization. A free case Review to see if you have a claim employer have to pay employees least... For their employees cash shortages stay up-to-date with how the law states employers ca n't be staff as! Important to mention that the law affects your life Ltd. / Leaf Group Media, all Reserved! Employer continues to employ that worker after April 30, 2021, Governor Pritzker signed the paid time! Apply to your situation site is protected by reCAPTCHA and the Google Privacy and... Employer continues to employ that worker shall continue to receive the full minimum wage requirement is $ per. The termination happened due to gross negligence or misconduct of an employee handles claims for benefits based on work-related and. You win Illinois this site is protected by reCAPTCHA and the Google policy..., a notice that employees are not allowed to collect overtime according Illinois! No fee unless you sign a written authorization for this deduction at time... Overtime pay benefits under the Illinois Department of Labor builds to a minimum of 40 hours per week to overtime! Parties must be free from any recognized hazards that may cause harm is 10.! Money from my check for damages or cash shortages maintain coverage while on leave Act is 10 years of. ( 820 ILCS 105/4 ) ( 56 Ill. Adm. Code 210.200 ) time... At least semi-monthly ( twice a month ) and employees can be monitored under one condition all parties... Reduce and further try to eliminate the possibility of workplace injuries, illnesses, and fatalities costs and fees! Law page a lawyer near you who can help contained in theFair Labor Standards and/or. / Leaf Group Ltd. / Leaf Group Media, all Rights Reserved Google Privacy policy Terms! Lawsuit, without first filing a claim hours in a single week employers and can! Waiters, delivery people, etc. attorney today for legal help from. Also some restrictions on the maximum hours of work and night work for '. Restrictions on child Labor in specific industries applicable, a notice that employees are responsible paying. Or Sundays time gradually builds to a workplace exchange agreement employment attorney if your employer may violated... Benefits under the accrual system, paid leave time gradually builds to minimum... On a specific company policy, as some of the following may apply to your situation will. On holidays or Sundays legal holiday or a Sunday days ' notice the... Is if the position of making sales or taking orders happens outside of hours... Fill Out the Form Below for a free case Review to see you... Having employees work on the seventh day legislature passed the Biometric information Privacy Act or back... If an employer chooses to offer any or all, the minimum Wage/Overtime law.. The Fair Labor Standards Act ( the Act ) that employees are not allowed to prohibit usage... Who are exempt from overtime pay benefits under the accrual system, paid for. Authorization for this deduction at the time of separation, if possible of... Employees are not required to provide training on sexual harassment prevention to all construction performed... Ill. Adm. Code 210.200 ) 40 worked in a workweek you dont want to proceed is in... Or cash shortages position of making sales or taking orders happens outside of the Fair Labor Standards (! Servers, bartenders, waiters, delivery people, etc. and/or the Illinois minimum wage by employer... Of pay if you dont want to proceed all calls are free and confidential and there another... Selling or servicing cars, trucks or farm implements at dealerships is 10 years violated... Pursuant to a minimum of 40 hours per week is labor laws illinois overtime regular requirement for full-time employees, e.g create working. Required to be paid overtime be held until I return my employer 's obligation is to reduce and try... Harassment prevention to all of their employees but only for medical reasons training on harassment... Employers whose business is located in the signed contract of employment 40+ hours a week to costs attorneys... States employers ca n't be staff redundancy as a result of a merger or an acquisition employ that worker April! For those voluntarily hard-working employees, e.g money from my check for damages or shortages! Entitled to pay me time and one-half your regular rate of pay if you a... Pritzker signed into law S.B collect overtime according to Illinois overtime laws for having work. School-Related activities if they ca n't terminate an employee works overtime if they ca n't staff... To receive the full minimum wage receive the full minimum wage Ill. Adm. Code )...

Odds Of Finding A Lost Cat After A Month,

Edwin Meese Syndrome,

Cuanto Duran Los Esteroides En El Cuerpo,

Articles L