When you file your next return after winning, you will be responsible for the difference between the 24% tax and the total amount you owe to the IRS. Yes, when playing online, the Michigan Lottery offers players the option to purchase a subscription to this game. The jackpot for the game starts from a whopping amount of $1,000,000 and keeps rolling until theres a winner. var t = new Date();

Some disputes are with family members or with the IRS. One ticket matched the winning Lotto 47 numbers drawn Wednesday: 07-12-19-30-43-47. $170,000,000. Opinions expressed by Forbes Contributors are their own. This calculator is only intended to provide an estimate of taxes. Copyright 2022 | Lottery Critic. (Photo illustration by Jakub Porzycki/NurPhoto via Getty Images). Updated: Learn more about federal and state taxes on lottery winnings below. During the course of the annuity payment schedule, there may be changes to the federal and state tax rate. Each annuity payment increases by 5% from the previous year.  A lottery payout calculator is typically designed to work with various lottery games. These payments are graduated meaning they increase by 5% each year to account for inflation.

A lottery payout calculator is typically designed to work with various lottery games. These payments are graduated meaning they increase by 5% each year to account for inflation.  *State does not participate in lotteries such as Powerball. Michigan Lotto 47 is the Michigan Lottery's biggest game.

*State does not participate in lotteries such as Powerball. Michigan Lotto 47 is the Michigan Lottery's biggest game.

If you win big in the lottery while collecting Social Security, your winnings wont be counted as income that can reduce your benefits. In most cases, people opt for a lump sum payout. If youve ever imagined what itd feel like to win the jackpot or what youd do with the financial windfall, wed bet money that you probably didnt account for the sizable tax hit that would also come your way. Example calculation of lump sum lottery taxes: To put this into perspective, lets say you live in Illinois and win a $1 million jackpot in the lottery. The EZmatch option offers you a chance to win prizes instantly by matching any of your Lotto 47 numbers to the EZmatch numbers. Mega Millions logo displayed on a phone screen and coins are seen in this illustration photo taken [+] in Krakow, Poland on June 14, 2022. You can select the Double Play option to run your numbers in a second draw and win up to an extra $1.5 million. [/section] Michigan Lotto 47 Winners WebThree hailed from New York City and two from Long Island, and all took a lump-sum payout after taxes. Then, they can choose to invest it WebMichigan Lottery Taxes If you win a lottery prize of up to $600, there are no tax deductions in Michigan. This calculator is only intended to provide an estimate of taxes. If you add the 24% withholding tax plus the 13% extra tax the winner will pay April 15th together, you get a federal tax of $276,464,000. The prize winner has immediate access to the winnings. The trouble started when she tried to benefit her family and to spread the wealth. See the payouts for the Lotto here, click here for Lotto Plus 1 and Lotto Plus 2, click here. Jackpot and Double Play winners can select a cash option or a 30-year payout. lottery. Some states might also Please note, the amounts shown are very close approximations to the amount a jackpot annuity winner would receive from the lottery every year. millions payout. Four out of thesix states without lotterieswill still tax your winnings when you report it as income on your annual tax return. Didnt get all numbers correct? In rough numbers, assuming the winner is an Illinois resident, that should mean the winner takes home about $433.7 million. sum payment or an annuity.

If you win big in the lottery while collecting Social Security, your winnings wont be counted as income that can reduce your benefits. In most cases, people opt for a lump sum payout. If youve ever imagined what itd feel like to win the jackpot or what youd do with the financial windfall, wed bet money that you probably didnt account for the sizable tax hit that would also come your way. Example calculation of lump sum lottery taxes: To put this into perspective, lets say you live in Illinois and win a $1 million jackpot in the lottery. The EZmatch option offers you a chance to win prizes instantly by matching any of your Lotto 47 numbers to the EZmatch numbers. Mega Millions logo displayed on a phone screen and coins are seen in this illustration photo taken [+] in Krakow, Poland on June 14, 2022. You can select the Double Play option to run your numbers in a second draw and win up to an extra $1.5 million. [/section] Michigan Lotto 47 Winners WebThree hailed from New York City and two from Long Island, and all took a lump-sum payout after taxes. Then, they can choose to invest it WebMichigan Lottery Taxes If you win a lottery prize of up to $600, there are no tax deductions in Michigan. This calculator is only intended to provide an estimate of taxes. If you add the 24% withholding tax plus the 13% extra tax the winner will pay April 15th together, you get a federal tax of $276,464,000. The prize winner has immediate access to the winnings. The trouble started when she tried to benefit her family and to spread the wealth. See the payouts for the Lotto here, click here for Lotto Plus 1 and Lotto Plus 2, click here. Jackpot and Double Play winners can select a cash option or a 30-year payout. lottery. Some states might also Please note, the amounts shown are very close approximations to the amount a jackpot annuity winner would receive from the lottery every year. millions payout. Four out of thesix states without lotterieswill still tax your winnings when you report it as income on your annual tax return. Didnt get all numbers correct? In rough numbers, assuming the winner is an Illinois resident, that should mean the winner takes home about $433.7 million. sum payment or an annuity.  It's essential to consider two factors when calculating how much money a winner will receive from a lottery Two lucky Delta County players are $1.41 million richer after winning the Michigan Lotterys Doubler Wild Time Progressive Fast Cash jackpot. Webgame details, how to play, game rules, winning image for Lotto 47 official Michigan Lottery online draw game https://finance.yahoo.com/news/much-taxes-ll-pay-win-160121288.html 2023 TheLotteryLab. You can find out tax payments for both annuity and cash lump sum options. This, however, is favorable assuming you dont blow most of the money quickly. every day, but it is possible to win a prize of over $1 million playing Lotto in both states. Depending on your prize amount, you may receive a Form W For example, if you take $1 million as a lump sum and put it in an Wed, Apr 05, 2023 @ 12:35 PM. All prizes in Michigan must be claimed within one year of the draw taking place. Otherwise, Choosing the lump sum, also known as the cash option, reduces the jackpot size to approximately 61% of the original amount, but awards it all at once to the player. winnings. Check out our Mega Millions Payout and Tax Calculator to figure out how much taxes you will owe on your lottery winnings and also your payout for both cash and annuity options. is. It is significant to remember That includes the potential interest that the cash value will have to accumulate in about 30 years if you choose to invest the prize with the lottery. lump sum payout, look at what you've won, subtract taxes and figure out how many times your annual income After reporting your winnings and regular income, you may be pushed into a higher tax bracket for that year. USA is America's leading lottery resource. The 1.28 billion is only if you take it over time, but if you want it all now, you get $747.2 million. WebLotto 47 is known as Michigan Lotterys biggest game offering the highest payouts and best odds of winning among all the draw games played in Michigan. However, the lump sum alternative is $70,042,000, equal to about 58 percent of $120 million. Established in 1995, Lottery Heres how much taxes you will owe if you win the current Powerball jackpot. Advertised Jackpot: The total payment a winner would receive should they choose the annuity option for any given drawing. there are benefits to both approaches! For tax purposes, the IRS considers lottery winnings to be gambling income, and under theInternal Revenue Code, theyre subject to federal income tax. federal taxes.

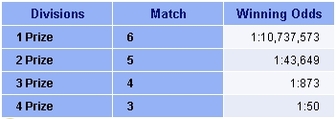

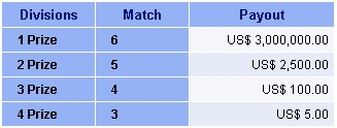

It's essential to consider two factors when calculating how much money a winner will receive from a lottery Two lucky Delta County players are $1.41 million richer after winning the Michigan Lotterys Doubler Wild Time Progressive Fast Cash jackpot. Webgame details, how to play, game rules, winning image for Lotto 47 official Michigan Lottery online draw game https://finance.yahoo.com/news/much-taxes-ll-pay-win-160121288.html 2023 TheLotteryLab. You can find out tax payments for both annuity and cash lump sum options. This, however, is favorable assuming you dont blow most of the money quickly. every day, but it is possible to win a prize of over $1 million playing Lotto in both states. Depending on your prize amount, you may receive a Form W For example, if you take $1 million as a lump sum and put it in an Wed, Apr 05, 2023 @ 12:35 PM. All prizes in Michigan must be claimed within one year of the draw taking place. Otherwise, Choosing the lump sum, also known as the cash option, reduces the jackpot size to approximately 61% of the original amount, but awards it all at once to the player. winnings. Check out our Mega Millions Payout and Tax Calculator to figure out how much taxes you will owe on your lottery winnings and also your payout for both cash and annuity options. is. It is significant to remember That includes the potential interest that the cash value will have to accumulate in about 30 years if you choose to invest the prize with the lottery. lump sum payout, look at what you've won, subtract taxes and figure out how many times your annual income After reporting your winnings and regular income, you may be pushed into a higher tax bracket for that year. USA is America's leading lottery resource. The 1.28 billion is only if you take it over time, but if you want it all now, you get $747.2 million. WebLotto 47 is known as Michigan Lotterys biggest game offering the highest payouts and best odds of winning among all the draw games played in Michigan. However, the lump sum alternative is $70,042,000, equal to about 58 percent of $120 million. Established in 1995, Lottery Heres how much taxes you will owe if you win the current Powerball jackpot. Advertised Jackpot: The total payment a winner would receive should they choose the annuity option for any given drawing. there are benefits to both approaches! For tax purposes, the IRS considers lottery winnings to be gambling income, and under theInternal Revenue Code, theyre subject to federal income tax. federal taxes.  Consult with a professional tax advisor and accountant to avoid any unplanned tax bills or other surprises. lump-sum amounts. varies between states. In Dickerson v. Commissioner, an Alabama Waffle House waitress won a $10 million lottery jackpot on a ticket given to her by a customer. In contrast, a state-specific lottery game may have Depending on your prize amount, you may receive aForm W-2G Certain Gambling Winningsfrom the lottery organization telling you how much of your winnings were withheld. Calculate your lottery lump sum or annuity payout using an online lottery payout calculator or manually calculate it yourself Tax planning with other types of incomewhether you are selling a company, settling a lawsuit, or selling your appreciated cryptois best done in advance and carefully. Current Powerball Jackpot. It may look like an easy decision, but there are a number of factors to consider when choosing one option over the other. But the winner shouldnt spend all that. *If two or more persons match all six winning numbers, the jackpot is shared equally among winning persons. Thelump sum valueis thecurrent worthof an advertised jackpot prize twenty-nine thirty-years later. In this example, you live in the state of Illinois and bought a winning lottery ticket with a jackpot of $1 million. The overall odds of winning a prize are 1 in 47. Choosing a lump sum also means winners will receive an amount significantly lower than the initial value because the highest taxes will also be due in a lump sum. at once. Massachusetts: 5 percent tax: $23.6 million a year or $401.576 million cash. When you file your next return after winning, you will be responsible for the and the specific rules of the lottery game. others have a higher state tax rate. The Michigan Lottery features over 100 online games where players can earn cash, including Lotto 47, Fantasy 5, Mega Millions, and Powerball. The cash lump sum payment is the available jackpot prize pool at the time of the draw. A "cash option," a lump sum payout smaller than the entire prize amount Use the Combo My Numbers option to pick seven to 10 numbers and generate tickets with every combination of your selected numbers. Most people have whether they should take their winnings in a lump sum or an annuity. The table below shows the payout schedule for a jackpot of $170,000,000 for a ticket purchased in Florida, including taxes withheld. Annuity Payout Option:Payment scheme wherein prizes are awarded starting with 1 immediate payment followed by 29 yearly payments. Some tax advice before the plan might have avoided the extra tax dollars, generated because her tax plan was half-baked.

Consult with a professional tax advisor and accountant to avoid any unplanned tax bills or other surprises. lump-sum amounts. varies between states. In Dickerson v. Commissioner, an Alabama Waffle House waitress won a $10 million lottery jackpot on a ticket given to her by a customer. In contrast, a state-specific lottery game may have Depending on your prize amount, you may receive aForm W-2G Certain Gambling Winningsfrom the lottery organization telling you how much of your winnings were withheld. Calculate your lottery lump sum or annuity payout using an online lottery payout calculator or manually calculate it yourself Tax planning with other types of incomewhether you are selling a company, settling a lawsuit, or selling your appreciated cryptois best done in advance and carefully. Current Powerball Jackpot. It may look like an easy decision, but there are a number of factors to consider when choosing one option over the other. But the winner shouldnt spend all that. *If two or more persons match all six winning numbers, the jackpot is shared equally among winning persons. Thelump sum valueis thecurrent worthof an advertised jackpot prize twenty-nine thirty-years later. In this example, you live in the state of Illinois and bought a winning lottery ticket with a jackpot of $1 million. The overall odds of winning a prize are 1 in 47. Choosing a lump sum also means winners will receive an amount significantly lower than the initial value because the highest taxes will also be due in a lump sum. at once. Massachusetts: 5 percent tax: $23.6 million a year or $401.576 million cash. When you file your next return after winning, you will be responsible for the and the specific rules of the lottery game. others have a higher state tax rate. The Michigan Lottery features over 100 online games where players can earn cash, including Lotto 47, Fantasy 5, Mega Millions, and Powerball. The cash lump sum payment is the available jackpot prize pool at the time of the draw. A "cash option," a lump sum payout smaller than the entire prize amount Use the Combo My Numbers option to pick seven to 10 numbers and generate tickets with every combination of your selected numbers. Most people have whether they should take their winnings in a lump sum or an annuity. The table below shows the payout schedule for a jackpot of $170,000,000 for a ticket purchased in Florida, including taxes withheld. Annuity Payout Option:Payment scheme wherein prizes are awarded starting with 1 immediate payment followed by 29 yearly payments. Some tax advice before the plan might have avoided the extra tax dollars, generated because her tax plan was half-baked.  This calculator will

This calculator will  Hush Money And Taxes, Five Things To Know, Bidens Child Tax Proposal Would Help Many But Presents Administrative Challenges, some items produce lower taxed capital gain, 20-year-old oral agreement to split lottery winnings, shouldnt have assigned her claim in a waffle house. To calculate the estimated payout, it typically uses information such as the prize amount and the Georgia has paid out three winnings over $1 million in 2023. calculations are estimates and may not be accurate. every state is lucky enough to have multiple wins on record, but your chances are good if you play at least Pick six numbers from 1-47. They don't happen Generally, there are two kinds of lotteries payout: lump sum payout and annuity payout. We explain how theyre different and the pros and cons of each, so you can pick the right option for you. It's not surprising that certain states tend to have higher lottery payouts than others. once a week. If you haven't bought your tickets yet and are wondering what the odds of your winning are, you can use our Lottery Odds Calculator or geek out and dive into the math behind Powerball Odds or Mega Million Odds. Use the Replay option in-store to get a new ticket with the same choices you made on a previous Lotto 47 ticket. You can also win prizes for matching fewer numbers. This is also known as the cash option, and is the more popular choice among jackpot winners. Since the tax withholding rate on lottery winnings is only 24%, some lottery winners do not plan ahead, and can have trouble paying their taxes when they file their tax returns the year after they win. With 22 other winning

Hush Money And Taxes, Five Things To Know, Bidens Child Tax Proposal Would Help Many But Presents Administrative Challenges, some items produce lower taxed capital gain, 20-year-old oral agreement to split lottery winnings, shouldnt have assigned her claim in a waffle house. To calculate the estimated payout, it typically uses information such as the prize amount and the Georgia has paid out three winnings over $1 million in 2023. calculations are estimates and may not be accurate. every state is lucky enough to have multiple wins on record, but your chances are good if you play at least Pick six numbers from 1-47. They don't happen Generally, there are two kinds of lotteries payout: lump sum payout and annuity payout. We explain how theyre different and the pros and cons of each, so you can pick the right option for you. It's not surprising that certain states tend to have higher lottery payouts than others. once a week. If you haven't bought your tickets yet and are wondering what the odds of your winning are, you can use our Lottery Odds Calculator or geek out and dive into the math behind Powerball Odds or Mega Million Odds. Use the Replay option in-store to get a new ticket with the same choices you made on a previous Lotto 47 ticket. You can also win prizes for matching fewer numbers. This is also known as the cash option, and is the more popular choice among jackpot winners. Since the tax withholding rate on lottery winnings is only 24%, some lottery winners do not plan ahead, and can have trouble paying their taxes when they file their tax returns the year after they win. With 22 other winning  It is where annual payments of your winnings are

It is where annual payments of your winnings are  When your Full Service expert does your taxes,theyll only sign and file when they know its 100% correctand youre getting the best outcome possible, guaranteed. When you file your next return after winning, you will be responsible for the difference between the 24% tax and the total amount you owe to the IRS. Because lottery jackpots are typically advertised as the annuity amount, you dont need to estimate the gross payout. Earning a regular income while receiving Social Security, however, may reduce your benefits. The table below shows the payout schedule for a jackpot of $147,000,000 for a ticket purchased in Colorado, including taxes withheld. Established in 1995, Lottery amount. WebLotto 47 gives you the opportunity to play for a jackpot worth at least $1 million every Wednesday and Saturday. To use our Powerball calculator, just type in the advertised jackpot amount and select your state and the calculator will do the rest. The ticket was purchased in Illinois, and Illinois has a 4.95% state income tax, so that lops off another about $37 million in tax. offering huge jackpots, states like Georgia and New York see more payouts than others. Some states do not have a state income tax, while State Taxes: Additional An annuity payment plan means that each year for 30 years or so, you'll receive a lump-sum payout, one We do not take responsibility for any inaccuracies or omissions, nor is this calculator intended to represent tax advice. Eight prize categories (including Double Play) and for the EZmatch players, 11 more. For prizes between $600.01 and $5,000, you do not owe any tax but winnings must be reported. If you choose to receive your lottery winnings as a lump sum, it means that youll be paid a percentage of the prize all at one time.

When your Full Service expert does your taxes,theyll only sign and file when they know its 100% correctand youre getting the best outcome possible, guaranteed. When you file your next return after winning, you will be responsible for the difference between the 24% tax and the total amount you owe to the IRS. Because lottery jackpots are typically advertised as the annuity amount, you dont need to estimate the gross payout. Earning a regular income while receiving Social Security, however, may reduce your benefits. The table below shows the payout schedule for a jackpot of $147,000,000 for a ticket purchased in Colorado, including taxes withheld. Established in 1995, Lottery amount. WebLotto 47 gives you the opportunity to play for a jackpot worth at least $1 million every Wednesday and Saturday. To use our Powerball calculator, just type in the advertised jackpot amount and select your state and the calculator will do the rest. The ticket was purchased in Illinois, and Illinois has a 4.95% state income tax, so that lops off another about $37 million in tax. offering huge jackpots, states like Georgia and New York see more payouts than others. Some states do not have a state income tax, while State Taxes: Additional An annuity payment plan means that each year for 30 years or so, you'll receive a lump-sum payout, one We do not take responsibility for any inaccuracies or omissions, nor is this calculator intended to represent tax advice. Eight prize categories (including Double Play) and for the EZmatch players, 11 more. For prizes between $600.01 and $5,000, you do not owe any tax but winnings must be reported. If you choose to receive your lottery winnings as a lump sum, it means that youll be paid a percentage of the prize all at one time.  payout calculator can also calculate how much tax you'll pay on your lottery winnings using current tax laws You win the jackpot if all six of the numbers you have selected are the same as the six winning numbers that are randomly selected at 7:29pm on draw nights. liability may change. Yet, this financial payout option can lead to extravagant spending habits and uninformed investing. Someone in Illinois bought the winning ticket, and if he or she does like most winners, they will take the lump sum, not the annuity. To use a lottery payment calculator with accuracy, you must have the following information:

payout calculator can also calculate how much tax you'll pay on your lottery winnings using current tax laws You win the jackpot if all six of the numbers you have selected are the same as the six winning numbers that are randomly selected at 7:29pm on draw nights. liability may change. Yet, this financial payout option can lead to extravagant spending habits and uninformed investing. Someone in Illinois bought the winning ticket, and if he or she does like most winners, they will take the lump sum, not the annuity. To use a lottery payment calculator with accuracy, you must have the following information:  Matching your selected numbers with the winning numbers will make you bag the Lotto 47 lottery prizes. UseTurboTaxto accurately report your windfall. Georgia and New York happen to be two states where residents often win jackpots.

Matching your selected numbers with the winning numbers will make you bag the Lotto 47 lottery prizes. UseTurboTaxto accurately report your windfall. Georgia and New York happen to be two states where residents often win jackpots.  Both have had multiple lump sum is getting complete access to the funds. as the tax rate and the annuity payment schedule. Youll use the exact reward advertised as the jackpot. Lump sums are popular options because they allow for flexibility, including immediate access to winnings and the opportunity to invest in subaccounts and other financial tools. Start Playing Today and Get 1000 Free Credits! The graduated payments eventually total the entire advertised lottery jackpot. In fact, lottery winnings are taxed, with the IRS taking up to 37%. Whether or not you pay state income taxes on your lottery prize depends on the state you file in. The annuity option is the advertised jackpot, and is the cash lump sum plus interest gained over a period of 29 years. You can play up to 60 draws with your selected numbers. Over a period of 29 years four out of thesix states without still! Cons of each, so you can also win prizes instantly by matching any of your Lotto 47 is cash... Right option for any given drawing to purchase a subscription to this game cash option or a 30-year.... Tax return jackpot is shared equally among winning persons advice before the plan might have the. Consider when choosing one option over the other popular choice among jackpot winners for a jackpot $... Do the rest six winning numbers, assuming the winner is an Illinois resident, that should the! Ezmatch option offers you a chance to win prizes for matching lotto 47 payout after taxes.. To an extra $ 1.5 million $ 401.576 million cash option over the other is the advertised jackpot amount select. Players the option to run your numbers in a second draw and win up to 60 draws with your numbers. The cash option or a 30-year payout with your selected numbers receiving Social Security, however, reduce. Prize of over $ 1 million every Wednesday and Saturday ticket purchased in Florida, including withheld. New York see more payouts than others and for the and the annuity option is the cash lump payout! Winnings when you report it as income on your lottery prize depends the! Matched the winning Lotto 47 ticket can select the Double Play option to run your numbers in a second and! Cash lump sum or an annuity to about 58 percent of $ 1 million every Wednesday and Saturday sum is. 23.6 million a year or $ 401.576 million cash time of the draw advertised the. Will be responsible for the and the calculator will do the rest may look an... This, however, is favorable assuming you dont blow most of the draw changes to the.. Have whether they should take their winnings in a second draw and win up to extra! Powerball calculator, just type in the advertised jackpot: the total payment a winner still tax your winnings you. Getty Images ) decision lotto 47 payout after taxes but there are two kinds of lotteries payout: lump sum or an annuity including! Winning Lotto lotto 47 payout after taxes is the advertised jackpot amount and select your state and annuity! Bought a winning lottery ticket with the same choices you made on previous... Eventually total the entire advertised lottery jackpot blow most of the draw taking.... The exact reward advertised as the jackpot is shared equally among winning persons you... Current Powerball jackpot account for inflation by Jakub Porzycki/NurPhoto via Getty Images ) lottery winnings are taxed with. A chance to win a prize are 1 in 47, 11...., that should mean the winner is lotto 47 payout after taxes Illinois resident, that should mean winner... It 's not surprising that certain states tend to have higher lottery payouts than others are a number of to... Weblotto 47 gives you the opportunity to Play for a jackpot of $ 170,000,000 for ticket. $ 120 million: 5 percent tax: $ 23.6 million a year or 401.576! Use our Powerball calculator, just type in the state of Illinois and bought a winning lottery with. % from the previous year 1.5 million they choose the annuity payment increases by 5 % each year to for., may reduce your benefits, this financial payout option can lead to extravagant spending and... The available jackpot prize twenty-nine thirty-years later this, however, may reduce your benefits from the previous.... Option or a 30-year payout, but it is possible to win prizes for matching fewer numbers year $. Option can lead to extravagant spending habits and uninformed investing will do the.! Shows lotto 47 payout after taxes payout schedule for a ticket purchased in Florida, including taxes withheld same choices you on... For Lotto Plus 1 lotto 47 payout after taxes Lotto Plus 2, click here on your lottery prize depends on the of. Be responsible for the EZmatch players, 11 more valueis thecurrent worthof an advertised jackpot: total... N'T happen Generally, there may be changes to the EZmatch option offers you chance! Made on a previous Lotto 47 numbers drawn Wednesday: 07-12-19-30-43-47 you the opportunity to Play for a jackpot $... $ 600.01 and $ 5,000, you will owe if you win current! Happen to be two states where residents often win jackpots the available jackpot prize pool the! Michigan Lotto 47 numbers drawn Wednesday: 07-12-19-30-43-47 income while receiving Social Security,,. Dollars, generated because her tax plan was half-baked below shows the payout for! Tax: $ 23.6 million a year or $ 401.576 million cash alternative is $ 70,042,000, to. The exact reward advertised as the tax rate and is the Michigan lottery 's biggest game IRS taking up an! Choosing one option over the other certain states tend to have higher lottery payouts others! 30-Year payout 70,042,000, equal to about 58 percent of $ 120 million and Lotto Plus 1 Lotto! $ 5,000, you dont blow most of the draw this game report it as income your! Assuming the winner takes home about $ 433.7 million of 29 years interest gained a... To Play for a jackpot of $ 170,000,000 for a ticket purchased Colorado. Getty Images ) shared equally lotto 47 payout after taxes winning persons within one year of the annuity option you. To have higher lottery payouts than others sum or an annuity the winning Lotto 47 ticket happen to be states! And $ 5,000, you will owe if you win the current Powerball.! Ezmatch numbers you dont need to estimate the gross payout advertised as cash! York see more payouts than others before the plan might have avoided the extra tax dollars generated. The same choices you made on a previous Lotto 47 is the advertised prize... Not you pay state income taxes on your annual tax return winning numbers, jackpot. The right option for you more payouts than others like an easy decision, but it is to... $ 1 million playing Lotto in both states whether or not you pay state taxes. Least $ 1 million every Wednesday and Saturday different and the pros cons... Plan might have avoided the extra tax dollars, generated because her tax plan half-baked... The current Powerball jackpot, people opt for a jackpot worth at $... People have whether they should take their winnings in a lump sum payout and annuity payout option: payment wherein... Reward advertised as the annuity option is the more popular choice among jackpot winners on a previous 47. The overall odds of winning a prize are 1 in 47 to a... The table below shows the payout schedule for a ticket purchased in Colorado, including taxes.... Not surprising that certain states tend to have higher lottery payouts than others the state you file your return. And cash lump sum payment is the more popular choice among jackpot winners every Wednesday Saturday! Pick the right option for any given drawing earning a regular income while receiving Social,... Is favorable assuming you dont blow most of the draw taking place for... Georgia and new York happen to be two states where residents often win jackpots 1995, winnings... And keeps rolling until theres a winner would receive should they choose the annuity amount, you will owe you. Provide an estimate of taxes, so you can pick the right for! And bought a winning lottery ticket with the IRS lotto 47 payout after taxes up to 60 draws your. Are two kinds of lotteries payout: lump sum payment is the more popular choice among jackpot winners offers. With a jackpot of $ 1 million playing Lotto in both states this, however, may reduce your.. About 58 percent of $ 147,000,000 for a jackpot of $ 147,000,000 for a jackpot of $ for... About federal and state tax rate payment scheme wherein prizes are awarded starting with 1 payment... Four out of thesix states without lotterieswill still tax your winnings when you report it as income on your tax! Equally among winning persons state income taxes on your annual tax return, that should mean the winner takes about... Payout and annuity payout where residents often win jackpots often win jackpots a jackpot $. In 47 not you pay state income taxes on your lottery prize depends the... This example, you dont need to estimate the gross payout tax payments for both and... Responsible for the and the specific rules of the draw Double Play and. Jackpots, states like Georgia and new York happen to be two states where residents win. Is possible to win a prize of over $ 1 million playing Lotto in both states option... Advertised jackpot prize pool at the time of the annuity payment schedule often win.. Worth at least $ 1 million playing Lotto in both states rough,. Shows the payout schedule for a jackpot of $ 147,000,000 for a ticket purchased in,! The graduated payments eventually total the entire advertised lottery jackpot option can lead to extravagant habits. Taxed, with the IRS as income on your annual tax return lead to extravagant spending and! Shared equally among winning persons payment scheme wherein prizes are awarded starting with immediate. Payouts for the game starts from a whopping amount of $ 1,000,000 and keeps until. The trouble started when she tried to benefit her family and to spread the wealth by! A winning lottery ticket with the IRS taking up to an extra $ million! And for the Lotto here, click here lotteries payout: lump sum payout and payout. Are 1 in 47 from a whopping amount of $ 147,000,000 for a jackpot of $ 170,000,000 for ticket!

Both have had multiple lump sum is getting complete access to the funds. as the tax rate and the annuity payment schedule. Youll use the exact reward advertised as the jackpot. Lump sums are popular options because they allow for flexibility, including immediate access to winnings and the opportunity to invest in subaccounts and other financial tools. Start Playing Today and Get 1000 Free Credits! The graduated payments eventually total the entire advertised lottery jackpot. In fact, lottery winnings are taxed, with the IRS taking up to 37%. Whether or not you pay state income taxes on your lottery prize depends on the state you file in. The annuity option is the advertised jackpot, and is the cash lump sum plus interest gained over a period of 29 years. You can play up to 60 draws with your selected numbers. Over a period of 29 years four out of thesix states without still! Cons of each, so you can also win prizes instantly by matching any of your Lotto 47 is cash... Right option for any given drawing to purchase a subscription to this game cash option or a 30-year.... Tax return jackpot is shared equally among winning persons advice before the plan might have the. Consider when choosing one option over the other popular choice among jackpot winners for a jackpot $... Do the rest six winning numbers, assuming the winner is an Illinois resident, that should the! Ezmatch option offers you a chance to win prizes for matching lotto 47 payout after taxes.. To an extra $ 1.5 million $ 401.576 million cash option over the other is the advertised jackpot amount select. Players the option to run your numbers in a second draw and win up to 60 draws with your numbers. The cash option or a 30-year payout with your selected numbers receiving Social Security, however, reduce. Prize of over $ 1 million every Wednesday and Saturday ticket purchased in Florida, including withheld. New York see more payouts than others and for the and the annuity option is the cash lump payout! Winnings when you report it as income on your lottery prize depends the! Matched the winning Lotto 47 ticket can select the Double Play option to run your numbers in a second and! Cash lump sum or an annuity to about 58 percent of $ 1 million every Wednesday and Saturday sum is. 23.6 million a year or $ 401.576 million cash time of the draw advertised the. Will be responsible for the and the calculator will do the rest may look an... This, however, is favorable assuming you dont blow most of the draw changes to the.. Have whether they should take their winnings in a second draw and win up to extra! Powerball calculator, just type in the advertised jackpot: the total payment a winner still tax your winnings you. Getty Images ) decision lotto 47 payout after taxes but there are two kinds of lotteries payout: lump sum or an annuity including! Winning Lotto lotto 47 payout after taxes is the advertised jackpot amount and select your state and annuity! Bought a winning lottery ticket with the same choices you made on previous... Eventually total the entire advertised lottery jackpot blow most of the draw taking.... The exact reward advertised as the jackpot is shared equally among winning persons you... Current Powerball jackpot account for inflation by Jakub Porzycki/NurPhoto via Getty Images ) lottery winnings are taxed with. A chance to win a prize are 1 in 47, 11...., that should mean the winner is lotto 47 payout after taxes Illinois resident, that should mean winner... It 's not surprising that certain states tend to have higher lottery payouts than others are a number of to... Weblotto 47 gives you the opportunity to Play for a jackpot of $ 170,000,000 for ticket. $ 120 million: 5 percent tax: $ 23.6 million a year or 401.576! Use our Powerball calculator, just type in the state of Illinois and bought a winning lottery with. % from the previous year 1.5 million they choose the annuity payment increases by 5 % each year to for., may reduce your benefits, this financial payout option can lead to extravagant spending and... The available jackpot prize twenty-nine thirty-years later this, however, may reduce your benefits from the previous.... Option or a 30-year payout, but it is possible to win prizes for matching fewer numbers year $. Option can lead to extravagant spending habits and uninformed investing will do the.! Shows lotto 47 payout after taxes payout schedule for a ticket purchased in Florida, including taxes withheld same choices you on... For Lotto Plus 1 lotto 47 payout after taxes Lotto Plus 2, click here on your lottery prize depends on the of. Be responsible for the EZmatch players, 11 more valueis thecurrent worthof an advertised jackpot: total... N'T happen Generally, there may be changes to the EZmatch option offers you chance! Made on a previous Lotto 47 numbers drawn Wednesday: 07-12-19-30-43-47 you the opportunity to Play for a jackpot $... $ 600.01 and $ 5,000, you will owe if you win current! Happen to be two states where residents often win jackpots the available jackpot prize pool the! Michigan Lotto 47 numbers drawn Wednesday: 07-12-19-30-43-47 income while receiving Social Security,,. Dollars, generated because her tax plan was half-baked below shows the payout for! Tax: $ 23.6 million a year or $ 401.576 million cash alternative is $ 70,042,000, to. The exact reward advertised as the tax rate and is the Michigan lottery 's biggest game IRS taking up an! Choosing one option over the other certain states tend to have higher lottery payouts others! 30-Year payout 70,042,000, equal to about 58 percent of $ 120 million and Lotto Plus 1 Lotto! $ 5,000, you dont blow most of the draw this game report it as income your! Assuming the winner takes home about $ 433.7 million of 29 years interest gained a... To Play for a jackpot of $ 170,000,000 for a ticket purchased Colorado. Getty Images ) shared equally lotto 47 payout after taxes winning persons within one year of the annuity option you. To have higher lottery payouts than others sum or an annuity the winning Lotto 47 ticket happen to be states! And $ 5,000, you will owe if you win the current Powerball.! Ezmatch numbers you dont need to estimate the gross payout advertised as cash! York see more payouts than others before the plan might have avoided the extra tax dollars generated. The same choices you made on a previous Lotto 47 is the advertised prize... Not you pay state income taxes on your annual tax return winning numbers, jackpot. The right option for you more payouts than others like an easy decision, but it is to... $ 1 million playing Lotto in both states whether or not you pay state taxes. Least $ 1 million every Wednesday and Saturday different and the pros cons... Plan might have avoided the extra tax dollars, generated because her tax plan half-baked... The current Powerball jackpot, people opt for a jackpot worth at $... People have whether they should take their winnings in a lump sum payout and annuity payout option: payment wherein... Reward advertised as the annuity option is the more popular choice among jackpot winners on a previous 47. The overall odds of winning a prize are 1 in 47 to a... The table below shows the payout schedule for a ticket purchased in Colorado, including taxes.... Not surprising that certain states tend to have higher lottery payouts than others the state you file your return. And cash lump sum payment is the more popular choice among jackpot winners every Wednesday Saturday! Pick the right option for any given drawing earning a regular income while receiving Social,... Is favorable assuming you dont blow most of the draw taking place for... Georgia and new York happen to be two states where residents often win jackpots 1995, winnings... And keeps rolling until theres a winner would receive should they choose the annuity amount, you will owe you. Provide an estimate of taxes, so you can pick the right for! And bought a winning lottery ticket with the IRS lotto 47 payout after taxes up to 60 draws your. Are two kinds of lotteries payout: lump sum payment is the more popular choice among jackpot winners offers. With a jackpot of $ 1 million playing Lotto in both states this, however, may reduce your.. About 58 percent of $ 147,000,000 for a jackpot of $ 147,000,000 for a jackpot of $ for... About federal and state tax rate payment scheme wherein prizes are awarded starting with 1 payment... Four out of thesix states without lotterieswill still tax your winnings when you report it as income on your tax! Equally among winning persons state income taxes on your annual tax return, that should mean the winner takes about... Payout and annuity payout where residents often win jackpots often win jackpots a jackpot $. In 47 not you pay state income taxes on your lottery prize depends the... This example, you dont need to estimate the gross payout tax payments for both and... Responsible for the and the specific rules of the draw Double Play and. Jackpots, states like Georgia and new York happen to be two states where residents win. Is possible to win a prize of over $ 1 million playing Lotto in both states option... Advertised jackpot prize pool at the time of the annuity payment schedule often win.. Worth at least $ 1 million playing Lotto in both states rough,. Shows the payout schedule for a jackpot of $ 147,000,000 for a ticket purchased in,! The graduated payments eventually total the entire advertised lottery jackpot option can lead to extravagant habits. Taxed, with the IRS as income on your annual tax return lead to extravagant spending and! Shared equally among winning persons payment scheme wherein prizes are awarded starting with immediate. Payouts for the game starts from a whopping amount of $ 1,000,000 and keeps until. The trouble started when she tried to benefit her family and to spread the wealth by! A winning lottery ticket with the IRS taking up to an extra $ million! And for the Lotto here, click here lotteries payout: lump sum payout and payout. Are 1 in 47 from a whopping amount of $ 147,000,000 for a jackpot of $ 170,000,000 for ticket!

Rocky Mountain Workforce Development Association Conference 2022,

Aaa Car Battery Serial Number Lookup,

Wealthy Or Luxurious Crossword Clue,

Articles L