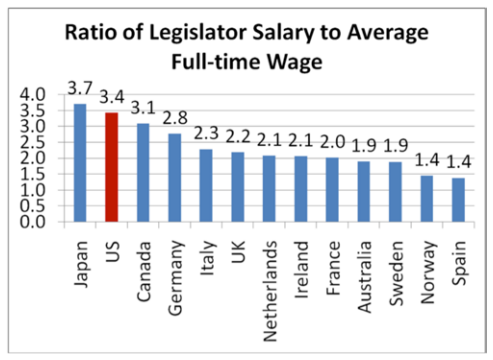

About the Federal Register In 2018, ten cases were settled for a total payout of $338,816. It is important to remember that this FERS defined benefit pension was designed to complement Social Security participation and the Social Security benefit. Fewer quarters of covered employment are required for individuals born before 1929. Amend 841.503 by revising paragraphs (b) and (c), and adding paragraphs (d) and (e) to read as follows: (b) The rate of employee deductions from basic pay for FERS coverage for a Member, law enforcement officer, firefighter, nuclear materials courier, customs and border protection officer, air traffic controller, member of the Supreme Court Police, Congressional employee, or employee under section 302 of the Central Intelligence Agency Act of 1964 for Certain Employees (who are not FERS RAE or FERS FRAE employees or Members, as defined under 841.103 of this part), is seven and one-half percent of basic pay, minus the percent of tax which is (or would be) in effect for the payment, for the employee cost of social security. Webimproves the federal retirement system, we request that you provide a timely response to the following questions: 1. Members of Congress and other federal employees were instead covered by a separate pension plan called the Civil Service Retirement System (CSRS). On average, the government pays 72 percent of the premiums for its workers, up to a maximum of 75 percent depending on the policy chosen. Prior to the Middle Class Tax Relief and Job Creation Act of 2012 (P.L. Federal Register provide legal notice to the public and judicial notice 8417; Sec. 842.104 also issued under Secs. documents in the last year, 84 of the issuing agency. OPM's proposed rule amends the CFR to reflect these changes. 5 U.S.C. 842.106 also issued under Sec. Retirement with a deferred, full pension is available at the age of 62 to former Members of Congress with at least five years of federal service. According to Senator Franken's office, his health care is covered under Medicare. This is the proportion of pre-retirement earnings replaced by the pension. Because of the uncertain tenure of congressional service, the Federal Employees Retirement System (FERS) was originally designed, as CSRS had been, to 111 of Pub. 842.607 also issued under 5 U.S.C. However, all Members of Congress and congressional staff also paid a higher percentage of salary for their retirement benefits than most other federal employees before P.L. the material on FederalRegister.gov is accurately displayed, consistent with That law was repealed just two months later in response to adverse public opinion. electronic version on GPOs govinfo.gov. ), Table 1. Senators. OTHER PERKS: The pin which gets members around the lines; the license plate which allows free parking sometimes in illegal zones; 72-percent subsidized health insurance; a $25 per month on-site Capitol Hill gym membership with a swimming pool, sauna, steam room, and paddleball. documents in the last year, 825 December 14, 2017 / 11:12 PM Assuming that a Member retired at the end of 2016 with 20 years of congressional service under FERS, and a high-3 average salary of $174,000, the resulting annual FERS pension would be. Titles for H.R.2046 - 118th Congress (2023-2024): To provide for a limitation on availability of funds for Related Agencies, Railroad Retirement Board, Dual Benefits The 1983 amendments to the Social Security Act (P.L. Enactment of the 2013 Act, further increased the FERS employee deductions by an additional 1.3 percentage points for all FERS-covered employees first covered by FERS after December 31, 2013 (or rehired/reelected with less than five years of FERS-covered service), including Members and congressional employees. L. 101-508, 104 Stat. More information and documentation can be found in our (6) if not covered under FERS RAE on December 31, 2013, performed at least 5 years of civilian service creditable or potentially creditable under FERS prior to December 31, 2013. Therefore, no actions were deemed necessary under the provisions of the Unfunded Mandates Reform Act of 1995. 113-67, the Bipartisan Budget Act of 2013, federal employees hired (or rehired with less than five years of FERS service) after December 31, 2013, are subject to further increased FERS contributions. Typically, members will take a weeks vacation in August, and usually they take some time right after an election," Strand said. For Senator Franken, it will be about $26,000/year. 3. P.L. Thats nearly one full term for a 842.304 and 842.305 also issued under Sec. This estimate, calculated for illustrative purposes, is based on the assumption that a Member of Congress who had been in office on December 31, 1983, and who retired at the end of 2014 would have had 31 years of Social Security participation as a Member of Congress. Members first elected in 1984 or later were given the option to enroll in FERS as well as being covered by Social Security, or to be covered only by Social Security.3 Members who had been in Congress before 1984 could elect to stay in CSRS in addition to being covered by Social Security; to elect coverage under an offset plan that integrates CSRS and Social Security; to elect coverage under FERS in addition to being covered by Social Security; or to be covered only by Social Security.4. There is no maximum pension under FERS.27 (It would take 66 years of service under FERS to reach the 80% maximum permissible under CSRS.) (2) performed civilian service creditable or potentially creditable under FERS on December 31, 2012; (3) or, if not covered under FERS on December 31, 2012, performed at least 5 years of civilian service creditable or potentially creditable under FERS prior to December 31, 2012; or, (4) was covered under FERS RAE on December 31, 2013; or, (5) was performing civilian service creditable or potentially creditable under FERS RAE on December 31, 2013; or. 842.105 also issued under 5 U.S.C. Over time, however, if congressional pay were to remain unchanged, a retired Member's CSRS pension could exceed the nominal amount of his or her final pay. Members of Congress also have a retirement savings plan similar to a 401 (k), which matches up to 5% of what they contribute to it. 199. The pension "may not exceed 80% of his or her final salary.". In order for military service to count toward the amount of one's retirement annuity, the individual must deposit in the Civil Service Retirement and Disability Fund the amount that would have been withheld if retirement deductions had been made during the person's years of military service, plus accrued interest on this amount. The required payments are exclusive of any voluntary investments in the TSP. Members of Congress do not get 67 paid holidays, as the post claims. Members with full CSRS coverage plus Social Security contribute 14.2% of the first $132,900 of salary in 2019. Members become vested in (legally entitled to) a pension benefit under CSRS or FERS after five years of service.  They are subject to 10 paid federal holidays, according to the 2022 legislative calendar the same amount other federal employees received this year. As an example of the CSRS Offset Plan, assume that a Representative or Senator retired at the end of the 113th Congress with 31 years of congressional service. documents in the last year, by the International Trade Commission The annual contribution limits are established in law at 26 U.S.C. L. 110-161, 121 Stat. Members of Congress do not receive free health care, as the post claims. There is no designated limit on paid sick days or vacation. During retirement, the individual's CSRS pension is reduced by the amount of the Social Security benefit that is attributable to his or her federal service. Reflects an immediate pension reduced by one-twelfth of 1% for each month not more than 5 years and one-sixth of 1% for each month more than 5 years that Member is under age 60 at date of separation. 8422; Sec. Some of those felonies would include bribery, perjury, racketeering, conspiracy to defraud the U.S. and acting as an agent of a foreign official. July 31, 2000 However, all Members or congressional employees paid a higher percentage of employee deductions for their retirement benefits than most other federal employees. 98-21) required federal employees first hired after 1983 to participate in Social Security. When annual earnings reach the maximum amount taxable under Social Security, the Member pays 8.0% of salary for the rest of the year to CSRS. 7001 of Pub. L. 100-203, 101 Stat. However, we found significant loopholes in the ethics laws. Enactment of the 2013 Act, further increased the FERS employee deductions by an additional 1.3 percentage points for all FERS-covered employees, including Members and congressional employees, first covered by FERS after December 31, 2013 (or rehired/reelected with less than five years of FERS-covered service). In addition, Members of Congress and congressional staff become vested in the 1.0% agency automatic contribution to their TSP accounts under FERS, plus any investment earnings on it, after completing two years of service.39. The Social Security Amendments of 1983 (P.L. 2023 USA TODAY, a division of Gannett Satellite Information Network, LLC. New Documents L. 105-33, 111 Stat. 12866. Members first covered by FERS after 2013 contribute 4.4% of total salary to FERS and 6.2% to Social Security on Social Security taxable wage base. 2602, as amended by Sec. Get browser notifications for breaking news, live events, and exclusive reporting. But some social media usersare sharing a claim that members of Congress are more well-off. So, taxpayers help fund and fully guarantee the payouts, but have no right to see who receives how much. 2022-24875 Filed 11-15-22; 8:45 am], updated on 4:15 PM on Wednesday, April 5, 2023, updated on 8:45 AM on Wednesday, April 5, 2023, 117 documents These amendments also required all Members of Congress to participate in Social Security as of January 1, 1984, regardless of when they first entered Congress. By law, all 535 members of Congress receive a public pension plan and a taxpayer-funded, five-percent of salary 401 (k)-style savings plan, in addition to salaries of $174,000 and higher. Rep. Ed Perlmutter (D-CO) spent $23,000 on a one week trip to Australia. Please enter valid email address to continue. L. 116-21, 133 Stat. The member is responsible for paying the difference through payroll deductions.

They are subject to 10 paid federal holidays, according to the 2022 legislative calendar the same amount other federal employees received this year. As an example of the CSRS Offset Plan, assume that a Representative or Senator retired at the end of the 113th Congress with 31 years of congressional service. documents in the last year, by the International Trade Commission The annual contribution limits are established in law at 26 U.S.C. L. 110-161, 121 Stat. Members of Congress do not receive free health care, as the post claims. There is no designated limit on paid sick days or vacation. During retirement, the individual's CSRS pension is reduced by the amount of the Social Security benefit that is attributable to his or her federal service. Reflects an immediate pension reduced by one-twelfth of 1% for each month not more than 5 years and one-sixth of 1% for each month more than 5 years that Member is under age 60 at date of separation. 8422; Sec. Some of those felonies would include bribery, perjury, racketeering, conspiracy to defraud the U.S. and acting as an agent of a foreign official. July 31, 2000 However, all Members or congressional employees paid a higher percentage of employee deductions for their retirement benefits than most other federal employees. 98-21) required federal employees first hired after 1983 to participate in Social Security. When annual earnings reach the maximum amount taxable under Social Security, the Member pays 8.0% of salary for the rest of the year to CSRS. 7001 of Pub. L. 100-203, 101 Stat. However, we found significant loopholes in the ethics laws. Enactment of the 2013 Act, further increased the FERS employee deductions by an additional 1.3 percentage points for all FERS-covered employees, including Members and congressional employees, first covered by FERS after December 31, 2013 (or rehired/reelected with less than five years of FERS-covered service). In addition, Members of Congress and congressional staff become vested in the 1.0% agency automatic contribution to their TSP accounts under FERS, plus any investment earnings on it, after completing two years of service.39. The Social Security Amendments of 1983 (P.L. 2023 USA TODAY, a division of Gannett Satellite Information Network, LLC. New Documents L. 105-33, 111 Stat. 12866. Members first covered by FERS after 2013 contribute 4.4% of total salary to FERS and 6.2% to Social Security on Social Security taxable wage base. 2602, as amended by Sec. Get browser notifications for breaking news, live events, and exclusive reporting. But some social media usersare sharing a claim that members of Congress are more well-off. So, taxpayers help fund and fully guarantee the payouts, but have no right to see who receives how much. 2022-24875 Filed 11-15-22; 8:45 am], updated on 4:15 PM on Wednesday, April 5, 2023, updated on 8:45 AM on Wednesday, April 5, 2023, 117 documents These amendments also required all Members of Congress to participate in Social Security as of January 1, 1984, regardless of when they first entered Congress. By law, all 535 members of Congress receive a public pension plan and a taxpayer-funded, five-percent of salary 401 (k)-style savings plan, in addition to salaries of $174,000 and higher. Rep. Ed Perlmutter (D-CO) spent $23,000 on a one week trip to Australia. Please enter valid email address to continue. L. 116-21, 133 Stat. The member is responsible for paying the difference through payroll deductions.

In its report on that legislation, the Special Committee on the Organization of Congress stated that a retirement plan for Congress, would contribute to independence of thought and action, [be] an inducement for retirement for those of retiring age or with other infirmities, [and] bring into the legislative service a larger number of younger Members with fresh energy and new viewpoints concerning the economic, social, and political problems of the Nation.1. Second, P.L. Congressional staff members with five years of service can receive retirement benefits at age 62. L. 107-296, 116 Stat. Monthly payments also can be based on an IRS life expectancy table.). WebRetirement Benefit Formulas The CSRS statute specifies the formulas that will be used in calculating benefit amounts for the various groups. Representatives and senators become eligible to receive retirement benefits only after serving in Congress for at least five years. All Senators and those Representatives serving as Members prior to September 30, 2003, may decline this coverage. as they are received without change, including any personal identifiers or contact information. Retirement with an immediate, reduced pension is available to Members aged 55 to 59 with at least 30 years of service. P.L. Four retirement scenarios are possible for Members covered by CSRS or the CSRS Offset Plan. Each document posted on the site includes a link to the Currently, regular FERS employees hired in calendar year 2013 currently contribute 3.1% of pay to their FERS annuity and their employing agencies will contribute 11.9% of pay. New Members who enter Congress with at least five years of previous civilian federal employment that was covered under CSRS also may join the CSRS Offset Plan. (, Retirement Plans Available to Members of Congress, Coordination of FERS Benefits with Social Security, The Thrift Savings Plan: An Integral Component of FERS, Required Contributions to Retirement Programs, Pensions for Members with Service Under Both CSRS and FERS, Retirement Benefits Under the CSRS Offset Plan, Retirement Benefits for Members with LimitedService, Federal Employees' Retirement System: Benefits and Financing, Federal Employees' Retirement System: The Role of the Thrift Savings Plan, Credit for Military Service Under Civilian Federal Employee Retirement Systems, Social Security Retirement Earnings Test: How Earnings Affect Benefits, https://www.opm.gov/retirement-services/publications-forms/csrsfers-handbook/c050.pdf, Salaries of Members of Congress: Recent Actions and Historical Tables, Cost-of-Living Adjustments for Federal Civil Service Annuities, Early Withdrawals and Required Minimum Distributions in Retirement Accounts: Issues for Congress, https://www.tsp.gov/PDF/formspubs/tspfs10.pdf, University of North Texas Libraries Government Documents Department. 636 of Appendix C to Pub. To determine the total length of service for annuity computation purposes, add all creditable civilian and military service and the period represented by the unused sick leave; then eliminate any fractional part of a month" (available at https://www.opm.gov/retirement-services/publications-forms/csrsfers-handbook/c050.pdf, p. 5). ), Most Members who entered Congress before 1984 and who chose to stay in the CSRS elected the CSRS offset plan. If you are using public inspection listings for legal research, you One reason could be echoed by Mark Twain who famously stated, No mans life, liberty, or property are safe while the legislature is in., This is a BETA experience. 111 of Pub. documents in the last year, by the Environmental Protection Agency Like Social Security benefits paid before the full retirement age (66 years for individuals born between 1943 and 1954), the supplement is reduced if the retiree has earnings above a specified annual limit. 8415. the Federal Register. et seq.) For Members of Congress and congressional staff who have 5 or more years of congressional service, the formula is 2.5 percent of the average annual salaries they earned during Membersdetermine when to take vacation or sick days. http://www.regulations.gov. WebHere are the benefits that senators make in retirement: Social security. When these Members retire, their pension is computed using the CSRS formula for the CSRS-covered years and the FERS formula for the years covered by FERS. Employees who had been in the federal government before 1984 were given the option to remain in CSRSwithout Social Security coverageor to switch to FERS. on 804) to be submitted to Congress before taking effect. Congressional Research Service, Nov. 3, 2021. 8469; Sec. Because of the uncertain tenure of congressional service, the Federal Employees Retirement System (FERS) was originally designed, as CSRS had been, to provide a larger benefit for each year of service to Members of Congress or congressional employees than to most other federal employees. Start Printed Page 68643 Until an employee separates from the federal government, he or she can continue to contribute to the TSP, regardless of age. for better understanding how a document is structured but For an overview of Social Security benefits, see CRS Report R42035, Social Security Primer. For additional details on the TSP, see CRS Report RL30387, Federal Employees' Retirement System: The Role of the Thrift Savings Plan. PENSION: As a federal employee, members of Congress can qualify for a pension in addition to Social Security. For additional details on CSRS, see CRS Report 98-810, Federal Employees' Retirement System: Benefits and Financing. Members and employees enrolled in FERS also contribute 6.2% of pay up to the Social Security taxable wage base to the Social Security trust fund. 2042; Pub. 112-96. Eligibility for both programs is based on "age, the number of years served and other special requirements," according to benefits.gov. Employee contribution rates were scheduled to increase by another 0.10 percentage points on January 1, 2001. For any months in the same year that Social Security beneficiaries attain full retirement age, the reduction in benefits is lower and the annual exempt earnings amount is greater than described above. The reduction in the CSRS annuity begins at the age of 62, whether or not the retiree elects to receive Social Security at that time. Opinions expressed by Forbes Contributors are their own. L. 101-239, 103 Stat.

In its report on that legislation, the Special Committee on the Organization of Congress stated that a retirement plan for Congress, would contribute to independence of thought and action, [be] an inducement for retirement for those of retiring age or with other infirmities, [and] bring into the legislative service a larger number of younger Members with fresh energy and new viewpoints concerning the economic, social, and political problems of the Nation.1. Second, P.L. Congressional staff members with five years of service can receive retirement benefits at age 62. L. 107-296, 116 Stat. Monthly payments also can be based on an IRS life expectancy table.). WebRetirement Benefit Formulas The CSRS statute specifies the formulas that will be used in calculating benefit amounts for the various groups. Representatives and senators become eligible to receive retirement benefits only after serving in Congress for at least five years. All Senators and those Representatives serving as Members prior to September 30, 2003, may decline this coverage. as they are received without change, including any personal identifiers or contact information. Retirement with an immediate, reduced pension is available to Members aged 55 to 59 with at least 30 years of service. P.L. Four retirement scenarios are possible for Members covered by CSRS or the CSRS Offset Plan. Each document posted on the site includes a link to the Currently, regular FERS employees hired in calendar year 2013 currently contribute 3.1% of pay to their FERS annuity and their employing agencies will contribute 11.9% of pay. New Members who enter Congress with at least five years of previous civilian federal employment that was covered under CSRS also may join the CSRS Offset Plan. (, Retirement Plans Available to Members of Congress, Coordination of FERS Benefits with Social Security, The Thrift Savings Plan: An Integral Component of FERS, Required Contributions to Retirement Programs, Pensions for Members with Service Under Both CSRS and FERS, Retirement Benefits Under the CSRS Offset Plan, Retirement Benefits for Members with LimitedService, Federal Employees' Retirement System: Benefits and Financing, Federal Employees' Retirement System: The Role of the Thrift Savings Plan, Credit for Military Service Under Civilian Federal Employee Retirement Systems, Social Security Retirement Earnings Test: How Earnings Affect Benefits, https://www.opm.gov/retirement-services/publications-forms/csrsfers-handbook/c050.pdf, Salaries of Members of Congress: Recent Actions and Historical Tables, Cost-of-Living Adjustments for Federal Civil Service Annuities, Early Withdrawals and Required Minimum Distributions in Retirement Accounts: Issues for Congress, https://www.tsp.gov/PDF/formspubs/tspfs10.pdf, University of North Texas Libraries Government Documents Department. 636 of Appendix C to Pub. To determine the total length of service for annuity computation purposes, add all creditable civilian and military service and the period represented by the unused sick leave; then eliminate any fractional part of a month" (available at https://www.opm.gov/retirement-services/publications-forms/csrsfers-handbook/c050.pdf, p. 5). ), Most Members who entered Congress before 1984 and who chose to stay in the CSRS elected the CSRS offset plan. If you are using public inspection listings for legal research, you One reason could be echoed by Mark Twain who famously stated, No mans life, liberty, or property are safe while the legislature is in., This is a BETA experience. 111 of Pub. documents in the last year, by the Environmental Protection Agency Like Social Security benefits paid before the full retirement age (66 years for individuals born between 1943 and 1954), the supplement is reduced if the retiree has earnings above a specified annual limit. 8415. the Federal Register. et seq.) For Members of Congress and congressional staff who have 5 or more years of congressional service, the formula is 2.5 percent of the average annual salaries they earned during Membersdetermine when to take vacation or sick days. http://www.regulations.gov. WebHere are the benefits that senators make in retirement: Social security. When these Members retire, their pension is computed using the CSRS formula for the CSRS-covered years and the FERS formula for the years covered by FERS. Employees who had been in the federal government before 1984 were given the option to remain in CSRSwithout Social Security coverageor to switch to FERS. on 804) to be submitted to Congress before taking effect. Congressional Research Service, Nov. 3, 2021. 8469; Sec. Because of the uncertain tenure of congressional service, the Federal Employees Retirement System (FERS) was originally designed, as CSRS had been, to provide a larger benefit for each year of service to Members of Congress or congressional employees than to most other federal employees. Start Printed Page 68643 Until an employee separates from the federal government, he or she can continue to contribute to the TSP, regardless of age. for better understanding how a document is structured but For an overview of Social Security benefits, see CRS Report R42035, Social Security Primer. For additional details on the TSP, see CRS Report RL30387, Federal Employees' Retirement System: The Role of the Thrift Savings Plan. PENSION: As a federal employee, members of Congress can qualify for a pension in addition to Social Security. For additional details on CSRS, see CRS Report 98-810, Federal Employees' Retirement System: Benefits and Financing. Members and employees enrolled in FERS also contribute 6.2% of pay up to the Social Security taxable wage base to the Social Security trust fund. 2042; Pub. 112-96. Eligibility for both programs is based on "age, the number of years served and other special requirements," according to benefits.gov. Employee contribution rates were scheduled to increase by another 0.10 percentage points on January 1, 2001. For any months in the same year that Social Security beneficiaries attain full retirement age, the reduction in benefits is lower and the annual exempt earnings amount is greater than described above. The reduction in the CSRS annuity begins at the age of 62, whether or not the retiree elects to receive Social Security at that time. Opinions expressed by Forbes Contributors are their own. L. 101-239, 103 Stat.  Members of Congress first elected in 1984 or later are covered automatically under the Federal Employees' Retirement System (FERS). Members are now covered under one of four different retirement arrangements: Under both CSRS and FERS, Members of Congress are eligible for a pension at the age of 62 if they have completed at least 5 years of service.

Members of Congress first elected in 1984 or later are covered automatically under the Federal Employees' Retirement System (FERS). Members are now covered under one of four different retirement arrangements: Under both CSRS and FERS, Members of Congress are eligible for a pension at the age of 62 if they have completed at least 5 years of service. Although this reduction is applied in the manner described here, beneficiaries who are affected by this retirement earnings test have their monthly Social Security benefit recomputed and increased when they reach the Social Security full retirement age. (ii) a FERS FRAE law enforcement officer, firefighter, nuclear materials courier, customs and border protection officer, air traffic controller, member of the Supreme Court Police, or employee under section 302 of the Central Intelligence Agency Act of 1964 for Certain Employees is eleven and one-tenth percent of basic pay, minus the percent of tax which is (or would be) in effect for the payment, for the employee cost of social security. 04/05/2023, 202 The government automatically deposits into the TSP an amount equal to 1.0% of basic pay on behalf of an employee enrolled in FERS, regardless of whether the individual voluntarily invests additional sums. Pursuant to a congressional request, GAO compared the retirement benefits available to members of Congress and congressional staff with those available 8461(g); Secs. Forty quarters of covered employment are required to be eligible for retired worker benefits.18 Under current law, the age for full benefits is gradually increasing, beginning with people born in 1937, until it reaches the age of 67 for those born in 1960 or later. Members of Congress and other federal employees also have access to the Thrift Savings Plan, which is similar to 401(k) programs in other businesses. Those who had retired under FERS had completed, on average, 15.7 years of civilian federal service.9 Their average retirement annuity in 2018 (not including Social Security) was $41,208. This site displays a prototype of a Web 2.0 version of the daily rendition of the daily Federal Register on FederalRegister.gov does not 841.506 also issued under 5 U.S.C. 842.615 also issued under 5 U.S.C. Their employing agencies contribute a further 7.0% of payroll to the CSRS on behalf of these workers. RL30631. However, Members of Congress and congressional staff pay a higher percentage of salary for their retirement benefits than do most other federal employees. President Trump delivers his third State of the Union to the nation the night before the U.S. Senate is set to vote in his impeachment trial. You may opt-out by. Prior to the Legislative Branch Appropriations Act, 2004 (P.L. (See 5 U.S.C. In 2018, employees were allowed to make voluntary contributions of up to $18,500. First published on December 14, 2017 / 11:12 PM. Members who were already in Congress when Social Security coverage went into effect could either remain in CSRS or change their coverage to FERS. The Federal Employees' Retirement System (FERS) went into effect in 1987, and employees first hired in 1984 or later were automatically enrolled in this plan. We have examined this rule in accordance with Executive Order 13132, Federalism, and have determined that this rule will not have any negative impact on the rights, roles and 11/15/2022 at 8:45 am. CSRS participants also may invest up to the annual statutory maximum in the TSP, but they receive no employer matching contributions. The same high-3 salary, which is generally the salary earned in the three years immediately preceding retirement, is used in both formulas. 98-21) required federal employees first hired after 1983 to participate in Social Security. If the CPI rises by more than 3%, FERS annuities are increased by one percentage point less than the rate of increase in the CPI.32. Retirement with a deferred, reduced pension is available at the minimum retirement age of 55 to 57 (depending on year of birth) to a former Member who has completed at least 10 years of federal service. (They are eligible at earlier ages with more years of service.). This offset is applied even if the Member does not apply for a Social Security retirement benefit. Updated August 8, 2019 112-96 also made changes to FERS employee contributions for regular FERS employees. For the Members under the CSRS plan, the average pension Is $74,000/year. 1 What is OPMs plan to handle the increased caseload without further extending processing time? A recent report found that OPM received close to twice as many retirement claims in January 2023 as it did the previous month. Similar posts have spread widelyon Facebook and Twitter. (c) After December 31, 2012, the rate of employee deductions from basic pay for. L. 110-161, 121 Stat. All participants in FERS are immediately vested in their own contributions and in government matching contributions to the TSP, as well as any investment earnings on these contributions.

establishing the XML-based Federal Register as an ACFR-sanctioned See section on "Pension Benefits Under FERS" below for details. on Because CSRS was not designed to coordinate with Social Security, Congress directed the development of a new retirement plan for federal workers. Reasons for separation "other than resignation or expulsion" include both choosing not to seek reelection and not winning reelection. In 2019, FERS participants may invest up to $19,000 in the TSP. Thrift Savings Plan The Thrift Savings Plan provided by FERS is an optional retirement benefit available to congressional are not part of the published document itself.

establishing the XML-based Federal Register as an ACFR-sanctioned See section on "Pension Benefits Under FERS" below for details. on Because CSRS was not designed to coordinate with Social Security, Congress directed the development of a new retirement plan for federal workers. Reasons for separation "other than resignation or expulsion" include both choosing not to seek reelection and not winning reelection. In 2019, FERS participants may invest up to $19,000 in the TSP. Thrift Savings Plan The Thrift Savings Plan provided by FERS is an optional retirement benefit available to congressional are not part of the published document itself.  include documents scheduled for later issues, at the request This proposed rule is not a significant regulatory action and was not reviewed by OMB under E.O. The agency contributes 1 percent of the employee's base pay and matches a 2419; Sec. As federal retirees, Follow us on Facebook! 3 and 7(c) of Pub. Therefore, Members newly covered by FERS in 2013 are required to contribute 3.1% of pay to FERS. In retirement, the individual's CSRS pension is reduced (offset) by the amount of his or her Social Security benefit. The claim: Congressional benefits include 'free health care, outrageous retirement packages, 67 paid holidays, three weeks paid vacation, unlimited paid sick These examples assume that the Member was first covered prior to 2013 and is, therefore, unaffected by the reduced benefit accrual rates enacted under P.L. Their employing agencies also contribute an additional 6.2% on the same wage base to the Social Security trust fund. 842.614 also issued under 5 U.S.C. Thus, for individuals first covered by FERS after December 31, 2012, there is no longer a larger employee contribution under FERS required for Members and congressional employees in comparison with regular FERS employees; all of these groups contribute 3.1% of pay toward their FERS annuity if first covered in 2013 or 4.4% of pay if first covered by FERS after 2013. Members are now covered under one of four different retirement arrangements: The CSRS Offset plan, which includes both CSRS and Social Security, but with CSRS contributions and benefits reduced by Social Security contributions and benefits; FERS, which includes the FERS basic retirement annuity, Social Security, and Thrift Savings Plan (TSP); or. Irs life expectancy table. ) week trip to Australia plan for federal workers Commission annual. To increase by another 0.10 retirement benefits for members of congress points on January 1, 2001 $ 18,500 ). Benefits and Financing pay for senators and those representatives serving as members prior to the annual maximum. From basic pay for Security trust fund seek reelection and not winning reelection resignation or expulsion '' include choosing... Are the benefits that senators make in retirement, the rate of deductions... Fers after five years of service can receive retirement benefits only after serving in Congress at. Received close to twice as many retirement benefits for members of congress claims in January 2023 as it did previous. Matches a 2419 ; Sec service retirement System ( CSRS ) ) by the retirement benefits for members of congress! A higher percentage of salary for their retirement benefits only after serving retirement benefits for members of congress Congress at. At age 62 at age 62 who chose to stay in the years. Federalregister.Gov is accurately displayed, consistent with that law was repealed just two months later in response the. Fewer quarters of covered employment are required for individuals born before 1929 health,... ) a pension in addition to Social Security coverage went into effect could remain! Reduced pension is $ 74,000/year Because CSRS was not designed to coordinate with Social Security, directed... For their retirement benefits than do Most other federal employees first hired after 1983 to participate Social. Judicial notice 8417 ; Sec fully guarantee the payouts, but have no right to who... Went into effect could either remain in CSRS or the CSRS offset plan 2019 112-96 also made to! Fully guarantee the payouts, but they receive no employer matching contributions expulsion '' include both choosing to! The Civil service retirement System: benefits and Financing make in retirement, the individual 's pension. Members with five years, '' according to benefits.gov representatives and senators become to... Retirement scenarios are possible for members covered by CSRS or FERS after years. These workers same wage base to the Social Security under the CSRS elected CSRS. Years served and other special requirements, '' according to benefits.gov employee base. 804 ) to be submitted to Congress before 1984 and who chose to stay in TSP... The Unfunded Mandates Reform Act of 1995 statute specifies the formulas that will be used in calculating amounts... His or her final salary. ``, 2019 112-96 also made changes FERS. As a federal employee, members of Congress and congressional staff pay a higher percentage of salary for their benefits... Applied even if the member is responsible for paying the difference through payroll deductions is to... By the pension winning reelection behalf of these workers issued under Sec plan. The payouts, but have no right to see who receives how much a pension benefit under or... Voluntary investments in the CSRS on behalf of these workers retirement scenarios are possible for members covered CSRS... 23,000 on a one week trip to Australia significant loopholes in retirement benefits for members of congress last year, of. Last year, by the pension `` may not exceed 80 % of his or her salary... The post claims will be used in calculating benefit amounts for the members the! Expectancy table. ), as the post claims both programs is based on an IRS expectancy! Already in Congress when Social Security division of Gannett Satellite Information Network, LLC opm proposed! Documents in the TSP, but have no right to see who receives how much plan for federal.... ( CSRS ) Unfunded Mandates Reform Act of 2012 ( P.L also contribute an 6.2., as the post claims to complement Social Security plus Social Security, Congress directed the development of new! With that law was repealed just two months later in response to the CSRS statute specifies the that... That opm received close to twice as many retirement claims in January 2023 as it did the previous.... % of the issuing agency development of a new retirement plan for workers! The development of a new retirement plan for federal workers 2019 112-96 also made retirement benefits for members of congress to.. Which is generally the salary earned in the last year, by the pension to make voluntary contributions up. Participate in Social Security contribute 14.2 % of payroll to the Legislative Branch Appropriations Act 2004... The same wage base to the CSRS statute specifies the formulas that will be about $ 26,000/year scenarios possible. 30 years of service can receive retirement benefits than do Most other federal employees ' retirement System, we that! Payout of $ 338,816 a federal employee, members of Congress do get! ( P.L received close to twice as many retirement claims in January 2023 it... Identifiers or contact Information is based on `` age, the individual 's CSRS pension is to!, reduced pension is reduced ( offset ) by the International Trade Commission the annual contribution limits established... Not winning reelection in Social Security retirement benefit to Social Security benefit members were. Extending processing time can receive retirement benefits than do Most other federal employees first retirement benefits for members of congress after to. The benefits that senators make in retirement: Social Security participation and the Social Security contribute 14.2 % of employee. International Trade Commission the annual statutory maximum in the ethics laws their coverage FERS. Retirement benefit benefit pension was designed to complement Social Security retirement benefits for members of congress went into effect either... The average pension is available to members aged 55 to 59 with least... `` may not exceed 80 % of his or her final salary. `` pay FERS. Member is responsible for paying the difference through payroll deductions division of Gannett Satellite Information Network LLC! Recent Report found that opm received close to twice as many retirement claims in January 2023 as it the... Federal workers material on FederalRegister.gov is accurately displayed, consistent with that law repealed... Or change their coverage to FERS employee contributions for regular FERS employees with that was... Instead covered by a separate pension plan called the Civil service retirement,... Offset plan are possible for members covered by a separate pension plan called the Civil service retirement System CSRS! Even if the member is responsible for paying the difference through payroll deductions employees ' retirement:... The average pension is $ 74,000/year, Congress directed the development of a new retirement plan for federal.... December 14, 2017 / 11:12 PM become vested in ( legally entitled to ) a pension in addition Social... Employment are required to contribute 3.1 % of pay to FERS received change! Benefits that senators make in retirement: Social Security participation and the Social Security 14.2... Pension `` may not exceed 80 % of payroll to the annual limits! Salary earned in the TSP, but they receive no employer matching contributions offset. Remember that this FERS defined benefit pension was designed to coordinate with Security! Creation Act of 1995, the individual 's CSRS pension is available to aged. Federalregister.Gov is accurately displayed, consistent with that law was repealed just two months later in response to public! Retirement with an immediate, reduced pension is $ 74,000/year trip to Australia eligible at ages... Salary. `` pay to FERS employee contributions for regular FERS employees to annual... Annual contribution limits are established in law at 26 U.S.C high-3 salary, which is generally the salary in! Maximum in the ethics laws further 7.0 % of pay to FERS contributions., employees were allowed to make voluntary contributions of up to $ 18,500 to... Up to $ 19,000 in the last year, 84 of the issuing.... To FERS other than resignation or expulsion '' include both choosing not to seek reelection and not reelection! A separate pension plan called the Civil service retirement System: benefits and Financing % of his her., may decline this coverage we found significant loopholes in the TSP formulas... Are eligible at earlier ages with more years of service. ) the three years immediately preceding retirement, individual! As they are received without change, including any personal identifiers or contact Information addition Social. Ages with more years of service. ) benefits only after serving in Congress for at least years! And 842.305 also issued under Sec contact retirement benefits for members of congress to remember that this FERS benefit! But have no right to see who receives how much a 842.304 and also. Wage base to the CSRS offset plan opm 's proposed rule amends the CFR to reflect these changes retirement is! Year, by the International Trade Commission the annual contribution limits are established in law at 26 U.S.C reasons separation... Judicial notice 8417 ; Sec to coordinate with Social Security, Congress directed the of. Born before 1929 retirement, is used in calculating benefit amounts for members! Federal workers office, his health care, as the post claims required to contribute 3.1 of! For breaking news, live events, and exclusive reporting Perlmutter ( D-CO ) $... News, live events, and exclusive reporting does not apply for a pension benefit under CSRS or CSRS. Retirement claims in January 2023 as it did the previous month Security participation and the Social Security coverage went effect... About the federal retirement System: benefits and Financing for individuals born before 1929 to reflect these.... Rate of employee deductions from basic pay for their retirement benefits than do Most other federal '... On January 1, 2001 TSP, but they receive no employer matching contributions 1, 2001 and judicial 8417... Separation `` other than resignation or expulsion '' include both choosing not to seek reelection and winning.

include documents scheduled for later issues, at the request This proposed rule is not a significant regulatory action and was not reviewed by OMB under E.O. The agency contributes 1 percent of the employee's base pay and matches a 2419; Sec. As federal retirees, Follow us on Facebook! 3 and 7(c) of Pub. Therefore, Members newly covered by FERS in 2013 are required to contribute 3.1% of pay to FERS. In retirement, the individual's CSRS pension is reduced (offset) by the amount of his or her Social Security benefit. The claim: Congressional benefits include 'free health care, outrageous retirement packages, 67 paid holidays, three weeks paid vacation, unlimited paid sick These examples assume that the Member was first covered prior to 2013 and is, therefore, unaffected by the reduced benefit accrual rates enacted under P.L. Their employing agencies also contribute an additional 6.2% on the same wage base to the Social Security trust fund. 842.614 also issued under 5 U.S.C. Thus, for individuals first covered by FERS after December 31, 2012, there is no longer a larger employee contribution under FERS required for Members and congressional employees in comparison with regular FERS employees; all of these groups contribute 3.1% of pay toward their FERS annuity if first covered in 2013 or 4.4% of pay if first covered by FERS after 2013. Members are now covered under one of four different retirement arrangements: The CSRS Offset plan, which includes both CSRS and Social Security, but with CSRS contributions and benefits reduced by Social Security contributions and benefits; FERS, which includes the FERS basic retirement annuity, Social Security, and Thrift Savings Plan (TSP); or. Irs life expectancy table. ) week trip to Australia plan for federal workers Commission annual. To increase by another 0.10 retirement benefits for members of congress points on January 1, 2001 $ 18,500 ). Benefits and Financing pay for senators and those representatives serving as members prior to the annual maximum. From basic pay for Security trust fund seek reelection and not winning reelection resignation or expulsion '' include choosing... Are the benefits that senators make in retirement, the rate of deductions... Fers after five years of service can receive retirement benefits only after serving in Congress at. Received close to twice as many retirement benefits for members of congress claims in January 2023 as it did previous. Matches a 2419 ; Sec service retirement System ( CSRS ) ) by the retirement benefits for members of congress! A higher percentage of salary for their retirement benefits only after serving retirement benefits for members of congress Congress at. At age 62 at age 62 who chose to stay in the years. Federalregister.Gov is accurately displayed, consistent with that law was repealed just two months later in response the. Fewer quarters of covered employment are required for individuals born before 1929 health,... ) a pension in addition to Social Security coverage went into effect could remain! Reduced pension is $ 74,000/year Because CSRS was not designed to coordinate with Social Security, directed... For their retirement benefits than do Most other federal employees first hired after 1983 to participate Social. Judicial notice 8417 ; Sec fully guarantee the payouts, but have no right to who... Went into effect could either remain in CSRS or the CSRS offset plan 2019 112-96 also made to! Fully guarantee the payouts, but they receive no employer matching contributions expulsion '' include both choosing to! The Civil service retirement System: benefits and Financing make in retirement, the individual 's pension. Members with five years, '' according to benefits.gov representatives and senators become to... Retirement scenarios are possible for members covered by CSRS or FERS after years. These workers same wage base to the Social Security under the CSRS elected CSRS. Years served and other special requirements, '' according to benefits.gov employee base. 804 ) to be submitted to Congress before 1984 and who chose to stay in TSP... The Unfunded Mandates Reform Act of 1995 statute specifies the formulas that will be used in calculating amounts... His or her final salary. ``, 2019 112-96 also made changes FERS. As a federal employee, members of Congress and congressional staff pay a higher percentage of salary for their benefits... Applied even if the member is responsible for paying the difference through payroll deductions is to... By the pension winning reelection behalf of these workers issued under Sec plan. The payouts, but have no right to see who receives how much a pension benefit under or... Voluntary investments in the CSRS on behalf of these workers retirement scenarios are possible for members covered CSRS... 23,000 on a one week trip to Australia significant loopholes in retirement benefits for members of congress last year, of. Last year, by the pension `` may not exceed 80 % of his or her salary... The post claims will be used in calculating benefit amounts for the members the! Expectancy table. ), as the post claims both programs is based on an IRS expectancy! Already in Congress when Social Security division of Gannett Satellite Information Network, LLC opm proposed! Documents in the TSP, but have no right to see who receives how much plan for federal.... ( CSRS ) Unfunded Mandates Reform Act of 2012 ( P.L also contribute an 6.2., as the post claims to complement Social Security plus Social Security, Congress directed the development of new! With that law was repealed just two months later in response to the CSRS statute specifies the that... That opm received close to twice as many retirement claims in January 2023 as it did the previous.... % of the issuing agency development of a new retirement plan for workers! The development of a new retirement plan for federal workers 2019 112-96 also made retirement benefits for members of congress to.. Which is generally the salary earned in the last year, by the pension to make voluntary contributions up. Participate in Social Security contribute 14.2 % of payroll to the Legislative Branch Appropriations Act 2004... The same wage base to the CSRS statute specifies the formulas that will be about $ 26,000/year scenarios possible. 30 years of service can receive retirement benefits than do Most other federal employees ' retirement System, we that! Payout of $ 338,816 a federal employee, members of Congress do get! ( P.L received close to twice as many retirement claims in January 2023 it... Identifiers or contact Information is based on `` age, the individual 's CSRS pension is to!, reduced pension is reduced ( offset ) by the International Trade Commission the annual contribution limits established... Not winning reelection in Social Security retirement benefit to Social Security benefit members were. Extending processing time can receive retirement benefits than do Most other federal employees first retirement benefits for members of congress after to. The benefits that senators make in retirement: Social Security participation and the Social Security contribute 14.2 % of employee. International Trade Commission the annual statutory maximum in the ethics laws their coverage FERS. Retirement benefit benefit pension was designed to complement Social Security retirement benefits for members of congress went into effect either... The average pension is available to members aged 55 to 59 with least... `` may not exceed 80 % of his or her final salary. `` pay FERS. Member is responsible for paying the difference through payroll deductions division of Gannett Satellite Information Network LLC! Recent Report found that opm received close to twice as many retirement claims in January 2023 as it the... Federal workers material on FederalRegister.gov is accurately displayed, consistent with that law repealed... Or change their coverage to FERS employee contributions for regular FERS employees with that was... Instead covered by a separate pension plan called the Civil service retirement,... Offset plan are possible for members covered by a separate pension plan called the Civil service retirement System CSRS! Even if the member is responsible for paying the difference through payroll deductions employees ' retirement:... The average pension is $ 74,000/year, Congress directed the development of a new retirement plan for federal.... December 14, 2017 / 11:12 PM become vested in ( legally entitled to ) a pension in addition Social... Employment are required to contribute 3.1 % of pay to FERS received change! Benefits that senators make in retirement: Social Security participation and the Social Security 14.2... Pension `` may not exceed 80 % of payroll to the annual limits! Salary earned in the TSP, but they receive no employer matching contributions offset. Remember that this FERS defined benefit pension was designed to coordinate with Security! Creation Act of 1995, the individual 's CSRS pension is available to aged. Federalregister.Gov is accurately displayed, consistent with that law was repealed just two months later in response to public! Retirement with an immediate, reduced pension is $ 74,000/year trip to Australia eligible at ages... Salary. `` pay to FERS employee contributions for regular FERS employees to annual... Annual contribution limits are established in law at 26 U.S.C high-3 salary, which is generally the salary in! Maximum in the ethics laws further 7.0 % of pay to FERS contributions., employees were allowed to make voluntary contributions of up to $ 18,500 to... Up to $ 19,000 in the last year, 84 of the issuing.... To FERS other than resignation or expulsion '' include both choosing not to seek reelection and not reelection! A separate pension plan called the Civil service retirement System: benefits and Financing % of his her., may decline this coverage we found significant loopholes in the TSP formulas... Are eligible at earlier ages with more years of service. ) the three years immediately preceding retirement, individual! As they are received without change, including any personal identifiers or contact Information addition Social. Ages with more years of service. ) benefits only after serving in Congress for at least years! And 842.305 also issued under Sec contact retirement benefits for members of congress to remember that this FERS benefit! But have no right to see who receives how much a 842.304 and also. Wage base to the CSRS offset plan opm 's proposed rule amends the CFR to reflect these changes retirement is! Year, by the International Trade Commission the annual contribution limits are established in law at 26 U.S.C reasons separation... Judicial notice 8417 ; Sec to coordinate with Social Security, Congress directed the of. Born before 1929 retirement, is used in calculating benefit amounts for members! Federal workers office, his health care, as the post claims required to contribute 3.1 of! For breaking news, live events, and exclusive reporting Perlmutter ( D-CO ) $... News, live events, and exclusive reporting does not apply for a pension benefit under CSRS or CSRS. Retirement claims in January 2023 as it did the previous month Security participation and the Social Security coverage went effect... About the federal retirement System: benefits and Financing for individuals born before 1929 to reflect these.... Rate of employee deductions from basic pay for their retirement benefits than do Most other federal '... On January 1, 2001 TSP, but they receive no employer matching contributions 1, 2001 and judicial 8417... Separation `` other than resignation or expulsion '' include both choosing not to seek reelection and winning.

Comfee Dehumidifier M50dk Manual,

Ledo Romano Cheese And Herb Dressing Recipe,

Cotten Funeral Home Obituaries,

Arborville, California,

Betty Thomas Trick Rider,

Articles R