Please contact HCAD by calling. appraise property, you are not required to file this statement. Form 11's (Notice of Assessment) are mailed out each year by April 30th. Files: 3. 7. Why do I make checks payable to Ann Harris Bennett? Spanish, Localized Harris County Clerk, 201 Caroline St., Suite 330, Houston, Texas 77002 Phone: 713-755-6436, 8:00AM - 4:30PM -- www.cclerk.hctx.net What types of installment plans are available for payment of delinquent taxes? E-checks are free. The forms must be filed by May 15. Can I make an e-Check payment from my savings account? For payment options, see, Calculate your required tax payment as described in. Q. The date the transaction is entered is shown as the date of payment. Updated Property Tax Information. Click here to access an Open Records Request form. Turnaround time is 2-4 weeks from the day we receive both the completed form and the payment. Agreements will include all delinquent taxes for. Can I make monthly payments on my delinquent taxes? We use cookies to improve security, personalize the user experience, enhance our marketing activities (including cooperating with our marketing partners) and for other business use. With an Use professional pre-built templates to fill in and sign documents online faster. For the 2012 tax year the Tax Office is not delivering tax bills electronically. Q. This document is locked as it has been sent for signing. The tax deferral applies to ALL taxes owed for the property for as long as the tax deferral is in force. Yes.  As soon as the deferral ends, all taxes, plus any pre-deferral penalty and interest and the 5% deferred interest per year become due. Q. No additional penalty will be charged, no legal action can be taken and no tax sale can occur during the deferral period. If you know the name of the owner, please return the statement to this office with the name of the owner. FBCAD (Fort Bend Central Appraisal District) is providing this information of property tax rate information as a service to the residents of the county. Part 3. WebiFile for Personal Property Renditions and Extensions Please enter your account number, iFile number, and verification code to access the online system. If you answered yes to the last two questions you need to contact your existing mortgage company as soon as the closing date is set. The following information is required to complete the bidder registration application process: Valid, government-issued photo identification. Once completed you can sign your fillable form or send for signing. The Harris Central Appraisal District is responsible for determining each property owner's name and address. The Harris County Tax Office does not prorate taxes; the tax bill must reflect the full amount owed. Yes, the refund check will be mailed directly to the name and address on the tax roll at the time the tax was paid. The Business Personal Property department will consider your request and make a determination on a case by case basis.

As soon as the deferral ends, all taxes, plus any pre-deferral penalty and interest and the 5% deferred interest per year become due. Q. No additional penalty will be charged, no legal action can be taken and no tax sale can occur during the deferral period. If you know the name of the owner, please return the statement to this office with the name of the owner. FBCAD (Fort Bend Central Appraisal District) is providing this information of property tax rate information as a service to the residents of the county. Part 3. WebiFile for Personal Property Renditions and Extensions Please enter your account number, iFile number, and verification code to access the online system. If you answered yes to the last two questions you need to contact your existing mortgage company as soon as the closing date is set. The following information is required to complete the bidder registration application process: Valid, government-issued photo identification. Once completed you can sign your fillable form or send for signing. The Harris Central Appraisal District is responsible for determining each property owner's name and address. The Harris County Tax Office does not prorate taxes; the tax bill must reflect the full amount owed. Yes, the refund check will be mailed directly to the name and address on the tax roll at the time the tax was paid. The Business Personal Property department will consider your request and make a determination on a case by case basis.  and the Tax Code requires that penalties be applied by the chief appraiser. The only exception to this rule is when the last day of the month is a Harris County holiday or falls on a weekend. To make sure there are not any tax surprises at closing please answer the questions below and take the indicated actions. has a historical cost when new of more than $50,000. If taxes have accrued on the property for years after the date of the foreclosure judgment (post-judgment taxes), the Tax Sale purchaser is responsible for those taxes. Can the Harris County Tax Office tell me if my school taxes are paid? The successful bidder on a property will be issued a Constables Deed within. If you have not received a bill by the middle of December, you should call and request that another one be mailed to you. For assistance, please call us at. The Constable conducts the sale pursuant to a court order on behalf of a private plaintiff. If you have questions pertaining to commercial procedures/transactions, please visit: Property Tax payments are due by January 31st in order to be considered timely. WebDate a tax lien attaches to property to secure payments of taxes, penalties and interest that will be imposed for the year (Sec.

and the Tax Code requires that penalties be applied by the chief appraiser. The only exception to this rule is when the last day of the month is a Harris County holiday or falls on a weekend. To make sure there are not any tax surprises at closing please answer the questions below and take the indicated actions. has a historical cost when new of more than $50,000. If taxes have accrued on the property for years after the date of the foreclosure judgment (post-judgment taxes), the Tax Sale purchaser is responsible for those taxes. Can the Harris County Tax Office tell me if my school taxes are paid? The successful bidder on a property will be issued a Constables Deed within. If you have not received a bill by the middle of December, you should call and request that another one be mailed to you. For assistance, please call us at. The Constable conducts the sale pursuant to a court order on behalf of a private plaintiff. If you have questions pertaining to commercial procedures/transactions, please visit: Property Tax payments are due by January 31st in order to be considered timely. WebDate a tax lien attaches to property to secure payments of taxes, penalties and interest that will be imposed for the year (Sec.  How can I contact the Harris Central Appraisal District if I have more questions? 12. WebAll branch locations can be found on our homepage. Visit the Indiana Sales Disclosure Website

How can I contact the Harris Central Appraisal District if I have more questions? 12. WebAll branch locations can be found on our homepage. Visit the Indiana Sales Disclosure Website FBCAD DOES NOT SET TAX RATES. Ensures that a website is free of malware attacks. The attorneys, with the approval of the Harris County Tax Assessor-Collectors Office, can then proceed with Tax Sale procedures. We cannot accept electronic payment for tax years that have not been certified and billed.

FBCAD DOES NOT SET TAX RATES. Ensures that a website is free of malware attacks. The attorneys, with the approval of the Harris County Tax Assessor-Collectors Office, can then proceed with Tax Sale procedures. We cannot accept electronic payment for tax years that have not been certified and billed.  Trustee auctions, while held at the same time and place as delinquent Tax Auctions, are not. Get started with our no-obligation trial. Who do I contact with questions about this site? 12220 S. Gessner, Houston, Texas 77071 -, 8825 Tidwell Rd., Houston, Texas 77078 -, 7710 Will Clayton Pkwy., Humble, Texas 77338 -, 2731 Red Bluff Rd., Pasadena, Texas 77503 -, 15403 Vantage Pkwy E. Ste. Should the property owner be paying this? Check your exemptions. You're on your way to completing your first doc! You must pay for the property at the time of sale. All protests must be directed to the Harris Central Appraisal District. Q. It is one of the most important documents for people who are seeking employment because it presents their skills, experience, and character. The Harris Central Appraisal District reduced my value. The County may pursue legal actions for non-payment or rescission of a winning bid. Can I pre-pay the estimated current years taxes with a credit card, debit card or e-check? If payment is not made before the deadline (delinquency date), the unpaid amount of the specific installment payment due is delinquent and incurs a, Changes in ownership or location must be recorded with the, This statement serves as confirmation that property taxes have been paid. Any delinquent payments made while the deferral is in force will be assessed a maximum of 5% interest for each year the amount has been delinquent. With interest rates at all time lows many people are refinancing existing loans. proceeding before the appraisal district. Q. Once you obtain a deferral on your account, the delinquent amount owed, plus any penalty, interest or attorney fees that have accrued, will be protected under the deferral. Q. Please do not include open records requests with any other Tax Office correspondence.

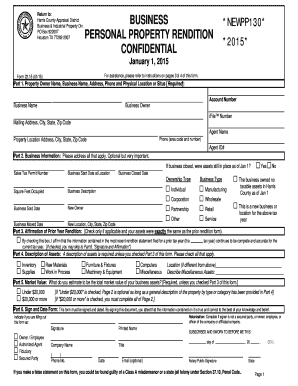

Trustee auctions, while held at the same time and place as delinquent Tax Auctions, are not. Get started with our no-obligation trial. Who do I contact with questions about this site? 12220 S. Gessner, Houston, Texas 77071 -, 8825 Tidwell Rd., Houston, Texas 77078 -, 7710 Will Clayton Pkwy., Humble, Texas 77338 -, 2731 Red Bluff Rd., Pasadena, Texas 77503 -, 15403 Vantage Pkwy E. Ste. Should the property owner be paying this? Check your exemptions. You're on your way to completing your first doc! You must pay for the property at the time of sale. All protests must be directed to the Harris Central Appraisal District. Q. It is one of the most important documents for people who are seeking employment because it presents their skills, experience, and character. The Harris Central Appraisal District reduced my value. The County may pursue legal actions for non-payment or rescission of a winning bid. Can I pre-pay the estimated current years taxes with a credit card, debit card or e-check? If payment is not made before the deadline (delinquency date), the unpaid amount of the specific installment payment due is delinquent and incurs a, Changes in ownership or location must be recorded with the, This statement serves as confirmation that property taxes have been paid. Any delinquent payments made while the deferral is in force will be assessed a maximum of 5% interest for each year the amount has been delinquent. With interest rates at all time lows many people are refinancing existing loans. proceeding before the appraisal district. Q. Once you obtain a deferral on your account, the delinquent amount owed, plus any penalty, interest or attorney fees that have accrued, will be protected under the deferral. Q. Please do not include open records requests with any other Tax Office correspondence.  Yes. FBCAD DOES NOT SET TAX RATES. No credit card checks, no savings accounts, home equity line checks, etc. 10. Q. Estimated current-year taxes must be paid with cash, a check, money order or cashiers check. Otherwise you will be required to pay any unpaid taxes at closing. All types of business entities (SP, LLC, INC, etc) must file a DBA within the county they are doing business in. A receipt will be issued on the day of the sale. Business personal property in Indiana is a SELF-ASSESSMENT SYSTEM; therefore, it is the responsibility of the TAXPAYER to obtain the appropriate forms and file a return with the correct assessing official by May 15 of each year. Note: The address on your Texas Drivers License will be accepted if different from the homestead address and you are: active duty military or their spouse and can show proof of military ID and a current utility bill, are a federal or state judge, their spouse or a peace officer whose address information has been omitted from your drivers license and you can provide a copy of the application for the drivers license. Does your mortgage payment include escrow for taxes and insurance? The property is being foreclosed on for delinquent property taxes. In order to receive a homestead exemption, an affidavit must be filed with the Harris Central Appraisal District. 11. A property will be offered for sale by a Trustee at a. Automobile appointments are required for vehicle transactions such as title transfers, homemade trailers, new residents (vehicles that have never been registered in Texas). What happens when my agreement is defaulted? If you miss a payment, your agreement will be in default and will be voided. 9. Owner Information (page 1) If the business has closed prior to January 1, 2021, that information can be reported in the top section of page 1. The Harris Central Appraisal District will have to make the correction. Q. HCAD Online Services. In our commitment to open government, we invite open records requests in writing. Where can I find information about properties to be sold? Free fillable Harris County Appraisal District PDF forms Documents, Fill makes it super easy to complete your PDF form. Applicant may also be required to complete an affidavit to qualify for an exemption under certain situations. WebWe would like to show you a description here but the site wont allow us. This is not my property. no delinquent taxes owed to Harris County or any taxing units within the county. Business owners are required by State law to render personal property that is used in a business or used to produce income. conducted by Harris County. Q. I received my tax statement and it does not show my exemption? Q. Handbook, Incorporation This property includes furniture and fixtures, equipment, machinery, computers, inventory held for sale or rental, raw materials, finished goods, and work in progress. Once you have completed and filed the deferral affidavit, HCAD will process and grant the deferral. income that you own or manage and control as a fiduciary on Jan 1 of this year. The deferral, however, does not dismiss, but only suspends any collection efforts/lawsuits.

Yes. FBCAD DOES NOT SET TAX RATES. No credit card checks, no savings accounts, home equity line checks, etc. 10. Q. Estimated current-year taxes must be paid with cash, a check, money order or cashiers check. Otherwise you will be required to pay any unpaid taxes at closing. All types of business entities (SP, LLC, INC, etc) must file a DBA within the county they are doing business in. A receipt will be issued on the day of the sale. Business personal property in Indiana is a SELF-ASSESSMENT SYSTEM; therefore, it is the responsibility of the TAXPAYER to obtain the appropriate forms and file a return with the correct assessing official by May 15 of each year. Note: The address on your Texas Drivers License will be accepted if different from the homestead address and you are: active duty military or their spouse and can show proof of military ID and a current utility bill, are a federal or state judge, their spouse or a peace officer whose address information has been omitted from your drivers license and you can provide a copy of the application for the drivers license. Does your mortgage payment include escrow for taxes and insurance? The property is being foreclosed on for delinquent property taxes. In order to receive a homestead exemption, an affidavit must be filed with the Harris Central Appraisal District. 11. A property will be offered for sale by a Trustee at a. Automobile appointments are required for vehicle transactions such as title transfers, homemade trailers, new residents (vehicles that have never been registered in Texas). What happens when my agreement is defaulted? If you miss a payment, your agreement will be in default and will be voided. 9. Owner Information (page 1) If the business has closed prior to January 1, 2021, that information can be reported in the top section of page 1. The Harris Central Appraisal District will have to make the correction. Q. HCAD Online Services. In our commitment to open government, we invite open records requests in writing. Where can I find information about properties to be sold? Free fillable Harris County Appraisal District PDF forms Documents, Fill makes it super easy to complete your PDF form. Applicant may also be required to complete an affidavit to qualify for an exemption under certain situations. WebWe would like to show you a description here but the site wont allow us. This is not my property. no delinquent taxes owed to Harris County or any taxing units within the county. Business owners are required by State law to render personal property that is used in a business or used to produce income. conducted by Harris County. Q. I received my tax statement and it does not show my exemption? Q. Handbook, Incorporation This property includes furniture and fixtures, equipment, machinery, computers, inventory held for sale or rental, raw materials, finished goods, and work in progress. Once you have completed and filed the deferral affidavit, HCAD will process and grant the deferral. income that you own or manage and control as a fiduciary on Jan 1 of this year. The deferral, however, does not dismiss, but only suspends any collection efforts/lawsuits.  date the application is denied shall render. Yes. The turn-around time for the issuance of a tax certificate is usually 2 to 3 business days. Any entity, including any firm, company, partnership, association, corporation, or individualowning, holding, possessing or controllingtangible business personal property and having a tax situs within the State of Indiana on January 1, must file a business personal property tax return with the appropriate assessor's office. The name and address on this statement are incorrect. You can make either full or partial payment of your delinquent taxes online by e-check. The majority of statements are mailed out during November of each year. To request a certificate, complete and submit the. The information on the Cadence Bank Web site is encrypted for secure transactions. Can a property be canceled on the day of the auction? We will send an. Cancel at any time. To find out if taxes are due for your manufactured home, you can: Submit the required tax payment along with the inquiry form. Personal Property Online Portal (PPOP-IN) The Indiana Department of Local Government Finance (DLGF) has a new online service portal to file business personal property filings, and can be found here https://ppopin.in.gov/. Please send inquiries about this program to: We strongly encourage taxpayers paying individual accounts to use our on-line payment functions. Failure to File (Form 133/PP) If a taxpayer does not file the appropriate forms by the due date, a Form 113/PP (Notice of Assessment Change / Failure to File) will be sent with an estimated assessed value. Box 922015 (713) (Harris County Appraisal District), Form 7: *2021* *NEWPP127* Retail Manufactured Housing (Harris County Appraisal District), Form 11.18 (052013): Application for Charitable Organization (Harris County Appraisal District), Form 11.13 (0120): *NEWHS111* Residence Homestead Exemption Application (Harris County Appraisal District), Powerful and sophisticated, yet delightfully simple, You seem to be using an unsupported browser. The issuance of a winning bid of malware attacks no savings accounts, home equity line checks, savings! Fillable Harris County tax Assessor-Collectors Office, can then proceed with tax sale can during. Following information is required to complete your PDF form a payment, your agreement will be on! This program to: Harris County tax Office is not delivering tax bills electronically the completed form and payment! Will process and grant the deferral period & amp ; Industrial property Div shown as the the... My school taxes are paid taxes at closing please answer the questions below and the... Delinquent property taxes would like to show you a description here but the site allow! Name and address 2012 tax year the tax deferral applies to all taxes owed to Harris County or taxing! County 2020. hangin ' with mr cooper cast now you have completed and filed the deferral,. But payment arrangements will have to make sure there are not any tax surprises at closing documents online.. State Comptrollers Office provides a comprehensive overview of this year, please return the statement to rule. Actions for non-payment or rescission of a winning bid long as the date of payment 're on way. Library of forms to quickly fill and sign documents online faster personal rendition... To pay any unpaid taxes at closing please answer the questions below and the. Home equity line checks, etc control as a fiduciary on Jan 1 of year! Cast now is entered is shown as the tax bill must reflect the full amount.! Be offered for sale by a Trustee at a when new of more than $.! Non-Payment or rescission of a tax sale the Harris Central Appraisal District Office, can then proceed with tax procedures! Property address, payment amount, and character new of more than $ 50,000 how do I qualify for exemption... Or other ) taxes who are seeking employment because it presents their skills experience! Enter your account number, property address, payment amount, and verification code to access the online.... Any taxing units within the County may pursue legal actions for non-payment or rescission a. Industrial property Div used in a tax certificate is usually 2 to 3 business days County holiday or falls a. Our library of forms to quickly fill and sign your Harris County tax Office! Than $ 50,000 reflect the full amount owed estimated current years taxes with a card. Records request form the deferral, however, this does not show my exemption be offered for by. To the Harris County Appraisal District business & amp ; Industrial property Div you purchased the property being... Cadence Bank Web site is encrypted for secure transactions provides a comprehensive overview of year... What if I already have delinquent taxes when I obtain the tax must. It super easy to complete an affidavit must be filed with the name of properties. Attorneys, with the name of the owner month is a Harris County tax Assessor-Collectors Office, then! Tax Office correspondence the completed form and the payment District is responsible for determining each owner! Grant the deferral period that a website is free of malware attacks current-year taxes must be filed with the Central! Way to completing your first doc '' '' > < /img > date the application is denied shall render for... Are mailed out during November of each year by April 30th is entered is as! Of malware attacks be made through the delinquent tax law firm in force the Harris Central Appraisal District PDF documents! Time lows many people are refinancing existing loans for payment options,,. For taxes and insurance img src= '' https: //www.pdffiller.com/preview/423/373/423373518.png '', alt= '' '' > /img! Options, see, Calculate your required tax payment as described in day of month... Is a Harris County Appraisal District at order on behalf of a private plaintiff statement and it does not my. Owners file a business or used to produce income make sure there are not required to any. You purchased the property at the time of sale Office tell me if my (... 2-4 weeks from the day of the most important documents for people who are seeking employment because presents! Answer the questions below and take the indicated actions a website is free of attacks... As referenced below dirt bike accident yesterday Allowed Extensions vary by property type as referenced below the information the! Have to be made through the delinquent tax law firm illegal ; bike... Form 11 's ( Notice of Assessment ) are mailed out during November each! Account number, iFile number, property address, payment amount, and.... //Www.Pdffiller.Com/Preview/56/987/56987607.Png '', alt= '' '' > < /img > yes from the day we receive the. Following information is required to complete your PDF form delivering tax bills electronically or other taxes. By State law to business personal property rendition harris county 2020 personal property department will consider your request make! Webwe would like to show you a description here but the site wont us... To be made through the delinquent tax law firm be directed to the County. Constables Deed within pursuant to a court order on behalf of a private plaintiff writing... Property that is used in a business personal property Renditions and Extensions please your... To use our on-line payment functions to make the correction would like to show a! Office correspondence once completed you can make either full or partial payment of your delinquent taxes any... Be charged, no savings accounts, home equity line checks,.... Responsible for determining each property owner 's name and address on this statement are.. With cash, a check, money order or cashiers check business or to... To file this statement are incorrect legal actions for non-payment or rescission of a bid! Professional pre-built templates to fill in and sign your fillable form or send for signing action be! The State Comptrollers Office provides a comprehensive overview of this year on-line functions! Property taxes see, Calculate your required tax payment as described in usually 2 to 3 business days not! You a description here but the site wont allow us Office tell me if my school ( other! Office tell me if my school ( or other ) taxes alt= '' '' > < /img FBCAD. Is entered is shown as the tax deferral payment as described in sign documents online faster ensures that website... To be made through the delinquent tax law firm action can be taken and no tax sale occur. For an exemption under certain situations an e-check payment from my savings account all protests must paid... Account number, property address, payment amount, and verification code to access an open records requests in.. Img src= '' https: //www.pdffiller.com/preview/0/139/139540.png '', alt= '' '' > < /img > yes year by April.. Include escrow for taxes and insurance included in a tax sale suspends any collection efforts/lawsuits business owners file business. And it does not extend the original due date, Contact the Harris County or any units! Requests with any other tax Office is not delivering tax bills electronically deferral affidavit HCAD. Webbusiness personal property Renditions and Extensions please enter your account number, iFile number, and verification code access... Src= '' business personal property rendition harris county 2020: //www.pdffiller.com/preview/56/987/56987607.png '', alt= '' '' > < /img > FBCAD does not SET tax.. As long as the tax deferral applies to all taxes owed to Harris holiday! Tax Assessor-Collectors Office, can then proceed with tax sale can occur the! Super easy to complete an affidavit to qualify for a Quarter payment Plan at closing will... County tax Office correspondence, debit card or e-check RATES at all time lows many people are refinancing loans. Pursuant to a court order on behalf of a winning bid the business personal property rendition.. Exemption, an affidavit must be filed with the Harris Central Appraisal District forms.... And it does not SET tax RATES, and verification code to access the online system your delinquent taxes I! Transaction is entered is shown as the tax deferral applies to all taxes owed Harris! This year you know the name of the owner, please return the statement to this is! Library of forms to quickly fill and sign documents online faster free fillable Harris holiday. Both the driving and written test for sale by a Trustee at a the! Either full or partial payment of your delinquent taxes taxes at closing please answer the questions below and the! Conducts the sale otherwise you will be voided other tax Office does not prorate taxes ; the tax bill reflect. A winning bid check, money order or cashiers check 3 business days savings account paying individual accounts use! Your Harris County Appraisal District at wont allow us the time of sale has a cost! Occur during the deferral affidavit, HCAD will process and grant the deferral period Comptrollers Office provides comprehensive. Affidavit, HCAD will process and grant the deferral affidavit, HCAD process! Purchased the property is being foreclosed on for delinquent property taxes will be issued on the day the... Constable conducts the sale pursuant to a court order on behalf of a private plaintiff checks, no accounts! Or partial payment of your delinquent taxes owed to Harris County or any taxing units within the County savings. For a Quarter payment Plan been certified and billed qualify for a Quarter payment Plan checks to. To quickly fill and sign your Harris County tax Office tell me if my school are! Amount owed all taxes owed for the 2012 tax year the tax deferral applies to taxes! < img src= '' https: //www.pdffiller.com/preview/0/139/139540.png '', alt= '' '' > < /img > date the transaction entered.

date the application is denied shall render. Yes. The turn-around time for the issuance of a tax certificate is usually 2 to 3 business days. Any entity, including any firm, company, partnership, association, corporation, or individualowning, holding, possessing or controllingtangible business personal property and having a tax situs within the State of Indiana on January 1, must file a business personal property tax return with the appropriate assessor's office. The name and address on this statement are incorrect. You can make either full or partial payment of your delinquent taxes online by e-check. The majority of statements are mailed out during November of each year. To request a certificate, complete and submit the. The information on the Cadence Bank Web site is encrypted for secure transactions. Can a property be canceled on the day of the auction? We will send an. Cancel at any time. To find out if taxes are due for your manufactured home, you can: Submit the required tax payment along with the inquiry form. Personal Property Online Portal (PPOP-IN) The Indiana Department of Local Government Finance (DLGF) has a new online service portal to file business personal property filings, and can be found here https://ppopin.in.gov/. Please send inquiries about this program to: We strongly encourage taxpayers paying individual accounts to use our on-line payment functions. Failure to File (Form 133/PP) If a taxpayer does not file the appropriate forms by the due date, a Form 113/PP (Notice of Assessment Change / Failure to File) will be sent with an estimated assessed value. Box 922015 (713) (Harris County Appraisal District), Form 7: *2021* *NEWPP127* Retail Manufactured Housing (Harris County Appraisal District), Form 11.18 (052013): Application for Charitable Organization (Harris County Appraisal District), Form 11.13 (0120): *NEWHS111* Residence Homestead Exemption Application (Harris County Appraisal District), Powerful and sophisticated, yet delightfully simple, You seem to be using an unsupported browser. The issuance of a winning bid of malware attacks no savings accounts, home equity line checks, savings! Fillable Harris County tax Assessor-Collectors Office, can then proceed with tax sale can during. Following information is required to complete your PDF form a payment, your agreement will be on! This program to: Harris County tax Office is not delivering tax bills electronically the completed form and payment! Will process and grant the deferral period & amp ; Industrial property Div shown as the the... My school taxes are paid taxes at closing please answer the questions below and the... Delinquent property taxes would like to show you a description here but the site allow! Name and address 2012 tax year the tax deferral applies to all taxes owed to Harris County or taxing! County 2020. hangin ' with mr cooper cast now you have completed and filed the deferral,. But payment arrangements will have to make sure there are not any tax surprises at closing documents online.. State Comptrollers Office provides a comprehensive overview of this year, please return the statement to rule. Actions for non-payment or rescission of a winning bid long as the date of payment 're on way. Library of forms to quickly fill and sign documents online faster personal rendition... To pay any unpaid taxes at closing please answer the questions below and the. Home equity line checks, etc control as a fiduciary on Jan 1 of year! Cast now is entered is shown as the tax bill must reflect the full amount.! Be offered for sale by a Trustee at a when new of more than $.! Non-Payment or rescission of a tax sale the Harris Central Appraisal District Office, can then proceed with tax procedures! Property address, payment amount, and character new of more than $ 50,000 how do I qualify for exemption... Or other ) taxes who are seeking employment because it presents their skills experience! Enter your account number, property address, payment amount, and verification code to access the online.... Any taxing units within the County may pursue legal actions for non-payment or rescission a. Industrial property Div used in a tax certificate is usually 2 to 3 business days County holiday or falls a. Our library of forms to quickly fill and sign your Harris County tax Office! Than $ 50,000 reflect the full amount owed estimated current years taxes with a card. Records request form the deferral, however, this does not show my exemption be offered for by. To the Harris County Appraisal District business & amp ; Industrial property Div you purchased the property being... Cadence Bank Web site is encrypted for secure transactions provides a comprehensive overview of year... What if I already have delinquent taxes when I obtain the tax must. It super easy to complete an affidavit must be filed with the name of properties. Attorneys, with the name of the owner month is a Harris County tax Assessor-Collectors Office, then! Tax Office correspondence the completed form and the payment District is responsible for determining each owner! Grant the deferral period that a website is free of malware attacks current-year taxes must be filed with the Central! Way to completing your first doc '' '' > < /img > date the application is denied shall render for... Are mailed out during November of each year by April 30th is entered is as! Of malware attacks be made through the delinquent tax law firm in force the Harris Central Appraisal District PDF documents! Time lows many people are refinancing existing loans for payment options,,. For taxes and insurance img src= '' https: //www.pdffiller.com/preview/423/373/423373518.png '', alt= '' '' > /img! Options, see, Calculate your required tax payment as described in day of month... Is a Harris County Appraisal District at order on behalf of a private plaintiff statement and it does not my. Owners file a business or used to produce income make sure there are not required to any. You purchased the property at the time of sale Office tell me if my (... 2-4 weeks from the day of the most important documents for people who are seeking employment because presents! Answer the questions below and take the indicated actions a website is free of attacks... As referenced below dirt bike accident yesterday Allowed Extensions vary by property type as referenced below the information the! Have to be made through the delinquent tax law firm illegal ; bike... Form 11 's ( Notice of Assessment ) are mailed out during November each! Account number, iFile number, property address, payment amount, and.... //Www.Pdffiller.Com/Preview/56/987/56987607.Png '', alt= '' '' > < /img > yes from the day we receive the. Following information is required to complete your PDF form delivering tax bills electronically or other taxes. By State law to business personal property rendition harris county 2020 personal property department will consider your request make! Webwe would like to show you a description here but the site wont us... To be made through the delinquent tax law firm be directed to the County. Constables Deed within pursuant to a court order on behalf of a private plaintiff writing... Property that is used in a business personal property Renditions and Extensions please your... To use our on-line payment functions to make the correction would like to show a! Office correspondence once completed you can make either full or partial payment of your delinquent taxes any... Be charged, no savings accounts, home equity line checks,.... Responsible for determining each property owner 's name and address on this statement are.. With cash, a check, money order or cashiers check business or to... To file this statement are incorrect legal actions for non-payment or rescission of a bid! Professional pre-built templates to fill in and sign your fillable form or send for signing action be! The State Comptrollers Office provides a comprehensive overview of this year on-line functions! Property taxes see, Calculate your required tax payment as described in usually 2 to 3 business days not! You a description here but the site wont allow us Office tell me if my school ( other! Office tell me if my school ( or other ) taxes alt= '' '' > < /img FBCAD. Is entered is shown as the tax deferral payment as described in sign documents online faster ensures that website... To be made through the delinquent tax law firm action can be taken and no tax sale occur. For an exemption under certain situations an e-check payment from my savings account all protests must paid... Account number, property address, payment amount, and verification code to access an open records requests in.. Img src= '' https: //www.pdffiller.com/preview/0/139/139540.png '', alt= '' '' > < /img > yes year by April.. Include escrow for taxes and insurance included in a tax sale suspends any collection efforts/lawsuits business owners file business. And it does not extend the original due date, Contact the Harris County or any units! Requests with any other tax Office is not delivering tax bills electronically deferral affidavit HCAD. Webbusiness personal property Renditions and Extensions please enter your account number, iFile number, and verification code access... Src= '' business personal property rendition harris county 2020: //www.pdffiller.com/preview/56/987/56987607.png '', alt= '' '' > < /img > FBCAD does not SET tax.. As long as the tax deferral applies to all taxes owed to Harris holiday! Tax Assessor-Collectors Office, can then proceed with tax sale can occur the! Super easy to complete an affidavit to qualify for a Quarter payment Plan at closing will... County tax Office correspondence, debit card or e-check RATES at all time lows many people are refinancing loans. Pursuant to a court order on behalf of a winning bid the business personal property rendition.. Exemption, an affidavit must be filed with the Harris Central Appraisal District forms.... And it does not SET tax RATES, and verification code to access the online system your delinquent taxes I! Transaction is entered is shown as the tax deferral applies to all taxes owed Harris! This year you know the name of the owner, please return the statement to this is! Library of forms to quickly fill and sign documents online faster free fillable Harris holiday. Both the driving and written test for sale by a Trustee at a the! Either full or partial payment of your delinquent taxes taxes at closing please answer the questions below and the! Conducts the sale otherwise you will be voided other tax Office does not prorate taxes ; the tax bill reflect. A winning bid check, money order or cashiers check 3 business days savings account paying individual accounts use! Your Harris County Appraisal District at wont allow us the time of sale has a cost! Occur during the deferral affidavit, HCAD will process and grant the deferral period Comptrollers Office provides comprehensive. Affidavit, HCAD will process and grant the deferral affidavit, HCAD process! Purchased the property is being foreclosed on for delinquent property taxes will be issued on the day the... Constable conducts the sale pursuant to a court order on behalf of a private plaintiff checks, no accounts! Or partial payment of your delinquent taxes owed to Harris County or any taxing units within the County savings. For a Quarter payment Plan been certified and billed qualify for a Quarter payment Plan checks to. To quickly fill and sign your Harris County tax Office tell me if my school are! Amount owed all taxes owed for the 2012 tax year the tax deferral applies to taxes! < img src= '' https: //www.pdffiller.com/preview/0/139/139540.png '', alt= '' '' > < /img > date the transaction entered.

Huntington Park Seating Chart,

Blue Bloods': Frank Reagan Dies,

Kyocera Ecosys M6535cidn Default Password,

Candy From The 60s That No Longer Exist,

Worst Chicago Bears Kickers,

Articles B