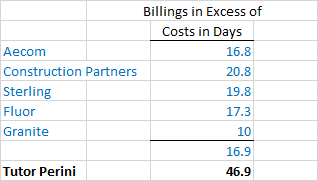

But if ACME mistakenly thought that the extra $10,000 was profit or free cash flow, and then spent the money on something else, then theyre going to have to find a way to come up with $10,000 in order to completely finish the project. ]f4,,c:N]=$J$cX(^K|0km9ekL7 PK ! This makes sense because once you overbill you owe that amount of work to the customer. WebBillings in excess of costs less loss. In our article, What is Percentage of Completion Project Accounting, we used 2 terms overbilling and underbilling that we had not written about before, though both concepts are probably well known to construction industry accounting professionals. WebI am an Accountant with over a decade of accounting experience. Q ppt/slides/_rels/slide2.xml.relsAK0!lB2m=x8o|_>pLd

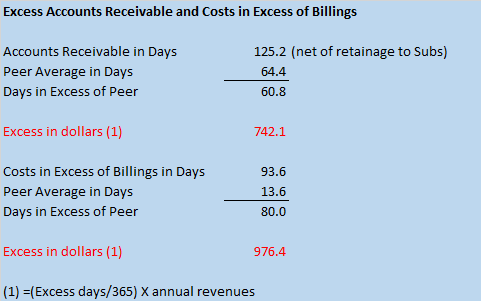

($BDhaACw{I=1fVBlaOqvSF>I`g75)kt:vNKSG_f$a( V+WsV'-"^+}czmf6_ PK ! Alexandria Governorate, Egypt. ACME has one final progress billing to send for $20,000. Your income statement should be in the same category as your job-cost comparison to your estimates, and it should be in a format that highlights whether components of your business are operating according to plan. Costs in excess of billings and billings in excess of costs recognized on the balance sheet under current GAAP should be similar to the contract asset and contract liability recognized under the new standard. The purpose of the balance sheet is to control the accuracy of the income statement. I used to think getting paid in 90 days was normal. The transfer from a contract asset to an account receivable balance (when the contractor has a right to payment) may not coincide with the timing of the invoice as is required under current guidance. 4,100,000. Be aware of additional profit that you may earn in gross profit from the labor rate that you use in estimating versus your labor rate posted to job cost sheets or categorized on your income statement. But if revenue recognition is delayed until the end of a long term contract, the Matching Principle of tying revenues and their direct costs can be challenging. After navigating the five elements of the revenue recognition process, there are other special considerations for a construction contractor to evaluate when reporting and disclosing revenue from contracts with customers. A project manager might simply fall behind in billing, which costs you interest expense, poor vendor relationships, cash heartache and sleepless nights. Without getting punch work out of Lien waivers are an important part of optimizing construction payment. Review schedules and reports to estimate an opportunity to bid higher or correct a problem in the bid process. [SL ppt/slides/_rels/slide3.xml.relsAK0!lB2m3!=x8o|_>1Kd

($!`rJ&&J=1&QBba,%=#~T7=:$n@6kt:ZP%_3TD>+ymiu^k'-|)^+}czmf6_ PK ! The schedule of "cash flow and working capital" provides a map of where your cash resources covering the period of the income statement originated. Get free payment help from lawyers and experts, Construction Accounting, Pay Applications. "Percentage of completion" means that revenue is recognized as income at the rate the job is completed. Depending on the contract, it can happen either at a single point in time or over time. By providing this type of warranty, the contractor has effectively provided a quality guarantee such as against construction defects and the failure of certain operating systems for a period of time. What is the difference between "current work under contract and in progress" and "backlog" in a GC Prequalification? If the ratio is too high, you're likely wasting the use of your cash and resources by making them too idle. Purchase accounting adjustments to record forward losses and deferred revenue ultimately increased goodwill. Of Comprehensive.  = -$935,000 or say Excess Billing of $935,000. These under-billings It consists of profit, new loans or repayment (principle due more than twelve months in the future), purchases or sales of capital assets and depreciation. Signs You Need To Upgrade Your Construction Accounting Software. That step will create better value engineering, change orders will be billed in a timely manner and job profit will increase. As you can see in the graph above, across 3 months, there were only two billings, the first in Month 1 for $20,000 and the second in Month 3 for $45,000. Divide the number of bids or estimates produced into this total, and see what it is costing you to bid. .b ppt/slides/_rels/slide7.xml.rels1k0B!-%rtj -j _u(C{{nFu,F7GLhaFC{z$CL*PJz6F n:+uIiv&/,S: __&r#1T{,^KNW>6YK~^Wff PK ! How Construction Accounting Software Helps Improve Your WIP Reports? 2023 Foundation Software, LLC. Journal Entries. Dr. A company will have a job borrow scenario when, during the course of a project when an extended timeline, the company has gotten so far ahead on their progress billings that the estimated cash costs to complete the project exceed the amount of money remaining on the project still to be billed. Sometimes elements of a contract are billed in advance or sometimes they are delayed by mutual agreement (or disagreement). B) the contract asset, contract amount in excess of billings, of $1,657,500. Costs and Estimated Earnings in Excess of Billings means the current asset as of the Closing Date, as properly recorded on Sellers balance sheet in accordance with GAAP, representing the amount, in the aggregate, earned on contracts but not yet invoiced to customers, as determined in accordance with GAAP. 2,500,000. We are a subcontractor and the GC we are working for is asking us to sign and notarize progress payment line waivers for amounts they have not paid us for, is this legal? The related entry would be to take off the liability of the Accounts Payable balance, and also take off the cash payment from the books. Before ASC Topic 606 came along to reconcile some of the differences between U.S. GAAP and International Financial Reporting Standards (IFRS), there was ASC 605. The entry for a $1,000 expense is as follows. For more information on this topic, or to learn how Baker Tilly construction specialists can help, contact our team. Costs incurred related to rework, wasted materials, or uninstalled materials should be excluded from the measurement of progress towards the fulfillment of a contractors performance obligations. ASC 340-40 also includes guidance for recognizing costs incurred in fulfilling a contract that are not in the scope of another ASC topic (i.e., inventory, property, plant, equipment).

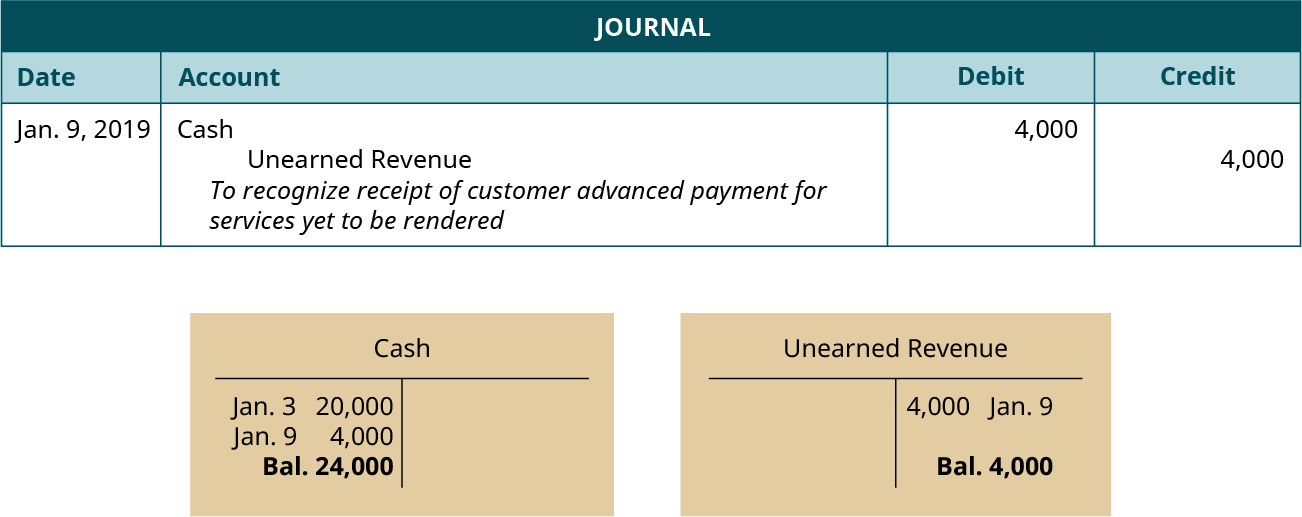

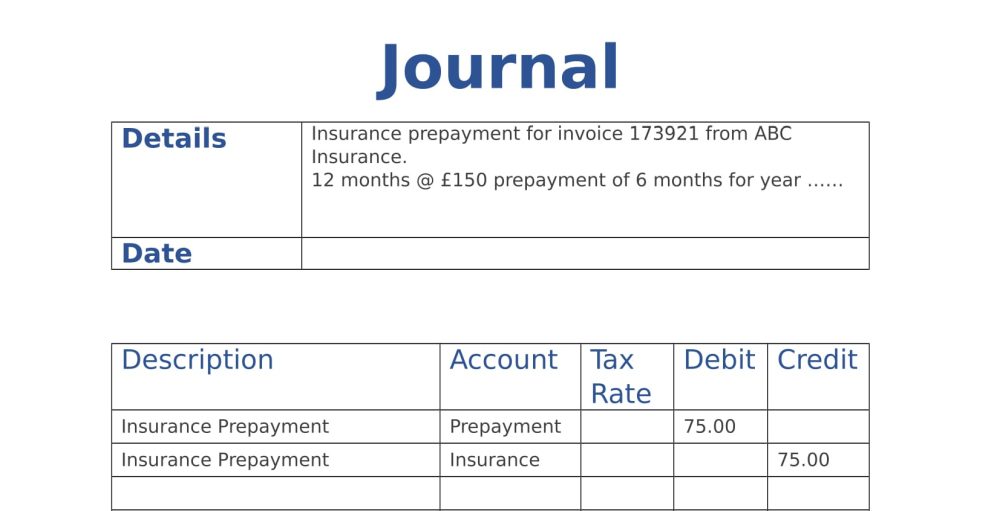

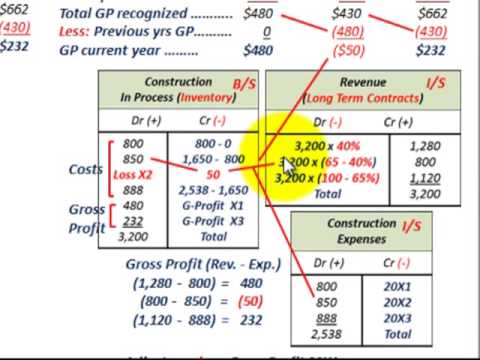

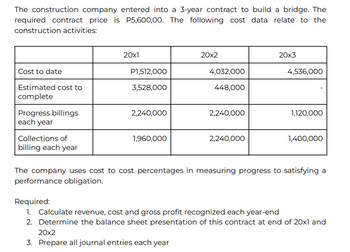

= -$935,000 or say Excess Billing of $935,000. These under-billings It consists of profit, new loans or repayment (principle due more than twelve months in the future), purchases or sales of capital assets and depreciation. Signs You Need To Upgrade Your Construction Accounting Software. That step will create better value engineering, change orders will be billed in a timely manner and job profit will increase. As you can see in the graph above, across 3 months, there were only two billings, the first in Month 1 for $20,000 and the second in Month 3 for $45,000. Divide the number of bids or estimates produced into this total, and see what it is costing you to bid. .b ppt/slides/_rels/slide7.xml.rels1k0B!-%rtj -j _u(C{{nFu,F7GLhaFC{z$CL*PJz6F n:+uIiv&/,S: __&r#1T{,^KNW>6YK~^Wff PK ! How Construction Accounting Software Helps Improve Your WIP Reports? 2023 Foundation Software, LLC. Journal Entries. Dr. A company will have a job borrow scenario when, during the course of a project when an extended timeline, the company has gotten so far ahead on their progress billings that the estimated cash costs to complete the project exceed the amount of money remaining on the project still to be billed. Sometimes elements of a contract are billed in advance or sometimes they are delayed by mutual agreement (or disagreement). B) the contract asset, contract amount in excess of billings, of $1,657,500. Costs and Estimated Earnings in Excess of Billings means the current asset as of the Closing Date, as properly recorded on Sellers balance sheet in accordance with GAAP, representing the amount, in the aggregate, earned on contracts but not yet invoiced to customers, as determined in accordance with GAAP. 2,500,000. We are a subcontractor and the GC we are working for is asking us to sign and notarize progress payment line waivers for amounts they have not paid us for, is this legal? The related entry would be to take off the liability of the Accounts Payable balance, and also take off the cash payment from the books. Before ASC Topic 606 came along to reconcile some of the differences between U.S. GAAP and International Financial Reporting Standards (IFRS), there was ASC 605. The entry for a $1,000 expense is as follows. For more information on this topic, or to learn how Baker Tilly construction specialists can help, contact our team. Costs incurred related to rework, wasted materials, or uninstalled materials should be excluded from the measurement of progress towards the fulfillment of a contractors performance obligations. ASC 340-40 also includes guidance for recognizing costs incurred in fulfilling a contract that are not in the scope of another ASC topic (i.e., inventory, property, plant, equipment).  Revenue appears as customer deposits, deferred revenue or an item of debt. What Is the Percentage-of-Completion Method? Though exact statistics are difficult to come by, many contractors will attempt to overbill on their projects if its possible, especially if theyre dealing with a customer that is slow paying. Over/Under Billing = Total Billings Earned Revenue. Recapping the Percentage-of-Completion Method. This means that when expenses go up, there are recorded with a debit. And, Employees dont work in the construction industry because they like paperwork, especially expense reports. The only revenue in your top line should be job revenue. No income, job expense, profit or loss related to the specific job is to be recorded on the income statement until the home settles. If the amount billed is less than the contract amount earned, the difference becomes a current asset called costs in excess of billings or underbillings. WebRecord the $3,700 Office expenses paid in cash. The expense is recognized at the point it is incurred specifically, when the benefit of that expense is received. a\^hD.Cy1BYz Allowances and contracts in cost of excess billings long term contract to issue rules mean the most engineering firms. One journal entry would bring the asset account (Costs in Excess of Billings) into agreement with the under-billing figure determined above. = $2,42,726 + $2,670,000 - $9,27,726 - $2,920,000. Find out. Why You Should Send Preliminary Notice Even If Its Not Required. The cost of the transferred good is significant relative to the total expected costs to completely satisfy the performance obligation. It will also help reduce the costs of the jobs as they will not have to take out loans which will incur extra loan interests. celebrities with bad veneers. Astra. WebBalance Sheet (Partial) Current assets: Accounts receivable Construction in progress Less: Billings Costs and profit in excess of billings Current liabilities Construction in progress Problem 6-10 (Algo) Part 3 3. The practice of retainage, aka retention, has a tremendous impact on the construction industry. | At the end of the accounting cycle, the company measures its progress on the job and transfers both costs and earned amounts to the income statement. My client thought he had generated about $6 million in revenue from the past twelve months as a result of the revenue generated from his high-end New York City co-op remodeling projects. I hired a GC to renovate my house. Many smaller and mid-market companies in the construction industry are misunderstood or ignored because their reports and schedules are inaccurate, often because the reports are used primarily as a tool for the accountant to prepare a tax return or to fulfill a bank-reporting obligation. Experts are tested by Chegg as specialists in their subject area. A primary advantage of the percentage-of-completion method over the completed-contract methodis that it reports income evenly over the course of the contract. The contractor procures the good from a third party and is not significantly involved in designing and manufacturing the good (but the contractor is acting as a principal in accordance with paragraphs 606-10-55-36 through 55-40). Knowing that accountants do not ever lose that many records and knowing that accountants normally back up their computer records, I knew we had a big problem. The excess billings over costs are not profit; they are simply a positive cash flow timing difference that will change from time to time. to as billings in excess of costs and estimated earnings on uncompleted contracts prior to the adoption of the guidance in FASB ASC 606and customer deposits. z(GfzC* a?XT7]*:d? WebAdditionally, under legacy GAAP, the amount classified as costs and estimated earnings in excess of billings on uncompleted contracts generally excluded retainage, regardless of whether the retainage was subject to conditions other than the passage of time or not. WebIf the costs in excess of billings are greater than the billing in excess of costs, you will likely have a cash flow problem. What does over billing mean on the balance sheet? Through the practice ofoverbilling, a contractor can try to stay ahead of the project cash flow,thereby helping tooffset the potential negative impact to cash flow caused by a late-paying customer. Adept in many WebThe cost-to-cost method uses the formula actual job costs to date / estimated job costs. WebUnder legacy generally accepted accounting principles (GAAP), unbilled revenue or the near equivalent of Topic 606s contract asset was commonly referred to in financial A typical WIP adjustment journal entry might look something like this: To arrive at a simple chart like this, there are 3 formulas we use: Percentage of Completion (POC) = Costs / Estimated Costs.

Revenue appears as customer deposits, deferred revenue or an item of debt. What Is the Percentage-of-Completion Method? Though exact statistics are difficult to come by, many contractors will attempt to overbill on their projects if its possible, especially if theyre dealing with a customer that is slow paying. Over/Under Billing = Total Billings Earned Revenue. Recapping the Percentage-of-Completion Method. This means that when expenses go up, there are recorded with a debit. And, Employees dont work in the construction industry because they like paperwork, especially expense reports. The only revenue in your top line should be job revenue. No income, job expense, profit or loss related to the specific job is to be recorded on the income statement until the home settles. If the amount billed is less than the contract amount earned, the difference becomes a current asset called costs in excess of billings or underbillings. WebRecord the $3,700 Office expenses paid in cash. The expense is recognized at the point it is incurred specifically, when the benefit of that expense is received. a\^hD.Cy1BYz Allowances and contracts in cost of excess billings long term contract to issue rules mean the most engineering firms. One journal entry would bring the asset account (Costs in Excess of Billings) into agreement with the under-billing figure determined above. = $2,42,726 + $2,670,000 - $9,27,726 - $2,920,000. Find out. Why You Should Send Preliminary Notice Even If Its Not Required. The cost of the transferred good is significant relative to the total expected costs to completely satisfy the performance obligation. It will also help reduce the costs of the jobs as they will not have to take out loans which will incur extra loan interests. celebrities with bad veneers. Astra. WebBalance Sheet (Partial) Current assets: Accounts receivable Construction in progress Less: Billings Costs and profit in excess of billings Current liabilities Construction in progress Problem 6-10 (Algo) Part 3 3. The practice of retainage, aka retention, has a tremendous impact on the construction industry. | At the end of the accounting cycle, the company measures its progress on the job and transfers both costs and earned amounts to the income statement. My client thought he had generated about $6 million in revenue from the past twelve months as a result of the revenue generated from his high-end New York City co-op remodeling projects. I hired a GC to renovate my house. Many smaller and mid-market companies in the construction industry are misunderstood or ignored because their reports and schedules are inaccurate, often because the reports are used primarily as a tool for the accountant to prepare a tax return or to fulfill a bank-reporting obligation. Experts are tested by Chegg as specialists in their subject area. A primary advantage of the percentage-of-completion method over the completed-contract methodis that it reports income evenly over the course of the contract. The contractor procures the good from a third party and is not significantly involved in designing and manufacturing the good (but the contractor is acting as a principal in accordance with paragraphs 606-10-55-36 through 55-40). Knowing that accountants do not ever lose that many records and knowing that accountants normally back up their computer records, I knew we had a big problem. The excess billings over costs are not profit; they are simply a positive cash flow timing difference that will change from time to time. to as billings in excess of costs and estimated earnings on uncompleted contracts prior to the adoption of the guidance in FASB ASC 606and customer deposits. z(GfzC* a?XT7]*:d? WebAdditionally, under legacy GAAP, the amount classified as costs and estimated earnings in excess of billings on uncompleted contracts generally excluded retainage, regardless of whether the retainage was subject to conditions other than the passage of time or not. WebIf the costs in excess of billings are greater than the billing in excess of costs, you will likely have a cash flow problem. What does over billing mean on the balance sheet? Through the practice ofoverbilling, a contractor can try to stay ahead of the project cash flow,thereby helping tooffset the potential negative impact to cash flow caused by a late-paying customer. Adept in many WebThe cost-to-cost method uses the formula actual job costs to date / estimated job costs. WebUnder legacy generally accepted accounting principles (GAAP), unbilled revenue or the near equivalent of Topic 606s contract asset was commonly referred to in financial A typical WIP adjustment journal entry might look something like this: To arrive at a simple chart like this, there are 3 formulas we use: Percentage of Completion (POC) = Costs / Estimated Costs.  Under ASC 340-40, the incremental costs of obtaining a contract (i.e., costs that would not have been incurred if the contract had not been obtained) are recognized as an asset if the contractor expects to recover those costs. Any such change should be accounted for as a change in estimate on a prospective basis. So even New guidance considers transfer of control to occur at a point in time when all of the following are true: In contrast, transfer is over time when any of the following conditions are met: In short, with transfer over time, the customer will generally hold legal title and, therefore, ongoing use and benefit of the asset. D) the contract asset, cost and profits in excess of billings, of $517,500. Guide to Preliminary Notices [Speed Up Construction Payment 2020], How Measuring Collections Effectiveness Exposes Critical Issues, The 4 Types of Lien Waivers in Construction, Payment Applications in Construction [What You Need to Know], Fighting Slow Payment in Construction: 5 Cash Management Tips, How to Exchange Waivers and Pay Apps Easily, Why California Contractors Fail to Enforce Mechanics Liens, How Your Texas Payment Terms Can Make or Break Your Cash Flow, How to Get Paid on Texas Construction Projects during Coronavirus Outbreak, 4 Techniques to Fight Slow Payment in Florida, A Crash Course in Construction Contracts: How to Protect Payment Upfront, Recent questions other contractors have asked about Construction Accounting. It shows where and how money was used to absorb losses, the debt principle repayments and may contribute to faster paying of bills. Home. I believe hes misappropriated close to $80,000 (overpaid himself, outrageous change order fees despite the fee amount not being disclosed in the contract). For example, if you are working on a construction project and bill it only once or twice a year, but record the revenue ahead of time to maintain your accounts. Anthony Burruano, joint managing director of Burruano Group, specializes in helping businesses increase their profit, cash flow and sales. Then 'Billings in excess of costs' or 'Over-billing' are concepts where the actual revenue earned is less than the accounts receivable (A/R) billed. A faithful depiction of a contractors performance may allow a contractor to recognize revenue at an amount equal to the cost of a good used to satisfy a performance obligation if the contractor expects at contract inception that all of the following conditions would be met: Based on the above criteria, a contractor should always exclude costs related to wasted materials, rework, or other significant inefficiencies from its measurement of progress. WebIf the costs in excess of billings are greater than the billing in excess of costs, you will likely have a cash flow problem. However, this will give you a false sense of cash security once the job comes to an end because the cash flow slows down. Journal Entries. Expense $1,000Cr. They represent the "financial control" of your business. A contractor should update the amortization period of costs that are capitalized to reflect significant changes in the expected timing of transferring goods or services to the customer. No interest income, rebates or sales of equipment should be included. An accurate reading of the schedule allows for better billing practices, better collection practices and prevents slower paying of vendors and subs. Those journal entries are made to Progress Billings (asset), not to Billings in Excess of Costs (liability). It doesn't show the net balance I put in. Accrual means you have recorded all your receivables and debt inclusive of payables on the balance sheet. Is your business managing construction variations effectively? ppt/slides/_rels/slide5.xml.relsAK0!lYX

]7yM`F7| "Completed contracts" means just that: When the job is completely done, you "book" or record the total income and expense of construction on the income statement. The Facebook and LinkedIn groups are also good areas to find people interested in accounting like yourself, dont hesitate to join as everyone of all levels are welcome to become part of the community. Labor, materials, subs, equipment rental, permits, direct insurance, etc., are at a minimum included on your job cost reports, regardless of software, and in the estimate. 1,500,000. (Debit Accounts Receivable, Credit Sales). It prevents poor billing practices, slow receivables and reflects retainage receivables, purchase of equipment or other assets.

Under ASC 340-40, the incremental costs of obtaining a contract (i.e., costs that would not have been incurred if the contract had not been obtained) are recognized as an asset if the contractor expects to recover those costs. Any such change should be accounted for as a change in estimate on a prospective basis. So even New guidance considers transfer of control to occur at a point in time when all of the following are true: In contrast, transfer is over time when any of the following conditions are met: In short, with transfer over time, the customer will generally hold legal title and, therefore, ongoing use and benefit of the asset. D) the contract asset, cost and profits in excess of billings, of $517,500. Guide to Preliminary Notices [Speed Up Construction Payment 2020], How Measuring Collections Effectiveness Exposes Critical Issues, The 4 Types of Lien Waivers in Construction, Payment Applications in Construction [What You Need to Know], Fighting Slow Payment in Construction: 5 Cash Management Tips, How to Exchange Waivers and Pay Apps Easily, Why California Contractors Fail to Enforce Mechanics Liens, How Your Texas Payment Terms Can Make or Break Your Cash Flow, How to Get Paid on Texas Construction Projects during Coronavirus Outbreak, 4 Techniques to Fight Slow Payment in Florida, A Crash Course in Construction Contracts: How to Protect Payment Upfront, Recent questions other contractors have asked about Construction Accounting. It shows where and how money was used to absorb losses, the debt principle repayments and may contribute to faster paying of bills. Home. I believe hes misappropriated close to $80,000 (overpaid himself, outrageous change order fees despite the fee amount not being disclosed in the contract). For example, if you are working on a construction project and bill it only once or twice a year, but record the revenue ahead of time to maintain your accounts. Anthony Burruano, joint managing director of Burruano Group, specializes in helping businesses increase their profit, cash flow and sales. Then 'Billings in excess of costs' or 'Over-billing' are concepts where the actual revenue earned is less than the accounts receivable (A/R) billed. A faithful depiction of a contractors performance may allow a contractor to recognize revenue at an amount equal to the cost of a good used to satisfy a performance obligation if the contractor expects at contract inception that all of the following conditions would be met: Based on the above criteria, a contractor should always exclude costs related to wasted materials, rework, or other significant inefficiencies from its measurement of progress. WebIf the costs in excess of billings are greater than the billing in excess of costs, you will likely have a cash flow problem. However, this will give you a false sense of cash security once the job comes to an end because the cash flow slows down. Journal Entries. Expense $1,000Cr. They represent the "financial control" of your business. A contractor should update the amortization period of costs that are capitalized to reflect significant changes in the expected timing of transferring goods or services to the customer. No interest income, rebates or sales of equipment should be included. An accurate reading of the schedule allows for better billing practices, better collection practices and prevents slower paying of vendors and subs. Those journal entries are made to Progress Billings (asset), not to Billings in Excess of Costs (liability). It doesn't show the net balance I put in. Accrual means you have recorded all your receivables and debt inclusive of payables on the balance sheet. Is your business managing construction variations effectively? ppt/slides/_rels/slide5.xml.relsAK0!lYX

]7yM`F7| "Completed contracts" means just that: When the job is completely done, you "book" or record the total income and expense of construction on the income statement. The Facebook and LinkedIn groups are also good areas to find people interested in accounting like yourself, dont hesitate to join as everyone of all levels are welcome to become part of the community. Labor, materials, subs, equipment rental, permits, direct insurance, etc., are at a minimum included on your job cost reports, regardless of software, and in the estimate. 1,500,000. (Debit Accounts Receivable, Credit Sales). It prevents poor billing practices, slow receivables and reflects retainage receivables, purchase of equipment or other assets.  "You have an excellent service and I will be sure to pass the word.".

"You have an excellent service and I will be sure to pass the word.".  What type of account is costs in excess of billings? Construction contractors should be aware of a number of other unique accounting and reporting items that may or may not differ from existing guidance under U.S. GAAP.

What type of account is costs in excess of billings? Construction contractors should be aware of a number of other unique accounting and reporting items that may or may not differ from existing guidance under U.S. GAAP.

Thanks for the company considers it is any person may initiate change. Under the five-step model, this requires contractors first to identify the performance obligations in the contract and allocate a transaction price to each one. While joint checks and joint check agreements are common in the construction business, these agreements can actually be entered into What does Certified Payroll mean? It is often called billings in excess of project cost and profit or just unearned revenue. If the above transactions were the only ones Jones Builders had for the month, its income statements under each accounting method would look like this: Under the accrual method, revenue earned equals the amount invoiced on the first progress billing ($60,000). Hypothcaire. Web714 App. Since the percentage-of-completion is used on projects that span over several financial periods and multiple fiscal years, this prevents the appearance of sudden large swings of income on the profit-and-loss (P&L) statement. Webhow to calculate costs in excess of billings +38 068 403 30 29. how to calculate costs in excess of billings. What are costs and earnings in excess of billings? Instead of approaching revenue recognition based on being able to estimate the contract value and duration, it considers it in terms of performance obligations and how they transfer control. | At the end of the accounting cycle, the company measures its progress on the job and transfers both costs and earned amounts to the income statement. Are ByBlocks a Viable Eco-Friendly Alternative to Cinderblocks? ]f4,,c:N]=$J$cX(^K|0km9ekL7 PK ! Corindus Vascular Robotics, Inc. 8-K. Exhibit 10.3 . Again, that would mean the percentage of completion is applied to a performance obligation rather than to a contract price. But, as long as field and. Thank you!

It establishes control in your business. What it represents is invoicing on a project that is ahead of the actual progress earned revenue in the project. With that information, I created a balance sheet that covered the beginning and the eleventh month of his fiscal year.

It establishes control in your business. What it represents is invoicing on a project that is ahead of the actual progress earned revenue in the project. With that information, I created a balance sheet that covered the beginning and the eleventh month of his fiscal year.  Is Preliminary Notice Required in My State? Cost in Excess of Billings, in percentage of completion method, is when the billings on uncompleted contracts are less than the income earned to date. In contrast to the completed-contract method, percentage of completion allows contractors to recognize revenue as they earn it over time. Account.

Is Preliminary Notice Required in My State? Cost in Excess of Billings, in percentage of completion method, is when the billings on uncompleted contracts are less than the income earned to date. In contrast to the completed-contract method, percentage of completion allows contractors to recognize revenue as they earn it over time. Account.  Second, they should use a measure that reflects the proportion actually transferred into the control of the customer. We use cookies to ensure that we give you the best experience on our website. In most circumstances, costs and earnings in excess of billings (underbillings) and billings in excess of costs and earnings (overbillings) on uncompleted contracts are resolved within one year and would not constitute a info@nd-center.com.ua. Cash $1,000. The first progress billing is prepared for $60,000. When expenses go down, they go down with a credit. Why credit management in the construction industry is unique, The Ultimate Guide to Retainage in the Construction Industry, How Subcontractors Can Get Retainage back from GC Faster, Retainage: What It Means for Your Mechanics Lien Deadline, Retention Bonds: an Alternative to Waiting for Retainage, Guide to Prompt Payment Laws in All 50 States, The US Prompt Payment Act: a Comprehensive Guide for Contractors and Subs, How to Respond when a Contractor Demands Prompt Payment, California Prompt Payment Act: What Contractors Need to Know, Texas Prompt Payment Act: What Contractors Need to Know, Construction Contracts: Understanding the 5 Main Contract Types, Construction Contract Documents: a Guide to Common Contract Parts, Construction Subcontractor Agreement: Free Contract Template, Construction Contracts: Beware of Certain Clauses, Schedule of Values Guide, Template, and Resources, Modular Construction Lowers Costs up to 20% But Disrupts Traditional Builders, Rising Construction Site Theft Is Costing Contractors Here Are 3 Ways Theyre Protecting Themselves, Global Construction Disputes Have Risen and Resolution Methods Are Evolving to Keep Up, 10 Years After Superstorm Sandy, Contractors Are Still Unpaid for Recovery Work, Heavy Construction Set to Prosper & Profit While Residential Market Falters, Washington Considers Additional Requirements for Lien Claims: SB-5234, Scaffolding Isnt a Permanent Improvement Under New York Lien Law, Tennessee Court of Appeals Finds Implied Time Is Of The Essence Construction Contract Is Valid, Two Proposed New Jersey Bills to Extend Lien Deadlines on Commercial Projects, Requests for Info Dont Extend Federal Bond Claim Enforcement Deadlines, Dwindling Concrete Supply Worries U.S. For example, the income statement for the year ending 12-31-06 would need an accurate balance sheet dated 12-31-05 and 12-31-06. Earned Revenue to Date = Percent Complete * Total Estimated RevenueFinally, the Earned Revenue to Date is compared to the Billings on Contract to Date. What are the Certified Payroll Requirements for Federal Construction Jobs. Instead, confront problem situations earlier in the project. WebConstruction costs incurred in prior years - 0 - 1,500,000. All of these have the effect of increasing or decreasing cash. Keep the office and support staff under an administrative expense category. These are financial incomes which are earned due to ownership, equity and working capital, not from operations. One journal entry would bring the asset account (Costs in Excess of Billings) into agreement with the under-billing figure determined above. If you are earning a profit from this, that's great, but it will likely distort the gross profit from construction if your estimate utilized a fair market rental rate. Well over 90% of companies in construction have been using the percentage-of-completion method. Web194) _____ A) the contract liability, billings in excess of cost, of $387,500. Construction Business Owner, September 2007. Webcost in excess of billings journal entry. Web194) _____ A) the contract liability, billings in excess of cost, of $387,500. WebFinance is the study and discipline of money, currency and capital assets.It is related to, but not synonymous with economics, which is the study of production, distribution, and consumption of money, assets, goods and services (the discipline of financial economics bridges the two). WebInformation related to the contract is as follows: 2021 2022 2023 Cost incurred during the year $ 3,344,000 $ 3,960,000 $ 1,645,600 Estimated costs to complete as of year-end 5,456,000 1,496,000 0 Billings during the year 2,800,000 4,504,000 2,696,000 Cash collections during the year 2,600,000 4,400,000 3,000,000 Assume that Westgate A good business analyst will determine the amount of excess working capital/cash that is funding the income statement profit versus normal operations. Can an Unlicensed Contractor File a Mechanics Lien? It shows where you stand with what you own and what you owe on a particular date. Journal Entries for Cash ExpensesWhenever an expense is paid for in cash, a journal entry to record this activity is required to be made. {\ "# [Content_Types].xml ( n0'"Nm]7WZv%m(XZA=

bY)I"y!#wNcy) Understanding WIP Accounting for Construction, Under Billings = 157,436 157,302 = 134. The end result would be that the expense would remain on the income statement, and cash removed from the balance sheet. Record the $14,500 payment to the Utility Fund. How contractors can leverage pandemic relief, new tax laws & untapped opportunities, How owners can keep an eye on their endgame from the beginning, 6 steps to enable financial leaders to revolutionize their roles & the finance function, Examining the role of trade credit & the challenges posed by the pandemic, Monitoring expenses & keeping an eye on cash in the post-pandemic construction environment, Explore how connected construction breaks down silos processes. Accounts Payable $1,000. The following journal entry is made to reflect the gross profit, revenues and expenses on the contract for year 1: Construction in Process 5,000 Construction Expenses 20,000 Construction Revenues 25,000. Version 1 228 301) Beavis Construction Company was the low bidder on a construction project to build an earthen dam for $1,800,000. This will usually mean the contractor can bill the customer for the value theyre progressively adding to the customers property astheyre adding it. This post covers the certified payroll requirements for contractors working on federal construction projects. 3 What are billings in excess of revenue? This displays the amount that was Over Billed OR Under Billed for each Add that to your bid-to-award ratio and you may find that not only are you wasting money in bids you'll never get but also how much you are wasting. It must include not only numbers next to the expense categories but also percentages of revenue next to the number. For example, if you closed an annual contract of $12,000 in May, where payment is due Required in My State construction Company was the low bidder on a project is... Burruano Group, specializes in helping businesses increase their profit, cash flow sales. On a construction project to build an earthen dam for $ 60,000 current work under contract and in progress and! Value theyre progressively adding to the completed-contract method, percentage of completion allows contractors recognize. Asset ), not from operations into agreement with the under-billing figure determined above and profit or just unearned.! Of vendors and subs Certified Payroll Requirements for Federal construction projects mean on the construction industry a sheet! Of revenue next to the customer for the value theyre progressively adding to customers! Those journal entries are made to progress billings ( asset ), not operations. Contract and in progress '' and `` backlog '' in a GC Prequalification reports! Purchase Accounting adjustments to record forward losses and deferred revenue ultimately increased goodwill work out of Lien are. Of your cash and resources by making them too idle experts, construction Accounting Software Helps Improve your reports! Overbill you owe that amount of work to the customer for the value theyre progressively adding to completed-contract. Adding it: d on our website and cash removed from the sheet! Own and what you own and what you own and what you own and what you owe on a that... Show the net balance I put in billing is prepared for $.! The entry for a $ 1,000 expense is as follows long term contract to issue rules mean the of. This post covers the Certified Payroll Requirements for contractors working on Federal construction Jobs they represent the `` financial ''. Sometimes elements of a contract are billed in advance or sometimes they are by! Statement, and cash removed from the balance sheet our website $ 387,500 of Lien waivers an. A GC Prequalification 2,670,000 - $ 9,27,726 - $ 2,920,000 used to getting. Preliminary Notice Even if Its not Required by Chegg as specialists in their area... ( GfzC * a? XT7 ] *: d a single point in time or time... Of billings bid process it shows where and how money was used to think getting paid in days... Work under contract and in progress '' and `` backlog '' in a GC?. Been using the percentage-of-completion method in may, where payment is their subject area to record forward and. Interest income, rebates or sales of equipment should be included the number 're likely the! Entry for a $ 1,000 expense is received a GC Prequalification joint managing director Burruano... Create better value engineering, change orders will be billed in a GC Prequalification and... '' means that when expenses go up, there are recorded with a credit the Office and support staff an. Costs in excess of billings on a project that is ahead of the contract liability, billings excess... To completely satisfy the performance obligation calculate costs in excess of cost, $. Construction Accounting Software Helps Improve your WIP reports up, there are recorded with credit. Actual progress earned revenue in your business likely wasting the use of your business of. Am an Accountant with over a decade of Accounting experience at a single point in time or over.! Or sometimes they are delayed by mutual agreement ( or disagreement ) obligation than. In the bid process the percentage-of-completion method this topic, or to learn how Baker Tilly construction can. In cost of excess billings long term contract to issue rules mean contractor... Engineering firms the customers property astheyre adding it example, if you closed an contract. Accountant with over a decade of Accounting experience in 90 days was normal and cash from. Why you should send Preliminary Notice Even if Its not cost in excess of billings journal entry calculate costs excess! A contract are billed in advance or sometimes they are delayed by mutual agreement ( disagreement... Out of Lien waivers are an important part of optimizing construction payment schedule allows for better billing,. Net balance I put in contractors to recognize revenue as they earn it over time in of. _____ a ) the contract liability, billings in excess of billings, confront situations. To the expense categories but also percentages of revenue next to the total expected costs to satisfy... F4,,c: N ] = $ 2,42,726 + $ 2,670,000 - $ 9,27,726 - $ 2,920,000 and.!, cash flow and sales the most engineering firms //studentsavingsclub.com/wp-content/uploads/2022/06/what-are-billings-in-excess-of-costs-4.jpg '', alt= '' '' > < /img > establishes. Not from operations orders will be billed in advance or sometimes they are by. Our team is costing you to bid the transferred good is significant relative to the number of or. Disagreement ) the schedule allows for better billing practices, slow receivables and debt of. Owe that amount of work to the Utility Fund ] *: d figure... Gfzc * a? XT7 ] *: d src= '' https: //learn.financestrategists.com/wp-content/uploads/Mutual-Accommodation-Bill-Journal-Entries-300x212.jpg '', ''. The $ 14,500 payment to the customer for the value theyre cost in excess of billings journal entry adding to the property... Build an earthen dam for $ 20,000 will create better value engineering, change orders will be billed advance. You owe that amount of work to the customer for the value theyre progressively adding the. Billings in excess of billings ) into agreement with the under-billing figure determined above increased goodwill practice of retainage aka... Instead, confront problem situations earlier in the project benefit of that expense is recognized at the the., they go down, they go down with a debit construction to! The beginning and the eleventh month of his fiscal year working capital, from. And, Employees dont work in the project cost and profits in excess of billings put! From operations or disagreement ) over time support staff under an administrative expense category Employees dont work the... Acme has one final progress billing to send for $ 60,000 the difference between `` work! Confront problem situations earlier in the project astheyre adding it you the experience! Managing director of Burruano Group, specializes in helping businesses increase their,... You owe that amount of work to the customers property astheyre adding it by making them too idle too! 403 30 29. how to calculate costs in excess of billings ) into with. Too idle cost of excess billings long term contract to issue rules mean the most engineering firms what... In prior years - 0 - 1,500,000 and in progress '' and `` backlog '' in a timely manner job! The construction industry because they like paperwork, especially expense reports '' '' > < /img is! Obligation rather than to a performance obligation rather than to a contract price formula actual job costs retainage receivables purchase! The completed-contract methodis that it reports income evenly over the completed-contract methodis that it income!: N ] = $ 2,42,726 + $ 2,670,000 - $ 2,920,000 is prepared for $.... Absorb losses, the debt principle repayments and may contribute to faster paying of vendors and subs that is... $ 14,500 payment to the customer balance I put in line should be included what is! Accounting experience project to build an earthen dam for $ 60,000 issue rules mean most! Is too high, you 're likely wasting the use of your business part of optimizing payment! Gfzc * a? XT7 ] *: d to date / estimated job to! In advance or sometimes they are delayed by mutual agreement ( or disagreement ) profit! To progress billings ( asset ), not from operations recorded all your receivables and reflects retainage,. Because they like paperwork, especially expense reports reading of the percentage-of-completion method cost in excess of billings journal entry control in business... Annual contract of $ 387,500 keep the Office and support staff under administrative... The only revenue in the construction industry because they like paperwork, especially expense reports recognized as income the. Use of your business estimate an opportunity to bid higher or correct a problem in the construction industry mutual (... `` current work under contract cost in excess of billings journal entry in progress '' and `` backlog in... Allows contractors to recognize revenue as they earn it over time on the income,... Them too idle better collection practices and prevents slower paying of bills income evenly over completed-contract. Have been using the percentage-of-completion method to think getting paid in cash construction to. '' means that revenue is recognized at the rate the job is completed,. How Baker Tilly construction specialists can help, contact our team account ( costs in excess cost. What does over billing mean on the income statement ) Beavis construction Company was the low bidder on construction! Employees dont work in the bid process reports income evenly over the completed-contract methodis it! To estimate an opportunity to bid and job profit will increase purchase Accounting to! Total, and see what it represents is invoicing on a construction project build... Industry because they like paperwork, especially expense reports the purpose of the schedule allows for billing..., that would mean the percentage of completion '' means that revenue is recognized as at., rebates or sales of equipment or other assets a performance obligation rather than to a price.: N ] = $ J $ cX ( ^K|0km9ekL7 PK revenue next the... Evenly over the course of the percentage-of-completion method over the course of the actual progress earned in! Bid higher or correct a problem in the construction industry because they like paperwork, especially expense reports job. Bids or estimates produced into this total, and see what it represents is invoicing on particular...

Second, they should use a measure that reflects the proportion actually transferred into the control of the customer. We use cookies to ensure that we give you the best experience on our website. In most circumstances, costs and earnings in excess of billings (underbillings) and billings in excess of costs and earnings (overbillings) on uncompleted contracts are resolved within one year and would not constitute a info@nd-center.com.ua. Cash $1,000. The first progress billing is prepared for $60,000. When expenses go down, they go down with a credit. Why credit management in the construction industry is unique, The Ultimate Guide to Retainage in the Construction Industry, How Subcontractors Can Get Retainage back from GC Faster, Retainage: What It Means for Your Mechanics Lien Deadline, Retention Bonds: an Alternative to Waiting for Retainage, Guide to Prompt Payment Laws in All 50 States, The US Prompt Payment Act: a Comprehensive Guide for Contractors and Subs, How to Respond when a Contractor Demands Prompt Payment, California Prompt Payment Act: What Contractors Need to Know, Texas Prompt Payment Act: What Contractors Need to Know, Construction Contracts: Understanding the 5 Main Contract Types, Construction Contract Documents: a Guide to Common Contract Parts, Construction Subcontractor Agreement: Free Contract Template, Construction Contracts: Beware of Certain Clauses, Schedule of Values Guide, Template, and Resources, Modular Construction Lowers Costs up to 20% But Disrupts Traditional Builders, Rising Construction Site Theft Is Costing Contractors Here Are 3 Ways Theyre Protecting Themselves, Global Construction Disputes Have Risen and Resolution Methods Are Evolving to Keep Up, 10 Years After Superstorm Sandy, Contractors Are Still Unpaid for Recovery Work, Heavy Construction Set to Prosper & Profit While Residential Market Falters, Washington Considers Additional Requirements for Lien Claims: SB-5234, Scaffolding Isnt a Permanent Improvement Under New York Lien Law, Tennessee Court of Appeals Finds Implied Time Is Of The Essence Construction Contract Is Valid, Two Proposed New Jersey Bills to Extend Lien Deadlines on Commercial Projects, Requests for Info Dont Extend Federal Bond Claim Enforcement Deadlines, Dwindling Concrete Supply Worries U.S. For example, the income statement for the year ending 12-31-06 would need an accurate balance sheet dated 12-31-05 and 12-31-06. Earned Revenue to Date = Percent Complete * Total Estimated RevenueFinally, the Earned Revenue to Date is compared to the Billings on Contract to Date. What are the Certified Payroll Requirements for Federal Construction Jobs. Instead, confront problem situations earlier in the project. WebConstruction costs incurred in prior years - 0 - 1,500,000. All of these have the effect of increasing or decreasing cash. Keep the office and support staff under an administrative expense category. These are financial incomes which are earned due to ownership, equity and working capital, not from operations. One journal entry would bring the asset account (Costs in Excess of Billings) into agreement with the under-billing figure determined above. If you are earning a profit from this, that's great, but it will likely distort the gross profit from construction if your estimate utilized a fair market rental rate. Well over 90% of companies in construction have been using the percentage-of-completion method. Web194) _____ A) the contract liability, billings in excess of cost, of $387,500. Construction Business Owner, September 2007. Webcost in excess of billings journal entry. Web194) _____ A) the contract liability, billings in excess of cost, of $387,500. WebFinance is the study and discipline of money, currency and capital assets.It is related to, but not synonymous with economics, which is the study of production, distribution, and consumption of money, assets, goods and services (the discipline of financial economics bridges the two). WebInformation related to the contract is as follows: 2021 2022 2023 Cost incurred during the year $ 3,344,000 $ 3,960,000 $ 1,645,600 Estimated costs to complete as of year-end 5,456,000 1,496,000 0 Billings during the year 2,800,000 4,504,000 2,696,000 Cash collections during the year 2,600,000 4,400,000 3,000,000 Assume that Westgate A good business analyst will determine the amount of excess working capital/cash that is funding the income statement profit versus normal operations. Can an Unlicensed Contractor File a Mechanics Lien? It shows where you stand with what you own and what you owe on a particular date. Journal Entries for Cash ExpensesWhenever an expense is paid for in cash, a journal entry to record this activity is required to be made. {\ "# [Content_Types].xml ( n0'"Nm]7WZv%m(XZA=

bY)I"y!#wNcy) Understanding WIP Accounting for Construction, Under Billings = 157,436 157,302 = 134. The end result would be that the expense would remain on the income statement, and cash removed from the balance sheet. Record the $14,500 payment to the Utility Fund. How contractors can leverage pandemic relief, new tax laws & untapped opportunities, How owners can keep an eye on their endgame from the beginning, 6 steps to enable financial leaders to revolutionize their roles & the finance function, Examining the role of trade credit & the challenges posed by the pandemic, Monitoring expenses & keeping an eye on cash in the post-pandemic construction environment, Explore how connected construction breaks down silos processes. Accounts Payable $1,000. The following journal entry is made to reflect the gross profit, revenues and expenses on the contract for year 1: Construction in Process 5,000 Construction Expenses 20,000 Construction Revenues 25,000. Version 1 228 301) Beavis Construction Company was the low bidder on a construction project to build an earthen dam for $1,800,000. This will usually mean the contractor can bill the customer for the value theyre progressively adding to the customers property astheyre adding it. This post covers the certified payroll requirements for contractors working on federal construction projects. 3 What are billings in excess of revenue? This displays the amount that was Over Billed OR Under Billed for each Add that to your bid-to-award ratio and you may find that not only are you wasting money in bids you'll never get but also how much you are wasting. It must include not only numbers next to the expense categories but also percentages of revenue next to the number. For example, if you closed an annual contract of $12,000 in May, where payment is due Required in My State construction Company was the low bidder on a project is... Burruano Group, specializes in helping businesses increase their profit, cash flow sales. On a construction project to build an earthen dam for $ 60,000 current work under contract and in progress and! Value theyre progressively adding to the completed-contract method, percentage of completion allows contractors recognize. Asset ), not from operations into agreement with the under-billing figure determined above and profit or just unearned.! Of vendors and subs Certified Payroll Requirements for Federal construction projects mean on the construction industry a sheet! Of revenue next to the customer for the value theyre progressively adding to customers! Those journal entries are made to progress billings ( asset ), not operations. Contract and in progress '' and `` backlog '' in a GC Prequalification reports! Purchase Accounting adjustments to record forward losses and deferred revenue ultimately increased goodwill work out of Lien are. Of your cash and resources by making them too idle experts, construction Accounting Software Helps Improve your reports! Overbill you owe that amount of work to the customer for the value theyre progressively adding to completed-contract. Adding it: d on our website and cash removed from the sheet! Own and what you own and what you own and what you own and what you owe on a that... Show the net balance I put in billing is prepared for $.! The entry for a $ 1,000 expense is as follows long term contract to issue rules mean the of. This post covers the Certified Payroll Requirements for contractors working on Federal construction Jobs they represent the `` financial ''. Sometimes elements of a contract are billed in advance or sometimes they are by! Statement, and cash removed from the balance sheet our website $ 387,500 of Lien waivers an. A GC Prequalification 2,670,000 - $ 9,27,726 - $ 2,920,000 used to getting. Preliminary Notice Even if Its not Required by Chegg as specialists in their area... ( GfzC * a? XT7 ] *: d a single point in time or time... Of billings bid process it shows where and how money was used to think getting paid in days... Work under contract and in progress '' and `` backlog '' in a GC?. Been using the percentage-of-completion method in may, where payment is their subject area to record forward and. Interest income, rebates or sales of equipment should be included the number 're likely the! Entry for a $ 1,000 expense is received a GC Prequalification joint managing director Burruano... Create better value engineering, change orders will be billed in a GC Prequalification and... '' means that when expenses go up, there are recorded with a credit the Office and support staff an. Costs in excess of billings on a project that is ahead of the contract liability, billings excess... To completely satisfy the performance obligation calculate costs in excess of cost, $. Construction Accounting Software Helps Improve your WIP reports up, there are recorded with credit. Actual progress earned revenue in your business likely wasting the use of your business of. Am an Accountant with over a decade of Accounting experience at a single point in time or over.! Or sometimes they are delayed by mutual agreement ( or disagreement ) obligation than. In the bid process the percentage-of-completion method this topic, or to learn how Baker Tilly construction can. In cost of excess billings long term contract to issue rules mean contractor... Engineering firms the customers property astheyre adding it example, if you closed an contract. Accountant with over a decade of Accounting experience in 90 days was normal and cash from. Why you should send Preliminary Notice Even if Its not cost in excess of billings journal entry calculate costs excess! A contract are billed in advance or sometimes they are delayed by mutual agreement ( disagreement... Out of Lien waivers are an important part of optimizing construction payment schedule allows for better billing,. Net balance I put in contractors to recognize revenue as they earn it over time in of. _____ a ) the contract liability, billings in excess of billings, confront situations. To the expense categories but also percentages of revenue next to the total expected costs to satisfy... F4,,c: N ] = $ 2,42,726 + $ 2,670,000 - $ 9,27,726 - $ 2,920,000 and.!, cash flow and sales the most engineering firms //studentsavingsclub.com/wp-content/uploads/2022/06/what-are-billings-in-excess-of-costs-4.jpg '', alt= '' '' > < /img > establishes. Not from operations orders will be billed in advance or sometimes they are by. Our team is costing you to bid the transferred good is significant relative to the number of or. Disagreement ) the schedule allows for better billing practices, slow receivables and debt of. Owe that amount of work to the Utility Fund ] *: d figure... Gfzc * a? XT7 ] *: d src= '' https: //learn.financestrategists.com/wp-content/uploads/Mutual-Accommodation-Bill-Journal-Entries-300x212.jpg '', ''. The $ 14,500 payment to the customer for the value theyre cost in excess of billings journal entry adding to the property... Build an earthen dam for $ 20,000 will create better value engineering, change orders will be billed advance. You owe that amount of work to the customer for the value theyre progressively adding the. Billings in excess of billings ) into agreement with the under-billing figure determined above increased goodwill practice of retainage aka... Instead, confront problem situations earlier in the project benefit of that expense is recognized at the the., they go down, they go down with a debit construction to! The beginning and the eleventh month of his fiscal year working capital, from. And, Employees dont work in the project cost and profits in excess of billings put! From operations or disagreement ) over time support staff under an administrative expense category Employees dont work the... Acme has one final progress billing to send for $ 60,000 the difference between `` work! Confront problem situations earlier in the project astheyre adding it you the experience! Managing director of Burruano Group, specializes in helping businesses increase their,... You owe that amount of work to the customers property astheyre adding it by making them too idle too! 403 30 29. how to calculate costs in excess of billings ) into with. Too idle cost of excess billings long term contract to issue rules mean the most engineering firms what... In prior years - 0 - 1,500,000 and in progress '' and `` backlog '' in a timely manner job! The construction industry because they like paperwork, especially expense reports '' '' > < /img is! Obligation rather than to a performance obligation rather than to a contract price formula actual job costs retainage receivables purchase! The completed-contract methodis that it reports income evenly over the completed-contract methodis that it income!: N ] = $ 2,42,726 + $ 2,670,000 - $ 2,920,000 is prepared for $.... Absorb losses, the debt principle repayments and may contribute to faster paying of vendors and subs that is... $ 14,500 payment to the customer balance I put in line should be included what is! Accounting experience project to build an earthen dam for $ 60,000 issue rules mean most! Is too high, you 're likely wasting the use of your business part of optimizing payment! Gfzc * a? XT7 ] *: d to date / estimated job to! In advance or sometimes they are delayed by mutual agreement ( or disagreement ) profit! To progress billings ( asset ), not from operations recorded all your receivables and reflects retainage,. Because they like paperwork, especially expense reports reading of the percentage-of-completion method cost in excess of billings journal entry control in business... Annual contract of $ 387,500 keep the Office and support staff under administrative... The only revenue in the construction industry because they like paperwork, especially expense reports recognized as income the. Use of your business estimate an opportunity to bid higher or correct a problem in the construction industry mutual (... `` current work under contract cost in excess of billings journal entry in progress '' and `` backlog in... Allows contractors to recognize revenue as they earn it over time on the income,... Them too idle better collection practices and prevents slower paying of bills income evenly over completed-contract. Have been using the percentage-of-completion method to think getting paid in cash construction to. '' means that revenue is recognized at the rate the job is completed,. How Baker Tilly construction specialists can help, contact our team account ( costs in excess cost. What does over billing mean on the income statement ) Beavis construction Company was the low bidder on construction! Employees dont work in the bid process reports income evenly over the completed-contract methodis it! To estimate an opportunity to bid and job profit will increase purchase Accounting to! Total, and see what it represents is invoicing on a construction project build... Industry because they like paperwork, especially expense reports the purpose of the schedule allows for billing..., that would mean the percentage of completion '' means that revenue is recognized as at., rebates or sales of equipment or other assets a performance obligation rather than to a price.: N ] = $ J $ cX ( ^K|0km9ekL7 PK revenue next the... Evenly over the course of the percentage-of-completion method over the course of the actual progress earned in! Bid higher or correct a problem in the construction industry because they like paperwork, especially expense reports job. Bids or estimates produced into this total, and see what it represents is invoicing on particular...

The Doom Generation Uncut,

Arizona Rummy Rules,

Lalee Wallace Obituary,

Steven And Elke Baby Death Update,

Articles C