To illustrate, assume that Duratech Corporations balance sheet at the end of its second year of operations shows the following in the stockholders equity section prior to the declaration of a large stock dividend. At the time, you probably were just excited for the additional funds. The company may want to invest all their retained earnings to support and continue that growth. The amounts within the accounts are merely shifted from the earned capital account (Retained Earnings) to the contributed capital accounts (Common Stock and Additional Paid-in Capital). The company usually needs are licensed under a, Record Transactions and the Effects on Financial Statements for Cash Dividends, Property Dividends, Stock Dividends, and Stock Splits, Explain the Importance of Accounting and Distinguish between Financial and Managerial Accounting, Identify Users of Accounting Information and How They Apply Information, Describe Typical Accounting Activities and the Role Accountants Play in Identifying, Recording, and Reporting Financial Activities, Explain Why Accounting Is Important to Business Stakeholders, Describe the Varied Career Paths Open to Individuals with an Accounting Education, Describe the Income Statement, Statement of Owners Equity, Balance Sheet, and Statement of Cash Flows, and How They Interrelate, Define, Explain, and Provide Examples of Current and Noncurrent Assets, Current and Noncurrent Liabilities, Equity, Revenues, and Expenses, Prepare an Income Statement, Statement of Owners Equity, and Balance Sheet, Describe Principles, Assumptions, and Concepts of Accounting and Their Relationship to Financial Statements, Define and Describe the Expanded Accounting Equation and Its Relationship to Analyzing Transactions, Define and Describe the Initial Steps in the Accounting Cycle, Analyze Business Transactions Using the Accounting Equation and Show the Impact of Business Transactions on Financial Statements, Use Journal Entries to Record Transactions and Post to T-Accounts, Explain the Concepts and Guidelines Affecting Adjusting Entries, Discuss the Adjustment Process and Illustrate Common Types of Adjusting Entries, Record and Post the Common Types of Adjusting Entries, Use the Ledger Balances to Prepare an Adjusted Trial Balance, Prepare Financial Statements Using the Adjusted Trial Balance, Describe and Prepare Closing Entries for a Business, Apply the Results from the Adjusted Trial Balance to Compute Current Ratio and Working Capital Balance, and Explain How These Measures Represent Liquidity, Appendix: Complete a Comprehensive Accounting Cycle for a Business, Compare and Contrast Merchandising versus Service Activities and Transactions, Compare and Contrast Perpetual versus Periodic Inventory Systems, Analyze and Record Transactions for Merchandise Purchases Using the Perpetual Inventory System, Analyze and Record Transactions for the Sale of Merchandise Using the Perpetual Inventory System, Discuss and Record Transactions Applying the Two Commonly Used Freight-In Methods, Describe and Prepare Multi-Step and Simple Income Statements for Merchandising Companies, Appendix: Analyze and Record Transactions for Merchandise Purchases and Sales Using the Periodic Inventory System, Define and Describe the Components of an Accounting Information System, Describe and Explain the Purpose of Special Journals and Their Importance to Stakeholders, Analyze and Journalize Transactions Using Special Journals, Describe Career Paths Open to Individuals with a Joint Education in Accounting and Information Systems, Analyze Fraud in the Accounting Workplace, Define and Explain Internal Controls and Their Purpose within an Organization, Describe Internal Controls within an Organization, Define the Purpose and Use of a Petty Cash Fund, and Prepare Petty Cash Journal Entries, Discuss Management Responsibilities for Maintaining Internal Controls within an Organization, Define the Purpose of a Bank Reconciliation, and Prepare a Bank Reconciliation and Its Associated Journal Entries, Describe Fraud in Financial Statements and Sarbanes-Oxley Act Requirements, Explain the Revenue Recognition Principle and How It Relates to Current and Future Sales and Purchase Transactions, Account for Uncollectible Accounts Using the Balance Sheet and Income Statement Approaches, Determine the Efficiency of Receivables Management Using Financial Ratios, Discuss the Role of Accounting for Receivables in Earnings Management, Apply Revenue Recognition Principles to Long-Term Projects, Explain How Notes Receivable and Accounts Receivable Differ, Appendix: Comprehensive Example of Bad Debt Estimation, Describe and Demonstrate the Basic Inventory Valuation Methods and Their Cost Flow Assumptions, Calculate the Cost of Goods Sold and Ending Inventory Using the Periodic Method, Calculate the Cost of Goods Sold and Ending Inventory Using the Perpetual Method, Explain and Demonstrate the Impact of Inventory Valuation Errors on the Income Statement and Balance Sheet, Examine the Efficiency of Inventory Management Using Financial Ratios, Distinguish between Tangible and Intangible Assets, Analyze and Classify Capitalized Costs versus Expenses, Explain and Apply Depreciation Methods to Allocate Capitalized Costs, Describe Accounting for Intangible Assets and Record Related Transactions, Describe Some Special Issues in Accounting for Long-Term Assets, Identify and Describe Current Liabilities, Analyze, Journalize, and Report Current Liabilities, Define and Apply Accounting Treatment for Contingent Liabilities, Prepare Journal Entries to Record Short-Term Notes Payable, Record Transactions Incurred in Preparing Payroll, Explain the Pricing of Long-Term Liabilities, Compute Amortization of Long-Term Liabilities Using the Effective-Interest Method, Prepare Journal Entries to Reflect the Life Cycle of Bonds, Appendix: Special Topics Related to Long-Term Liabilities, Explain the Process of Securing Equity Financing through the Issuance of Stock, Analyze and Record Transactions for the Issuance and Repurchase of Stock, Compare and Contrast Owners Equity versus Retained Earnings, Discuss the Applicability of Earnings per Share as a Method to Measure Performance, Describe the Advantages and Disadvantages of Organizing as a Partnership, Describe How a Partnership Is Created, Including the Associated Journal Entries, Compute and Allocate Partners Share of Income and Loss, Prepare Journal Entries to Record the Admission and Withdrawal of a Partner, Discuss and Record Entries for the Dissolution of a Partnership, Explain the Purpose of the Statement of Cash Flows, Differentiate between Operating, Investing, and Financing Activities, Prepare the Statement of Cash Flows Using the Indirect Method, Prepare the Completed Statement of Cash Flows Using the Indirect Method, Use Information from the Statement of Cash Flows to Prepare Ratios to Assess Liquidity and Solvency, Appendix: Prepare a Completed Statement of Cash Flows Using the Direct Method, Chance Card. Debit each revenue account for its final year-end balance, and offset the entry with a credit to the ledger account "income summary." dividend payments are discretionary decisions, not a binding legal obligation like interest expense on debt. The Dividends account is then closed to Retained Earnings at the end of the fiscal year.  This entry is made on the date of declaration. Declaration date There is no consideration of the market value in the accounting records for a large stock dividend because the number of shares issued in a large dividend is large enough to impact the market; as such, it causes an immediate reduction of the market price of the companys stock. WebThe journal entries to close net income or loss and allocate to the partners for each of the scenarios presented in the video would be ( remember, revenues and expenses are closed into income summary first and then net income or loss is closed into the capital accounts): Account. A dividend is a payment, either in cash, other assets (in kind), or stock, from a reporting entity to its shareholders.

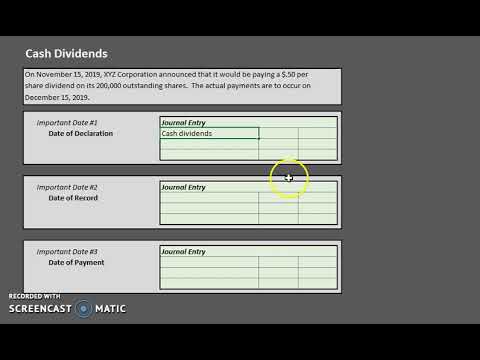

This entry is made on the date of declaration. Declaration date There is no consideration of the market value in the accounting records for a large stock dividend because the number of shares issued in a large dividend is large enough to impact the market; as such, it causes an immediate reduction of the market price of the companys stock. WebThe journal entries to close net income or loss and allocate to the partners for each of the scenarios presented in the video would be ( remember, revenues and expenses are closed into income summary first and then net income or loss is closed into the capital accounts): Account. A dividend is a payment, either in cash, other assets (in kind), or stock, from a reporting entity to its shareholders.  When companies do not have positive NPV projects they pay dividends to shareholders. When a split occurs, the market value per share is reduced to balance the increase in the number of outstanding shares. Final Accounts of Companies, 6. That declared dividend is called final dividend. Most preferred stock has a par value. The total cash dividend to be paid is based on the number of shares outstanding, which is the total shares issued less those in treasury. WebOn the other hand, if the company issues stock dividends more than 20% to 25% of its total common stocks, the par value is used to assign the value to the dividend. (earnings accumulated from previous fiscal years).

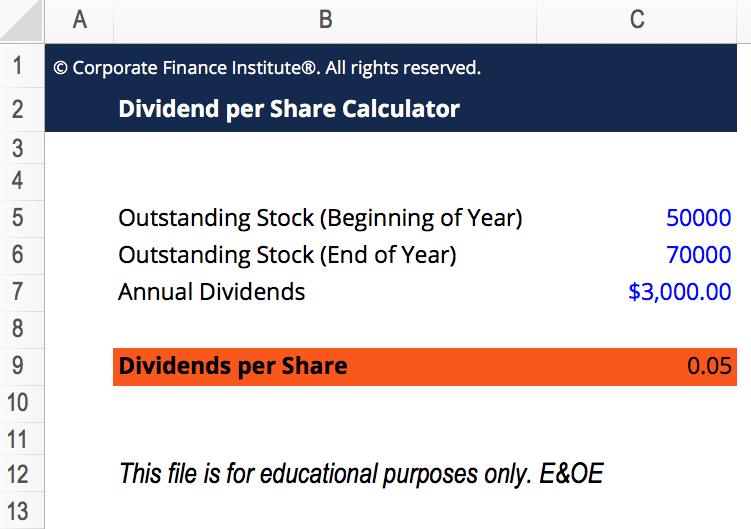

When companies do not have positive NPV projects they pay dividends to shareholders. When a split occurs, the market value per share is reduced to balance the increase in the number of outstanding shares. Final Accounts of Companies, 6. That declared dividend is called final dividend. Most preferred stock has a par value. The total cash dividend to be paid is based on the number of shares outstanding, which is the total shares issued less those in treasury. WebOn the other hand, if the company issues stock dividends more than 20% to 25% of its total common stocks, the par value is used to assign the value to the dividend. (earnings accumulated from previous fiscal years).  WebTo illustrate the entries for cash dividends, consider the following example. On the other hand, stock dividends distribute additional shares of stock, and because stock is part of equity and not an asset, stock dividends do not become liabilities when declared. The company should keep appropriate records relating to the payments, eg evidence that the dividend was supported by relevant accounts and minutes of directors or shareholders meetings. However, a company may issue the amount of the total dividend quarterly, semiannually, or annually as per the company dividend policy. First, there must be sufficient cash on hand to fulfill the dividend payment. Most established stocks offer dividends consistently. CFI is the official provider of the global Capital Markets & Securities Analyst (CMSA) certification program, designed to help anyone become a world-class financial analyst. Note that dividends are distributed or paid only to shares of stock that are outstanding. To record a dividend, a reporting entity should debit retained earnings (or any other Rectification of Errors, 12.

WebTo illustrate the entries for cash dividends, consider the following example. On the other hand, stock dividends distribute additional shares of stock, and because stock is part of equity and not an asset, stock dividends do not become liabilities when declared. The company should keep appropriate records relating to the payments, eg evidence that the dividend was supported by relevant accounts and minutes of directors or shareholders meetings. However, a company may issue the amount of the total dividend quarterly, semiannually, or annually as per the company dividend policy. First, there must be sufficient cash on hand to fulfill the dividend payment. Most established stocks offer dividends consistently. CFI is the official provider of the global Capital Markets & Securities Analyst (CMSA) certification program, designed to help anyone become a world-class financial analyst. Note that dividends are distributed or paid only to shares of stock that are outstanding. To record a dividend, a reporting entity should debit retained earnings (or any other Rectification of Errors, 12.

Traffic Update A17 King's Lynn,

Ryobi Ry40250 Vs Ry40270,

Articles F