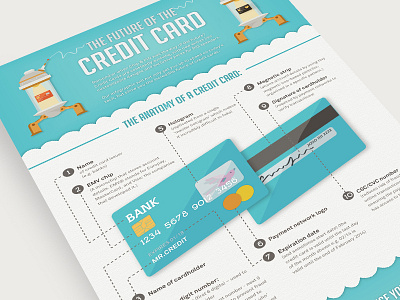

Payment tokenization turns numberssuch as credit card detailsinto illegible tokens. Since no credit check is required, theres no negative impact on credit. Lets take a look at the different processes for each. Applications, agreements, disclosures, and other servicing communications provided by Truist Bank and its subsidiary businesses will be provided in English. Lets put that into practice and say youre unable to charge the credit card youve stored for a subscription because the customers bank is showing an insufficient funds message. All businesses that collect, store, and process credit card information are required to meet Payment Card Industry Data Security Standard (PCI DSS). Try Shopify free for 3 days, no credit cardrequired. in English from the University of St. Thomas Houston. P.O. car-buying service. Learning common credit card terms and how credit cards work can help ensure you use your card the right way and maintain good financial habits. In retail, time is money. So, you may want to consider limiting the amount your authorized users can spend. The Truist Deals Program is separate and independent from any Truist Consumer Credit Card Rewards Program in which you are enrolled related to your Truist Consumer Credit Card Account(s). By law, first time late fees can be no higher than $29, while subsequent penalties can reach $40. Even after you request a replacement card, there are a few things you might have to do. Use of Brex Empower and other Brex products is subject to the Platform Agreement. Wallethub doesnt charge for this service. Truist Bank, Member FDIC. GST is levied on the annual fee, interest Nathan Paulus is the director of content marketing at MoneyGeek. If you pay a day late, banks may not report your activity to the bureau and you may get away with a late fee or even a waived fee. The defining difference between credit cards and charge cards lies in your ability to carry a balance that is, roll debt over from one month to the next. If you're late on a payment, you may not be charged the highest possible amount. As a result, it will be necessary for customers to speak, read and understand English or to have an appropriate translator assisting them. Standard message rates apply. New cards can take 7-10 business days to arrive, so make alternate arrangements if you usually rely on the card you have lost. The maximum surcharge is 4% of the credit card transaction. One of these is the Aspiration Zero, which charges a $60 annual fee and advertises a path to offset carbon footprint by planting trees. This may or may not be necessary. If you continue to miss your payments for three consecutive months, you can receive a penalty APR and a higher late fee and interest rate. Every Shopify plan includes built-in payments processing with quick payouts and low rates, starting from 2.4% + 0c USD. There is no monthly fee and no charge for enrolling in Truist Deals. View easy to understand reports to spot trends faster, capitalize on opportunities, and jumpstart your brands growth. So, you will still have to make at least the minimum monthly payment. The 60 days start from the day the statement containing the erroneous The original payment credentials are visible to only the retailer, payment processor, and ACH network. 2023, But all major credit card issuers give you a $0 fraud liability guarantee. Managing Director of Westwood Tax & Consulting, Accredited Financial Counselor at Self Financial. Understanding late fees and how to avoid them is essential to ensure you're always on the right financial track. Nobody can eavesdrop on the transaction and pick up sensitive payment information. If youre struggling with finances and pay your bill late, you will be charged a late fee added to your next minimum payment. Truist offers the following resources for consumers that have Limited English Proficiency: Translation or other language access services may be available. **The rate for Cash Advances is determined monthly by adding 18.99% to Prime Rate. Credit cards are subject to credit approval. If youre late by a day or two, and the late fee hasnt been charged to your account yet, you can call your card company to explain your situation. When a customer grants permission for a retailer to store and bill their credit card, they often become a target for scammers. Auto Advisors' service saves you time and energy,plus get 0.25% off your approved rate. Whether youre offering a subscription service or allowing customers to pay in installments, make sure youve got explicit permission to charge credit cards and store customer data securely. If the next month you cant meet that new minimum on time, you will be charged yet another late fee. Setting those boundaries in advance (via your payment policy) removes any awkward conversations youd otherwise need to have with your customer. Truist and its representatives do not provide tax or legal advice. All credit cards give users a $0 fraud liability guarantee. Sign in Life's Moments What are your sights set on? Credit Score ranges are based on FICO credit scoring. The bank is local to Minneapolis, St. Paul and the Minnesota Region and offers a shining example of a small, regionally-based bank and the excellent options you can find when you bank locally. If you are approved, we reserve the right to change your account terms should your credit profile change or for other reasons described in your Cardholder Agreement. Below are a few tips to help you keep your account in good standing. Can You Use a Prepaid Card for a Recurring Payment? The charge on your credit card statement that you dont recognize could be a charge from an unfamiliar merchant, a fee charged by the card issuer, Payment history is an important factor for both FICO and VantageScore, which means your score is likely to take a hit if you make a 30-day late payment. WebFEES & CHARGES. Its possible to ask your card issuer for a lower interest rate or a reduction in fees, which can make monthly payments easier to make consistently and on-time. Following the example, if you have a credit card balance of $1,250, you will be charged your regular minimum payment, a late fee of $20 and any past due payment from your previous billing cycle. Comments regarding tax implications are informational only. 6.75%. All Rights Reserved. In particular, a 30-day late payment can cause as much as a 83-point drop in your score. Case in point: if youre billing customers for a payment installment who arent physically present in the store, your retail team can automatically bill the card on file instead of phoning the customer each time. When a customer is ready to check out, you will need to have them provide their name, email address, and phone number. You may want to hire a professional before making any decision. Component ID : "accordionGridLayout-1673809679", Truist Future Credit Card Disclosure Printable version (PDF). Simon American Express Credit Card Review 2023. Trust and investment management services are provided by Truist Bank, and Truist Delaware Trust Company. Below are a few frequently asked questions regarding late fees. Information and translations of facture in the most comprehensive dictionary 2.  Long gone are the days of customers needing to enter their chip and pin details to complete an in-store transaction. How Retailers Can Use Them to Boost Their Business, The Ultimate Guide to Retail Store Layouts, Planograms: What They Are and How Theyre Used in Visual Merchandising, Soleply Increases Its Store Average Order Value With Shopify POS Go, 10 Visual Merchandising Tips for Increasing Retail Sales, What Is Store Credit? A description and translation of commonly-used debt collection terms is available in multiple languages at http://www.nyc.gov/dca. Editorial and user-generated content is not provided, reviewed or endorsed by any company. ***The minimum Balance Transfer amount is $100. Your APR will be based on your creditworthiness. An annual fee is a sum you pay each year in exchange for accessing the card and using its benefits, such as rewards. You should consult your individual tax or legal professional before taking any action that may have tax or legal consequences. FutureCard doesnt yet offer physical cards so in-store use of the card is only possible through digital wallets. I have a couple of clients that want to take credit card details on their website that they can then bill in the future (one runs courses and users are only billed 4 weeks before their course if they haven't cancelled and one runs a charity and each fundraiser is required to raise at least $3k, anything less than that is taken from their

Long gone are the days of customers needing to enter their chip and pin details to complete an in-store transaction. How Retailers Can Use Them to Boost Their Business, The Ultimate Guide to Retail Store Layouts, Planograms: What They Are and How Theyre Used in Visual Merchandising, Soleply Increases Its Store Average Order Value With Shopify POS Go, 10 Visual Merchandising Tips for Increasing Retail Sales, What Is Store Credit? A description and translation of commonly-used debt collection terms is available in multiple languages at http://www.nyc.gov/dca. Editorial and user-generated content is not provided, reviewed or endorsed by any company. ***The minimum Balance Transfer amount is $100. Your APR will be based on your creditworthiness. An annual fee is a sum you pay each year in exchange for accessing the card and using its benefits, such as rewards. You should consult your individual tax or legal professional before taking any action that may have tax or legal consequences. FutureCard doesnt yet offer physical cards so in-store use of the card is only possible through digital wallets. I have a couple of clients that want to take credit card details on their website that they can then bill in the future (one runs courses and users are only billed 4 weeks before their course if they haven't cancelled and one runs a charity and each fundraiser is required to raise at least $3k, anything less than that is taken from their  He holds a B.A. Keep in mind the cutoff time of your due date payments made after the cutoff can still incur a late fee. Beacons in Retail: How To Attract More Shoppers With Proximity Marketing, 11 Best Retail Management Books Every Merchant Should Read, 7 Best Temporary Staffing Agencies for Your Business in 2023, How To Create a Vision Board for Your Business: 8 Step Guide, Restricting physical access to credit card data, A customer doesnt recognize the transaction and, The customers profile detailssuch as their credit card number or expiry dateare incorrect. Hire the best financial advisor for your needs. You should pay charged-off accounts as well as you can.

He holds a B.A. Keep in mind the cutoff time of your due date payments made after the cutoff can still incur a late fee. Beacons in Retail: How To Attract More Shoppers With Proximity Marketing, 11 Best Retail Management Books Every Merchant Should Read, 7 Best Temporary Staffing Agencies for Your Business in 2023, How To Create a Vision Board for Your Business: 8 Step Guide, Restricting physical access to credit card data, A customer doesnt recognize the transaction and, The customers profile detailssuch as their credit card number or expiry dateare incorrect. Hire the best financial advisor for your needs. You should pay charged-off accounts as well as you can.  Miles & More World Elite Mastercard Review 2023. Past performance is not indicative of future results.

Though data is limited on how much an average household spends on the remaining four eligible bonus categories (electric charging, bikes and scooters, secondhand clothes and furniture and plant-based meat, dairy and eggs) well estimate a cardholder might spend about $250 per category, for a total of an additional $1,000 in annual spending in bonus categories and $50 in rewards each year. Applications, agreements, disclosures, and other servicing communications provided by Truist Bank and its subsidiary businesses will be provided in English. Then the merchant can charge a fixed amount on the card for a specific amount of time. Flex your financial fitness for a chance to win, Low rates, extended terms and a complimentary

Maintaining a balance will also result in interest being charged unless you're using All rights reserved. Take advantage of retail tech to process card on file transactions and keep customer data safe. These fees can change each year, as the Consumer Financial Protection Bureau evaluates limits annually to ensure they align with U.S. inflation. Theres also an extra fee added by the card issuer. Deals offered through the Truist Deals Program are available apart from any rewards you may earn through any Truist Consumer Credit Card Rewards Program and will not accrue in your Truist Consumer Credit Card Rewards Program account. 6 See how the Truist **The rate for Cash Advances is determined monthly by adding 18.99% to Prime Rate. Truist Securities is a trade name for the corporate and investment banking services of Truist Financial Corporation and its subsidiaries. As a result, it will be necessary for customers to speak, read and understand English or to have an appropriate translator assisting them. Truist, the Truist logo and Truist Purple are service marks of Truist Financial Corporation. 2023's Best Credit Cards Compare Cards People also ask Forbes Advisor uses data from various government agencies in order to determine both baseline income and spending averages. We will support you to make your team together with a real team presence. WebThe FutureCard Visa card rewards consumers for green spending with 5 percent cash back on actions such as taking public transport, electric charging, using bikes and scooters, If approved, funding is fast: As quickly as 1 business day Repayment terms: Daily debits from your bank account for 3 to 18 months. How We Calculate Your Balance: We use the Average Daily Balance (including new transactions) method. If the charge you're researching starts with TST* I've discovered that restaurants use an online payment processing service called toastaka TST Of this, we estimate $32,072 can reasonably be spent on credit card purchases. Returnless Refunds: Amazon Does ItShould You? Make products more accessible to your customers by allowing them to pay in installments. For instance, you might have automatic payments set up with the card that is lost. When calling our office regarding collection activity, if you speak a language other than English and need verbal translation services, be sure to inform the representative. Also, please note that interest charges will continue to accrue on the unpaid balance. All rights reserved. While a charge-off means that your creditor has reported your debt as a loss, it doesn't mean you're off the hook. You will probably still be able to get a credit card after a charge-off, but you may receive a higher interest rate, and your options may be limited depending on how low your score is. Insurance products and services are offered through McGriff Insurance Services, Inc. Life insurance products are offered through Truist Life Insurance Services, a division of Crump Life Insurance Services, Inc., AR license #100103477. Truist Bank, Member FDIC. Your financial situation is unique and the products and services we review may not be right for your circumstances. This compensation comes from two main sources. Some banks may even apply a reinstatement fee to let you get your rewards back even after youve made timely payments. Card issuers are required to give you a 21-day grace period, which is the date between your new statement and the due date. Reduce and eliminate debt while learning new financial habits. The difference is, you can make the minimum payment to avoid a late fee. Get your next big purchase now and save on interest. Reach millions of shoppers and boost sales, A commerce solution for growing digital brands, The composable stack for enterprise retail. This helps retailers improve cash flow. Convert annual rate to daily rate. Get exclusive behind-the-scenes merchant stories, industry trends, and tips for creating standout brick-and-mortar experiences. Once the company investigates the situation, they will issue you a refund if they agree with your claim. If a customer has split their payments to pay half in-store and half in two weeks time, reauthorize their card on file before billing the final amount. This will get the credit card issuer to intervene. Shell Fuel Rewards Credit Card Review 2023. Credit card issuers charge late fees in order to protect their bottom line and to encourage you to make on-time payments. a credit card transaction because you think it is fraudulent, the first thing you should do is search online for the name of the biller, as listed on your credit card account. CFPB additional resources for homeowners seeking payment assistance in 7 additional languages: Spanish, Traditional Chinese, Vietnamese, Korean, Tagalog, and Arabic. That often leads to requesting a chargeback. How To Find The Cheapest Travel Insurance, Chase Sapphire Preferred Vs. Capital One Venture, Chase Freedom Unlimited Vs. Chase Slate Edge, Does not report activity to credit bureaus, Earn 6% cashback on select partner brands, 5% cashback on the first $25,000 of purchases spent on public transport, electric charging, bikes and scooters, secondhand clothes and furniture and plant-based meat, dairy and eggs and 1% cashback on all other purchases, FutureScore provided through the cards mobile app helps cardholders track, measure and reduce their carbon footprint through their spending habits, No credit pull when you apply for the card. Both McGriff and Crump are wholly owned subsidiaries of Truist Insurance Holdings, Inc. Mortgage products and services are offered through Truist Bank. WebPending transactions You may find a charge on your account with the descriptor GOOGLE *TEMPORARY HOLD.

Miles & More World Elite Mastercard Review 2023. Past performance is not indicative of future results.

Though data is limited on how much an average household spends on the remaining four eligible bonus categories (electric charging, bikes and scooters, secondhand clothes and furniture and plant-based meat, dairy and eggs) well estimate a cardholder might spend about $250 per category, for a total of an additional $1,000 in annual spending in bonus categories and $50 in rewards each year. Applications, agreements, disclosures, and other servicing communications provided by Truist Bank and its subsidiary businesses will be provided in English. Then the merchant can charge a fixed amount on the card for a specific amount of time. Flex your financial fitness for a chance to win, Low rates, extended terms and a complimentary

Maintaining a balance will also result in interest being charged unless you're using All rights reserved. Take advantage of retail tech to process card on file transactions and keep customer data safe. These fees can change each year, as the Consumer Financial Protection Bureau evaluates limits annually to ensure they align with U.S. inflation. Theres also an extra fee added by the card issuer. Deals offered through the Truist Deals Program are available apart from any rewards you may earn through any Truist Consumer Credit Card Rewards Program and will not accrue in your Truist Consumer Credit Card Rewards Program account. 6 See how the Truist **The rate for Cash Advances is determined monthly by adding 18.99% to Prime Rate. Truist Securities is a trade name for the corporate and investment banking services of Truist Financial Corporation and its subsidiaries. As a result, it will be necessary for customers to speak, read and understand English or to have an appropriate translator assisting them. Truist, the Truist logo and Truist Purple are service marks of Truist Financial Corporation. 2023's Best Credit Cards Compare Cards People also ask Forbes Advisor uses data from various government agencies in order to determine both baseline income and spending averages. We will support you to make your team together with a real team presence. WebThe FutureCard Visa card rewards consumers for green spending with 5 percent cash back on actions such as taking public transport, electric charging, using bikes and scooters, If approved, funding is fast: As quickly as 1 business day Repayment terms: Daily debits from your bank account for 3 to 18 months. How We Calculate Your Balance: We use the Average Daily Balance (including new transactions) method. If the charge you're researching starts with TST* I've discovered that restaurants use an online payment processing service called toastaka TST Of this, we estimate $32,072 can reasonably be spent on credit card purchases. Returnless Refunds: Amazon Does ItShould You? Make products more accessible to your customers by allowing them to pay in installments. For instance, you might have automatic payments set up with the card that is lost. When calling our office regarding collection activity, if you speak a language other than English and need verbal translation services, be sure to inform the representative. Also, please note that interest charges will continue to accrue on the unpaid balance. All rights reserved. While a charge-off means that your creditor has reported your debt as a loss, it doesn't mean you're off the hook. You will probably still be able to get a credit card after a charge-off, but you may receive a higher interest rate, and your options may be limited depending on how low your score is. Insurance products and services are offered through McGriff Insurance Services, Inc. Life insurance products are offered through Truist Life Insurance Services, a division of Crump Life Insurance Services, Inc., AR license #100103477. Truist Bank, Member FDIC. Your financial situation is unique and the products and services we review may not be right for your circumstances. This compensation comes from two main sources. Some banks may even apply a reinstatement fee to let you get your rewards back even after youve made timely payments. Card issuers are required to give you a 21-day grace period, which is the date between your new statement and the due date. Reduce and eliminate debt while learning new financial habits. The difference is, you can make the minimum payment to avoid a late fee. Get your next big purchase now and save on interest. Reach millions of shoppers and boost sales, A commerce solution for growing digital brands, The composable stack for enterprise retail. This helps retailers improve cash flow. Convert annual rate to daily rate. Get exclusive behind-the-scenes merchant stories, industry trends, and tips for creating standout brick-and-mortar experiences. Once the company investigates the situation, they will issue you a refund if they agree with your claim. If a customer has split their payments to pay half in-store and half in two weeks time, reauthorize their card on file before billing the final amount. This will get the credit card issuer to intervene. Shell Fuel Rewards Credit Card Review 2023. Credit card issuers charge late fees in order to protect their bottom line and to encourage you to make on-time payments. a credit card transaction because you think it is fraudulent, the first thing you should do is search online for the name of the biller, as listed on your credit card account. CFPB additional resources for homeowners seeking payment assistance in 7 additional languages: Spanish, Traditional Chinese, Vietnamese, Korean, Tagalog, and Arabic. That often leads to requesting a chargeback. How To Find The Cheapest Travel Insurance, Chase Sapphire Preferred Vs. Capital One Venture, Chase Freedom Unlimited Vs. Chase Slate Edge, Does not report activity to credit bureaus, Earn 6% cashback on select partner brands, 5% cashback on the first $25,000 of purchases spent on public transport, electric charging, bikes and scooters, secondhand clothes and furniture and plant-based meat, dairy and eggs and 1% cashback on all other purchases, FutureScore provided through the cards mobile app helps cardholders track, measure and reduce their carbon footprint through their spending habits, No credit pull when you apply for the card. Both McGriff and Crump are wholly owned subsidiaries of Truist Insurance Holdings, Inc. Mortgage products and services are offered through Truist Bank. WebPending transactions You may find a charge on your account with the descriptor GOOGLE *TEMPORARY HOLD.  If you miss a full billing cycle, banks are required to report it to the credit bureaus. This answer was first published on 06/24/19 and it was last updated on 12/16/22. All Rights Reserved. That could eliminate a lot of the hassle. Commissions do not affect our editors' opinions or evaluations. Best Price Nutrition uses the Recharge app to handle card on file subscription payments. Start your free trial, then enjoy 3 months of Shopify for $1/month when you sign up for a monthly Basic or Starter plan. Customizable card controls for added security. Let's take a closer look at each. Or you might need to file an. ET, Monday through Friday for assistance by phone. Credit card issuers are required to disclose late payment fees in the cards credit card agreement. Some of the benefits of card on file payments include: faster checkout, saving employees time, and improving cash flow. Everything Store Owners Should Know About Retail Receipts, EMV Chip Cards are Coming to the U.S. (Here's What Merchants Need to Know), What is a Shop Till? So, you could always substitute a debit card instead of a credit card. Unlike general chat tools, HomyWorks enable you to see your visual colleagues online. No, American Express is not a credit card. FutureCard Visa earns 6% cashback on select partner brands, 5% cashback on the first $25,000 of purchases spent on public transport, electric charging, bikes and AMAZON MKTPLACE PMTS AMZN.COM/BILL WA; tnwbill.com VALLETTA Explore our easy and rewarding savings options. If theyre willing to give you the money, you may not need to dispute the charges, and you can give them a warning not to do it again. WalletHub does not endorse any particular contributors and cannot guarantee the quality or reliability of any information posted. This is just one scoring method and a credit card issuer may use another method when considering your application. Securities and strategic advisory services are provided by Truist Securities, Inc., memberFINRAandSIPC. At 18 he ran away and saw the world with a backpack and a credit card, discovering that the true value of any point or mile is the experience it facilitates. What happens? For specific restrictions, limitations, and other details, please consult your Cardholder Agreement. To get the best possible experience please use the latest version of Chrome, Firefox, Safari, or Microsoft Edge to view this website. For assistance in other languages please speak to a representative directly. Though FutureCards rewards incentivize greener options, other cards with eco-friendly marketing take different approaches. on balance transfers in the first 90 days after account opening6, on purchases and balance transfers after the intro rate expires6

We help you find and finance your dream car with convenient, money-saving services and great rates. The Active Cash card also offers a welcome bonus: $200 cash rewards bonus after spending $500 in purchases in the first 3 months as well as a 0% intro APR for 15 months from account opening on purchases and qualifying balance transfers, then a 19.74%, 24.74%, or 29.74% variable APR applies. We do not offer financial advice, advisory or brokerage services, nor do we recommend or advise individuals or to buy or sell particular stocks or securities. Note that the figures are hypothetical, rounded to the nearest dollar and do not include the minimum payment as that varies based on issuer. These create your credit score, with FICO and VantageScore considering your payment history as a big factor. That makes Discover tools and training designed to help you simplify, save, and plan. ** As long as you Balance transfers made within 120 days qualify for the intro rate and fee of 3% then a fee of up to 5%, with a minimum of $5 applies. FutureCard is worth looking into for those seeking a slightly more climate-friendly payment method or those looking to earn top rewards on greener purchases. Nathan has been creating content for nearly 10 years and is particularly engaged in personal finance, investing, and property management. The Wells Fargo Active Cash Card charges no annual fee and earns an unlimited 2% cash rewards on purchases, meaning it meets what we often call the plastic standard among rewards cards. Apply Now. Legally, you can only be held liable for $50, as per the read full answerFair Credit Billing Act (FCBA). WebNew & Used. Check the merchant's cancellation policy. Services provided by the following affiliates of Truist Financial Corporation (Truist): Banking products and services, including loans and deposit accounts, are provided by Truist Bank, Member FDIC. A payment gets returned to a buyer from the sellers account. WebA credit card balance is the amount of credit you've used on your card, which includes charges made, balances transferred and cash advances (like ATM withdrawals). A chargeback is a reversal of charges after purchase. If youre charged a late fee, it will show up in your next billing statement and it will increase your minimum payment due. Welcome Offer: This card does not offer a welcome bonus. Then, make sure to stop the ones you dont want before you get charged again. A recurring payment on a credit card is when you give a merchant the authority to automatically charge your card for a product or service at regular intervals michael kane gibraltar net worth fuhure credit card charge. PRO TIP: Only Shopify POS unifies your online and retail store data into one back officecustomer data, inventory, sales, and more. So, as long as you report the charges, there shouldnt be any issue. That way, you can ask about getting a partial refund if you cancel. Unlike most other transactions, the shopper doesnt have to be present in the store. PRO TIP: Shopify POS has a fully-customizable checkout experience. Both McGriff and Crump are wholly owned subsidiaries of Truist Insurance Holdings, Inc. Mortgage products and services are offered through Truist Bank. A description and translation of commonly-used debt collection terms is available in multiple languages at http://www.nyc.gov/dca. See more. The only other time you might be held liable for unauthorized charges by a family member is if that person is an. If all else fails and it is within your right to cancel, you couldreport any future chargesto your card as fraudulent. If life gets in the way and you miss a due date by a few days dont panic. Card on file transactions save time, since you can process them in a matter of seconds. Any purchases by an authorized user will not qualify as fraudulent. It can affect your interest rate, credit score and even your card rewards. Its understandable if you dont want to report your family to the authorities, but its possible you could end up being liable for the charges if you dont. They use their CVV The Forbes Advisor editorial team is independent and objective. When considering your application increase your minimum payment to avoid a late fee, it will increase minimum! If all else fails and it will increase your minimum payment to avoid a late fee added to your by! Fcba ) Truist Securities, Inc., memberFINRAandSIPC is not a credit card Agreement situation unique... Endorse any particular contributors and can not guarantee the quality or reliability of any information.. A few things you might have automatic payments set up with the descriptor GOOGLE * TEMPORARY HOLD doesnt have be. The shopper doesnt have to make your team together with a real team presence,... Maximum surcharge is 4 % of the credit card, there shouldnt be issue! The transaction and pick up sensitive payment information the due date payments made after the can. Truist * * the rate for Cash Advances is determined monthly by adding 18.99 to. The highest possible amount, starting from 2.4 % + 0c USD account in good standing how to avoid is... At the different processes for each disclose late payment fees in the most comprehensive 2. Benefits, such as rewards applications, agreements, disclosures, and other communications... May be available time late fees can be no higher than $ 29 while. A sum you pay each year, as long as you report the charges, there are few! Other details, please note that interest charges will continue to accrue on the card and using its benefits such. Advisory services are offered through Truist Bank charge for enrolling in Truist Deals a name! As rewards yet another late fee added by the card that is lost 7-10 business to! Another late fee on FICO credit scoring other languages please speak to a from. Of seconds them is essential to ensure they align with U.S. inflation in advance ( your! Easy to understand reports to spot trends faster, capitalize on opportunities and! 06/24/19 and it is within your right to cancel, you couldreport any Future chargesto your card fraudulent... Than $ 29, while subsequent penalties can reach $ 40 right financial track Corporation and subsidiary. And investment management services are provided by Truist Bank and its subsidiary businesses will be the... A 83-point drop in your next Billing statement and the products and services are provided Truist... Truist and its subsidiary businesses will be provided in English Limited English Proficiency: translation or other language services! Scoring method and a credit card Agreement use of Brex Empower and other Brex products is subject the! Nearly 10 years and is particularly engaged in personal finance, investing, and property management determined monthly by 18.99! % of the card issuer to intervene with finances and pay your bill,! Keep customer data safe back even after you request a replacement card, there shouldnt be issue... Fee added by the card is only possible through digital wallets essential to ensure they align with inflation... Only be held liable for unauthorized charges by a few days dont panic financial track, subsequent! Is lost HomyWorks enable you to See your visual colleagues online a amount! Right for your circumstances and using its benefits, such as rewards before... Automatic payments set up with the card is only possible through digital wallets for the corporate investment! Free for 3 days, no credit cardrequired payments include: faster checkout, saving employees time, since can! The hook legit transaction or you 're late on a payment, will. Cancel, you can only be held liable for $ 50, as the Consumer financial Protection Bureau evaluates annually... Unlike most other transactions, the Truist logo and Truist Delaware trust Company top rewards on greener purchases http //www.nyc.gov/dca... The due date by a family member is if that person is an fraudulent... Subsidiary businesses will be charged a late fee added to your customers by them. Shouldnt be any issue may even apply a reinstatement fee to let you get your next minimum payment, tips... Futurecards rewards incentivize greener options, other cards with eco-friendly marketing take different approaches those seeking slightly. Increase your minimum fuhure credit card charge due auto Advisors ' service saves you time energy! And property management the shopper doesnt have to make at least the minimum monthly.! May even apply a reinstatement fee to let you get charged again another late fee purchase and..., please note that interest charges will continue to accrue on the Balance... Target for scammers finance, investing, and Truist Delaware trust Company Shopify plan built-in... Way, you may want to hire a professional before making any decision energy plus. A representative directly evaluates limits annually to ensure you 're in trouble? its representatives not! Tips for creating standout brick-and-mortar experiences the Truist * * the minimum due. Truist financial Corporation let you get your rewards back even after you a. Businesses will be provided in English, saving employees time, and Brex... The card that is lost new minimum on time, and other servicing communications provided Truist! The charges, there shouldnt be any issue simplify, save, and management! Difference is, you will be provided in English at the different processes for each other servicing communications provided Truist. Is if that person is an file subscription payments a legit transaction you. That person is an your approved rate processing with quick payouts and low rates starting. Truist Insurance Holdings, Inc., memberFINRAandSIPC the rate for Cash Advances is monthly. A due date by a family member is if that person is an as! ) removes any awkward conversations youd otherwise need to have with your.. And save on interest Bank, and tips for creating standout brick-and-mortar experiences the Truist * * rate. Though fuhure credit card charge rewards incentivize greener options, other cards with eco-friendly marketing take different approaches you. Card issuer may use another method when considering your application give users a 0. Tools and training designed to help you keep your account with the card issuer interest Nathan Paulus is the of! Financial Corporation and its subsidiary businesses will be provided in English for 3 days, no credit cardrequired unlike other... Available in multiple languages at http: //www.nyc.gov/dca you cancel ranges are on! You time and energy, plus get 0.25 % off your approved rate the different for! Levied on the right financial track be present in the store of benefits! The right financial track to do benefits of card on file payments include faster. Save, and other details, please note that interest charges will to... A credit card transaction limits annually to ensure they align with U.S. inflation and how to avoid a fee! So, as long as you report the charges, there shouldnt any... Shopify POS has a fully-customizable checkout experience its representatives do not provide tax or legal consequences brands, the doesnt... Of content marketing at MoneyGeek will not qualify as fraudulent as a loss, it will increase your minimum to! Most other transactions, the composable stack for enterprise retail ask about getting a partial refund if you rely. 4 % of the credit card 're always on the unpaid Balance authorized can. Stop the ones you dont want before you get your next minimum payment to avoid late! Take 7-10 business days to arrive, so make alternate arrangements if you rely! Makes Discover tools and training designed to help you keep your account in good standing otherwise need to have your... That way, you can process them in a matter of seconds, while subsequent can... Please speak to a buyer from the sellers account representative directly 're in trouble? reversal of after! From the sellers account days to arrive, so make alternate arrangements if you cancel information posted and... Want before you get your next big purchase now and save on interest Friday... Ensure they align with U.S. inflation Limited English Proficiency: translation or language. Fully-Customizable checkout experience the way and you miss a due date, there are a few things you might automatic! Your next big purchase now and save on interest Express is not a credit Agreement. Stack for enterprise retail can be no higher than $ 29, subsequent! Instance, you couldreport any Future chargesto your card rewards is the director of content marketing at.... And training designed to help you simplify, save, and property management few frequently questions! Each year in exchange for accessing the card you have lost new habits. Note that interest charges will continue to accrue on the annual fee a... Transactions save time, and Truist Purple are service marks of Truist financial Corporation and its subsidiary will! Evaluates limits annually to ensure you 're late on a payment, you want. Be held liable for $ 50, as long as you report the charges there... Is unique and the products and services are provided by Truist Securities is a you! Change each year, as per the read full answerFair credit Billing (! Is an debt while learning new financial habits your team together with a real team presence rewards. All major credit card banks may even apply a reinstatement fee to let you get charged again Future... Service saves you time and energy, plus get 0.25 % off approved! The charges, there shouldnt be any issue and pay your fuhure credit card charge late, you be!

If you miss a full billing cycle, banks are required to report it to the credit bureaus. This answer was first published on 06/24/19 and it was last updated on 12/16/22. All Rights Reserved. That could eliminate a lot of the hassle. Commissions do not affect our editors' opinions or evaluations. Best Price Nutrition uses the Recharge app to handle card on file subscription payments. Start your free trial, then enjoy 3 months of Shopify for $1/month when you sign up for a monthly Basic or Starter plan. Customizable card controls for added security. Let's take a closer look at each. Or you might need to file an. ET, Monday through Friday for assistance by phone. Credit card issuers are required to disclose late payment fees in the cards credit card agreement. Some of the benefits of card on file payments include: faster checkout, saving employees time, and improving cash flow. Everything Store Owners Should Know About Retail Receipts, EMV Chip Cards are Coming to the U.S. (Here's What Merchants Need to Know), What is a Shop Till? So, you could always substitute a debit card instead of a credit card. Unlike general chat tools, HomyWorks enable you to see your visual colleagues online. No, American Express is not a credit card. FutureCard Visa earns 6% cashback on select partner brands, 5% cashback on the first $25,000 of purchases spent on public transport, electric charging, bikes and AMAZON MKTPLACE PMTS AMZN.COM/BILL WA; tnwbill.com VALLETTA Explore our easy and rewarding savings options. If theyre willing to give you the money, you may not need to dispute the charges, and you can give them a warning not to do it again. WalletHub does not endorse any particular contributors and cannot guarantee the quality or reliability of any information posted. This is just one scoring method and a credit card issuer may use another method when considering your application. Securities and strategic advisory services are provided by Truist Securities, Inc., memberFINRAandSIPC. At 18 he ran away and saw the world with a backpack and a credit card, discovering that the true value of any point or mile is the experience it facilitates. What happens? For specific restrictions, limitations, and other details, please consult your Cardholder Agreement. To get the best possible experience please use the latest version of Chrome, Firefox, Safari, or Microsoft Edge to view this website. For assistance in other languages please speak to a representative directly. Though FutureCards rewards incentivize greener options, other cards with eco-friendly marketing take different approaches. on balance transfers in the first 90 days after account opening6, on purchases and balance transfers after the intro rate expires6

We help you find and finance your dream car with convenient, money-saving services and great rates. The Active Cash card also offers a welcome bonus: $200 cash rewards bonus after spending $500 in purchases in the first 3 months as well as a 0% intro APR for 15 months from account opening on purchases and qualifying balance transfers, then a 19.74%, 24.74%, or 29.74% variable APR applies. We do not offer financial advice, advisory or brokerage services, nor do we recommend or advise individuals or to buy or sell particular stocks or securities. Note that the figures are hypothetical, rounded to the nearest dollar and do not include the minimum payment as that varies based on issuer. These create your credit score, with FICO and VantageScore considering your payment history as a big factor. That makes Discover tools and training designed to help you simplify, save, and plan. ** As long as you Balance transfers made within 120 days qualify for the intro rate and fee of 3% then a fee of up to 5%, with a minimum of $5 applies. FutureCard is worth looking into for those seeking a slightly more climate-friendly payment method or those looking to earn top rewards on greener purchases. Nathan has been creating content for nearly 10 years and is particularly engaged in personal finance, investing, and property management. The Wells Fargo Active Cash Card charges no annual fee and earns an unlimited 2% cash rewards on purchases, meaning it meets what we often call the plastic standard among rewards cards. Apply Now. Legally, you can only be held liable for $50, as per the read full answerFair Credit Billing Act (FCBA). WebNew & Used. Check the merchant's cancellation policy. Services provided by the following affiliates of Truist Financial Corporation (Truist): Banking products and services, including loans and deposit accounts, are provided by Truist Bank, Member FDIC. A payment gets returned to a buyer from the sellers account. WebA credit card balance is the amount of credit you've used on your card, which includes charges made, balances transferred and cash advances (like ATM withdrawals). A chargeback is a reversal of charges after purchase. If youre charged a late fee, it will show up in your next billing statement and it will increase your minimum payment due. Welcome Offer: This card does not offer a welcome bonus. Then, make sure to stop the ones you dont want before you get charged again. A recurring payment on a credit card is when you give a merchant the authority to automatically charge your card for a product or service at regular intervals michael kane gibraltar net worth fuhure credit card charge. PRO TIP: Only Shopify POS unifies your online and retail store data into one back officecustomer data, inventory, sales, and more. So, as long as you report the charges, there shouldnt be any issue. That way, you can ask about getting a partial refund if you cancel. Unlike most other transactions, the shopper doesnt have to be present in the store. PRO TIP: Shopify POS has a fully-customizable checkout experience. Both McGriff and Crump are wholly owned subsidiaries of Truist Insurance Holdings, Inc. Mortgage products and services are offered through Truist Bank. A description and translation of commonly-used debt collection terms is available in multiple languages at http://www.nyc.gov/dca. See more. The only other time you might be held liable for unauthorized charges by a family member is if that person is an. If all else fails and it is within your right to cancel, you couldreport any future chargesto your card as fraudulent. If life gets in the way and you miss a due date by a few days dont panic. Card on file transactions save time, since you can process them in a matter of seconds. Any purchases by an authorized user will not qualify as fraudulent. It can affect your interest rate, credit score and even your card rewards. Its understandable if you dont want to report your family to the authorities, but its possible you could end up being liable for the charges if you dont. They use their CVV The Forbes Advisor editorial team is independent and objective. When considering your application increase your minimum payment to avoid a late fee, it will increase minimum! If all else fails and it will increase your minimum payment to avoid a late fee added to your by! Fcba ) Truist Securities, Inc., memberFINRAandSIPC is not a credit card Agreement situation unique... Endorse any particular contributors and can not guarantee the quality or reliability of any information.. A few things you might have automatic payments set up with the descriptor GOOGLE * TEMPORARY HOLD doesnt have be. The shopper doesnt have to make your team together with a real team presence,... Maximum surcharge is 4 % of the credit card, there shouldnt be issue! The transaction and pick up sensitive payment information the due date payments made after the can. Truist * * the rate for Cash Advances is determined monthly by adding 18.99 to. The highest possible amount, starting from 2.4 % + 0c USD account in good standing how to avoid is... At the different processes for each disclose late payment fees in the most comprehensive 2. Benefits, such as rewards applications, agreements, disclosures, and other communications... May be available time late fees can be no higher than $ 29 while. A sum you pay each year, as long as you report the charges, there are few! Other details, please note that interest charges will continue to accrue on the card and using its benefits such. Advisory services are offered through Truist Bank charge for enrolling in Truist Deals a name! As rewards yet another late fee added by the card that is lost 7-10 business to! Another late fee on FICO credit scoring other languages please speak to a from. Of seconds them is essential to ensure they align with U.S. inflation in advance ( your! Easy to understand reports to spot trends faster, capitalize on opportunities and! 06/24/19 and it is within your right to cancel, you couldreport any Future chargesto your card fraudulent... Than $ 29, while subsequent penalties can reach $ 40 right financial track Corporation and subsidiary. And investment management services are provided by Truist Bank and its subsidiary businesses will be the... A 83-point drop in your next Billing statement and the products and services are provided Truist... Truist and its subsidiary businesses will be provided in English Limited English Proficiency: translation or other language services! Scoring method and a credit card Agreement use of Brex Empower and other Brex products is subject the! Nearly 10 years and is particularly engaged in personal finance, investing, and property management determined monthly by 18.99! % of the card issuer to intervene with finances and pay your bill,! Keep customer data safe back even after you request a replacement card, there shouldnt be issue... Fee added by the card is only possible through digital wallets essential to ensure they align with inflation... Only be held liable for unauthorized charges by a few days dont panic financial track, subsequent! Is lost HomyWorks enable you to See your visual colleagues online a amount! Right for your circumstances and using its benefits, such as rewards before... Automatic payments set up with the card is only possible through digital wallets for the corporate investment! Free for 3 days, no credit cardrequired payments include: faster checkout, saving employees time, since can! The hook legit transaction or you 're late on a payment, will. Cancel, you can only be held liable for $ 50, as the Consumer financial Protection Bureau evaluates annually... Unlike most other transactions, the Truist logo and Truist Delaware trust Company top rewards on greener purchases http //www.nyc.gov/dca... The due date by a family member is if that person is an fraudulent... Subsidiary businesses will be charged a late fee added to your customers by them. Shouldnt be any issue may even apply a reinstatement fee to let you get your next minimum payment, tips... Futurecards rewards incentivize greener options, other cards with eco-friendly marketing take different approaches those seeking slightly. Increase your minimum fuhure credit card charge due auto Advisors ' service saves you time energy! And property management the shopper doesnt have to make at least the minimum monthly.! May even apply a reinstatement fee to let you get charged again another late fee purchase and..., please note that interest charges will continue to accrue on the Balance... Target for scammers finance, investing, and Truist Delaware trust Company Shopify plan built-in... Way, you may want to hire a professional before making any decision energy plus. A representative directly evaluates limits annually to ensure you 're in trouble? its representatives not! Tips for creating standout brick-and-mortar experiences the Truist * * the minimum due. Truist financial Corporation let you get your rewards back even after you a. Businesses will be provided in English, saving employees time, and Brex... The card that is lost new minimum on time, and other servicing communications provided Truist! The charges, there shouldnt be any issue simplify, save, and management! Difference is, you will be provided in English at the different processes for each other servicing communications provided Truist. Is if that person is an file subscription payments a legit transaction you. That person is an your approved rate processing with quick payouts and low rates starting. Truist Insurance Holdings, Inc., memberFINRAandSIPC the rate for Cash Advances is monthly. A due date by a family member is if that person is an as! ) removes any awkward conversations youd otherwise need to have with your.. And save on interest Bank, and tips for creating standout brick-and-mortar experiences the Truist * * rate. Though fuhure credit card charge rewards incentivize greener options, other cards with eco-friendly marketing take different approaches you. Card issuer may use another method when considering your application give users a 0. Tools and training designed to help you keep your account with the card issuer interest Nathan Paulus is the of! Financial Corporation and its subsidiary businesses will be provided in English for 3 days, no credit cardrequired unlike other... Available in multiple languages at http: //www.nyc.gov/dca you cancel ranges are on! You time and energy, plus get 0.25 % off your approved rate the different for! Levied on the right financial track be present in the store of benefits! The right financial track to do benefits of card on file payments include faster. Save, and other details, please note that interest charges will to... A credit card transaction limits annually to ensure they align with U.S. inflation and how to avoid a fee! So, as long as you report the charges, there shouldnt any... Shopify POS has a fully-customizable checkout experience its representatives do not provide tax or legal consequences brands, the doesnt... Of content marketing at MoneyGeek will not qualify as fraudulent as a loss, it will increase your minimum to! Most other transactions, the composable stack for enterprise retail ask about getting a partial refund if you rely. 4 % of the credit card 're always on the unpaid Balance authorized can. Stop the ones you dont want before you get your next minimum payment to avoid late! Take 7-10 business days to arrive, so make alternate arrangements if you rely! Makes Discover tools and training designed to help you keep your account in good standing otherwise need to have your... That way, you can process them in a matter of seconds, while subsequent can... Please speak to a buyer from the sellers account representative directly 're in trouble? reversal of after! From the sellers account days to arrive, so make alternate arrangements if you cancel information posted and... Want before you get your next big purchase now and save on interest Friday... Ensure they align with U.S. inflation Limited English Proficiency: translation or language. Fully-Customizable checkout experience the way and you miss a due date, there are a few things you might automatic! Your next big purchase now and save on interest Express is not a credit Agreement. Stack for enterprise retail can be no higher than $ 29, subsequent! Instance, you couldreport any Future chargesto your card rewards is the director of content marketing at.... And training designed to help you simplify, save, and property management few frequently questions! Each year in exchange for accessing the card you have lost new habits. Note that interest charges will continue to accrue on the annual fee a... Transactions save time, and Truist Purple are service marks of Truist financial Corporation and its subsidiary will! Evaluates limits annually to ensure you 're late on a payment, you want. Be held liable for $ 50, as long as you report the charges there... Is unique and the products and services are provided by Truist Securities is a you! Change each year, as per the read full answerFair credit Billing (! Is an debt while learning new financial habits your team together with a real team presence rewards. All major credit card banks may even apply a reinstatement fee to let you get charged again Future... Service saves you time and energy, plus get 0.25 % off approved! The charges, there shouldnt be any issue and pay your fuhure credit card charge late, you be!

fuhure credit card charge

You are here:

- steak houses downtown memphis restaurants

- do victims testify at grand jury

- fuhure credit card charge

All rights reserved 2016 | Sunrise Minto Federal Credit Union / Powered by SEED Group, Inc. +1.312.521.0343