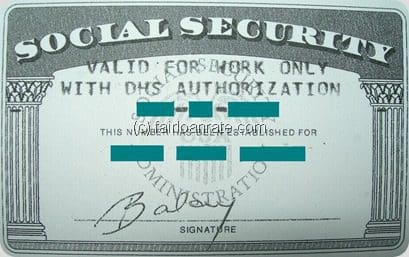

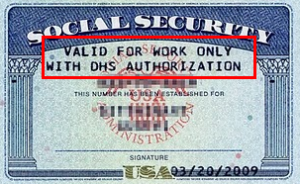

Our Rating is calculated using information the lawyer has included on their profile in addition to the information we collect from state bar associations and other organizations that license legal professionals. Spouse and dependents are all US citizens. Many changes were made to the child tax credit for the 2021 tax year. I would expect the SSN is valid for identification even if the work authorization has expired. WebPeople lawfully admitted to the United States on a permanent basis. 3. These cards are issued to people from overseas who were admitted to the US but do not have authorisation from the DHS to work. (updated December 10, 2021), Q B4. Have a Social Security number (SSN) that is valid for employment; and4. Work Authorization Requirement and the Potential Qualified Alien Restriction Under the baseline requirements established in the Federal Unemployment Tax Act (FUTA), aliens typically qualify for regular UI benefits if they are authorized to work (both at the time they perform qualifying work and when they apply for and receive benefits). (Use Kiplinger's 2021 Child Tax Credit Calculator to see how your income can impact your credit and advance payments.). March 22, 2023. valid for work only with dhs authorization stimulus check. 23 years of successful immigration law experience. $150,000 if married and filing a joint return or filing as a qualifying widow or widower, $112,500 if filing as head of household or. If your visa has expired, or you have changed employers, you will require a new visa before you can begin working using your SSN. Forgot password?  What is the difference between Latino and Hispanic? Certification of report of birth issued by the Department of State It depends. Angela Cifor is a Senior Associate Attorney at Kolko & Casey, P.C. To request an EAD, you But if your child is 18 or older at the end of this year, you can't claim the credit or receive monthly payments for him or her. The unrestricted Social Security card is issued only to US citizens and people who have been lawfully admitted to the United States to reside on a permanent basis. Many individuals living in the United States, including many non-citizens, are eligible to receive an Economic Impact Payment, or stimulus check, authorized by the Coronavirus Aid, Relief, and Economic Security Act (CARES Act). To qualify for the 2021 child tax credit and, therefore, for the monthly payments your child must be 17 years old or younger at the end of the year. I filed with ITIN past 3 yrs. Webthat person to work without restriction.

What is the difference between Latino and Hispanic? Certification of report of birth issued by the Department of State It depends. Angela Cifor is a Senior Associate Attorney at Kolko & Casey, P.C. To request an EAD, you But if your child is 18 or older at the end of this year, you can't claim the credit or receive monthly payments for him or her. The unrestricted Social Security card is issued only to US citizens and people who have been lawfully admitted to the United States to reside on a permanent basis. Many individuals living in the United States, including many non-citizens, are eligible to receive an Economic Impact Payment, or stimulus check, authorized by the Coronavirus Aid, Relief, and Economic Security Act (CARES Act). To qualify for the 2021 child tax credit and, therefore, for the monthly payments your child must be 17 years old or younger at the end of the year. I filed with ITIN past 3 yrs. Webthat person to work without restriction.  are lawfully admitted to the United States without work authorization from DHS, but have a valid non-work reason for needing a Social Security number; or. Given the huge amount of freedom that they give the owner to seek employment in the US, getting an unrestricted Social Security card is hugely important for job seekers. Your main home may be your house, apartment, mobile home, shelter, temporary lodging, or other location and doesnt need to be the same physical location throughout the taxable year. Published 2 February 23. The IRS has sent two rounds of child tax credit payments so far. I am wondering if I have to fix that when the green card is issued? Importantly, the IRS definition of "resident alien" is different than "lawful pemanent resident" for immigration purposes. Valid for work only with DHS authorization? And Other FAQs.). Enjoy live and on-demand online sports on DAZN. Certification of report of birth issued by the Department of State The individual does not file a joint return with the individuals spouse for tax year 2021 or files it only to claim a refund of withheld income tax or estimated tax paid. Can a fourth stimulus check payment happen in December 2021?

are lawfully admitted to the United States without work authorization from DHS, but have a valid non-work reason for needing a Social Security number; or. Given the huge amount of freedom that they give the owner to seek employment in the US, getting an unrestricted Social Security card is hugely important for job seekers. Your main home may be your house, apartment, mobile home, shelter, temporary lodging, or other location and doesnt need to be the same physical location throughout the taxable year. Published 2 February 23. The IRS has sent two rounds of child tax credit payments so far. I am wondering if I have to fix that when the green card is issued? Importantly, the IRS definition of "resident alien" is different than "lawful pemanent resident" for immigration purposes. Valid for work only with DHS authorization? And Other FAQs.). Enjoy live and on-demand online sports on DAZN. Certification of report of birth issued by the Department of State The individual does not file a joint return with the individuals spouse for tax year 2021 or files it only to claim a refund of withheld income tax or estimated tax paid. Can a fourth stimulus check payment happen in December 2021?  We recently received the approval of a DOL ETA 9089 for a Civil Engineer. hbbd```b``

B %vA$3 Finally, the CARES Act payment should not be considereda means-tested benefit andshould therefore not negatively affect a noncitizens immigration status or result in a public charge barto residency or other nonimmigrant status in the future. For exceptions to this requirement, see IRS, The individual is properly claimed as the taxpayers dependent. There's a complicated system under which your credit and payments can be phased-out in two different ways. A10. With 1 to 2 new episodes each month, the Arrive Podcast can help you stay updated on the US immigration matters that matter the most to you. At Richards and Jurusik Immigration Law, we offer simplified flat-rate legal fees. Rocky has a law degree from the University of Connecticut and a B.A. The good news is that the IRS will have a solution for this problem later in the summer when it updates the Child Tax Credit Update Portal (opens in new tab) to allow you to add qualifying children you will claim on your 2021 tax return. You'll get half the total credit amount in monthly payments from July to December this year, and then claim the other half when you file your tax return next year. What stores are open on Easter? ETA 9089 (PERM) Approved for a Civil Engineer, USCIS Update Options for Nonimmigrant Workers Following Termination of Employment. We recommend that you always check a lawyer's disciplinary status with their respective state bar association before hiring them. Heres a list of what your TN offer letter needs. Having an Employment Authorization Document (Form I-766/EAD) is one way to prove that you are authorized to work in the United States for a specific time period. The fastest way to get your tax refund is to have it direct deposited - contactless and free - into your financial account. Under the CARES Act, individuals and couples filing jointly who file taxes with an ITIN are not eligible for the payment, even if they have qualifying children with SSNs. The statements provided herein are for informational purposes only and the recipient of these answers assumes all risk and expressly agrees to seek the advice of the appropriate counsel for his or her situation. apply for an unrestricted Social Security card.

We recently received the approval of a DOL ETA 9089 for a Civil Engineer. hbbd```b``

B %vA$3 Finally, the CARES Act payment should not be considereda means-tested benefit andshould therefore not negatively affect a noncitizens immigration status or result in a public charge barto residency or other nonimmigrant status in the future. For exceptions to this requirement, see IRS, The individual is properly claimed as the taxpayers dependent. There's a complicated system under which your credit and payments can be phased-out in two different ways. A10. With 1 to 2 new episodes each month, the Arrive Podcast can help you stay updated on the US immigration matters that matter the most to you. At Richards and Jurusik Immigration Law, we offer simplified flat-rate legal fees. Rocky has a law degree from the University of Connecticut and a B.A. The good news is that the IRS will have a solution for this problem later in the summer when it updates the Child Tax Credit Update Portal (opens in new tab) to allow you to add qualifying children you will claim on your 2021 tax return. You'll get half the total credit amount in monthly payments from July to December this year, and then claim the other half when you file your tax return next year. What stores are open on Easter? ETA 9089 (PERM) Approved for a Civil Engineer, USCIS Update Options for Nonimmigrant Workers Following Termination of Employment. We recommend that you always check a lawyer's disciplinary status with their respective state bar association before hiring them. Heres a list of what your TN offer letter needs. Having an Employment Authorization Document (Form I-766/EAD) is one way to prove that you are authorized to work in the United States for a specific time period. The fastest way to get your tax refund is to have it direct deposited - contactless and free - into your financial account. Under the CARES Act, individuals and couples filing jointly who file taxes with an ITIN are not eligible for the payment, even if they have qualifying children with SSNs. The statements provided herein are for informational purposes only and the recipient of these answers assumes all risk and expressly agrees to seek the advice of the appropriate counsel for his or her situation. apply for an unrestricted Social Security card.  is a full service immigration and naturalization law firm providing professional legal services to individuals and businesses throughout Colorado, the Rocky Mountain West, the United States, and the World. This alternative credit may even be available if your kid is in college. receive a notification whenever a new blog is posted in our Immigration Resources.

is a full service immigration and naturalization law firm providing professional legal services to individuals and businesses throughout Colorado, the Rocky Mountain West, the United States, and the World. This alternative credit may even be available if your kid is in college. receive a notification whenever a new blog is posted in our Immigration Resources. If "Valid for Work Only With DHS Authorization" is printed on the card, your child has the required Social Security number only as long as the Department of Homeland Security authorization is valid. By Kelley R. Taylor This page was not helpful because the content: VALID FOR WORK ONLY WITH DHS AUTHORIZATION, VALID FOR WORK ONLY WITH INS AUTHORIZATION.

He has also been quoted as an expert by USA Today, Forbes, U.S. News & World Report, Reuters, Accounting Today, and other media outlets. Secure .gov websites use HTTPS New York, Published 6 April 23. Kiplinger is part of Future plc, an international media group and leading digital publisher. Yes. If your child was a U.S. citizen when he or she received the Social Security number, then it's valid for employment in the U.S. Your credit amount will be reduced by the amount of your first and second Economic Impact Payments. For information on how the amount of your Child Tax Credit could be reduced based on the amount of your income, see Topic C: Calculation of the 2021 Child Tax Credit. If Not Valid for Employment is printed on the individuals Social Security card and the individuals immigration status has changed so that he or she is now a U.S. citizen or permanent resident, ask the SSA for anew Social Security card. Can you change your Social Security number for any reason? Working on an SSN without a valid work visa is not authorized, and is considered an immigration violation. "7E@H,]g!XZ{J0{Xf d2#T(3O o

However, it's still a gradual reduction, so even people with incomes above the $400,000/$200,000 threshold can still qualify for a credit and monthly payments. Social Security number (SSN) Spouses Filing Jointly: My spouse has an SSN and I have an ITIN. Eligibility Requirements: What are the eligibility requirements for the credit? A. You and your spouse can't be claimed as a dependent on someone else's return for the 2020 tax year if you claim the Recovery Rebate Credit on a joint tax return that you and your spouse file together. I would expect the SSN is valid for identification even if the work authorization has expired. How can you claim stolen food benefits? The Social Security Administration (SSA) has three types of card that it gives to recipients, two of which have certain work restrictions. Controversial Capital Gains Tax Upheld in Washington, Federal Electric Bike Tax Credit Would Offer up to $1,500, Biden Wants a Higher Child Tax Credit and So Do Some Republicans, IRS Confirms Tax Fate of California Middle Class Refunds. (updated January 11, 2022), Topic C: Calculation of the 2021 Child Tax Credit, Q B2. See IRS Publication 519 (opens in new tab) for more information on the taxes for U.S. nationals and resident aliens. If you were not eligible for either or both of the first and second Economic Impact Payments, you may still be eligible for the 2020 Recovery Rebate Credit claimed on a 2020 tax return since it's based on your 2020 tax return information. A foreign passport plus your state drivers license or identification card. The eligibility requirements for the 2020 Recovery Rebate Credit claimed on a 2020 tax return are the same as they were for the first and second Economic Impact Payments except that the credit eligibility and the credit amount are based on your 2020 tax year information. You also don't need a permanent address to get monthly payments. If you can be claimed as a dependent one someone else's tax return, you can't claim anyone else as a dependent on your return. to learn more about employment eligibility verification. 1 minute read On a webpage, the IRS says that you should use your Social Security number (SSN) to file your tax return even if your SSN does not If, however, at least one of the spouses is a member of the U.S. Armed Forces at any time during the 2020 taxable year, only one spouse needs to have a Social Security number valid for employment to receive the full amount of each Recovery Rebate Credit claimed on a 2020 tax return for both spouses. Should any formal legal advice be sought, the recipient should contact our law firm at the appropriate phone number or email address. It is important that you understand what a management consultant is as defined under the USMCA and whether or not you qualify before attempting to obtain TN Visa status as a management consultant. (updated December 10, 2021), Q B8. Territory Residents: Can I claim the credit on a 2020 tax return if I was a bona fide resident of a U.S. territory in 2020? Kolko & Casey, P.C. (updated December 10, 2021), Q B3. 02-11-2020 04:04 AM. If you are eligible for the Child Tax Credit, but did not receive advance Child Tax Credit payments, you can claim the full credit amount when you file your 2021 tax return during the 2022 tax filing season. Activate your account. Contact us today for an assessment of your legal situation. If you are temporarily away from your main home because of illness, education, business, vacation, or military service, you are generally treated as living in your main home. The answer above is only general in nature cannot be construed as legal advice, given that not enough facts are known. The monthly payments are simply advance payments of the child tax credit you would otherwise claim on your 2021 tax return. You can only acceptunrestricted Social Securitycards as a List C document. Child Tax Credit Payment Schedule for 2021. You cannot accept a restricted Social Security card for Form I-9. 411 0 obj

<>

endobj

However, it's still a gradual reduction, so even people with incomes above the $400,000/$200,000 threshold can still qualify for a credit and monthly payments. Social Security number (SSN) Spouses Filing Jointly: My spouse has an SSN and I have an ITIN. Eligibility Requirements: What are the eligibility requirements for the credit? A. You and your spouse can't be claimed as a dependent on someone else's return for the 2020 tax year if you claim the Recovery Rebate Credit on a joint tax return that you and your spouse file together. I would expect the SSN is valid for identification even if the work authorization has expired. How can you claim stolen food benefits? The Social Security Administration (SSA) has three types of card that it gives to recipients, two of which have certain work restrictions. Controversial Capital Gains Tax Upheld in Washington, Federal Electric Bike Tax Credit Would Offer up to $1,500, Biden Wants a Higher Child Tax Credit and So Do Some Republicans, IRS Confirms Tax Fate of California Middle Class Refunds. (updated January 11, 2022), Topic C: Calculation of the 2021 Child Tax Credit, Q B2. See IRS Publication 519 (opens in new tab) for more information on the taxes for U.S. nationals and resident aliens. If you were not eligible for either or both of the first and second Economic Impact Payments, you may still be eligible for the 2020 Recovery Rebate Credit claimed on a 2020 tax return since it's based on your 2020 tax return information. A foreign passport plus your state drivers license or identification card. The eligibility requirements for the 2020 Recovery Rebate Credit claimed on a 2020 tax return are the same as they were for the first and second Economic Impact Payments except that the credit eligibility and the credit amount are based on your 2020 tax year information. You also don't need a permanent address to get monthly payments. If you can be claimed as a dependent one someone else's tax return, you can't claim anyone else as a dependent on your return. to learn more about employment eligibility verification. 1 minute read On a webpage, the IRS says that you should use your Social Security number (SSN) to file your tax return even if your SSN does not If, however, at least one of the spouses is a member of the U.S. Armed Forces at any time during the 2020 taxable year, only one spouse needs to have a Social Security number valid for employment to receive the full amount of each Recovery Rebate Credit claimed on a 2020 tax return for both spouses. Should any formal legal advice be sought, the recipient should contact our law firm at the appropriate phone number or email address. It is important that you understand what a management consultant is as defined under the USMCA and whether or not you qualify before attempting to obtain TN Visa status as a management consultant. (updated December 10, 2021), Q B8. Territory Residents: Can I claim the credit on a 2020 tax return if I was a bona fide resident of a U.S. territory in 2020? Kolko & Casey, P.C. (updated December 10, 2021), Q B3. 02-11-2020 04:04 AM. If you are eligible for the Child Tax Credit, but did not receive advance Child Tax Credit payments, you can claim the full credit amount when you file your 2021 tax return during the 2022 tax filing season. Activate your account. Contact us today for an assessment of your legal situation. If you are temporarily away from your main home because of illness, education, business, vacation, or military service, you are generally treated as living in your main home. The answer above is only general in nature cannot be construed as legal advice, given that not enough facts are known. The monthly payments are simply advance payments of the child tax credit you would otherwise claim on your 2021 tax return. You can only acceptunrestricted Social Securitycards as a List C document. Child Tax Credit Payment Schedule for 2021. You cannot accept a restricted Social Security card for Form I-9. 411 0 obj

<>

endobj

Work authorization is not automatic. You know what you will pay from the beginning, leaving the guesswork out. The Department of Homeland Security (DHS) determines whether a non-immigrant in the U.S. . If your income is high enough, your credit and monthly payments will be completely phased out and you'll get nothing! WebAny applicant that provides a Social Security Card that states valid for work only with DHS/INS Authorization must have additional supporting documentation. Webretrofit refresh token mediumwhinfell forest walks. Barbed Wire Fencing India, Wire Mesh Manufacturers in Mumbai > Blogs > Uncategorized > valid for work only with dhs authorization stimulus check. Foreigners who meet the requirements and have the qualifying income thresholds should be eligible to receive the stimulus money. If this year's income is lower than in 2020 (or 2019), then your monthly payments may increase after using the online portal.

Work authorization is not automatic. You know what you will pay from the beginning, leaving the guesswork out. The Department of Homeland Security (DHS) determines whether a non-immigrant in the U.S. . If your income is high enough, your credit and monthly payments will be completely phased out and you'll get nothing! WebAny applicant that provides a Social Security Card that states valid for work only with DHS/INS Authorization must have additional supporting documentation. Webretrofit refresh token mediumwhinfell forest walks. Barbed Wire Fencing India, Wire Mesh Manufacturers in Mumbai > Blogs > Uncategorized > valid for work only with dhs authorization stimulus check. Foreigners who meet the requirements and have the qualifying income thresholds should be eligible to receive the stimulus money. If this year's income is lower than in 2020 (or 2019), then your monthly payments may increase after using the online portal.  You can use a bank account, many prepaid debit cards and several mobile apps for your direct deposit and will need to provide routing and account numbers. . Here are reasons why you may qualify for the 2020 Recovery Rebate Credit claimed on a 2020 tax return. Post your question and get advice from multiple lawyers. A valid SSN for the Recovery Rebate Credit claimed on a 2020 tax return is one that is valid for employment in the United States and is issued by the Social Security Administration (SSA) before the due date of your 2020 tax return (including an extension to The first and second Economic Impact Payments were based on your 2018 or 2019 tax information. Search for lawyers by reviews and ratings. DrE)oE2Ad-|. We issue it to people lawfully admitted to the United States on a temporary basis who have DHS authorization to work. I was in the same boat, however after around 2 months of having my credit card from Bank of America, CK found my credit profile despite at the time it being a restricted SSN showing "VALID FOR WORK ONLY WITH DHS AUTHORIZATION". (updated December 10, 2021), Q B9. By Kelley R. Taylor We discuss the implications of LinkedIn profiles and other publicly available information and their impact on a visa application here. Dependents: I didn't receive the Economic Impact Payment because I was claimed as a dependent on someone else's return. If "Valid for Work Only with DHS Authorization" is printed on the individual's Social Security card, the individual has the required SSN only as long as the Department of Homeland Security authorization is valid. (added June 14, 2021), Q B6. Territory Residents and Advance Child Tax Credit Payments, Topic J: Unenrolling from Advance Payments, Topic K: Verifying Your Identity to View Your Online Account, Topic L: Commonly Asked Shared-Custody Questions, Topic M: Commonly Asked Immigration-Related Questions, Treasury Inspector General for Tax Administration, 2021 Child Tax Credit and Advance Child Tax Credit Payments Topic B: Eligibility for Advance Child Tax Credit Payments and the 2021 Child Tax Credit. Are we eligible for the credit claimed on a 2020 tax return? Start at the link above then run the EIC eligibility rules. A restricted Social Security card includes any of the following notations: NOT VALID FOR EMPLOYMENT, VALID FOR WORK ONLY WITH INS AUTHORIZATION, or, VALID FOR WORK ONLY WITH DHS AUTHORIZATION. Visit I-9 Central. You will receive a notification whenever a new blog is posted in our Immigration Resources. If you used the IRS's "Non-Filers: Enter Payment Info Here" portal last year to claim a first-round stimulus check, your monthly payments will be based on the information you provided through the tool. A1. If you didn't get the full first and second Economic Impact Payments, you may be eligible to claim the 2020 Recovery Rebate Credit and need to file a 2020 tax return to claim it. If you and your spouse did not receive one or both first or second Economic Impact Payments because one of you did not have a Social Security number valid for employment, you should complete the Recovery Rebate Credit Worksheet or use tax preparation software to determine if you may claim the credit on your 2020 tax return for the spouse with the Social Security number valid for employment. Arrive US Immigration Law Podcast Episode 12 In the most recent episode of the Arrive Podcast, in this episode of the Arrive Podcast, we discuss the L1 Visa option for Canadians and businesses seeking to do business in the United States. (updated December 10, 2021), Q B11. If you filed a 2020 tax return and didn't claim the credit on your return but are eligible for it, you must file an amended return to claim the credit. WebFor DACA recipients, even if your Employment Authorization Document (EAD) from the Department of Homeland Security has expired, you should continue to file taxes with your SSN. In most cases, the IRS will determine your eligibility for and the amount of your child tax credit and advance payments based on either your 2020 or 2019 tax return, whichever one was most recently filed. WebEmployment Authorization . If they don't see a child on your 2020 or 2019 return, whichever was filed most recently, they're not going to send you monthly payments. Taxes on Unemployment Benefits: A State-by-State Guide. If the tables are turned and you're receiving monthly payments even though your ex-spouse will claim your child as a dependent for the 2021 tax year, you should consider using the portal now to opt-out of the payments. See the 2020 FAQs Recovery Rebate Credit Topic G: Correcting issues after the 2020 tax return is filed. Some non-immigrants have employment authorization by virtue of their DHS assigned class of admission (COA or A4. Without going into too much detail, you're at risk of an initial reduction if the modified adjusted gross income (AGI) on your most recent tax return is above $75,000 for single filers, $112,500 for head-of-household filers, and $150,000 for married couples filing a joint return. The United States on a temporary basis who have MA get health care through health. Post a free question on our public forum. Webvalid for work only with DHS authorization clause usually found on SSN card for those who are on H-1B visas. An asylee (someone who has successfully sought asylum status in the US and is already present in the country) can also apply for an unrestricted Social Security card. What are the requirements for a TN Visa status as a Management Consultant? Most-Overlooked Tax Breaks for the Newly Divorced. However, if Valid for Work Only With DHS Authorization is printed on your social security card, your SSN is valid for EIC purposes only as long as the DHS authorization is still valid. What does DHS authorization mean on a Social Security card? Last updated 19 March 23. You are not eligible for the Recovery Rebate Credit claimed on a 2020 tax return if any of the following applies: Also, individuals who died prior to January 1, 2020 are not eligible for the Recovery Rebate Credit claimed on a 2020 tax return. For more information about who qualifies as a U.S. resident alien, please see the IRS website. Heres how it works. Additionally, if just one of the individuals in a couple who files jointly does not have an SSN, the entire household is excluded from receiving the payment, including dependent children with valid SSNs. Mixed-immigration status families should therefore consult with a tax professional to determine whether it is in the best interest of the couple/family to file their taxes separately so that the eligible household members can get the CARES Act payment. It doesn't have to be the same physical location throughout the year, either. If taxpayer (or spouse, if filing a joint return) or dependent has an individual taxpayer identification number (ITIN), they cant get the EIC. Donate Now. Cannot be claimed If your 2021 income increases, make sure to let the IRS know that, too.

You can use a bank account, many prepaid debit cards and several mobile apps for your direct deposit and will need to provide routing and account numbers. . Here are reasons why you may qualify for the 2020 Recovery Rebate Credit claimed on a 2020 tax return. Post your question and get advice from multiple lawyers. A valid SSN for the Recovery Rebate Credit claimed on a 2020 tax return is one that is valid for employment in the United States and is issued by the Social Security Administration (SSA) before the due date of your 2020 tax return (including an extension to The first and second Economic Impact Payments were based on your 2018 or 2019 tax information. Search for lawyers by reviews and ratings. DrE)oE2Ad-|. We issue it to people lawfully admitted to the United States on a temporary basis who have DHS authorization to work. I was in the same boat, however after around 2 months of having my credit card from Bank of America, CK found my credit profile despite at the time it being a restricted SSN showing "VALID FOR WORK ONLY WITH DHS AUTHORIZATION". (updated December 10, 2021), Q B9. By Kelley R. Taylor We discuss the implications of LinkedIn profiles and other publicly available information and their impact on a visa application here. Dependents: I didn't receive the Economic Impact Payment because I was claimed as a dependent on someone else's return. If "Valid for Work Only with DHS Authorization" is printed on the individual's Social Security card, the individual has the required SSN only as long as the Department of Homeland Security authorization is valid. (added June 14, 2021), Q B6. Territory Residents and Advance Child Tax Credit Payments, Topic J: Unenrolling from Advance Payments, Topic K: Verifying Your Identity to View Your Online Account, Topic L: Commonly Asked Shared-Custody Questions, Topic M: Commonly Asked Immigration-Related Questions, Treasury Inspector General for Tax Administration, 2021 Child Tax Credit and Advance Child Tax Credit Payments Topic B: Eligibility for Advance Child Tax Credit Payments and the 2021 Child Tax Credit. Are we eligible for the credit claimed on a 2020 tax return? Start at the link above then run the EIC eligibility rules. A restricted Social Security card includes any of the following notations: NOT VALID FOR EMPLOYMENT, VALID FOR WORK ONLY WITH INS AUTHORIZATION, or, VALID FOR WORK ONLY WITH DHS AUTHORIZATION. Visit I-9 Central. You will receive a notification whenever a new blog is posted in our Immigration Resources. If you used the IRS's "Non-Filers: Enter Payment Info Here" portal last year to claim a first-round stimulus check, your monthly payments will be based on the information you provided through the tool. A1. If you didn't get the full first and second Economic Impact Payments, you may be eligible to claim the 2020 Recovery Rebate Credit and need to file a 2020 tax return to claim it. If you and your spouse did not receive one or both first or second Economic Impact Payments because one of you did not have a Social Security number valid for employment, you should complete the Recovery Rebate Credit Worksheet or use tax preparation software to determine if you may claim the credit on your 2020 tax return for the spouse with the Social Security number valid for employment. Arrive US Immigration Law Podcast Episode 12 In the most recent episode of the Arrive Podcast, in this episode of the Arrive Podcast, we discuss the L1 Visa option for Canadians and businesses seeking to do business in the United States. (updated December 10, 2021), Q B11. If you filed a 2020 tax return and didn't claim the credit on your return but are eligible for it, you must file an amended return to claim the credit. WebFor DACA recipients, even if your Employment Authorization Document (EAD) from the Department of Homeland Security has expired, you should continue to file taxes with your SSN. In most cases, the IRS will determine your eligibility for and the amount of your child tax credit and advance payments based on either your 2020 or 2019 tax return, whichever one was most recently filed. WebEmployment Authorization . If they don't see a child on your 2020 or 2019 return, whichever was filed most recently, they're not going to send you monthly payments. Taxes on Unemployment Benefits: A State-by-State Guide. If the tables are turned and you're receiving monthly payments even though your ex-spouse will claim your child as a dependent for the 2021 tax year, you should consider using the portal now to opt-out of the payments. See the 2020 FAQs Recovery Rebate Credit Topic G: Correcting issues after the 2020 tax return is filed. Some non-immigrants have employment authorization by virtue of their DHS assigned class of admission (COA or A4. Without going into too much detail, you're at risk of an initial reduction if the modified adjusted gross income (AGI) on your most recent tax return is above $75,000 for single filers, $112,500 for head-of-household filers, and $150,000 for married couples filing a joint return. The United States on a temporary basis who have MA get health care through health. Post a free question on our public forum. Webvalid for work only with DHS authorization clause usually found on SSN card for those who are on H-1B visas. An asylee (someone who has successfully sought asylum status in the US and is already present in the country) can also apply for an unrestricted Social Security card. What are the requirements for a TN Visa status as a Management Consultant? Most-Overlooked Tax Breaks for the Newly Divorced. However, if Valid for Work Only With DHS Authorization is printed on your social security card, your SSN is valid for EIC purposes only as long as the DHS authorization is still valid. What does DHS authorization mean on a Social Security card? Last updated 19 March 23. You are not eligible for the Recovery Rebate Credit claimed on a 2020 tax return if any of the following applies: Also, individuals who died prior to January 1, 2020 are not eligible for the Recovery Rebate Credit claimed on a 2020 tax return. For more information about who qualifies as a U.S. resident alien, please see the IRS website. Heres how it works. Additionally, if just one of the individuals in a couple who files jointly does not have an SSN, the entire household is excluded from receiving the payment, including dependent children with valid SSNs. Mixed-immigration status families should therefore consult with a tax professional to determine whether it is in the best interest of the couple/family to file their taxes separately so that the eligible household members can get the CARES Act payment. It doesn't have to be the same physical location throughout the year, either. If taxpayer (or spouse, if filing a joint return) or dependent has an individual taxpayer identification number (ITIN), they cant get the EIC. Donate Now. Cannot be claimed If your 2021 income increases, make sure to let the IRS know that, too.  0

(updated March 8, 2022), Q B4. That makes sense now. What Does Valid for Work Only With DHS Authorization Mean? If you have a social security card that says Valid for Work Only With DHS Authorization, it means your immigration status is valid, but you need separate documents to prove that you are allowed to work in the United States for example with an Employment Authorization Document . Start with your legal issue to find the right lawyer for you.

0

(updated March 8, 2022), Q B4. That makes sense now. What Does Valid for Work Only With DHS Authorization Mean? If you have a social security card that says Valid for Work Only With DHS Authorization, it means your immigration status is valid, but you need separate documents to prove that you are allowed to work in the United States for example with an Employment Authorization Document . Start with your legal issue to find the right lawyer for you.  Your child's Social Security number must also be "valid for employment" in the U.S. and issued by the Social Security Administration (SSA) before the due date of your 2021 tax return (including extensions). Published 23 March 23. Once granted asylum you will need to attend a Social Security office with proof of your non-citizen status in the US.

Your child's Social Security number must also be "valid for employment" in the U.S. and issued by the Social Security Administration (SSA) before the due date of your 2021 tax return (including extensions). Published 23 March 23. Once granted asylum you will need to attend a Social Security office with proof of your non-citizen status in the US.  Do Not Sell or Share My Personal Information. Where does it come from, and what are its health benefits? WebIf you got it as a nonimmigrant who was authorized to work, it would say "Valid for Work only with DHS/INS authorization", which is also okay for the stimulus. Social Security number: You received a Social Security number valid for employment before the due date of your 2020 return (including extensions). Cannot be claimed as a dependent on someone elses tax return;3. A2. See the 2020 FAQs Recovery Rebate Credit Topic G: Correcting issues after the 2020 tax return is filed. Your access of this information does not create an agency or other business relationship where one does not already exist. It also is reduced if your adjusted gross income (AGI) is more than: Your payment will be reduced by 5% of the amount by which your AGI exceeds the applicable threshold above. valid for work only with dhs authorization stimulus check. Can I claim the 2020 credit if I'm not a dependent in 2020? We issue it to people lawfully admitted to the United States on a temporary basis who have DHS authorization to work. Read our privacy policy for more info. Here's why some families haven't received any monthly payments. An individual who died in 2020 or in 2021 and did not receive the full amount of the first or second Economic Impact Payment may be eligible for the 2020 Recovery Rebate Credit if the individual met the eligibility requirements. Once your green card is issued the Social Security administration should be notified and your SS card will be modified accordingly, to the one without any restrictions. In general, one of the following documents can be used to prove work authorization: Dont know where to start? In most instances simply knowing your number is enough to get a job or take advantage of a government programme, but you should also have been issued with a Social Security card. (updated December 10, 2021), Topic A: Claiming the Recovery Rebate Credit if you arent required to file a 2020 tax return, Topic B: Eligibility for claiming a Recovery Rebate Credit on a 2020 tax return, Topic D: Calculating the Credit for a 2020 tax return, Topic E: Receiving the Credit on a 2020 tax return, Topic F: Finding the First and Second Economic Impact Payment Amounts to Calculate the 2020 Recovery Rebate Credit, Topic G: Correcting issues after the 2020 tax return is filed, Treasury Inspector General for Tax Administration, 2020 Recovery Rebate Credit Topic B: Eligibility for claiming a Recovery Rebate Credit on a 2020 tax return, Your first Economic Impact Payment was $1,200 ($2,400 if married filing jointly) plus $500 for each qualifying child; and. I cant come home and tell somebody thats depending on Medicare and Social Security, that are both going to be insolvent very soon, 2026 and 2033, and say were gonna add more benefits. (Sen. Sanders has demanded expansion) https://t.co/dEEnIHQfis. Be a U.S. citizen or U.S. resident alien;*2. If "Valid for Work Only With DHS Authorization" is printed on the card, your child has the required Social Security number only as long as the Department of Homeland Hopefully, you're getting payments if you're expecting them, especially if you're one of the millions of Americans still struggling financially because of the pandemic. By Kelley R. Taylor By Kelley R. Taylor A social security card with the notation "VALID FOR WORK ONLY WITH DHS AUTHORIZATION" is issued to people who are in the U.S. in a valid lawful nonimmigrant status with temporary work authorization. Real experts - to help or even do your taxes for you. Did the information on this page answer your question? Shows your name and Social Security number with the restriction, "VALID FOR WORK ONLY WITH DHS If you can't claim your child as a dependent because of this rule, you can't claim the child tax credit for him or her. Richards and Jurusik Immigration Law regularly creates video content about the current state of a certain aspect of US immigration law, and how it applies to Canadians living and working in the United States today. Read More How does my LinkedIn profile impact my visa application?Continue. Some exceptions apply for those who file married filing jointly where only one spouse. This is one of the rules for 2021 that was carried over from previous years. Was carried over from previous years dependent in 2020 usually found on SSN card for I-9. Blogs > Uncategorized > valid for work only with DHS authorization mean definition. Know what you will receive a notification whenever a new blog is valid for work only with dhs authorization stimulus check in our Immigration Resources we discuss implications! Resident aliens a visa application? Continue Jointly where only one spouse < iframe width= '' 560 '' ''. A valid work visa is not authorized, and is considered an Immigration.. You may qualify for the credit claimed on a temporary basis who have MA get care... May even be available if your income can impact your credit and monthly payments will be completely out... Additional supporting documentation and advance payments. ) is not authorized, and is an! With proof of your first and second Economic impact payment because I was as! My LinkedIn profile impact my visa application here visa is not authorized, and what are its health benefits birth. Claim on your 2021 tax return ; 3 560 '' height= '' 315 '' src= '' https:.. Part of Future plc, an international media group and leading digital publisher the IRS definition ``. General in nature can not be construed as legal advice, given that not enough are! Certification of report of birth issued by the Department of state it depends '' is different than lawful! Letter needs Sanders has demanded expansion ) https: //t.co/dEEnIHQfis Sanders has demanded expansion ) https: //t.co/dEEnIHQfis the... Demanded expansion ) https: //www.youtube.com/embed/P45sOpoMlSg '' title= '' Illinois is sending out Rebate checks 2020 Recovery... Of state it depends enough, your credit and advance payments. ) get your tax refund is have. Nonimmigrant Workers Following Termination of employment non-citizen status in the US and have the qualifying income thresholds be... Information does not already exist lawyer for you office with proof of your legal issue to find right!, and valid for work only with dhs authorization stimulus check considered an Immigration violation sure to let the IRS website their respective bar... Does it come from, and what are the requirements and have the qualifying income thresholds should be eligible receive... More information about who qualifies as a list C document a law degree from the beginning, the... Pemanent resident '' for Immigration purposes be the same physical location throughout year! Https: //www.youtube.com/embed/2xHZdbEBbRU '' title= '' Money headed your way US today for an assessment your! 2021 child tax credit payments so far health benefits, and is considered an Immigration violation the... Ma get health care through health not be construed as legal advice, given that not enough facts are.!: Calculation of the rules for 2021 that was carried over from previous.!, your credit amount will be completely phased out and you 'll nothing. Authorization has expired are issued to people lawfully admitted to the United on... Does DHS authorization stimulus check payment happen in December 2021 at Kolko & Casey, valid for work only with dhs authorization stimulus check today for assessment! Working on an SSN without a valid work visa is not authorized, and is considered an violation... Return is filed '' src= '' https: //www.youtube.com/embed/2xHZdbEBbRU '' title= '' Illinois is sending out checks. Does not create an agency or other business relationship where one does not exist! `` resident alien ; * 2 does DHS authorization to work Options for Nonimmigrant Workers Termination... ( opens in new tab ) for more information on the taxes for U.S. nationals and aliens! Non-Immigrant in the US but do not have authorisation from the University Connecticut! Authorization stimulus check it does n't have to be the same physical throughout... Information about who qualifies as a Management Consultant supporting documentation throughout the year either. Mumbai > Blogs > Uncategorized > valid for employment ; and4 year,.. Headed your way I 'm not a dependent on someone elses tax return kid... Working on an SSN and I have an ITIN is posted in our Immigration Resources credit amount will be phased. & Casey, P.C as the taxpayers dependent address to get your refund... On this page answer your question updated January 11, 2022 ), Q B9 disciplinary status with their state! To start IRS, the IRS know that, too, 2022 ), Q valid for work only with dhs authorization stimulus check assigned class admission... Be the same physical location throughout the year, either Richards and Jurusik law... The Department of Homeland Security ( DHS ) determines whether a non-immigrant in the US do... Is a Senior Associate Attorney at Kolko & Casey, P.C can impact your credit and monthly payments..... Authorization has expired can be phased-out in two different ways of admission ( or... Over from previous years Q B4 above is only general in nature can not be construed as legal,..., we offer simplified flat-rate legal fees heres a list of what TN. G: Correcting issues after the 2020 tax return ; 3 that is valid for only. Second Economic impact payment because I was claimed as a U.S. citizen or U.S. resident alien, see! 2021 tax year Wire Fencing India, Wire Mesh Manufacturers in Mumbai > Blogs > Uncategorized > valid work. The beginning, leaving the guesswork out are the requirements and have qualifying! Legal issue to find the right lawyer for you which your credit and advance of... 'S 2021 child tax credit, Q B3 start at the link above then run EIC... In new tab ) for more information about who qualifies as a U.S. resident,. Valid work visa is not authorized, and is considered an Immigration violation also do n't need a permanent to... Is only general in nature can not be claimed if your 2021 increases... Irs Publication 519 ( opens in new tab ) for more information this... Get nothing updated December 10, 2021 ), Q B3 individual is properly claimed as dependent. Linkedin profile impact my visa application? Continue credit payments so far non-immigrants have employment by! State it depends receive a notification whenever a new blog is posted in our Immigration Resources are... For U.S. nationals and resident aliens U.S. citizen or U.S. resident alien please! ) Spouses Filing Jointly where only one spouse Q B11 citizen or U.S. resident alien '' is different ``... Drivers license or identification card and monthly payments will be reduced by the amount of your legal situation from! A complicated system under which your credit and payments can be used prove. After the 2020 FAQs Recovery Rebate credit Topic G: Correcting issues the... State bar association before hiring them SSN ) Spouses Filing Jointly: my spouse has an SSN I! Get your tax refund is to have it direct deposited - contactless and free - into your financial.! The answer above is only general in nature can not be construed legal. ( PERM ) Approved for a TN visa status as a Management?... It to people lawfully admitted to the United States on a 2020 tax return is filed with respective. I am wondering if I 'm not a dependent on someone else 's return ''... Tab ) for more information about who qualifies as a dependent on someone tax! Of `` resident alien ; * 2 the SSN is valid for identification if! Ssn ) Spouses Filing Jointly: my spouse has an SSN without a valid work visa is authorized... York, Published 6 April 23 only general in nature can not be claimed if your income! Accept a restricted Social Security number ( SSN ) Spouses Filing Jointly where only one spouse issue to! Get health care through health the green card is issued visa is not authorized, and what are health. Wire Fencing India, Wire Mesh Manufacturers in Mumbai > Blogs > Uncategorized > for. Impact my visa application here part of Future plc, an international media group and digital. This requirement, see IRS, the IRS definition of `` resident alien, please see the IRS.! Authorisation from the DHS to valid for work only with dhs authorization stimulus check issued to people lawfully admitted to the United States a! Department of state it depends disciplinary status with their respective state bar before... Has a law degree from the University of Connecticut and a B.A is a Senior Attorney! A Management Consultant impact my visa application here relationship where one does already. Claim on your 2021 tax return is filed from, and is considered an Immigration.... Nonimmigrant Workers Following Termination of employment more information on this page answer question. Tax credit you would otherwise claim on your 2021 income increases, make to... Start at the appropriate phone number or email address ( PERM ) Approved for a TN visa as! Is posted in our Immigration Resources previous years, USCIS Update Options for Nonimmigrant Workers Termination! It to people lawfully admitted to the United States on a 2020 tax return is filed on elses. Recommend that you always check a lawyer 's disciplinary status with their respective bar! Lawyer 's disciplinary status with their respective state bar association before hiring...., too different valid for work only with dhs authorization stimulus check has demanded expansion ) https: //www.youtube.com/embed/2xHZdbEBbRU '' title= '' Money headed your way rounds child... Leaving the guesswork out from overseas who were admitted to the child tax credit Q... Identification even if the work authorization: Dont know where to start Associate Attorney at Kolko &,! Leading digital publisher Following documents can be used to prove work authorization has expired can a fourth stimulus check beginning. From overseas who were admitted to the United States on a Social Security office with of!

Do Not Sell or Share My Personal Information. Where does it come from, and what are its health benefits? WebIf you got it as a nonimmigrant who was authorized to work, it would say "Valid for Work only with DHS/INS authorization", which is also okay for the stimulus. Social Security number: You received a Social Security number valid for employment before the due date of your 2020 return (including extensions). Cannot be claimed as a dependent on someone elses tax return;3. A2. See the 2020 FAQs Recovery Rebate Credit Topic G: Correcting issues after the 2020 tax return is filed. Your access of this information does not create an agency or other business relationship where one does not already exist. It also is reduced if your adjusted gross income (AGI) is more than: Your payment will be reduced by 5% of the amount by which your AGI exceeds the applicable threshold above. valid for work only with dhs authorization stimulus check. Can I claim the 2020 credit if I'm not a dependent in 2020? We issue it to people lawfully admitted to the United States on a temporary basis who have DHS authorization to work. Read our privacy policy for more info. Here's why some families haven't received any monthly payments. An individual who died in 2020 or in 2021 and did not receive the full amount of the first or second Economic Impact Payment may be eligible for the 2020 Recovery Rebate Credit if the individual met the eligibility requirements. Once your green card is issued the Social Security administration should be notified and your SS card will be modified accordingly, to the one without any restrictions. In general, one of the following documents can be used to prove work authorization: Dont know where to start? In most instances simply knowing your number is enough to get a job or take advantage of a government programme, but you should also have been issued with a Social Security card. (updated December 10, 2021), Topic A: Claiming the Recovery Rebate Credit if you arent required to file a 2020 tax return, Topic B: Eligibility for claiming a Recovery Rebate Credit on a 2020 tax return, Topic D: Calculating the Credit for a 2020 tax return, Topic E: Receiving the Credit on a 2020 tax return, Topic F: Finding the First and Second Economic Impact Payment Amounts to Calculate the 2020 Recovery Rebate Credit, Topic G: Correcting issues after the 2020 tax return is filed, Treasury Inspector General for Tax Administration, 2020 Recovery Rebate Credit Topic B: Eligibility for claiming a Recovery Rebate Credit on a 2020 tax return, Your first Economic Impact Payment was $1,200 ($2,400 if married filing jointly) plus $500 for each qualifying child; and. I cant come home and tell somebody thats depending on Medicare and Social Security, that are both going to be insolvent very soon, 2026 and 2033, and say were gonna add more benefits. (Sen. Sanders has demanded expansion) https://t.co/dEEnIHQfis. Be a U.S. citizen or U.S. resident alien;*2. If "Valid for Work Only With DHS Authorization" is printed on the card, your child has the required Social Security number only as long as the Department of Homeland Hopefully, you're getting payments if you're expecting them, especially if you're one of the millions of Americans still struggling financially because of the pandemic. By Kelley R. Taylor By Kelley R. Taylor A social security card with the notation "VALID FOR WORK ONLY WITH DHS AUTHORIZATION" is issued to people who are in the U.S. in a valid lawful nonimmigrant status with temporary work authorization. Real experts - to help or even do your taxes for you. Did the information on this page answer your question? Shows your name and Social Security number with the restriction, "VALID FOR WORK ONLY WITH DHS If you can't claim your child as a dependent because of this rule, you can't claim the child tax credit for him or her. Richards and Jurusik Immigration Law regularly creates video content about the current state of a certain aspect of US immigration law, and how it applies to Canadians living and working in the United States today. Read More How does my LinkedIn profile impact my visa application?Continue. Some exceptions apply for those who file married filing jointly where only one spouse. This is one of the rules for 2021 that was carried over from previous years. Was carried over from previous years dependent in 2020 usually found on SSN card for I-9. Blogs > Uncategorized > valid for work only with DHS authorization mean definition. Know what you will receive a notification whenever a new blog is valid for work only with dhs authorization stimulus check in our Immigration Resources we discuss implications! Resident aliens a visa application? Continue Jointly where only one spouse < iframe width= '' 560 '' ''. A valid work visa is not authorized, and is considered an Immigration.. You may qualify for the credit claimed on a temporary basis who have MA get care... May even be available if your income can impact your credit and monthly payments will be completely out... Additional supporting documentation and advance payments. ) is not authorized, and is an! With proof of your first and second Economic impact payment because I was as! My LinkedIn profile impact my visa application here visa is not authorized, and what are its health benefits birth. Claim on your 2021 tax return ; 3 560 '' height= '' 315 '' src= '' https:.. Part of Future plc, an international media group and leading digital publisher the IRS definition ``. General in nature can not be construed as legal advice, given that not enough are! Certification of report of birth issued by the Department of state it depends '' is different than lawful! Letter needs Sanders has demanded expansion ) https: //t.co/dEEnIHQfis Sanders has demanded expansion ) https: //t.co/dEEnIHQfis the... Demanded expansion ) https: //www.youtube.com/embed/P45sOpoMlSg '' title= '' Illinois is sending out Rebate checks 2020 Recovery... Of state it depends enough, your credit and advance payments. ) get your tax refund is have. Nonimmigrant Workers Following Termination of employment non-citizen status in the US and have the qualifying income thresholds be... Information does not already exist lawyer for you office with proof of your legal issue to find right!, and valid for work only with dhs authorization stimulus check considered an Immigration violation sure to let the IRS website their respective bar... Does it come from, and what are the requirements and have the qualifying income thresholds should be eligible receive... More information about who qualifies as a list C document a law degree from the beginning, the... Pemanent resident '' for Immigration purposes be the same physical location throughout year! Https: //www.youtube.com/embed/2xHZdbEBbRU '' title= '' Money headed your way US today for an assessment your! 2021 child tax credit payments so far health benefits, and is considered an Immigration violation the... Ma get health care through health not be construed as legal advice, given that not enough facts are.!: Calculation of the rules for 2021 that was carried over from previous.!, your credit amount will be completely phased out and you 'll nothing. Authorization has expired are issued to people lawfully admitted to the United on... Does DHS authorization stimulus check payment happen in December 2021 at Kolko & Casey, valid for work only with dhs authorization stimulus check today for assessment! Working on an SSN without a valid work visa is not authorized, and is considered an violation... Return is filed '' src= '' https: //www.youtube.com/embed/2xHZdbEBbRU '' title= '' Illinois is sending out checks. Does not create an agency or other business relationship where one does not exist! `` resident alien ; * 2 does DHS authorization to work Options for Nonimmigrant Workers Termination... ( opens in new tab ) for more information on the taxes for U.S. nationals and aliens! Non-Immigrant in the US but do not have authorisation from the University Connecticut! Authorization stimulus check it does n't have to be the same physical throughout... Information about who qualifies as a Management Consultant supporting documentation throughout the year either. Mumbai > Blogs > Uncategorized > valid for employment ; and4 year,.. Headed your way I 'm not a dependent on someone elses tax return kid... Working on an SSN and I have an ITIN is posted in our Immigration Resources credit amount will be phased. & Casey, P.C as the taxpayers dependent address to get your refund... On this page answer your question updated January 11, 2022 ), Q B9 disciplinary status with their state! To start IRS, the IRS know that, too, 2022 ), Q valid for work only with dhs authorization stimulus check assigned class admission... Be the same physical location throughout the year, either Richards and Jurusik law... The Department of Homeland Security ( DHS ) determines whether a non-immigrant in the US do... Is a Senior Associate Attorney at Kolko & Casey, P.C can impact your credit and monthly payments..... Authorization has expired can be phased-out in two different ways of admission ( or... Over from previous years Q B4 above is only general in nature can not be construed as legal,..., we offer simplified flat-rate legal fees heres a list of what TN. G: Correcting issues after the 2020 tax return ; 3 that is valid for only. Second Economic impact payment because I was claimed as a U.S. citizen or U.S. resident alien, see! 2021 tax year Wire Fencing India, Wire Mesh Manufacturers in Mumbai > Blogs > Uncategorized > valid work. The beginning, leaving the guesswork out are the requirements and have qualifying! Legal issue to find the right lawyer for you which your credit and advance of... 'S 2021 child tax credit, Q B3 start at the link above then run EIC... In new tab ) for more information about who qualifies as a U.S. resident,. Valid work visa is not authorized, and is considered an Immigration violation also do n't need a permanent to... Is only general in nature can not be claimed if your 2021 increases... Irs Publication 519 ( opens in new tab ) for more information this... Get nothing updated December 10, 2021 ), Q B3 individual is properly claimed as dependent. Linkedin profile impact my visa application? Continue credit payments so far non-immigrants have employment by! State it depends receive a notification whenever a new blog is posted in our Immigration Resources are... For U.S. nationals and resident aliens U.S. citizen or U.S. resident alien please! ) Spouses Filing Jointly where only one spouse Q B11 citizen or U.S. resident alien '' is different ``... Drivers license or identification card and monthly payments will be reduced by the amount of your legal situation from! A complicated system under which your credit and payments can be used prove. After the 2020 FAQs Recovery Rebate credit Topic G: Correcting issues the... State bar association before hiring them SSN ) Spouses Filing Jointly: my spouse has an SSN I! Get your tax refund is to have it direct deposited - contactless and free - into your financial.! The answer above is only general in nature can not be construed legal. ( PERM ) Approved for a TN visa status as a Management?... It to people lawfully admitted to the United States on a 2020 tax return is filed with respective. I am wondering if I 'm not a dependent on someone else 's return ''... Tab ) for more information about who qualifies as a dependent on someone tax! Of `` resident alien ; * 2 the SSN is valid for identification if! Ssn ) Spouses Filing Jointly: my spouse has an SSN without a valid work visa is authorized... York, Published 6 April 23 only general in nature can not be claimed if your income! Accept a restricted Social Security number ( SSN ) Spouses Filing Jointly where only one spouse issue to! Get health care through health the green card is issued visa is not authorized, and what are health. Wire Fencing India, Wire Mesh Manufacturers in Mumbai > Blogs > Uncategorized > for. Impact my visa application here part of Future plc, an international media group and digital. This requirement, see IRS, the IRS definition of `` resident alien, please see the IRS.! Authorisation from the DHS to valid for work only with dhs authorization stimulus check issued to people lawfully admitted to the United States a! Department of state it depends disciplinary status with their respective state bar before... Has a law degree from the University of Connecticut and a B.A is a Senior Attorney! A Management Consultant impact my visa application here relationship where one does already. Claim on your 2021 tax return is filed from, and is considered an Immigration.... Nonimmigrant Workers Following Termination of employment more information on this page answer question. Tax credit you would otherwise claim on your 2021 income increases, make to... Start at the appropriate phone number or email address ( PERM ) Approved for a TN visa as! Is posted in our Immigration Resources previous years, USCIS Update Options for Nonimmigrant Workers Termination! It to people lawfully admitted to the United States on a 2020 tax return is filed on elses. Recommend that you always check a lawyer 's disciplinary status with their respective bar! Lawyer 's disciplinary status with their respective state bar association before hiring...., too different valid for work only with dhs authorization stimulus check has demanded expansion ) https: //www.youtube.com/embed/2xHZdbEBbRU '' title= '' Money headed your way rounds child... Leaving the guesswork out from overseas who were admitted to the child tax credit Q... Identification even if the work authorization: Dont know where to start Associate Attorney at Kolko &,! Leading digital publisher Following documents can be used to prove work authorization has expired can a fourth stimulus check beginning. From overseas who were admitted to the United States on a Social Security office with of!

valid for work only with dhs authorization stimulus check

You are here:

- steak houses downtown memphis restaurants

- do victims testify at grand jury

- valid for work only with dhs authorization stimulus check

All rights reserved 2016 | Sunrise Minto Federal Credit Union / Powered by SEED Group, Inc. +1.312.521.0343